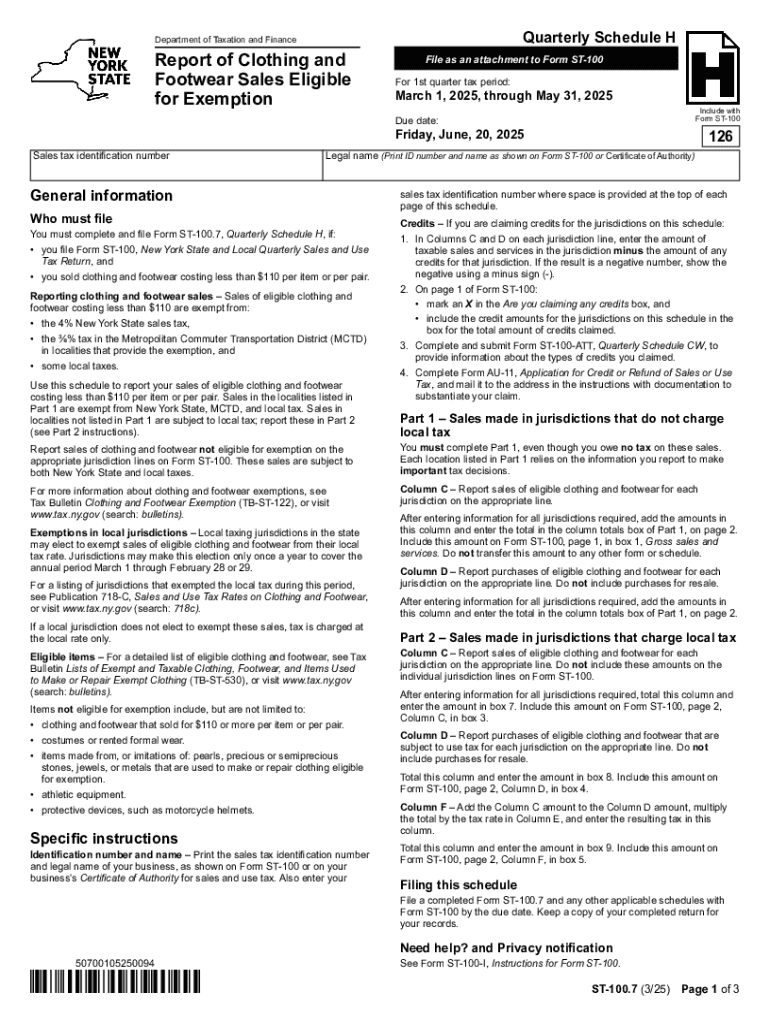

Get the free Online tax ny Quarterly Schedule H New York State ...

Get, Create, Make and Sign online tax ny quarterly

Editing online tax ny quarterly online

Uncompromising security for your PDF editing and eSignature needs

How to fill out online tax ny quarterly

How to fill out online tax ny quarterly

Who needs online tax ny quarterly?

