Get the free Payroll Deduction Authorization Form BlackRock ...

Get, Create, Make and Sign payroll deduction authorization form

Editing payroll deduction authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out payroll deduction authorization form

How to fill out payroll deduction authorization form

Who needs payroll deduction authorization form?

Payroll Deduction Authorization Form: Comprehensive How-to Guide

Understanding payroll deduction

Payroll deduction refers to the process by which an employer withholds a portion of an employee's earnings to cover various obligations. This might include income tax, Social Security contributions, benefits premiums, retirement plan contributions, and even wage garnishments in some cases. The purpose of payroll deductions is multi-faceted; primarily, they ensure that necessary taxes and contributions are collected seamlessly, enhancing compliance and benefiting both the employee and the employer. Common deductions include federal and state taxes, healthcare premiums, and contributions to retirement accounts.

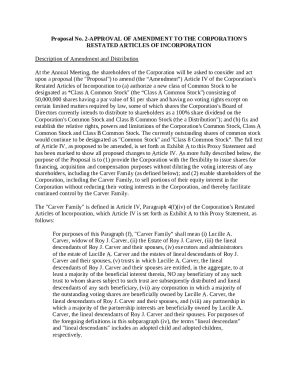

Having a signed payroll deduction authorization form is crucial. This form provides a legal framework confirming an employee's consent to the deductions from their paycheck. Without it, employers could face penalties, and employees might be unable to claim certain tax benefits or health insurance coverage. Essentially, this form acts as a protective measure for all parties involved.

