Get the free TCIDA-BVSHF-Second-Amendment-to-Tax-Agreement- ...

Get, Create, Make and Sign tcida-bvshf-second-amendment-to-tax-agreement

How to edit tcida-bvshf-second-amendment-to-tax-agreement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tcida-bvshf-second-amendment-to-tax-agreement

How to fill out tcida-bvshf-second-amendment-to-tax-agreement

Who needs tcida-bvshf-second-amendment-to-tax-agreement?

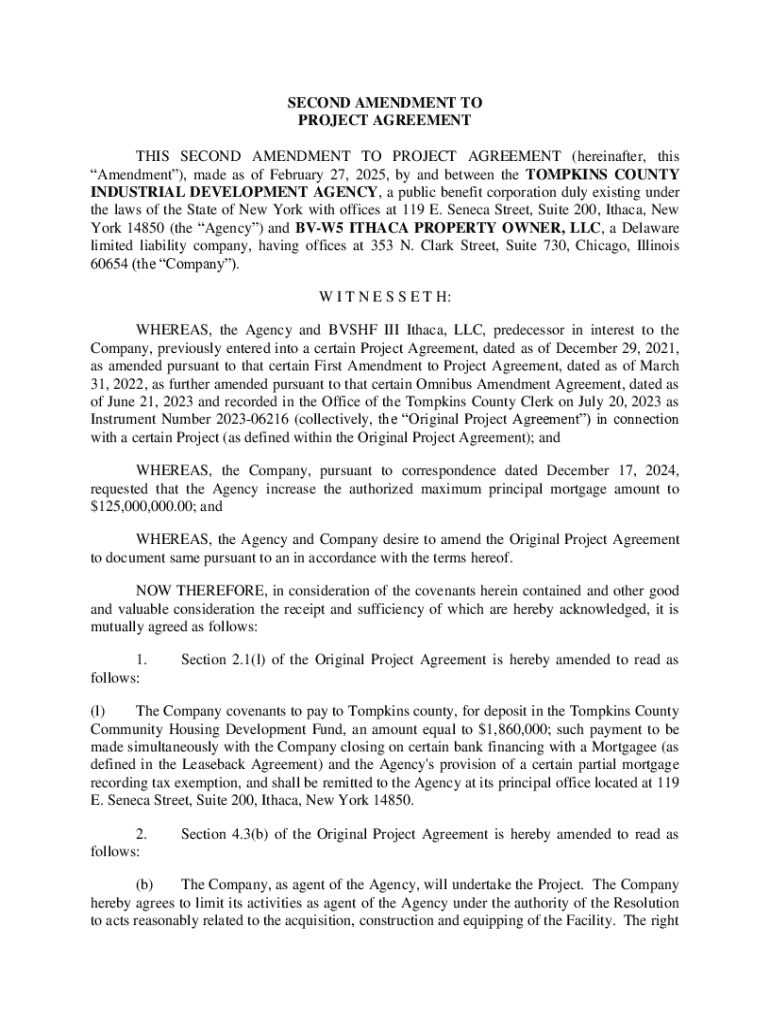

Understanding the TCIDA-BVSHF Second Amendment to Tax Agreement Form

Overview of the TCIDA-BVSHF Second Amendment to Tax Agreement Form

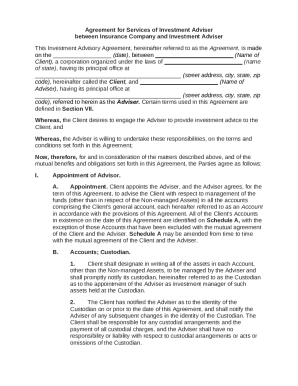

The TCIDA-BVSHF Second Amendment is a pivotal document within the framework of tax agreements, specifically tailored to address modifications necessary due to changes in business conditions or regulatory environments. The purpose of this amendment is to ensure that the tax obligations of all parties beyond their initial agreement are clearly defined and legally binding. This form is particularly significant as it fosters transparency and promotes trust among stakeholders involved in complex financial arrangements.

Key stakeholders typically include the local government authority, tax authorities, and any businesses directly impacted by the agreement. Each of these entities plays a critical role in ensuring the amendment is effective, fair, and compliant with relevant regulations, thus contributing to a more favorable economic environment.

Understanding the tax agreement amendment process

The amendment process for the TCIDA-BVSHF form involves several key steps that ensure thorough evaluation and transparency. Initially, an assessment of the proposed changes is conducted to determine their impact on existing agreements and stakeholders.

