Get the free Form-8937Report-of-Organizational- ...

Get, Create, Make and Sign form-8937report-of-organizational

Editing form-8937report-of-organizational online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form-8937report-of-organizational

How to fill out form-8937report-of-organizational

Who needs form-8937report-of-organizational?

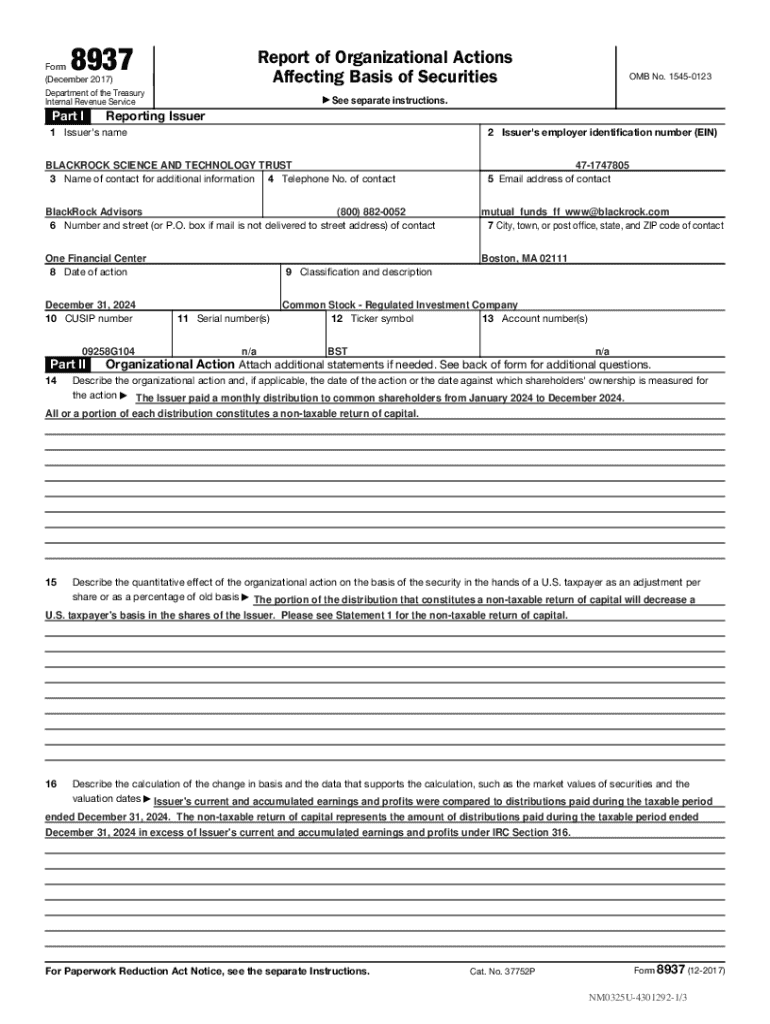

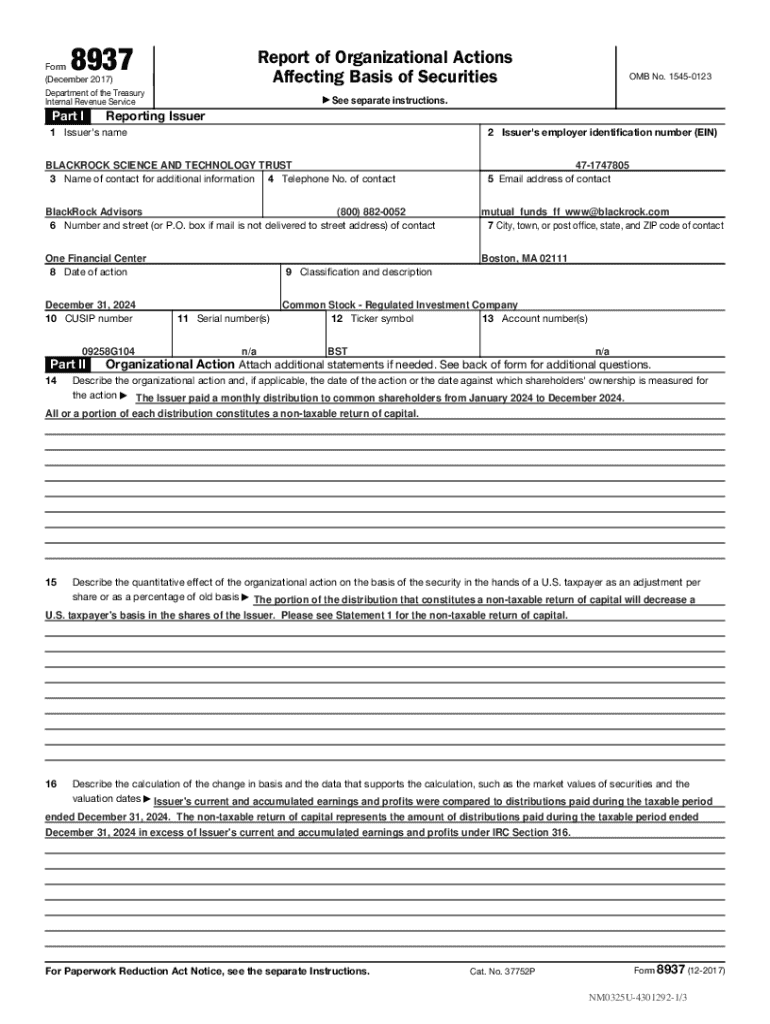

Form 8937: Report of Organizational Actions Affecting Basis of Securities

Understanding Form 8937

Form 8937 is a critical document used to report organizational actions that affect the basis of securities. It is designed primarily for issuers, such as corporations or partnerships, that must communicate to shareholders the impacts of certain corporate actions, like mergers, stock splits, or dividends, on the tax basis of their securities. The purpose of this form is to provide essential information regarding how these actions affect the amounts invested by shareholders, facilitating compliance with IRS requirements.

Issuers must file this form when they engage in specific organizational actions that may modify the basis of their securities or affect shareholders' tax reporting. By accurately completing and filing Form 8937, issuers ensure that their shareholders are informed about the implications of corporate activities on their tax obligations, which enhances transparency and accountability.

Who needs to file Form 8937?

Form 8937 must be filed by entities that are categorized as issuers of securities. This includes publicly traded companies, certain partnerships, and other organizations actively engaged in offering stock or other securities to the public. Moreover, these organizations must take action when they undertake events that would likely affect the valuation and tax reporting for their securities.

