Get the free Joint Annual Report pursuant to the Fighting Against Forced ...

Get, Create, Make and Sign joint annual report pursuant

How to edit joint annual report pursuant online

Uncompromising security for your PDF editing and eSignature needs

How to fill out joint annual report pursuant

How to fill out joint annual report pursuant

Who needs joint annual report pursuant?

Joint Annual Report Pursuant Form: A Comprehensive Guide

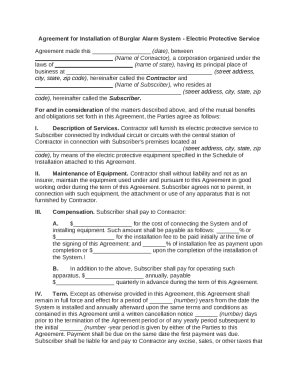

Understanding the Joint Annual Report Pursuant Form

The Joint Annual Report Pursuant Form is a critical document for organizations operating in a coordinated structure, such as joint ventures or partnerships. This form consolidates necessary financial and operational information to provide a holistic view of the entities involved. The primary purpose of this form is to ensure transparency and compliance with various regulatory standards, fostering trust and accountability among stakeholders.

Filing this form is vital as it not only meets legal requirements but also aids in strategic decision-making. By compiling financial performance data and management insights, organizations can better assess their joint ventures' effectiveness and align future strategies accordingly.

Key Regulatory Requirements

Organizations must adhere to guidelines set forth by the Securities and Exchange Commission (SEC) when filing the Joint Annual Report. It's imperative to stay informed about specific regulatory requirements, which can vary significantly based on the size and type of organization. For instance, larger publicly traded companies may have more stringent regulations compared to smaller entities.

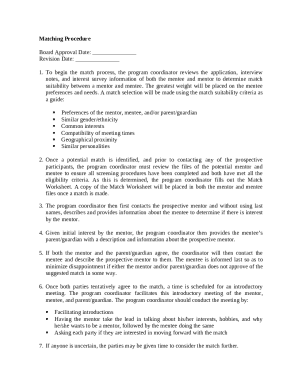

Preparing for the Joint Annual Report

Preparation for the Joint Annual Report involves collecting comprehensive information from all involved entities. The first step is gathering essential business information, including names, addresses, and Employer Identification Numbers (EINs) of each entity participating in the joint report.

Additionally, fostering collaboration among teams is crucial for a smooth preparation process. Utilizing collaborative tools can streamline communication and document sharing. Setting clear deadlines for information collection and assigning responsibilities can lead to more efficient teamwork.

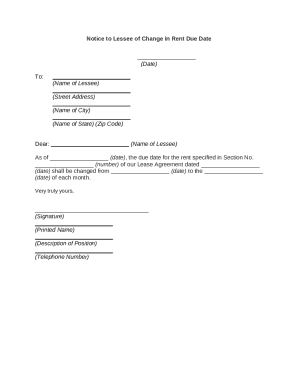

Step-by-step guide to completing the Joint Annual Report Pursuant Form

Completing the Joint Annual Report Pursuant Form involves a methodical approach to ensure accuracy and compliance. Each section of the form plays a critical role in presenting a cohesive narrative about the joint entities.

To facilitate this process, consider using tools like pdfFiller, which offer intuitive PDF editing capabilities, enabling you to fill out, sign, and collaborate on reports efficiently.

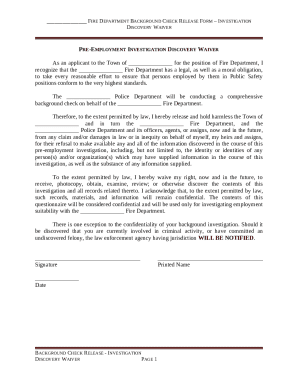

Navigating legal and compliance considerations

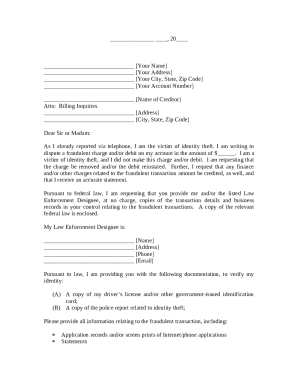

When preparing the Joint Annual Report, organizations often face compliance challenges, particularly regarding SEC regulations. Common issues include submitting incomplete documents or misinterpreting regulatory requirements.