Following this, the review and negotiation phases take place where parties can discuss terms and suggest modifications. It is crucial for all involved to engage openly to foster an atmosphere of collaboration. Finally, the amendment must undergo finalization where all parties sign, followed by necessary filing to appropriate government bodies.

Each phase typically spans a specific timeline, which can vary depending on the complexity of the amendments and the responsiveness of participating parties.

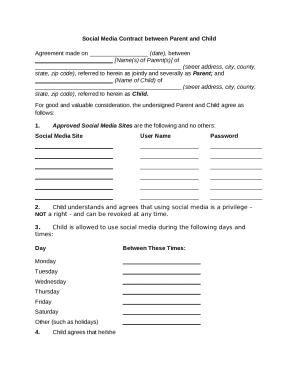

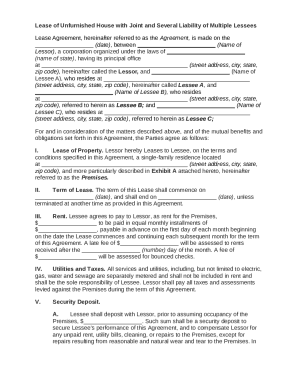

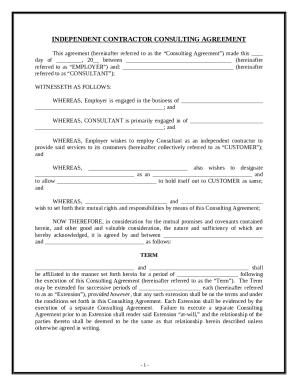

Detailed breakdown of the TCIDA-BVSHF second amendment form

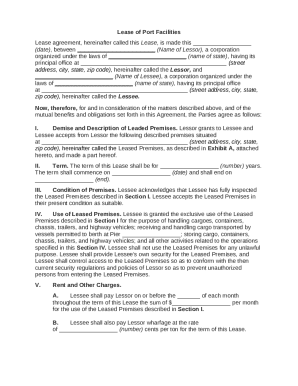

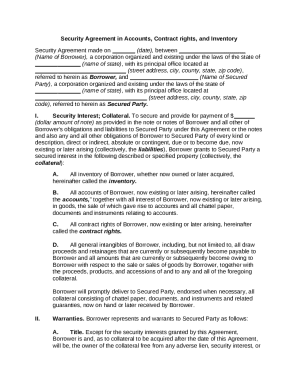

The TCIDA-BVSHF Second Amendment Form comprises several key components that outline the necessary details of the agreement. Each part of the form serves a specific purpose and contributes to the clarity of the document.

The header information typically includes the title of the document, the date, and a unique identifier. Following this are sections detailing the parties involved, clearly specifying their roles and responsibilities within the agreement.

The core of the form contains the terms and conditions governing the agreement, which should be articulated clearly to avoid misunderstanding. Finally, the document concludes with signature blocks where all parties involved confirm their understanding and consent to the amended terms.

Filling out the TCIDA-BVSHF second amendment form

Filling out the TCIDA-BVSHF Second Amendment Form requires careful attention to detail. Start with the header information, ensuring that all entries are accurate and formatted correctly. This sets a solid foundation for the entire document.

Next, clearly identify all parties involved in the amendment. It’s essential to describe their roles accurately to uphold accountability. In the terms and conditions section, provide explicit terms being amended and the reasoning behind these changes. Clarity is key in mitigating potential disputes later on.

Common errors to avoid include missing signatures, unclear descriptions of modified terms, or omitting important details that could lead to misunderstandings.

Editing and modifying the form

Making changes to an existing TCIDA-BVSHF Second Amendment Form requires a careful approach. First, clearly indicate any alterations made to the original document, ensuring that all stakeholders are aware of these changes. It's crucial to maintain an organized record of revisions for accountability.

Best practices suggest utilizing version control methods that allow for easy tracking of changes over time. Tools like pdfFiller provide enhanced features for editing PDFs, enabling seamless modification of the document without compromising the integrity of original content.

By following these best practices, you can efficiently handle revisions while maintaining an organized document management system.

eSigning the TCIDA-BVSHF second amendment

eSigning the TCIDA-BVSHF Second Amendment Form has become a popular and legally accepted method for closing agreements. The legality of electronic signatures is supported by regulations like the ESIGN Act, which validates their use in business transactions, making it easier for teams to finalize amendments swiftly and securely.

