Get the free Contractors Withholding Affidavits and Form IC-134 - CDS

Get, Create, Make and Sign contractors withholding affidavits and

Editing contractors withholding affidavits and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out contractors withholding affidavits and

How to fill out contractors withholding affidavits and

Who needs contractors withholding affidavits and?

Understanding Contractors Withholding Affidavits and Form

Understanding contractors withholding affidavits

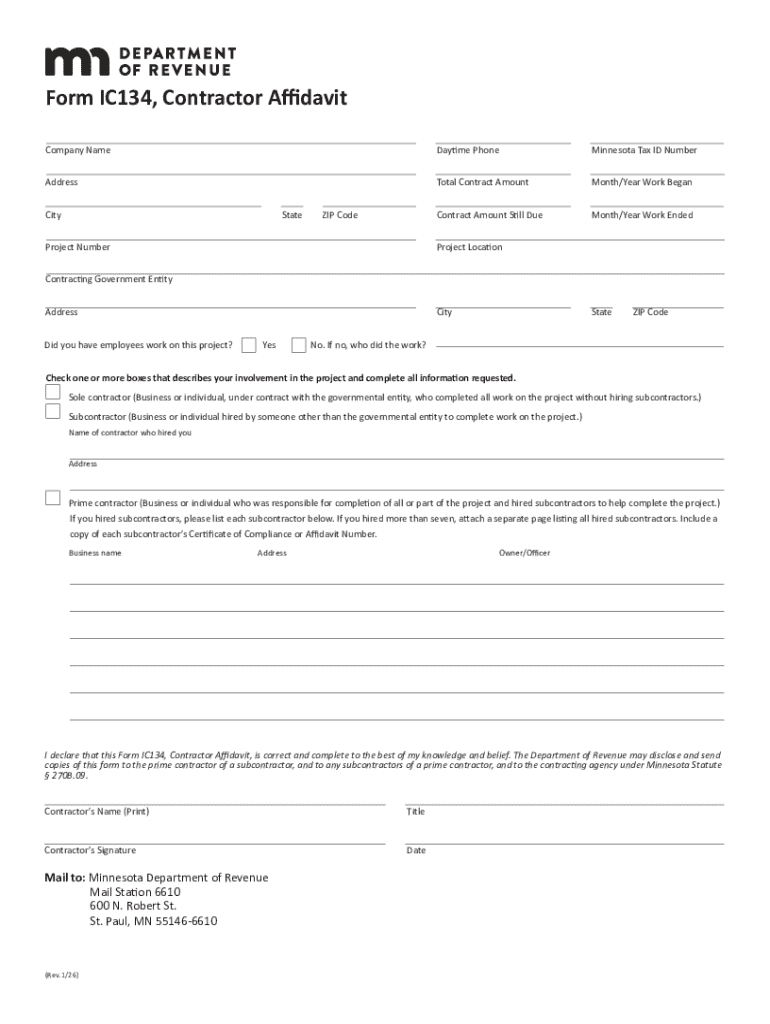

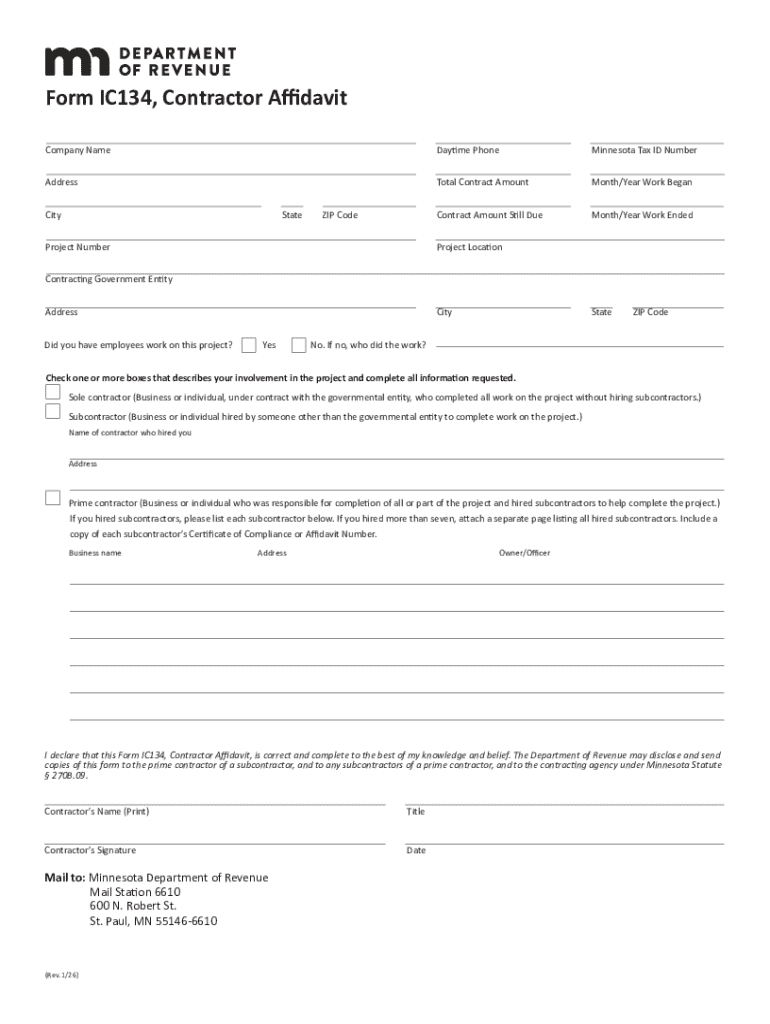

A Contractors Withholding Affidavit serves as a crucial document in the construction industry. This affidavit is a statement submitted by contractors detailing any amount that may be withheld from their payments. It is essential for maintaining transparency between the contractors and their clients, ensuring that all parties are informed about the withholding amounts for tax and compliance reasons.

These affidavits are particularly required to comply with state regulations, such as those set forth by the Minnesota Department of Revenue. Not only do they help in documenting the client's obligations, but also in safeguarding contractors against potential payment disputes that can arise during or after a project.

Importance for contractors and clients

Legal implications surrounding contractors withholding affidavits are substantial. These documents can protect contractors by providing a legal framework that supports their right to receive payments without delay due to miscommunications. For clients, knowing the exact amounts that are withheld can prevent any misunderstandings and lay a good foundation for future work and trust.

