Get the Tax planning questionnaire (free template)

Get, Create, Make and Sign tax planning questionnaire template

How to edit tax planning questionnaire template online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax planning questionnaire template

How to fill out tax planning questionnaire template

Who needs tax planning questionnaire template?

Tax planning questionnaire template form: A comprehensive guide

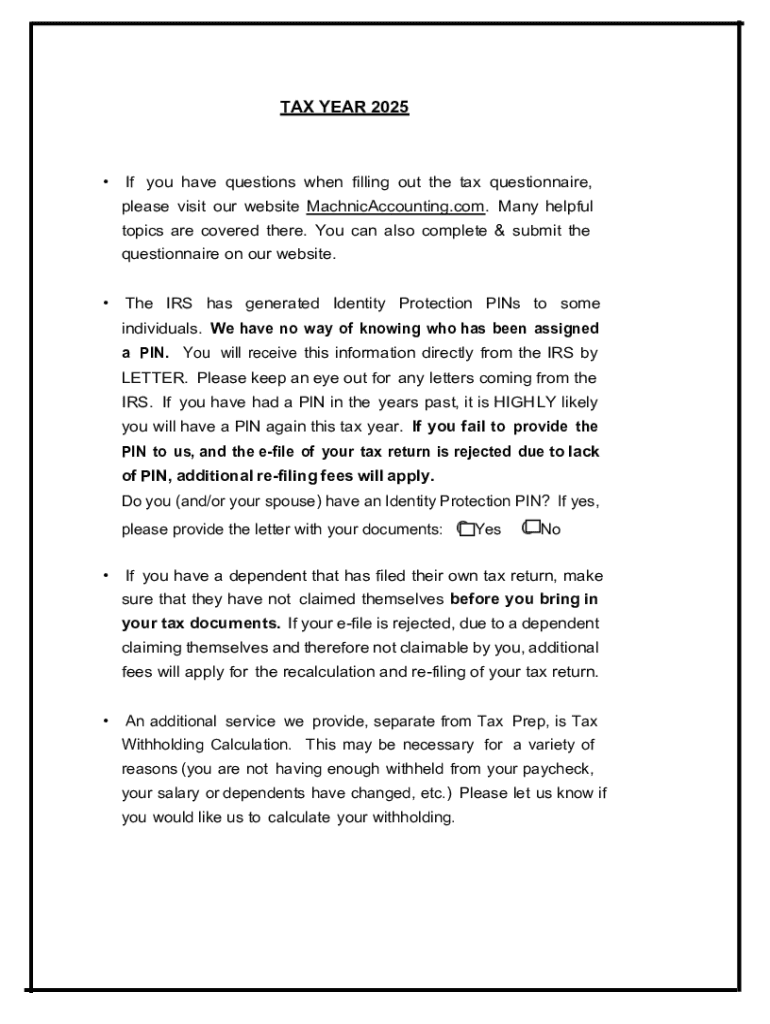

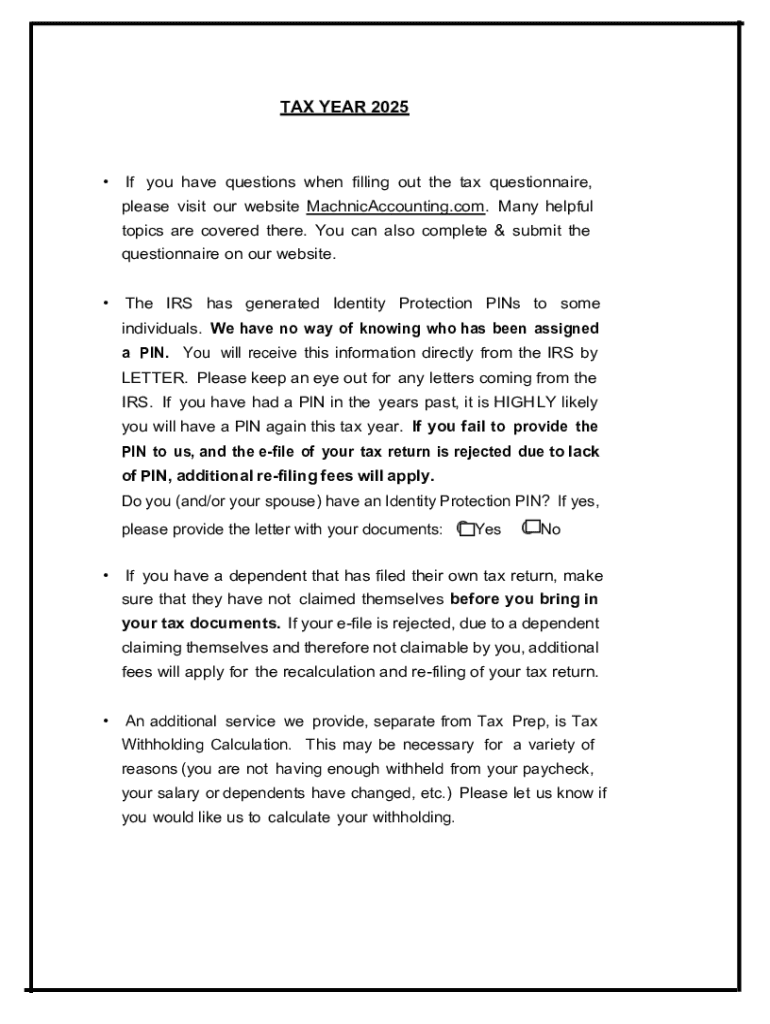

Overview of tax planning questionnaires

Tax planning is crucial for both individuals and businesses, enabling them to minimize tax liabilities while maximizing financial efficiency. A tax planning questionnaire is a vital tool in this process, acting as a structured guide to gather necessary information from clients. These questionnaires help tax professionals understand their clients' financial situations comprehensively, leading to more tailored and effective tax planning strategies.

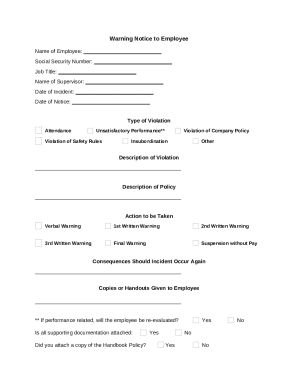

An effective tax planning questionnaire should encompass various essential components, such as personal information, income sources, deductions, and specific financial goals. By clearly defining these areas, both the client and the advisor can engage in productive discussions, ensuring all relevant aspects of tax planning are thoroughly addressed.

Understanding the tax planning process

Tax planning is a strategic approach to managing an individual's or business's tax obligations. The process typically involves several phases: data gathering, analysis, and implementation. Each phase is crucial for creating a valid tax strategy that aligns with financial goals and compliance with relevant tax laws.

The first phase, data gathering, involves collecting pertinent client information, often facilitated by a tax planning questionnaire. Following this, the analysis phase includes evaluating the data to identify potential tax-saving opportunities or liabilities. Lastly, implementation involves executing the proposed tax strategies tailored to the client’s needs.

A tax planning questionnaire is instrumental in the data gathering phase, ensuring that no significant detail is overlooked. It serves as a foundation for both advisors and clients to build a robust tax plan.

Components of an effective tax planning questionnaire form

