Get the free Malaysia Invoice Layout Samples

Get, Create, Make and Sign malaysia invoice layout samples

How to edit malaysia invoice layout samples online

Uncompromising security for your PDF editing and eSignature needs

How to fill out malaysia invoice layout samples

How to fill out malaysia invoice layout samples

Who needs malaysia invoice layout samples?

Malaysia Invoice Layout Samples Form: A Comprehensive Guide

Understanding the Malaysia Invoice Layout

In Malaysia, an invoice serves as a critical document that facilitates business transactions. A Malaysia invoice is a request for payment, capturing the details of products sold or services rendered. It's not merely a financial record; it protects your rights as a seller while ensuring that the buyers have a clear understanding of their obligations.

The layout of an invoice significantly impacts its effectiveness. An organized and aesthetically pleasing invoice not only enhances professionalism but also reduces the likelihood of payment disputes. Properly designed invoices facilitate easier record-keeping for both parties involved.

Types of Malaysia Invoice Layouts

The invoice layouts in Malaysia can be categorized into several types based on different needs and preferences. The most common ones include the standard invoice layout, customizable templates, and digital versus paper formats. Each type offers distinct advantages.

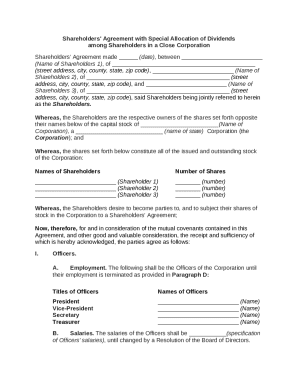

Standard Malaysia invoice layout

A standard Malaysia invoice layout includes mandatory elements such as seller's and buyer's information, invoice number, item descriptions, prices, taxes, and total amounts. Consistency in these elements helps ensure compliance with local regulations.

Customizable invoice templates

Customizable templates allow businesses to add personal branding and adjust layouts according to specific needs. Using customizable layouts, businesses can incorporate unique designs that resonate with their branding while providing necessary information.

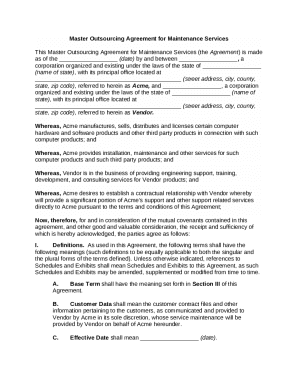

Digital vs. paper invoice formats

Digital invoices, which can be sent via email or shared through cloud platforms, offer immediate delivery and easier archiving. Conversely, paper invoices might still be preferred by businesses dealing with clients who require physical copies. Each format has its own advantages and disadvantages to consider.

Detailed breakdown of Malaysia invoice components

Creating an effective invoice requires attention to detail in various components. Here's a breakdown of essential elements to include in a Malaysia invoice.

Company logo and branding

Integrating your company logo adds professionalism to the invoice. To upload your logo in pdfFiller, follow these steps: navigate to the 'templates' section, select the 'upload logo' option, and choose the file from your device. Ensure the logo fits well in the layout.

Invoice numbering system

A structured invoice numbering system is vital for organization and tracking. Use a sequential numbering format to simplify reference. Best practices include starting from a unique number for each financial year.

Customer information section

Include essential client details such as their name, address, email, and contact number. A thorough customer information section ensures accurate communication and follow-ups.

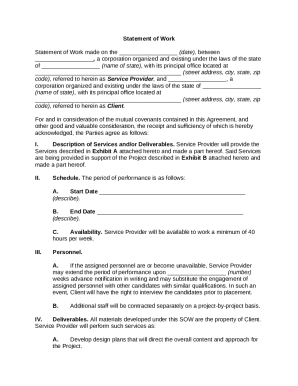

Itemization of products/services

Clearly list each product or service offered with respective descriptions. This helps clients understand what they are being charged for. Avoid jargon and be concise.

Pricing structure

Display unit prices next to item descriptions, and clearly state totals and any discounts applicable. Transparency in pricing reduces misunderstandings and builds trust.

Tax calculation

In Malaysia, understanding the Goods and Services Tax (GST) is crucial. Include any applicable tax information as part of the total amount, ensuring compliance with local tax regulations.

Payment terms and conditions

Provide clear payment terms. Include preferred payment methods, due dates, and any penalties for late payments. Clear communication here can significantly reduce payment delays.

Creating your own Malaysia invoice layout

Now, let’s delve into how you can create your own Malaysia invoice layout using pdfFiller, a platform designed for seamless document management.

Accessing custom invoice templates on pdfFiller

To get started, log into your pdfFiller account and navigate to 'Create New Document.' Select 'Invoice Templates' to browse available options. You can filter by design or category.

