Get the free My employer never completed my FMLA form which is ...

Get, Create, Make and Sign my employer never completed

How to edit my employer never completed online

Uncompromising security for your PDF editing and eSignature needs

How to fill out my employer never completed

How to fill out my employer never completed

Who needs my employer never completed?

What to Do When Your Employer Never Completed Your Form: A Comprehensive Guide

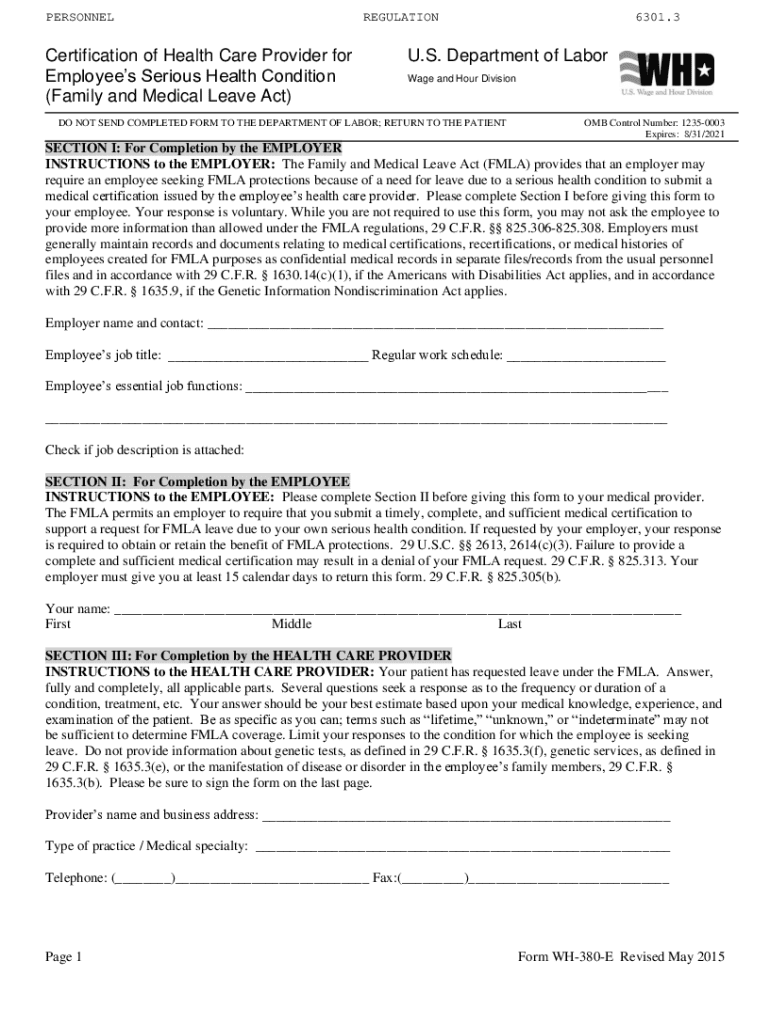

Understanding the importance of completing employment forms

Employment forms are vital for both employers and employees, ensuring compliance with legal regulations and facilitating essential processes like payroll and benefits. Key forms such as the W-2, I-9, and benefits enrollment documents provide a framework for verifying employment status and eligibility. Incomplete forms can lead to significant issues, including delays in accessing necessary benefits and potential legal problems for employers.

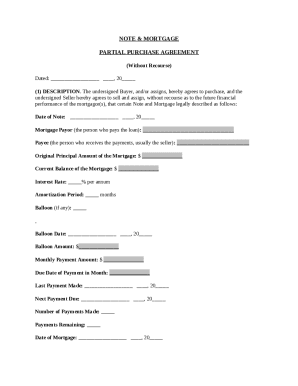

Identifying key forms your employer should complete

There are several critical employment forms that employers must complete, including the W-2 for tax reporting, the I-9 for employment eligibility verification, and benefits enrollment forms. Overall, these forms are intended to protect both the employer and the employee. Among these, the I-9 form holds particular importance as it verifies an employee's eligibility to work in the U.S.

The legal obligations surrounding the I-9 form are quite stringent. Employers are required by law to complete this form within three days of an employee’s hire date, ensuring that they verify each employee’s identity and work authorization documents. Failing to do so not only jeopardizes the employee’s position but could also subject the employer to significant penalties.

What to do if your employer never completed your -9 form

If you discover that your employer never completed your I-9 form, it’s crucial to take immediate action. Start by gathering the relevant documents you presented at the time of hiring, such as your passport or driver’s license, as well as your Social Security card. This information is essential for verifying your identity and eligibility.

Next, reach out to your HR department or direct supervisor to address the oversight. Formal communication is key; consider putting your request in writing, clearly stating that the I-9 needs to be completed. Ensure you document the date of your inquiry and any responses you receive to maintain a clear timeline.