A comprehensive tax planning questionnaire form should include multiple sections that address various aspects of a client's financial situation. These components serve to capture critical data effectively.

Country-specific tax considerations

Understanding country-specific tax regulations is critical for effective tax planning. Different jurisdictions have varying laws, credits, and deductions that can significantly impact financial decision-making.

Tax planning in the USA

For U.S. residents, a tax planning questionnaire should include key questions regarding specific deductions, such as those for mortgage interest, state taxes, and health care expenses. Additionally, understanding relevant tax credits, like those for education or energy efficiency, can greatly influence tax obligations. Engaging a tax advisor familiar with U.S. legislation ensures that clients take full advantage of all opportunities available.

Tax planning in Australia

Australian taxpayers need to consider specific questions related to local taxes, such as the Goods and Services Tax (GST) and various offsets available to them. The local tax environment changes frequently, and a tailored questionnaire for Australian residents should encompass inquiries about Family Tax Benefit eligibility or the Private Health Insurance Rebate. Monitoring these regulations allows taxpayers to effectively navigate their financial landscape.

20+ essential questions to include in your tax planning questionnaire

To create a well-rounded tax planning questionnaire, it’s essential to incorporate a range of questions that encourage detailed responses. Below are some pivotal questions classified into relevant categories.

Including open-ended questions will enable deeper insights into clients' financial perspectives, facilitating a tailored approach to tax planning that reflects their unique situations.

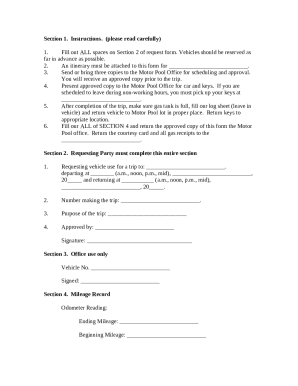

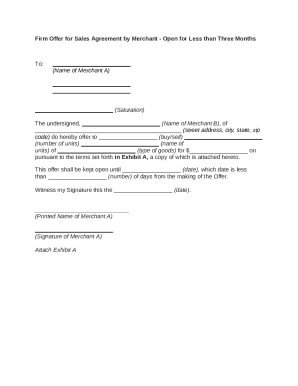

Streamlining document management with pdfFiller

With pdfFiller, users can create and manage tax planning questionnaires efficiently. The platform offers a variety of tools for customizing forms, making it easy to tailor the questionnaire to specific client needs or regulatory requirements. This flexibility is essential in accommodating diverse client profiles.