Using interactive tools for editing

Once you've chosen a template, utilize pdfFiller’s editing tools. You can drag and drop fields, edit text, and adjust layout features to fit your needs. This flexibility is essential for creating personalized invoices.

Filling out your invoice

Carefully input all required information into your invoice. Double-check for accuracy. Include all essential components discussed earlier to create a comprehensive document.

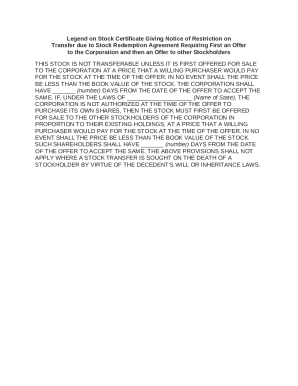

Sign off with confidence

Implement pdfFiller's eSignature features when finalizing invoices. This allows for quick official agreement from clients. Simply click on the 'eSign' option to insert your digital signature securely.

Managing and sending invoices

Proper invoice management is integral to maintaining cash flow. Effective sending, tracking, and handling of invoices can significantly improve your business operations.

Best practices for sending invoices

To ensure your invoices reach clients efficiently, consider these practices: send invoices promptly after providing services, use a standard email format for consistency, and attach relevant documents such as purchase orders.

Tracking invoice status

Utilize the tracking tools available in pdfFiller to monitor when invoices are opened and paid. This feature provides transparency and allows you to follow up without seeming pushy.

Handling late payments

Late payments can disrupt your business cycle. Implement polite reminders based on invoice terms and keep communication channels open. An open dialogue may yield better compliance.

Related templates you might need

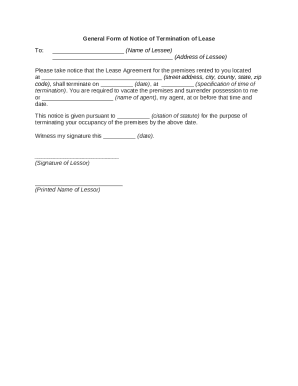

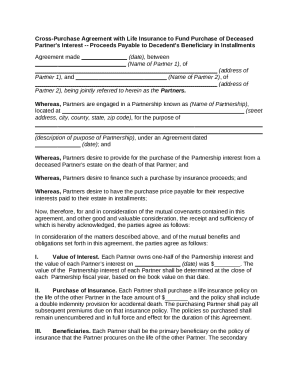

Aside from standard invoices, you may find other types of templates beneficial depending on your business needs. Here are some worth considering:

Other invoice types

Consider using pro forma invoices for estimates or credit memos for returned items. Understanding the difference between these types can help streamline your invoicing process.

Industry-specific invoice layouts

Different industries may require specialized templates. For example, freelancers in creative fields may prefer visually-rich layouts, whereas contractors might focus on detailed item listings and cost breakdowns.

Templates by country

When working internationally, it’s important to align with the local invoicing requirements. Research invoice specifications in ASEAN countries to ensure compliance and avoid penalties.

Frequently asked questions (FAQs)

Common issues with Malaysia invoices

Some common problems include missing client details, incorrect tax rates, and formatting issues. Regular audits of your invoices can help identify these issues early.

Can modify existing templates?

Yes, pdfFiller allows you to edit any of the available templates according to your specific needs. You can adjust layout, text fields, and more.

Understanding legal requirements for invoices in Malaysia

In Malaysia, invoices must comply with the Goods and Services Tax (GST) Act. Ensure the document includes necessary details, such as seller and buyer information, invoice number, date, a clear description of goods or services provided, prices, and total tax amount.

Enhancing your invoice process

Enhancing your invoicing process is crucial for efficiency and productivity. Utilizing software tools can help streamline various tasks involved in invoicing.

Integrating with accounting software

You can integrate pdfFiller with major accounting tools like QuickBooks or Xero. This automation reduces your manual tasks and ensures consistent records.

Collaborating with teams

For companies with multiple departments, collaboration on invoices can lead to better accuracy. Use shared access features in pdfFiller to allow team members to view and edit invoices in real-time.

Using analytics to improve efficiency

Leverage PDF analytics tools to understand patterns in your invoicing process. This data can help identify delays in payment, optimize your invoicing layout, and reduce follow-up effort.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my malaysia invoice layout samples in Gmail?

How do I edit malaysia invoice layout samples online?

Can I edit malaysia invoice layout samples on an Android device?

What is malaysia invoice layout samples?

Who is required to file malaysia invoice layout samples?

How to fill out malaysia invoice layout samples?

What is the purpose of malaysia invoice layout samples?

What information must be reported on malaysia invoice layout samples?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.