Get the free IMC-2023-Form-990.pdf

Get, Create, Make and Sign imc-2023-form-990pdf

Editing imc-2023-form-990pdf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out imc-2023-form-990pdf

How to fill out imc-2023-form-990pdf

Who needs imc-2023-form-990pdf?

2023 Form 990 PDF Guide

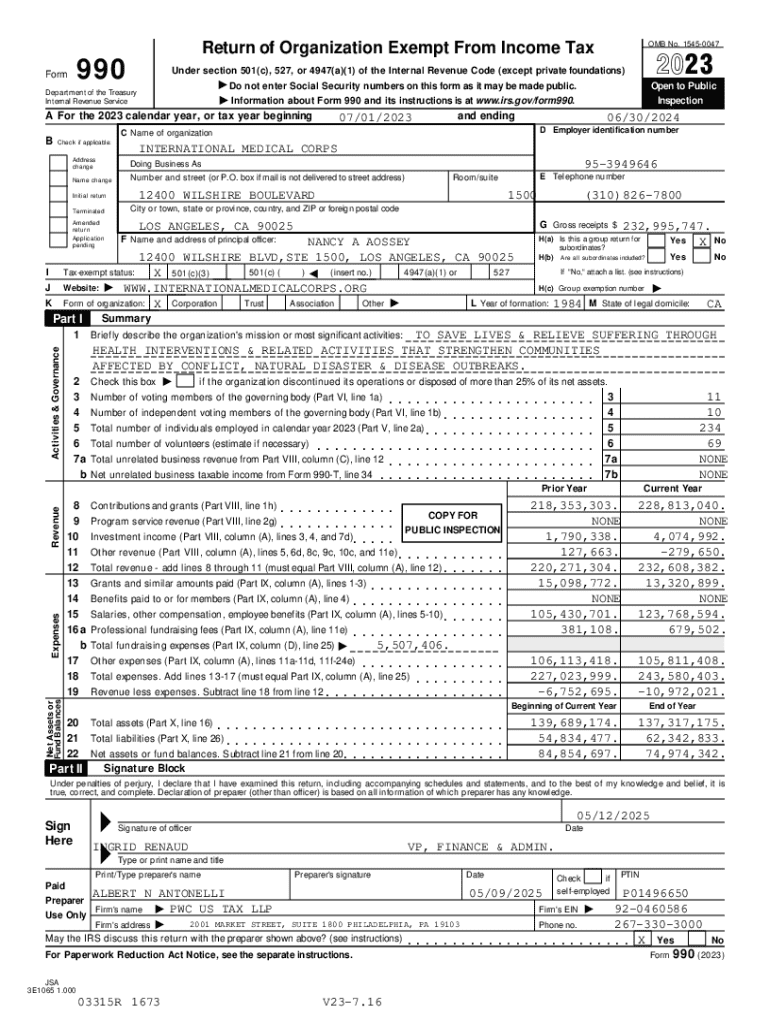

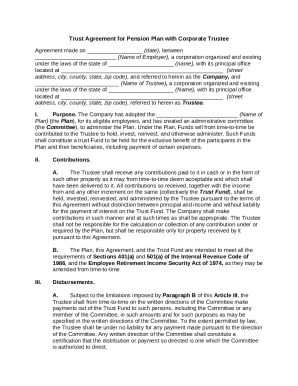

Understanding the 2023 Form 990

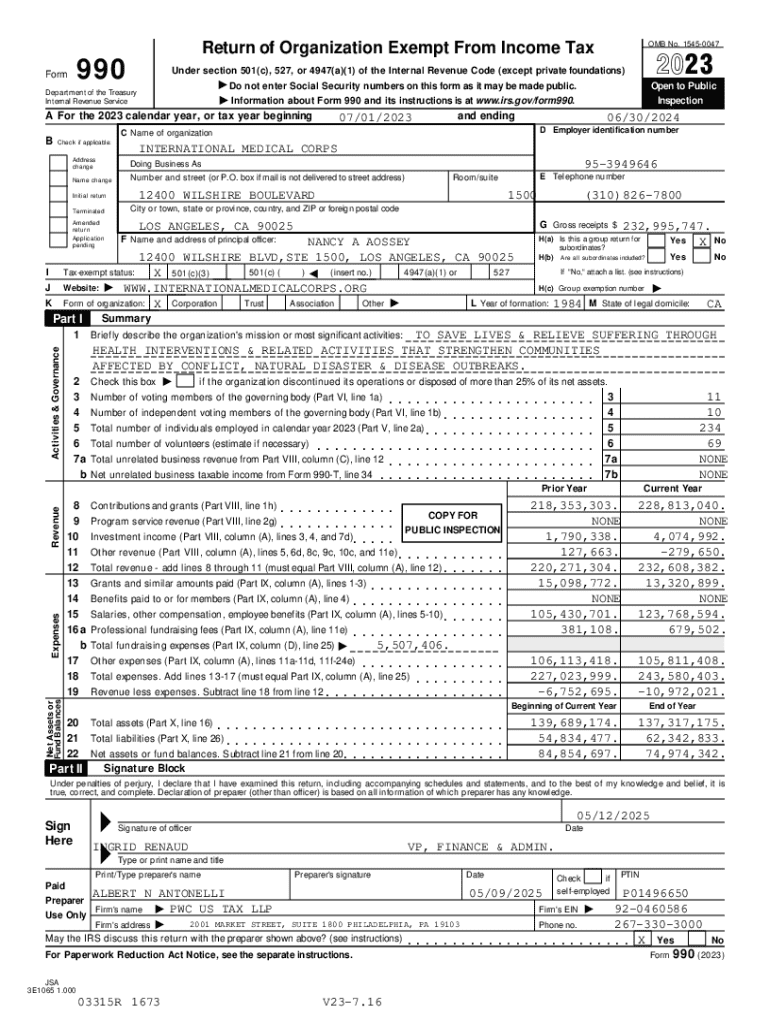

Form 990, the annual information return filed with the IRS by nonprofit organizations, serves a crucial role in ensuring transparency and accountability. It provides detailed information about an organization’s mission, programs, and finances, offering a valuable resource for donors, grantmakers, and the general public to assess the organization's operations and impacts.

For nonprofits, Form 990 is not merely a compliance requirement; it is a pivotal tool for maintaining credibility and securing funding. The IMC 2023 update introduces several modifications intended to enhance clarity and accountability in reporting, which will have significant implications for how organizations disclose their financial activities.

The 2023 Update

This year’s Form 990 has undergone several revisions, including changes in the way organizations report their governance practices, disclosures, and financial health. These updates reflect ongoing conversations about transparency in the nonprofit sector, with an emphasis on complete reporting to better serve stakeholders and the public. Nonprofits must prepare for these changes, as they directly impact the way they present their financial statements and organizational structures.

Organizations adopting the new guidelines will find their financial statements more accessible and informative to the public, reinforcing the importance of accurate data in fundraising efforts and community engagement.

Key components of the 2023 Form 990

Understanding the structure of Form 990 is essential for successful navigation and completion. The form is divided into several main sections, each designed to capture specific information about the nonprofit organization’s activities, finances, and governance.

Understanding financial statements

Reading and interpreting the financial statements included in Form 990 is essential for stakeholders. These statements showcase how well the organization manages funds and aligns its expenditures with its mission. Accurate reporting ensures trust and can significantly influence funding opportunities.

A non-profit must emphasize accurate financial reporting conventions, as any discrepancies or inaccuracies can jeopardize their credibility and lead to potential penalties from regulatory bodies.

Step-by-step guide to filling out the 2023 Form 990

Filling out the IMC 2023 Form 990 may seem daunting at first, but a structured approach can simplify the process significantly. Begin by preparing the necessary documentation, ensuring that you have all relevant records concerning financial activities, program descriptions, and governance practices.