Moreover, pdfFiller's interactive features streamline the process of filling out forms. Users can collaborate in real-time, ensuring that both tax advisors and clients are aligned in their financial planning efforts. The added eSigning capability provides a secure method for clients to approve documents efficiently, making the entire process seamless.

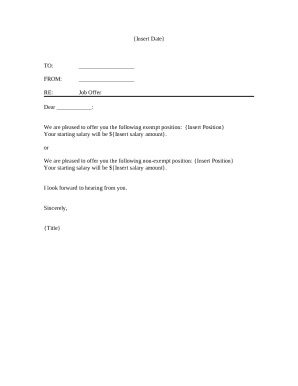

Editing and personalizing your tax planning questionnaire

Editing a tax planning questionnaire template using pdfFiller is straightforward. Users can follow specific steps to ensure the questionnaire meets their requirements while maintaining clarity and relevance.

Tailoring the questionnaire enhances the likelihood of receiving comprehensive, relevant responses from clients, empowering better financial strategies and planning.

Best practices for using a tax planning questionnaire

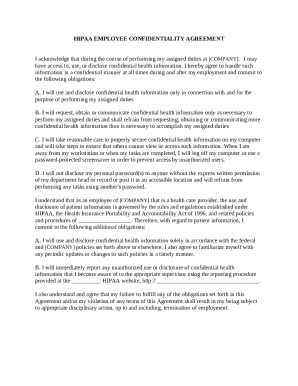

Effective use of a tax planning questionnaire requires careful attention to detail and best practices. Discussing financial information with advisors can be daunting for clients; hence, building a relationship based on trust is crucial. Encourage open dialogue and ensure that clients know their information will be kept confidential.

Using the questionnaire as a preparatory tool for consultations with tax professionals can lead to more fruitful discussions. Advise clients to fill it out thoroughly to maximize the appointment's effectiveness. This preparation helps taxpayers present their financial situations clearly and allows tax professionals to provide tailored advice.

FAQs about tax planning questionnaires

Addressing common questions about tax planning questionnaires can alleviate concerns for both clients and tax professionals. Clients often wonder what information they should provide and how it will be used in tax planning. Clarifying the structure and purpose of the questionnaire can enhance client engagement, leading to more accurate financial assessments.

Myths about tax planning, such as the belief that it is only necessary for high-income earners, can prevent individuals from seeking beneficial strategies. Raising awareness about the advantages and accessibility of tax planning can help demystify the process for many, encouraging proactive participation.

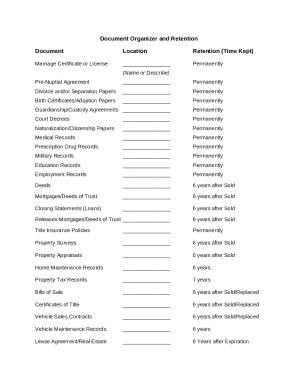

Insights on managing your tax planning documentation

Keeping tax documents organized is vital for effective tax planning. Establishing a system for record-keeping not only simplifies the documentation process but also enhances compliance with tax laws. Utilizing cloud-based solutions like pdfFiller ensures that records are easily accessible while remaining secure.

Regularly updating tax planning documentation is equally important. Changes in financial situations or tax regulations can affect tax obligations. To maintain an honest and effective tax strategy, ensure clients revisit their questionnaires and documentation periodically.

Encouragement for continuous learning in tax planning

Staying informed about changing tax laws and regulations is essential for both clients and tax professionals. Continuous education can take various forms, such as attending seminars, webinars, or utilizing online resources. Leveraging these tools helps ensure that tax planning strategies remain effective and compliant.

Encouraging an ongoing dialogue around tax planning fosters a culture of learning, helping clients recognize the value of proactive tax strategies. As they become more knowledgeable about their financial obligations and the benefits of effective planning, they will be more motivated to engage actively with their tax advisors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit tax planning questionnaire template from Google Drive?

How can I edit tax planning questionnaire template on a smartphone?

Can I edit tax planning questionnaire template on an iOS device?

What is tax planning questionnaire template?

Who is required to file tax planning questionnaire template?

How to fill out tax planning questionnaire template?

What is the purpose of tax planning questionnaire template?

What information must be reported on tax planning questionnaire template?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.