Essentially, any issuer involved in actions like a merger, acquisition, stock split, dividend distribution, or any restructuring efforts that impact the security's basis is obliged to complete and submit Form 8937. Compliance is crucial not merely for regulatory satisfaction but also for fostering trust with investors, ensuring that shareholders have clarity regarding how their investments are maintained.

Importance of timely submission

Filing Form 8937 promptly is essential for several reasons. One of the most significant consequences of delayed submission is the potential for penalties imposed by the IRS. These penalties can amount to thousands of dollars depending on the extent and frequency of the violations. Such ramifications not only affect the issuer financially but may also tarnish their reputation among investors and other stakeholders.

Furthermore, timely filing ensures that shareholders receive accurate information regarding the basis adjustments that affect their tax returns. Failure to submit the form on time could lead to misinformation, resulting in audits or inquiries from tax authorities. Hence, knowledge about these deadlines and diligent preparation to meet them is crucial for anyone in the position of issuing securities.

Detailed breakdown of Form 8937 sections

Form 8937 consists of several sections that must be meticulously completed to ensure accurate reporting. The first section, Header Information, requires basic identification of the issuer and outlines essential notes related to the filing. Accurate completion here is pivotal, as it sets the foundation for the remainder of the document.

Next, the Organizational Actions Overview section provides a critical definition of each organizational action undertaken. This section not only highlights the specifics of actions such as stock splits, mergers, or adjustments but also invites entries on outcomes that significantly affect the shareholders’ bases.

The Security Information section details necessary information concerning the affected securities, including their type and quantity. Here, issuers must provide specifics for shareholders to understand how many shares are impacted and the characteristics of these shares.

