Get the free Fiduciary Tax Deadlines

Get, Create, Make and Sign fiduciary tax deadlines

How to edit fiduciary tax deadlines online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fiduciary tax deadlines

How to fill out fiduciary tax deadlines

Who needs fiduciary tax deadlines?

Fiduciary tax deadlines form: A comprehensive guide

Understanding fiduciary tax responsibilities

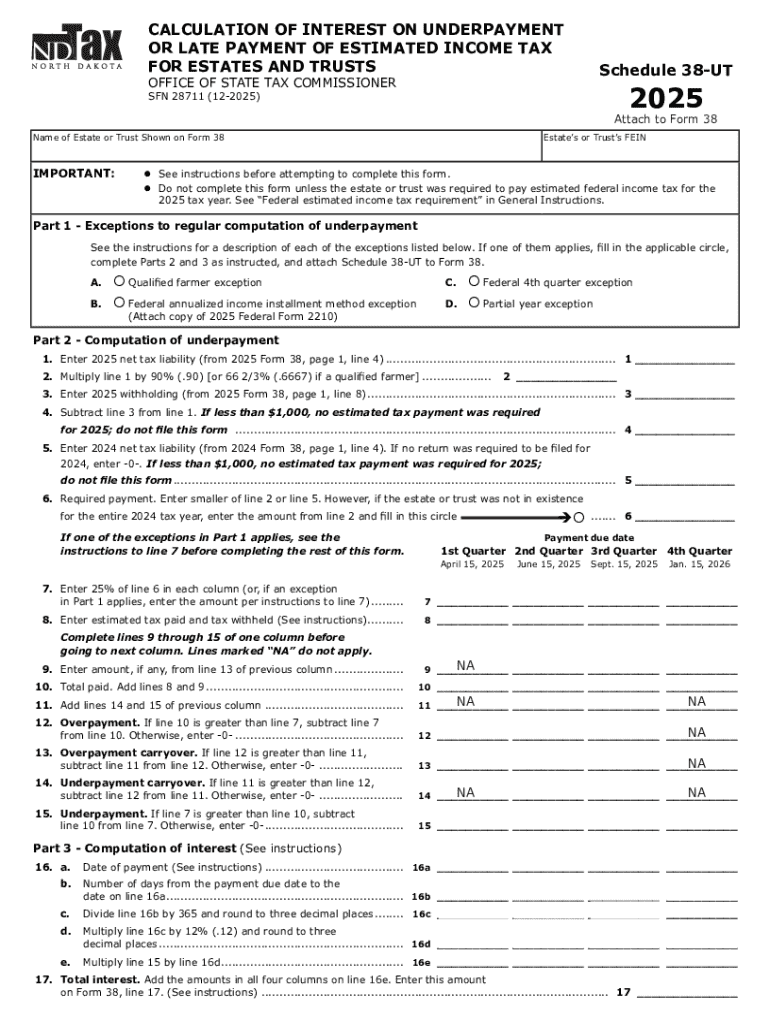

Fiduciary taxes are crucial for ensuring the proper handling of an estate's or trust's financial responsibilities. Fiduciary tax refers to taxes that responsible parties, often appointed through legal arrangements, must pay on behalf of trusts or estates. Understanding these tax obligations can help avoid penalties and ensure compliance with both federal and state laws.

A fiduciary is typically a person or entity entrusted to manage assets on behalf of another party. This can include executors of estates, administrators, and trustees. These fiduciaries bear the responsibility of managing the financial affairs of the beneficiaries and must report income and deductions accurately.

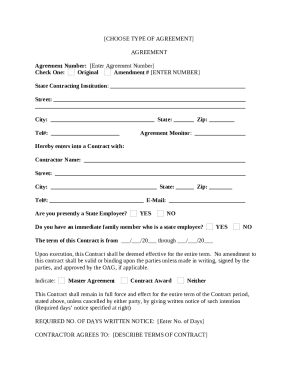

Several types of fiduciary forms must be utilized for tax reporting, including the federal Form 1041 and state-specific forms such as California's Form 541. Each form requires specific information about the income earned, deductions, and any distributions made to beneficiaries.

