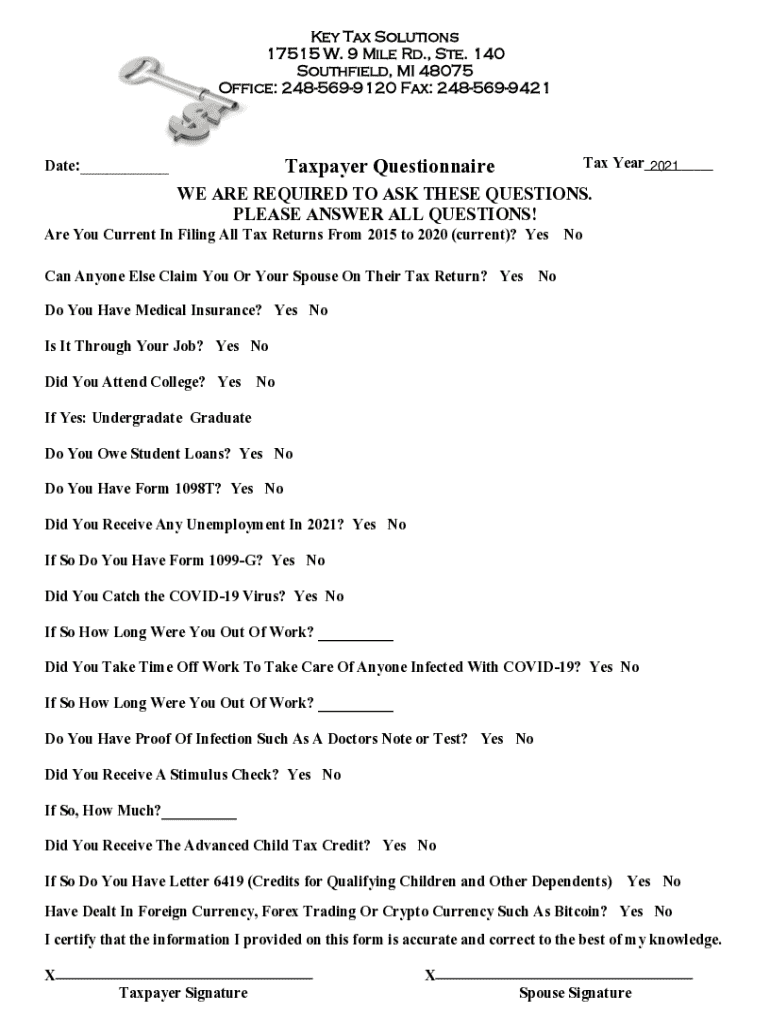

Get the free Key Tax Solutions

Get, Create, Make and Sign key tax solutions

Editing key tax solutions online

Uncompromising security for your PDF editing and eSignature needs

How to fill out key tax solutions

How to fill out key tax solutions

Who needs key tax solutions?

Key Tax Solutions Form: A Comprehensive Guide

Understanding the key tax solutions form

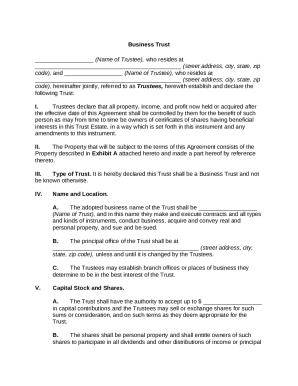

The key tax solutions form represents a vital document in the tax preparation landscape, serving not only as a means to report income but also as a gateway to potentially beneficial deductions and credits. It simplifies the tax filing process for individuals and entities and ensures compliance with federal and state tax laws. By accurately filling out this form, taxpayers can leverage available tax benefits, reduce their taxable income, and ultimately enhance their financial well-being.