Detailed instructions per section

To streamline the completion of each section, follow these steps:

Reviewing your form

Conduct a final review of your filled-out Form 990 using a checklist that ensures all sections are complete and accurate. This should be a collaborative effort involving key team members to catch potential errors and discrepancies.

Common pitfalls and how to avoid them

Despite careful preparation, nonprofits often encounter common challenges when filing Form 990. Previous years’ data highlights that many errors arise in the financial reporting sections, causing complications that could lead to penalties.

Best practices for accuracy

Utilizing best practices will ensure accuracy throughout the process. Adopt regular internal reviews of financial reporting and governance practices to maintain compliance.

Interactive tools for managing Form 990

pdfFiller offers an innovative platform that greatly simplifies the management of Form 990. The ability to edit PDF documents with ease, coupled with integrated eSigning capabilities, allows organizations to maintain a streamlined documentation process.

Benefits of cloud-based solutions

As a cloud-based platform, pdfFiller offers the flexibility of accessing Form 990 from any device, facilitating collaboration for teams working remotely. The ability to share documents easily allows for efficient communication and review processes.

Frequently asked questions about the 2023 Form 990

Navigating Form 990 can raise various questions, from requirements to deadlines. Understanding these is crucial for compliance.

Technical issues

During the filing process, many organizations face technical hurdles, which can frustrate the submission experience. Common issues include problems with document compatibility and submission errors. Utilizing platforms like pdfFiller can minimize these risks by offering user-friendly solutions tailored for Form 990.

Case studies: Successful Form 990 filings

Examining real-world examples can provide valuable insights into effective compliance practices. Several nonprofits have successfully navigated Form 990 filings by adhering to stringent financial practices and transparent governance.

Tips for future preparation

Staying informed about regulatory changes and preparing for future updates are vital for continuous compliance. Set up an annual review process of internal documentation practices to enhance your organization's readiness for Form 990 submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my imc-2023-form-990pdf directly from Gmail?

How can I get imc-2023-form-990pdf?

How do I make changes in imc-2023-form-990pdf?

What is imc-2023-form-990pdf?

Who is required to file imc-2023-form-990pdf?

How to fill out imc-2023-form-990pdf?

What is the purpose of imc-2023-form-990pdf?

What information must be reported on imc-2023-form-990pdf?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.