To eSign via pdfFiller, users simply upload the completed form and initiate the eSignature process. After all parties have reviewed the document, individuals can sign electronically, ensuring seamless compliance with local regulations.

Using an electronic signature simplifies the signing process and provides a secure, traceable method to complete the agreement.

Collaborating with teams on the amendment

Engaging multiple parties in the TCIDA-BVSHF Second Amendment process can often complicate communication. Using pdfFiller’s collaborative features aids teams in working together efficiently. By enabling real-time feedback and document sharing, team members can address each other’s suggestions directly on the document.

This collaborative approach not only streamlines amendments but also reduces the potential for errors. Managing contributions from various stakeholders is more organized when using a centralized platform like pdfFiller, allowing for a cohesive revision process.

With clear communication channels established, the amendment process can proceed smoothly, fostering collaboration and transparency.

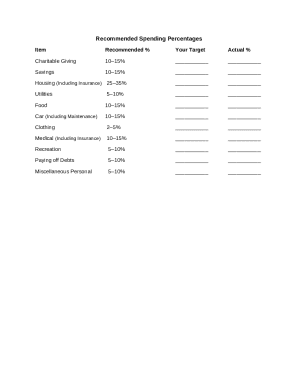

Best practices for managing your tax agreement amendments

Efficient document management is crucial for handling tax agreement amendments effectively. Establishing a systematic approach to organizing these documents ensures that they are easily accessible and retrievable when needed. This can be accomplished by labeling amendments distinctly, helping stakeholders quickly reference specific agreements.

Setting reminders for key dates, such as filing deadlines or renewal periods for amendments, keeps all parties informed of their responsibilities. Furthermore, creating a digital filing system using pdfFiller can enhance organization, allowing users to categorize documents by date, type, or relevant stakeholder.

Adopting these best practices strengthens your management strategies and minimizes the likelihood of oversights in your tax agreement processes.

Interactive tools and resources available

pdfFiller provides a suite of interactive tools that significantly enhance the management of the TCIDA-BVSHF Second Amendment Form. One notable feature is the extensive template library, which offers pre-designed forms related to tax agreements, facilitating quicker and more efficient document creation.

In addition, pdfFiller’s automated form capabilities enable users to set up workflows that streamline data entry and minimize errors. These resources are invaluable for individuals and teams aiming to optimize their document handling processes in today’s fast-paced business environment.

Utilizing these interactive tools allows for greater efficiency and accuracy in managing tax agreement amendments.

FAQs about the TCIDA-BVSHF second amendment form

Understanding the common questions surrounding the TCIDA-BVSHF Second Amendment Form can alleviate potential concerns. For specific inquiries about the form, consult a tax professional or the governing tax authority significantly involved in the agreement.

In instances of discrepancies within the document, it is essential to address these immediately. All parties should communicate effectively to ensure timely resolution. Updating agreements post-submission can also be complicated; however, utilizing pdfFiller allows for straightforward document revisions and resubmissions as needed.

Case studies and success stories

Real-world examples of effective amendments using the TCIDA-BVSHF Second Amendment Form illustrate the tangible benefits of proper documentation processes. Companies that have applied the TCIDA-BVSHF form effectively have noted significant reductions in processing time and improved clarity in tax obligations.

User testimonials indicate that incorporating pdfFiller into their amendment processes has led to better collaboration and efficiency. These success stories highlight the importance of utilizing the right tools in navigating complex tax agreements.

Future considerations and updates

As tax regulations continue to evolve, staying ahead of the curve is essential for anyone managing tax agreement amendments. Upcoming changes may affect how agreements should be structured or reported, urging stakeholders to conduct regular reviews of their documents to ensure compliance.

Long-term strategies for managing ongoing amendments include investing time in understanding new regulations and utilizing efficient document management systems like pdfFiller to keep agreements up-to-date. This proactive approach will position teams to handle future modifications seamlessly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get tcida-bvshf-second-amendment-to-tax-agreement?

How do I fill out the tcida-bvshf-second-amendment-to-tax-agreement form on my smartphone?

How can I fill out tcida-bvshf-second-amendment-to-tax-agreement on an iOS device?

What is tcida-bvshf-second-amendment-to-tax-agreement?

Who is required to file tcida-bvshf-second-amendment-to-tax-agreement?

How to fill out tcida-bvshf-second-amendment-to-tax-agreement?

What is the purpose of tcida-bvshf-second-amendment-to-tax-agreement?

What information must be reported on tcida-bvshf-second-amendment-to-tax-agreement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.