Can your employer backdate the -9 form?

Backdating an I-9 form is a legal gray area. On the one hand, employers often cannot backdate the I-9 to reflect an employment start date before the form is completed, as this would violate federal regulations. The law stipulates that the I-9 must be completed no later than three business days after the employee starts working.

If the I-9 is not completed and the employee has begun work, the employer must update their records accurately without deceptive practices. Employers must address incomplete forms promptly to avoid further complications, such as fines or the risk of losing the employee.

How to address delays in completing your employment forms

If delays in completing your employment forms occur, effective communication becomes paramount. When addressing your concerns to your HR department or management, be direct yet respectful. Explain the situation, emphasizing the need for urgency regarding the documentation. Remember, clear communication is often the key to resolution in workplace settings.

It might also be beneficial to consult legal advice if you face continued resistance or if the issue significantly impacts your work. Documenting your concerns is crucial; maintain a timeline of communications and actions taken, so you have a clear record of your attempts to resolve the matter.

Impact of incomplete forms on employment eligibility

Incomplete employment forms can lead to a host of repercussions. On a personal level, you may face difficulties with employment verification, which can affect your ability to apply for loans, rent property, or access benefits. Additionally, payroll delays may occur, preventing you from receiving your wages on time.

For employers, failing to maintain proper documentation opens them to audits and fines, particularly if they are found non-compliant with federal employment laws. This situation can harm the employer’s reputation and their relationship with employees, emphasizing the importance of accurate and complete documentation.

Exploring your legal rights and responsibilities

As an employee, you have rights regarding the completion of necessary forms. Legally, an employer is compelled to provide a suitable working environment, which includes properly managing documentation like the I-9 form. You have the right to request updates on your employment forms and to receive a timely response.

Employers also bear significant responsibilities, including ensuring that all forms comply with legal requirements and that they do not engage in discriminatory practices during the hiring process. By understanding both your rights and your employer’s obligations, you can navigate any issues pertaining to incomplete forms more effectively.

Navigating the E-Verify program

The E-Verify program plays a crucial role in confirming an employee's eligibility to work in the U.S. This system allows employers to electronically verify the information provided on the I-9 form against Social Security Administration and Department of Homeland Security databases. If your forms are incomplete, it could lead to discrepancies when your employer attempts to use E-Verify, potentially delaying your employment.

Moreover, if you are an employer using E-Verify, ensure that your I-9 forms are completed correctly and promptly. Failure to do so can result in negative audit responses and significant fines, jeopardizing your business's standing.

Assistance resources for employees

If you find yourself struggling with incomplete employment forms, several national resources can assist you. The U.S. Citizenship and Immigration Services (USCIS) offers guidance on the I-9 and other related employment documentation. They provide a range of materials designed to educate employees on their rights and responsibilities.

Additionally, pdfFiller stands out as an essential tool that can help streamline the completion and management of your employment forms. Features such as eSigning, editing, and easy collaboration make pdfFiller a valuable resource for those looking to maintain their documentation efficiently.

FAQs about uncompleted employment forms

Understanding the potential complications surrounding uncompleted employment forms can alleviate some concerns. For instance, you may wonder, 'What if my employer refuses to complete my I-9?' In such cases, it’s essential to know that you should raise the issue with HR and, if necessary, explore further options by contacting relevant labor authorities.

Another common question is whether you can work while the I-9 is pending. The answer is no; you cannot work until your employer has completed the requisite employment verification. It’s crucial to stay informed about your rights and the proper steps to take if you encounter issues.

Best practices for maintaining employment documentation

Keeping track of your employment forms is crucial, not just for compliance but also for your future security. Make sure to establish a robust filing system, whether physical or digital, to have quick access to important documents whenever needed. Regularly follow up with your employer regarding any forms you expect to be completed and maintain open lines of communication about your status.

Moreover, familiarize yourself with the requirements and timelines involved for each document you encounter. By staying proactive about documentation, you can mitigate the risks associated with incomplete forms in the future.

Contacting the right authorities for help

When internal resolutions fail, escalate your concerns to the appropriate authorities, such as your local labor board or the Department of Labor. Prepare to present your case clearly and factually, supported by documentation outlining your attempts to resolve the issues internally.

It's vital to remain professional and factual throughout this process. Gather necessary evidence, such as email correspondence and notes from conversations, to strengthen your case and ensure a higher chance of achieving a favorable outcome.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send my employer never completed to be eSigned by others?

How do I complete my employer never completed online?

How do I complete my employer never completed on an iOS device?

What is my employer never completed?

Who is required to file my employer never completed?

How to fill out my employer never completed?

What is the purpose of my employer never completed?

What information must be reported on my employer never completed?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.