Additionally, proper use of withholding affidavits can help protect clients from liabilities, ensuring that funds are set aside appropriately. This mutual protection fosters a professional atmosphere where both parties can work collaboratively towards common goals.

Key components of a contractors withholding affidavit

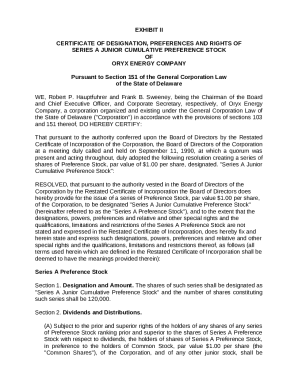

To be effective, a Contractors Withholding Affidavit must contain certain key components. Essential information includes personal identification details such as the contractor's name, address, and license number. Moreover, information about the contracting work itself, including project scope and deadlines, is paramount.

When it comes to payment terms, the affidavit should specify the total payment due and detail the amount being withheld. This clarity ensures all parties have a mutual understanding.

In addition to these details, other relevant documentation should be compiled. For instance, the contractor's tax identification number and any required licenses must be included. Proof of insurance and bonding is also critical to ensure that the client is protected against any unforeseen liabilities arising from the project.

Step-by-step guide to completing a contractors withholding affidavit

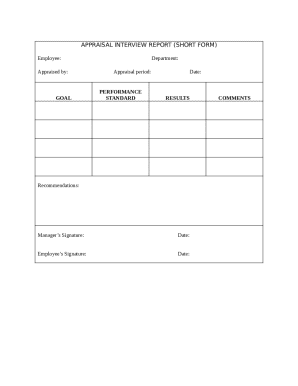

Completing a Contractors Withholding Affidavit can seem daunting, but a systematic approach makes it easier. Start by gathering all necessary information, including personal details, project specifics, and financial terms. A checklist format can simplify this process.

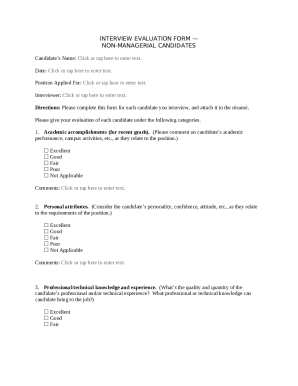

After obtaining the requisite information, proceed to fill out the form. Each section of the Contractors Withholding Affidavit should be completed accurately, starting with contractor information, moving to client information, then specifying project details and payment terms.