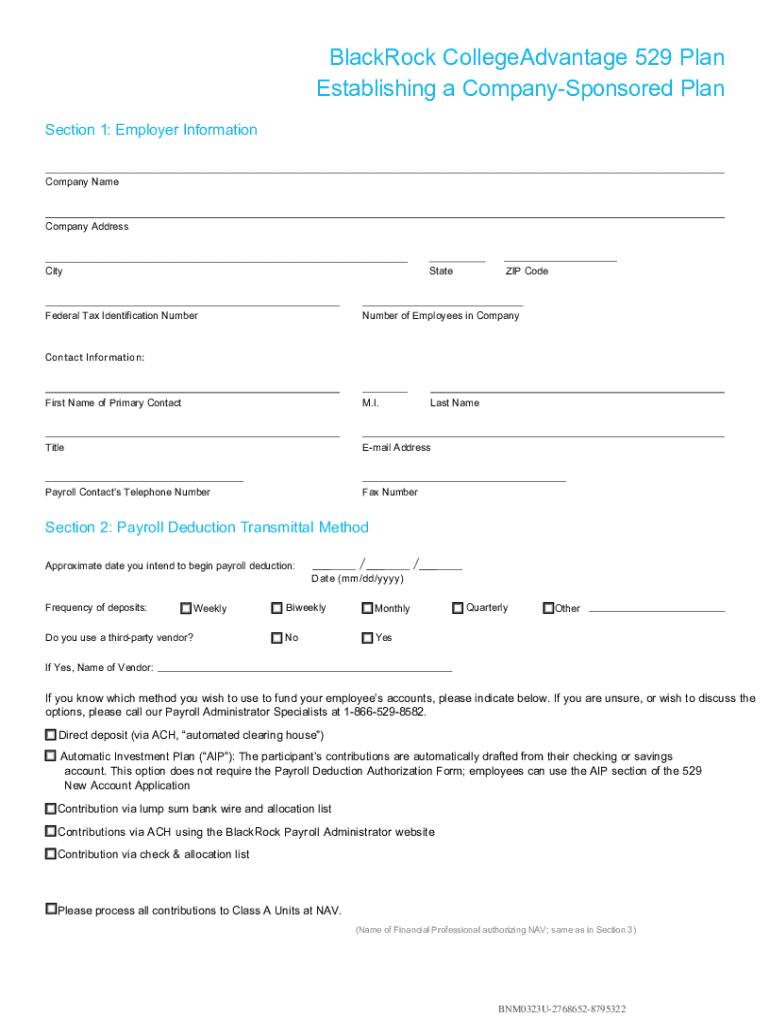

Overview of the payroll deduction authorization form

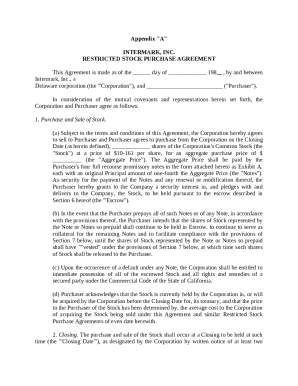

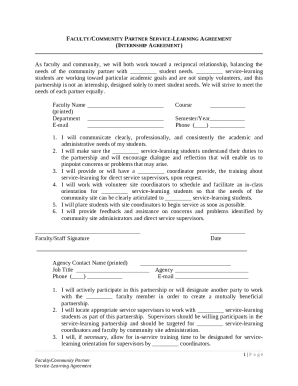

A payroll deduction authorization form is a document that outlines the specific deductions to be taken from an employee’s paycheck. It generally includes fields for both employee and employer information, the types of deductions authorized, and any relevant terms. The form serves a dual purpose: not only does it formalize which deductions are to be executed, but it also establishes a clear record of consent which is necessary for compliance with labor laws.

Typically, completion of a payroll deduction authorization form is necessary when employees are enrolling in benefits programs, adjusting existing deductions, or when there are changes in employment status. It's essential to distinguish between voluntary deductions, like contributions to a retirement plan, and mandatory deductions, such as taxes. Both types require formal authorization.

Components of the payroll deduction authorization form

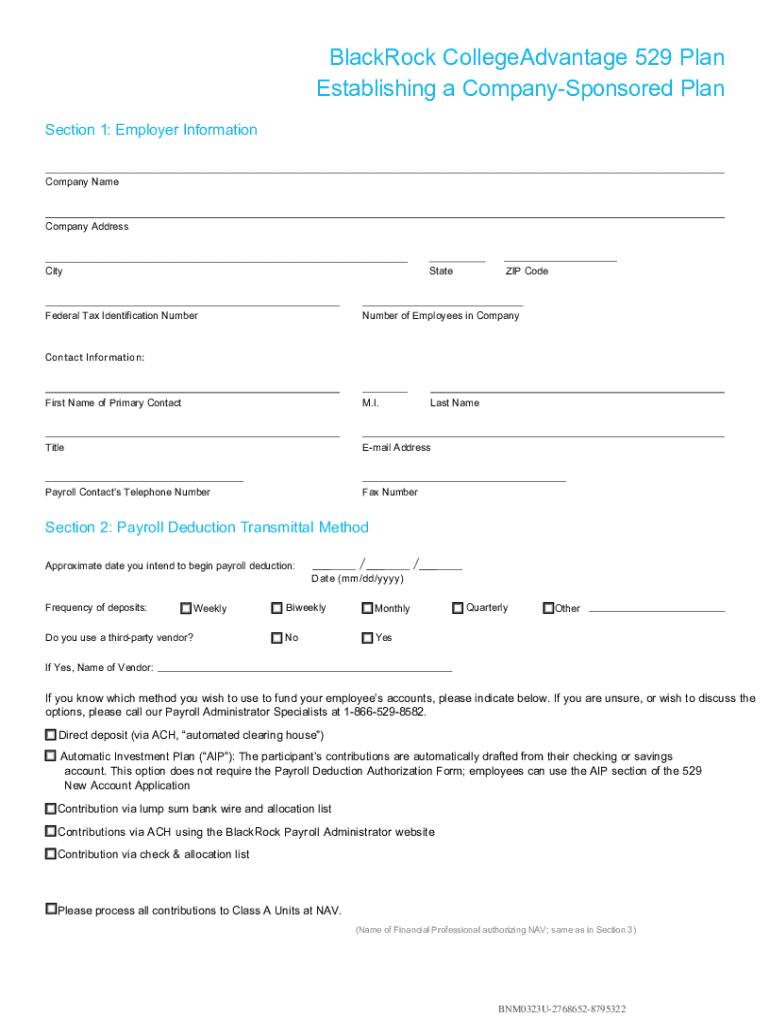

Understanding the components of the payroll deduction authorization form can help streamline the process of filling it out. The form generally comprises various sections that gather essential information. First, the employee information section will typically ask for details such as name, address, and Social Security number — crucial for correct identification in the payroll system.

Next, the employer information section captures the company name and contact details, ensuring both parties have a point of reference for any future inquiries. The deduction details section is where employees specify the deductions they wish to authorize, such as retirement contributions and health insurance options. Finally, the form will conclude with a section for the employee to sign and date the document, both of which are essential for the form's validity.