Online Tax NY Quarterly Form How-to Guide

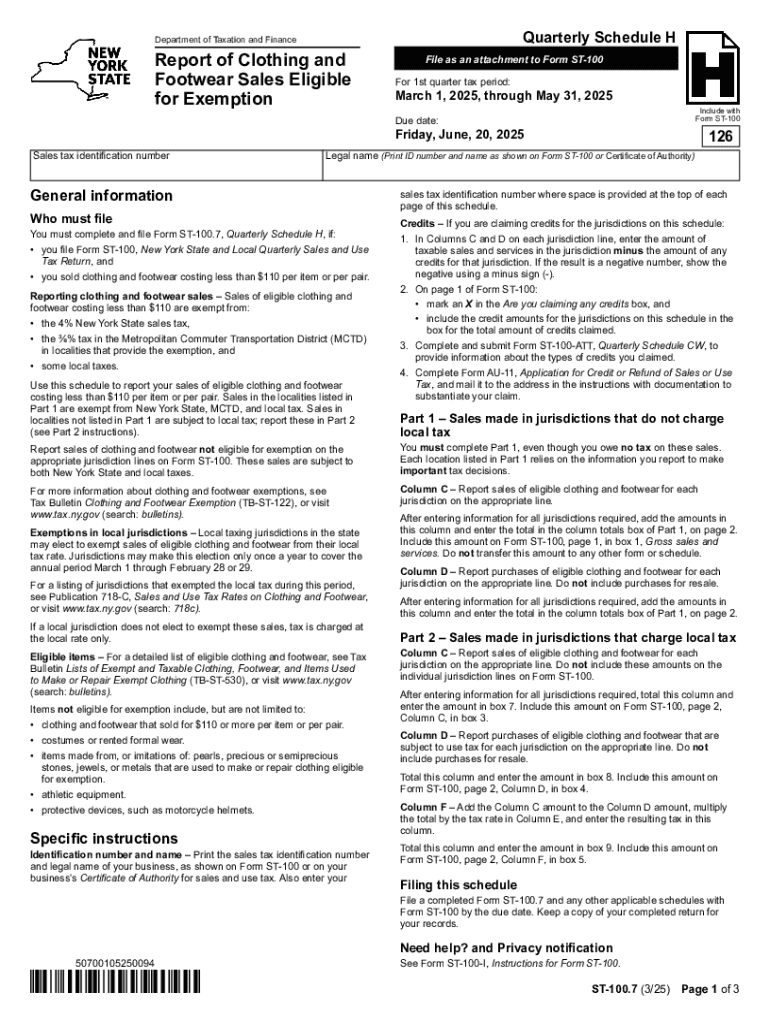

Understanding quarterly tax forms in New York

Quarterly tax obligations in New York are crucial for both individuals and businesses, as they ensure that taxes owed are paid on time, avoiding penalties and interest. This format allows taxpayers to make estimated tax payments based on their projected income, which helps maintain a consistent cash flow for the state and the taxpayer alike. It's essential to be aware of these taxes, as failing to file can lead to financial complications.

Timely filing and accurate reporting is imperative. The New York Department of Taxation and Finance emphasizes the importance of adhering to deadlines, which help prevent unnecessary audits and financial strain. Understanding the consequences of late or inaccurate submissions is vital for smooth financial management.

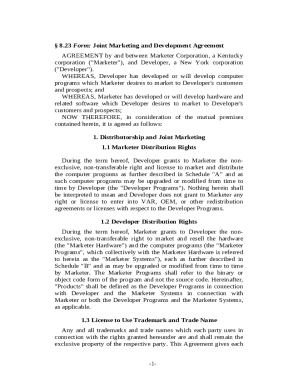

Types of quarterly tax forms in New York

In New York, there are several essential quarterly tax forms depending on your situation. Understanding each form's specific purpose is crucial for compliance and to avoid penalties. Here's a breakdown of the most commonly used forms:

Each of these forms has unique instructions and requirements that must be adhered to for successful filing.

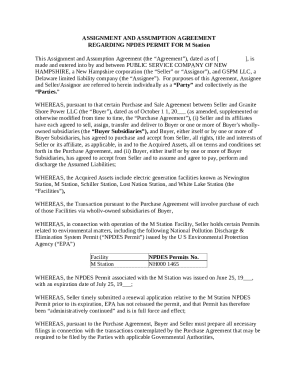

How to access online tax forms

Navigating the New York Department of Taxation and Finance website is straightforward for accessing forms. Start by visiting the official website, then follow these steps to find the necessary quarterly tax forms.

Using pdfFiller makes this process even easier because it provides seamless online access to a variety of forms, which can simplify your submission experience.

Filling out quarterly tax forms: step-by-step guide

Completing your quarterly tax forms can appear overwhelming at first, yet following a structured approach can help. Here’s a step-by-step guide to ensure you're set up for success:

Filing your quarterly tax return

Once you’ve completed your quarterly tax forms, the next step is to file your return. You have options regarding how you can do this, and understanding these options can simplify the process.

Make sure to double-check the submission requirements for your chosen method to avoid common mistakes and ensure successful filing.

Managing and organizing your tax documents

Effective document organization is crucial, especially for individuals or teams handling multiple filings. Using pdfFiller can streamline this process by providing comprehensive storage and tracking solutions.

Implementing these strategies will not only simplify your quarterly tax preparations but also enhance your overall financial management process.

FAQs about New York quarterly tax forms

Even with organized procedures, questions may arise. Addressing these frequently asked questions ensures clarity and peace of mind regarding quarterly tax responsibilities.

Seeking assistance for your quarterly taxes

Navigating tax requirements can be challenging, so having access to assistance is vital. The New York Department of Taxation and Finance offers resources for help, while pdfFiller provides support for users navigating the form-filling process.

The benefits of using pdfFiller for your tax needs

Using pdfFiller to manage your tax forms adds tremendous value. Beyond just editing PDFs, this platform offers various functionalities that help ensure efficiency and accuracy.

With these features, pdfFiller empowers users to manage their tax obligations seamlessly, making tax time less stressful and more organized.

Next steps after filing your quarterly tax form

After submitting your quarterly tax form, it’s crucial to understand what comes next. Processing times vary, but the state typically sends confirmations upon receipt of your filings.

Staying proactive in tax preparation not only prepares you for the next filing but also ensures compliance with evolving tax laws.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in online tax ny quarterly?

How can I edit online tax ny quarterly on a smartphone?

How do I edit online tax ny quarterly on an Android device?

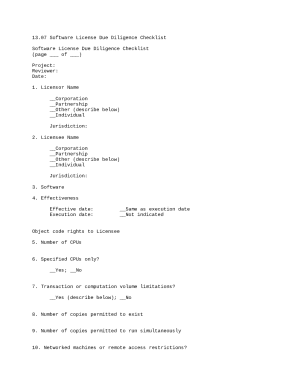

What is online tax ny quarterly?

Who is required to file online tax ny quarterly?

How to fill out online tax ny quarterly?

What is the purpose of online tax ny quarterly?

What information must be reported on online tax ny quarterly?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.