Get the free DCG Tax and Accounting Solutions in Tampa, FL

Get, Create, Make and Sign dcg tax and accounting

How to edit dcg tax and accounting online

Uncompromising security for your PDF editing and eSignature needs

How to fill out dcg tax and accounting

How to fill out dcg tax and accounting

Who needs dcg tax and accounting?

Your Comprehensive Guide to the DCG Tax and Accounting Form

Understanding the DCG Tax and Accounting Form

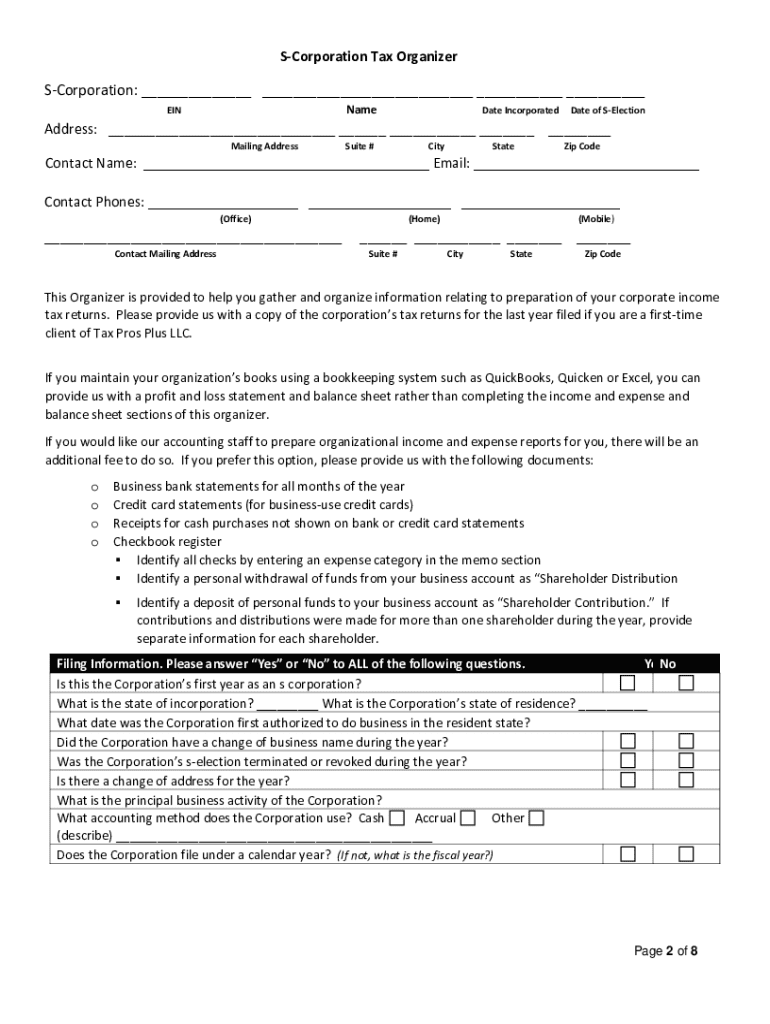

The DCG Tax and Accounting Form is a crucial document for various taxpayers, facilitating the accurate reporting of financial information to tax authorities. Its primary role is to streamline the tax filing process, ensuring that all necessary data is presented clearly and concisely. Understanding what this form entails is the first step toward effective tax management.

Proper completion of the DCG form is vital, as inaccuracies can lead to unnecessary audits or penalties. This form not only aids in fulfilling tax obligations but also provides a clear overview of one's financial situation. Key deadlines associated with the DCG form are critical for maintaining compliance, as failing to meet these deadlines can result in significant ramifications for taxpayers.

Who needs to use the DCG Tax and Accounting Form?

The DCG Tax and Accounting Form is intended for a wide range of users, including individuals with complex tax situations, small business owners, and accounting professionals. Each of these groups may face different scenarios that require the completion of this form, whether it be for annual reporting or for specific deductions and credits unique to their financial situations.

Individuals commonly use the DCG form when their income sources vary, or they wish to claim specific tax deductions. Small business owners utilize it to report business income and expenses, while accounting professionals may help clients navigate the intricate details of the form to ensure compliance and maximize tax benefits.

Key features of the DCG Tax and Accounting Form

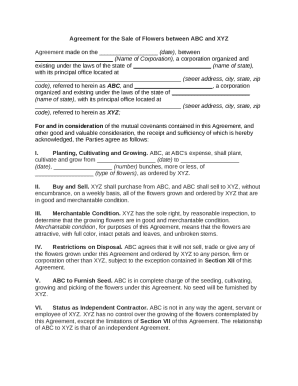

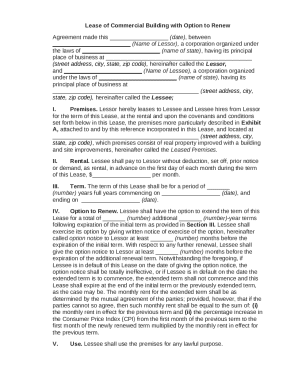

The DCG Tax and Accounting Form consists of several comprehensive sections that cater to different tax reporting needs. These sections often include areas for personal information, income details, and deductions or credits seeking to clarify taxpayers' financial standings. The unique aspect of the DCG form is its simplified design aimed at minimizing confusion and improving accuracy compared to other tax forms.