Both individuals and teams can benefit from utilizing the key tax solutions form. Freelancers, independent contractors, and self-employed individuals are prime examples of those who must navigate this form to fulfill their tax responsibilities. Additionally, small business owners and accountants, who manage tax processes for clients, also need to be adept with various tax-related forms to ensure accurate and timely submissions.

Types of key tax solutions forms

There are several common forms classified as key tax solutions forms that facilitate reporting different types of income and deductions. For instance, Form 1040 is the standard individual income tax return, while W-2 forms report employee wages and withholdings. Each type of form serves specific purposes, and understanding their distinctions is crucial for successful tax filing.

Knowing when to use each type of form is essential. For example, individuals earning income from self-employment must use Schedule C alongside their 1040. On the other hand, those receiving wages from an employer will primarily need the W-2. Identifying the right form based on specific tax situations helps ensure compliance and maximizes available deductions.

Step-by-step guide to filling out the key tax solutions form

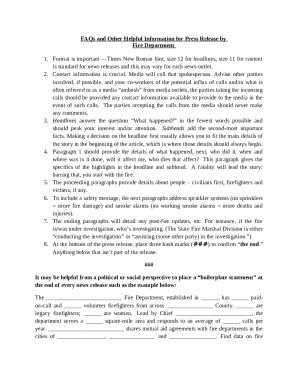

Preparing to fill out your key tax solutions form requires gathering several essential documents. Key information includes income statements such as W-2s and 1099s, investment records, previous year’s tax return, and any relevant receipts for deductions. Ensuring all documentation is organized can significantly streamline the preparation process.

Detailed instructions for each section of the form

Completing the key tax solutions form often necessitates careful attention to detail across various sections:

While filling out the form, avoiding common mistakes can save significant time and hassle down the line. Some frequent errors include entering incorrect Social Security numbers, failing to sign the form, and inconsistencies within income reporting.

Editing and managing your key tax solutions form

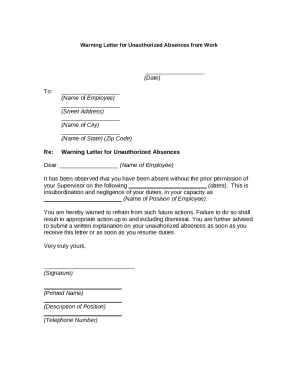

Managing your key tax solutions form can be significantly enhanced through platforms like pdfFiller, which provide user-friendly editing tools. To edit your form using pdfFiller, simply upload the document to the platform's workspace. Once uploaded, you can utilize various editing features that allow for adjustments to text, addition of new sections, and corrections, ensuring your form is accurate before submission.

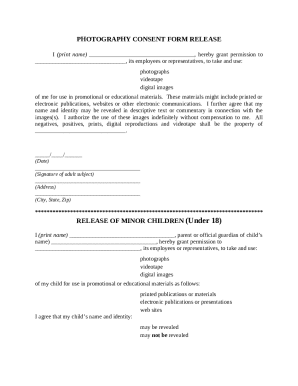

How to eSign your document via pdfFiller

Adding a digital signature is vital for validating your key tax solutions form. With pdfFiller, signing your document is straightforward. After finalizing any edits, select the option to add a signature. You can choose to draw your signature, type it in, or upload an image of it. This flexibility makes it easy for users to finalize documents securely and compliantly.

Collaborating with others

Collaboration is often essential when preparing tax forms. With pdfFiller, sharing your form with colleagues or tax advisors for feedback is simple. Users can share documents directly through the platform, allowing others to access and comment on the form without the need for back-and-forth email exchanges. This streamlined process ensures everyone involved stays informed and can provide input as necessary.

After submitting the key tax solutions form

Following submission of your key tax solutions form, it's crucial to track its status. Tax filers can confirm receipt by checking the IRS’s online portal or contacting their tax professional. This step ensures your return has been received and will be processed within the expected timeframe.

Managing audits and questions from the IRS

Handling potential audits or inquiries from the IRS can be daunting. If contacted, maintain clear and organized records to facilitate swift responses. Engage a tax professional to ensure guidance through the process, focusing on providing the requested information accurately and promptly.