The consequences of non-compliance can be severe, potentially leading to financial penalties and damaging reputations. Therefore, accuracy and timeliness are of utmost importance.

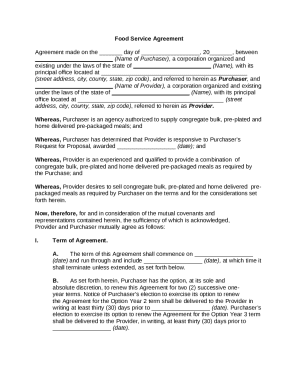

Best practices for submitting the Joint Annual Report

Successfully submitting the Joint Annual Report involves choosing the right method and following up diligently. Organizations have the option to file electronically or submit paper forms, each method bearing its own advantages.

Using a platform like pdfFiller for electronic submissions simplifies the process, allowing teams to collaborate in real-time, ensuring that all parts of the document are complete and correctly filled out before submission.

Following submission, routinely check the submission status. If corrections are necessary, take immediate action to rectify any discrepancies to maintain compliance.

Interactive tools for document management

In today's fast-paced business environment, utilizing effective document management tools is essential. pdfFiller provides a comprehensive suite of features designed to assist organizations in managing their Joint Annual Reports efficiently.

Navigating the pdfFiller platform is straightforward, with numerous tutorials available to assist new users in maximizing the platform's capabilities. Engaging with these resources can lead to enhanced efficiency throughout the report preparation process.

Case studies and real-world examples

Understanding how other organizations have successfully prepared and submitted their Joint Annual Reports can provide valuable insights. Highlighting success stories showcases practical applications and the positive outcomes achieved from effective reporting.

For instance, a mid-sized healthcare joint venture utilized a structured approach to improve its reporting accuracy and timeliness. The organization adopted a centralized documentation system, reducing compiling errors significantly. They reported increased confidence from stakeholders due to transparent communication.

Industry experts often emphasize the importance of rigorous preparation and teamwork. Interviews or insights from these professionals can further illuminate the best practices for completing joint reports successfully.

FAQs related to the Joint Annual Report

Many organizations have common questions when dealing with the Joint Annual Report. Understanding these frequently asked questions can clarify uncertainties and streamline the process.

Troubleshooting common issues may also arise, such as how to resolve errors during the form-filling process. Taking time to double-check and validate all data before finalizing the report can mitigate many issues.

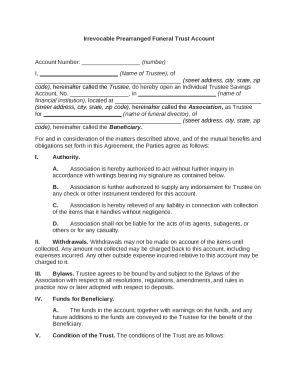

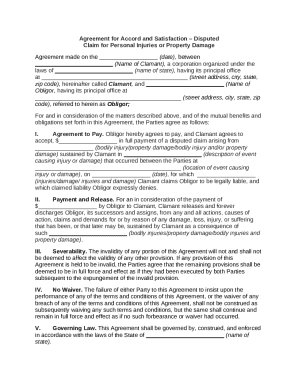

Significance of accurate documentation

Accurate documentation within the Joint Annual Report is essential for fostering trust and credibility in the organization. Well-prepared reports can significantly impact future financing opportunities as stakeholders seek transparent and reliable information.

Additionally, open communication between all parties in the joint venture promotes a culture of collaboration. Ensuring that partners are informed of financial standings and strategic decisions can lead to more successful and sustainable partnerships.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit joint annual report pursuant from Google Drive?

How do I edit joint annual report pursuant on an Android device?

How do I fill out joint annual report pursuant on an Android device?

What is joint annual report pursuant?

Who is required to file joint annual report pursuant?

How to fill out joint annual report pursuant?

What is the purpose of joint annual report pursuant?

What information must be reported on joint annual report pursuant?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.