How to fill out the payroll deduction authorization form

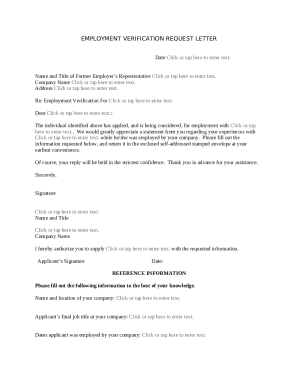

Filling out a payroll deduction authorization form might seem daunting, but it's straightforward if approached step-by-step. Start by gathering required information like last pay stubs, previous deduction setups, and personal identification documents. This will ensure you have all the necessary data at your fingertips.

Next, complete the employee information section accurately. Double-check your name, address, and Social Security number before moving on to the deduction details section. You’ll need to specify which deductions you want, such as health insurance or retirement contributions. Be diligent here, using checkboxes or dropdowns provided in the form.

Following that, review the employer information to ensure it aligns with your current workplace details. Errors can cause delays, so confirm that everything is accurate before signing. Finally, the signature and date sections must be completed; these are vital for the form's validity. If your company requires witnessing of signatures, don’t forget to have a colleague or HR representative sign as well.

Editing and managing your payroll deduction authorization form

pdfFiller offers an intuitive platform that simplifies editing your payroll deduction authorization form. Once you’ve uploaded your document, you can easily make changes online. The editing features allow you to add text, checkmarks, or even strike through sections that are no longer relevant. This flexibility ensures that your form is always up to date.

Once your form is ready, you can eSign it directly through pdfFiller. The platform’s eSignature functionality complies with legal standards, making your digital signature as binding as a handwritten one. After signing, you can save the completed form in various formats, such as PDF or DOCX, and share it easily with your HR or payroll department via email or cloud sharing.

Common mistakes to avoid

Filling out the payroll deduction authorization form requires attention to detail, and there are several frequent errors to watch out for. One common mistake is missing signatures or forgetting to date the form. These omissions can render your submission invalid, leading to processing delays that affect your deductions.

Another common pitfall is selecting incorrect deduction options. Employees may misread their options, leading to unintended withdrawals from their paycheck. Always double-check your selections, as mistakes can cause disruptions in your financial planning and potentially affect eligibility for certain benefits.

Frequently asked questions (FAQs)

If you submit your payroll deduction authorization form and later change your mind, revoking or altering deductions is usually straightforward. Most employers have a protocol for making changes, which may involve submitting a new authorization form. Check with your HR department for specific procedures relating to your workplace.

In today's digital world, many employers accept electronic submissions of this form, streamlining the process further. However, it's essential to verify that your employer's policies will accommodate e-submissions. If there are uncertainties, your HR representatives can provide clarification and guidance.

If you have questions about completing the payroll deduction authorization form, your first point of contact should be your HR or payroll representative. They are trained to assist with any uncertainties or issues you may encounter during the process. Engaging with them can significantly ease any confusion and provide clarity on company-specific procedures.

Best practices for managing payroll deductions

Monitoring your deductions on pay stubs is a good practice to ensure everything is accurate. Regular verification can alert you to any discrepancies or unauthorized deductions. Most payroll systems provide a detailed breakdown of your paycheck that can assist in tracking these deductions effectively.

It’s also wise to conduct a yearly review of your deductions. Life’s changes, such as getting married or having a child, may necessitate adjustments to your benefits and contributions. By regularly evaluating your payroll deductions, you can maximize your financial well-being and ensure that you are making efficient use of your earnings.

Conclusion for opting for digital tools

Managing your payroll deduction authorization form is significantly more efficient when utilizing tools like pdfFiller. The online platform offers an enhanced user experience for editing, eSigning, and sharing documents. Additionally, being cloud-based means that you can access your forms from anywhere, which is a considerable advantage for busy professionals.

Embracing digital tools not only streamlines the payroll deduction process but ensures that you have a secure, organized way to manage important documents. With pdfFiller, users benefit from ease of use alongside compliance and efficiency, making it the perfect solution for modern payroll management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my payroll deduction authorization form directly from Gmail?

Where do I find payroll deduction authorization form?

How do I make changes in payroll deduction authorization form?

What is payroll deduction authorization form?

Who is required to file payroll deduction authorization form?

How to fill out payroll deduction authorization form?

What is the purpose of payroll deduction authorization form?

What information must be reported on payroll deduction authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.