Common pitfalls include incorrect data entries or missing signatures. To avoid these issues, it’s advisable to double-check all information. Using pdfFiller’s editing tools can be invaluable in this step, enabling easy adjustments to entries and ensuring that the document remains professionally formatted.

Editable templates for contractors withholding affidavits

Using pdfFiller’s online editor can greatly enhance your ability to manage Contractors Withholding Affidavits. The platform offers a variety of templates tailored to meet industry standards while allowing for customization according to specific project needs.

Features within pdfFiller simplify document editing and signing processes. Accessing templates is straightforward; simply visit the website, browse through the available options, and select the one that suits your requirements.

Customizing these templates can include modifying language to suit your communication style or adjusting formats to align with your branding. Once completed, exporting options are available for various file types, ensuring that you can share your affidavit in a format that best suits your needs.

Electronic signature options for contractors withholding affidavits

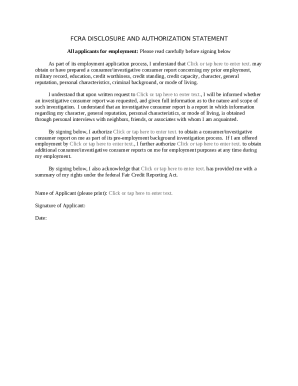

Receivers of Contractors Withholding Affidavits often require wet signatures; however, electronic signatures are increasingly accepted legally across many jurisdictions. Understanding the legal validity of eSignatures offers reassurance for both parties.

Using pdfFiller, the process of eSigning is straightforward. Users can simply select the appropriate section within the affidavit, and follow prompts to add their electronic signatures. Collaborative signing options are also available, enabling teams to sign off on documents efficiently.

Managing your contractors withholding affidavit after completion

Once a Contractors Withholding Affidavit is completed, storing and retrieving these documents safely is crucial. Utilizing cloud-based document management solutions, like pdfFiller, makes it easy to access and manage your documents from any location.

This accessibility ensures that all relevant parties can retrieve the affidavit when needed without worrying about physical storage issues. Additionally, pdfFiller offers secure sharing options, allowing clients and collaborators to review or comment on the affidavit walkthrough digital means.

Frequently asked questions (faqs)

When dealing with a Contractors Withholding Affidavit, it’s common to encounter various challenges. One frequently asked question is about what happens if a mistake is made on the affidavit. If an error is detected, it's essential to promptly amend the affidavit and communicate this change to all involved parties to prevent future discrepancies.

Another common point of confusion relates to updating information, especially when project details change. Keeping all parties promptly informed and ensuring the affidavit reflects current conditions is vital for maintaining legal compliance and fostering good business relations.

Best practices for utilizing withholding affidavits include timely filing and compliance with local regulations, which may vary significantly by state. Staying informed about these requirements is essential for successful project management.

Connect with support for assistance

Navigating the nuances of Contractors Withholding Affidavits can lead to questions or the need for further assistance. pdfFiller provides various support mechanisms, including a dedicated support team ready to assist you. Contacting them and seeking guidance is important for resolving issues promptly.

Additionally, staying updated with information and resources is advantageous. Signing up for newsletters can provide you with the latest tips on document management, legislation changes, and features available on the pdfFiller platform.

Legal considerations regarding contractors withholding affidavits

It's important to consider that requirements for Contractors Withholding Affidavits vary by state. States like Minnesota have specific laws outlined by their Department of Revenue that govern how these affidavits must be structured and submitted. Understanding these state-specific regulations is crucial for compliance.

Furthermore, the need for professional legal guidance cannot be overstated. When in doubt, especially with ambiguous project parameters or changing regulations, consulting with a legal professional can save you from potential disputes later on.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get contractors withholding affidavits and?

How do I execute contractors withholding affidavits and online?

Can I sign the contractors withholding affidavits and electronically in Chrome?

What is contractors withholding affidavits?

Who is required to file contractors withholding affidavits?

How to fill out contractors withholding affidavits?

What is the purpose of contractors withholding affidavits?

What information must be reported on contractors withholding affidavits?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.