One standout feature of the DCG form is its adaptability in specific situations, allowing users to navigate through various aspects of tax reporting seamlessly. Tools like pdfFiller enhance the use of this form by providing functionalities such as easy editing, digital signatures, and collaborative features that elevate the convenience of tax management.

Step-by-step guide to filling out the DCG Tax and Accounting Form

Preparing to fill out the DCG form involves gathering necessary documentation such as income statements, previous tax returns, and any relevant receipts or records needed for deductions. Understanding the data required for each section will also simplify the process significantly. The first step is completing the Personal Information section, followed by detailing your income.

In the Income Reporting section, accurately report all sources of income. Then, move on to the Deductions and Credits section, where you can include all applicable deductions. The final step is to verify the entire form for completeness and accuracy before submission. Common mistakes to avoid include neglecting to sign the form and failing to double-check calculations, which can lead to discrepancies and delays.

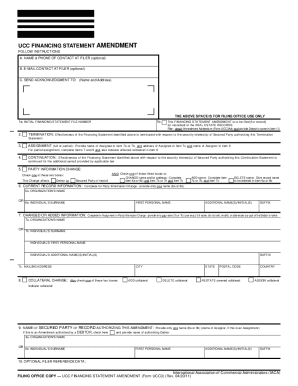

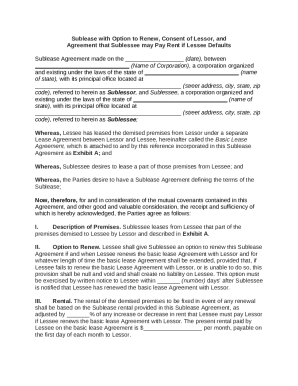

Editing and customizing the DCG Tax and Accounting Form with pdfFiller

pdfFiller provides a user-friendly platform that allows you to import the DCG Tax and Accounting Form easily. Users can edit text, add information, and make necessary adjustments directly within the document. The tools facilitate formatting changes, ensuring that the document adheres to professional standards and is easy to read.

Additionally, users can collaborate by sharing the document with team members or accounting professionals, making the editing process efficient. The ability to customize the DCG form enhances the overall user experience, creating a tailored tax document that meets individual needs.

Collaborating and signing the DCG Tax and Accounting Form

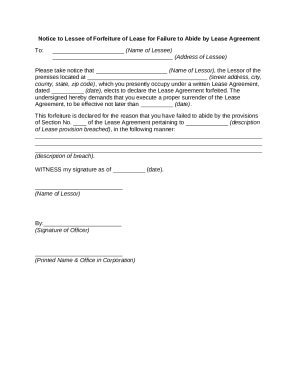

Collaboration is critical when dealing with tax paperwork, and pdfFiller allows easy sharing of the DCG Tax and Accounting Form with teammates or tax advisors. Users can send documents securely, ensuring collaboration doesn’t compromise data integrity. The eSignature feature enables users to sign forms digitally, reducing the need for physical copies and streamlining the approval process.

Ensuring compliance and security while sharing documents is paramount. pdfFiller’s secure platform provides peace of mind that your tax information remains confidential, thereby fostering trust between you and your collaborators during tax preparation.

Managing your DCG Tax and Accounting Form

Once you have filled out the DCG Tax and Accounting Form, effective management is crucial. Saving and storing your filled form correctly in pdfFiller's cloud-based storage ensures accessibility and organization. Users can categorize documents based on different years or tax types, making it easy to retrieve past submissions or revisions when needed.

By accessing your submission history through pdfFiller, you can maintain essential records that assist in calculating future taxes and verifying previous claims. This organized approach to document management simplifies the overall tax preparation process.

Tips for smooth submission of the DCG Tax and Accounting Form

Submissions of the DCG form can occur online or in person. For online submissions, confirming that all entries are correct before hitting submit is essential. Familiarize yourself with the submission portal and follow guidelines meticulously. If submitting in person, ensure you bring all necessary paperwork to avoid delays.

Post-submission, follow-up procedures may include checking the status of your submission and understanding timelines for reviews by tax authorities. Awareness of the review process can alleviate anxiety and provide clarity regarding the outcome of your efforts.

Frequently asked questions about the DCG Tax and Accounting Form

Many users encounter common challenges when working with the DCG Tax and Accounting Form. Questions often arise regarding how to handle specific scenarios, such as unique income sources or available deductions. Troubleshooting issues when filling out the form can be simplified by being aware of the guidelines and resources available.

For those seeking additional support, numerous resources exist, including online forums, tax professionals, and extensive guides that detail the process of completing the DCG form. Utilizing these resources can provide reassurance and clarity on complex issues.

Why choose pdfFiller for your DCG Tax and Accounting needs

Using pdfFiller offers unique advantages for managing the DCG Tax and Accounting Form effectively. The platform stands out with its robust suite of editing tools, collaborative features, and a simple interface that facilitates user experience. Testimonials from satisfied users frequently emphasize how pdfFiller has streamlined their document management processes, making tax preparation less daunting.

At pdfFiller, we are committed to ensuring that every user enjoys simplicity and efficiency in document handling. By providing such a comprehensive suite of features, we empower you to focus on what truly matters—successful tax reporting and compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in dcg tax and accounting without leaving Chrome?

Can I edit dcg tax and accounting on an iOS device?

How do I complete dcg tax and accounting on an Android device?

What is dcg tax and accounting?

Who is required to file dcg tax and accounting?

How to fill out dcg tax and accounting?

What is the purpose of dcg tax and accounting?

What information must be reported on dcg tax and accounting?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.