Lastly, the Basis Adjustments section highlights how adjustments to the basis of these securities are calculated and the rationale behind these adjustments. This includes detailed formulas and methodologies to ensure that shareholders receive an accurate reflection of their investments’ adjusted basis.

Step-by-step guide to completing Form 8937

Completing Form 8937 involves a systematic approach ensuring that all necessary information is captured accurately. The first step is gathering necessary information, which includes financial documents that substantiate the details of the organizational actions taken. This could involve stock transaction records, press releases, and any relevant correspondence with shareholders.

Next, you'll need to fill in the form fields accurately. Here’s a detailed guide for the form sections:

It's important to double-check the information for accuracy before submission. Common mistakes include omitting important details or miscalculating the adjusted basis, which can lead to compliance issues.

Editing and customizing Form 8937 on pdfFiller

pdfFiller provides a seamless platform to create, edit, and finalize Form 8937 without hassle. To upload your form, start by logging into your pdfFiller account and selecting the upload option to choose your blank or pre-filled document.

Once uploaded, pdfFiller’s editing features allow you to make text modifications easily. You can annotate sections as necessary, correct errors, and enhance the overall presentation of the form if needed. Collating additional documentation or evidence can also be done directly within the platform to keep everything organized.

Additionally, pdfFiller permits the inclusion of electronic signatures, which streamlines the process of obtaining final approvals. Collaboration is made simple, allowing users to share the form with team members for input or review before submission.

Managing your Form 8937 after completion

After completing Form 8937, effective management of the document is vital. The first step is ensuring that your forms are saved and stored digitally in a systematic manner. pdfFiller’s cloud platform provides a secure environment to access and organize your documents, which is essential for future reference, audits, and communications.

To further facilitate communication with stakeholders, share your completed form securely using pdfFiller’s sharing options, which allow for controlled access and trackable shares. Keeping track of submission status is also important for oversight. pdfFiller can help you maintain a record of when and how your forms were submitted, ensuring you have all necessary documentation readily available.

Common FAQs related to Form 8937

Several frequently asked questions often arise concerning Form 8937. One question might be, 'What happens if the information changes after submission?' Issuers should know they are responsible for amending the form with accurate updates to maintain compliance with IRS regulations.

Another common query involves the retention period for Form 8937. It is generally advisable to keep copies of this form for at least three years following the submission date. Additionally, users often inquire whether Form 8937 can be revised. Yes, if any mistakes are discovered post-filing, revisions should be made promptly to correct inaccuracies.

Lastly, users frequently ask about the differences between Form 8937 and other tax reporting forms. Unlike other forms solely focused on income tax reporting, Form 8937 is narrowly tailored to address the impact of organizational actions on basis reporting for securities.

Additional insights on organizational actions and securities basis

Organizational actions can vary broadly, encompassing several significant steps including stock splits, mergers, acquisitions, and capital gains. Each of these actions can dramatically influence the basis of securities held by investors. For instance, in a stock split, the number of shares may increase, yet the value per share decreases proportionately, necessitating clear communication via Form 8937 regarding how shareholders should adjust their basis.

The impact of tax regulations on reporting these actions is also profound. Current tax laws dictate specific treatments of organizational actions. For example, tax-exempt reorganizations can allow shareholders to defer recognition of income, which would require precise reporting on the form. Understanding these nuances is key to accurate compliance and can significantly affect shareholder tax liabilities.

Resources for further assistance

For those seeking additional support, pdfFiller offers live assistance options to help users navigate the specifics of Form 8937. Additionally, user tutorials guide individuals through advanced features of the platform, ensuring efficient use of the tools available. Furthermore, engaging with tax professionals becomes essential for complex situations. Professional insight can help unravel intricate regulatory requirements and ensure compliance across various organizational actions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form-8937report-of-organizational without leaving Google Drive?

How do I edit form-8937report-of-organizational in Chrome?

How do I complete form-8937report-of-organizational on an Android device?

What is form-8937report-of-organizational?

Who is required to file form-8937report-of-organizational?

How to fill out form-8937report-of-organizational?

What is the purpose of form-8937report-of-organizational?

What information must be reported on form-8937report-of-organizational?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.