Storing your form and supporting documents

Safely storing your completed key tax solutions form and supporting documents is crucial for future reference. Using pdfFiller, you can store files electronically, with options for categorization and tagging. This ensures that all your tax documents are organized and readily accessible for future filings or in the event of an audit.

Additional features of pdfFiller for tax management

One of the standout features of pdfFiller is its suite of interactive tools designed to simplify tax filing. Users can access tax calculators, checklists, and tutorials, ensuring they are equipped to make informed decisions throughout the filing process. These resources help guarantee accurate tax filings without overwhelming complexity.

Templates for future tax years

With pdfFiller, you can also save templates for future tax filings. By storing a pre-populated form, users can use it as a reference for subsequent tax years or modify it as their financial situation changes. This saves time and provides a reliable starting point for future tax preparation.

Accessing customer support

If any issues or questions arise while using pdfFiller, accessing customer support is straightforward. Users can reach out via live chat, email, or phone, ensuring they receive timely assistance with their tax solution needs. Having this support readily available helps ease any concerns during the busy tax season.

Frequently asked questions (FAQs) about key tax solutions forms

What to do if you make a mistake on your form?

Mistakes on your key tax solutions form can be rectified by filing an amended return. This can usually be done with Form 1040-X. Ensure that you clearly identify the changes and provide the correct information to avoid complications with the IRS.

How do change my tax filing status?

To change your tax filing status, complete the key tax solutions form accordingly. You will need to decide whether you want to file as single, married filing jointly, married filing separately, or head of household, based on your specific circumstances. It's essential to assess how each status impacts your taxes.

Can submit my form online?

Yes, many key tax solutions forms can be submitted electronically through the IRS e-file system or via authorized e-file providers. Utilizing platforms such as pdfFiller can also assist in submitting forms online, making the entire process smoother and more efficient.

User testimonials on key tax solutions form experiences

Success stories

Many users have shared success stories regarding their experiences with pdfFiller. For instance, a small business owner described how using pdfFiller streamlined her tax filing process, allowing her to save hours of paperwork preparation. This facilitated timely submissions and minimized stress during tax season.

User ratings and reviews

User feedback consistently highlights pdfFiller’s ease of use and effective tax management features. Many users rate the platform highly for its intuitive design, convertibility of documents, and collaborative capabilities — all of which contribute to a positive tax filing experience.

Contacting pdfFiller for more help

Customer support options

Should you have specific inquiries or need assistance with tax solutions forms, pdfFiller offers multiple customer support options. From using live chat support for quick responses to submitting detailed inquiries via email, the platform aims to provide robust support to users facing tax-related challenges.

Addressing specific inquiries related to tax solutions forms

Users can also schedule consultations with pdfFiller representatives to discuss complex questions or personalized tax situations. This hands-on approach helps ensure that users receive tailored advice and insights concerning their particular document needs in a timely manner.

In-app tools and resources

Educational resources and articles

pdfFiller provides a treasure trove of educational resources, including articles focused on key tax dates, filing tips, and various guides to help users navigate their tax obligations. These resources empower individuals to make informed decisions related to their taxes and boost their overall confidence.

Key tax dates and deadlines

Staying aware of key tax dates and deadlines is crucial in ensuring timely filings. pdfFiller offers a calendar of important tax-related cutoffs, encompassing submission dates, payment deadlines, and other significant events in the tax calendar. This proactive approach means users can set reminders and preemptively prepare for what lies ahead.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the key tax solutions in Chrome?

Can I create an eSignature for the key tax solutions in Gmail?

How do I fill out key tax solutions using my mobile device?

What is key tax solutions?

Who is required to file key tax solutions?

How to fill out key tax solutions?

What is the purpose of key tax solutions?

What information must be reported on key tax solutions?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.