Overview of the fiduciary tax deadlines

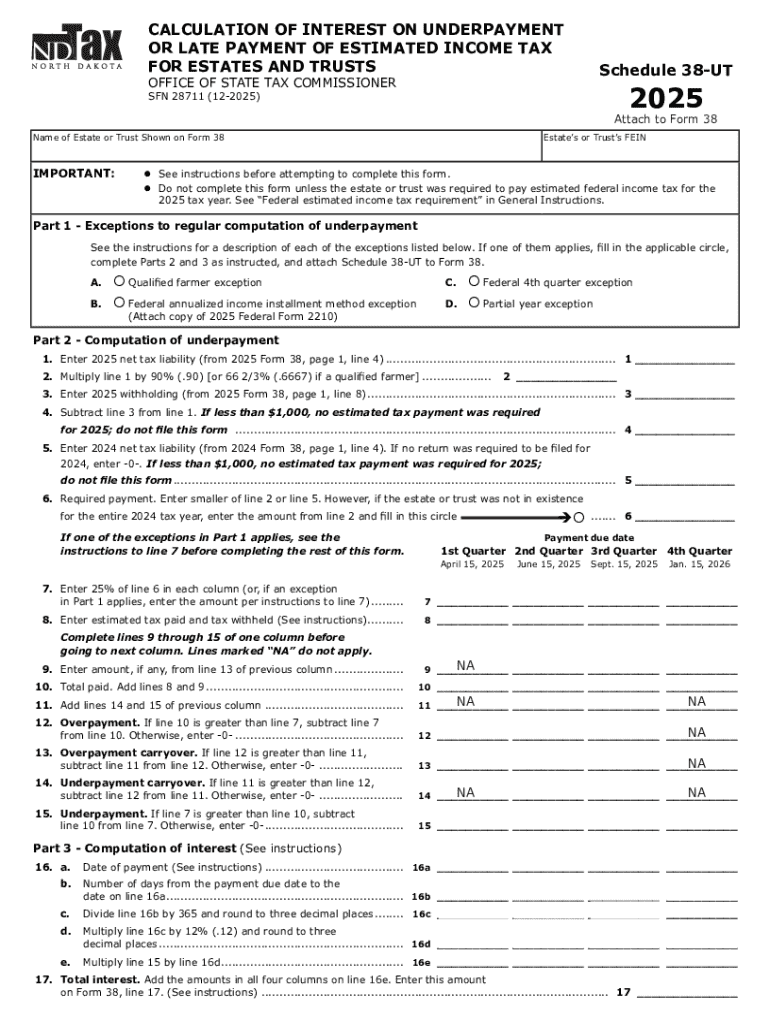

Fiduciary tax returns, such as Form 541 for California, come with distinct due dates that must be adhered to. These deadlines are structured to ensure timely submission and tax compliance. Generally, fiduciary returns are due on the 15th day of the fourth month after the close of the tax year for calendar year filers. For fiscal year filers, the deadline varies based on their chosen fiscal year end.

Adhering to these deadlines is crucial, as failing to do so can result in various penalties, including fines and interest on late payments. It's essential to distinguish between fiscal year versus calendar year filing requirements when managing fiduciary duties.

Detailed breakdown of fiduciary tax forms

Form 541: California fiduciary income tax return

Form 541 serves as the primary document for California fiduciaries to report income, deductions, and distributions. This form is pivotal for ensuring accurate compliance with California's tax laws. Understanding its purpose is essential for fiduciaries as it represents the income earned by the estate or trust and is used to calculate the amount owed to the state.

Eligibility to use Form 541 typically pertains to estates or trusts that have gross income exceeding a certain threshold set by the California Franchise Tax Board. Supporting documents required for submission include Schedule K-1, financial statements detailing the trust's income and deductions, and any relevant documentation to support claims made in the form.

Other relevant forms

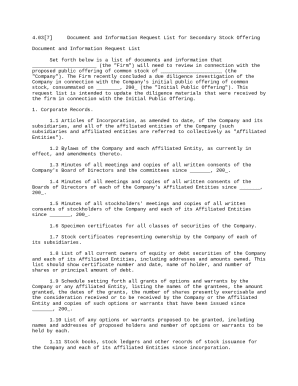

In addition to Form 541, fiduciaries must also be aware of other relevant forms, the most significant being Form 1041 for federal tax purposes. This U.S. Income Tax Return for Estates and Trusts serves similar functions at the federal level, requiring fiduciaries to report income, exemptions, and distributions. Each state may also have specific fiduciary forms, necessitating research into local requirements.

Important dates and filing schedules

Filing deadlines for Form 541

For fiduciaries employing Form 541, specific deadlines vary according to the type of tax year they are operating under. For calendar year taxpayers, the due date is April 15th of the following year. When applying for extensions, fiduciaries generally file Form 3537 to obtain additional time, typically up to six months. Missing these deadlines can result in penalties, making it vital for fiduciaries to remain vigilant.

Other key dates

It's also essential for fiduciaries to keep track of estimated tax payments, which may be required at quarterly intervals. Each state may impose its own additional deadlines for other relevant forms, necessitating close attention to ensure all obligations are met without repercussions.

Step-by-step guide to preparing the fiduciary tax form

Gathering required information and documents

Before filling out the fiduciary tax form, fiduciaries must compile all necessary information and documents, ensuring accurate completion. A checklist may include documents such as income statements (W-2s, 1099s), records of expenses, receipts for deductions, and prior year tax returns.

Filling out Form 541

Filling out Form 541 requires careful attention to detail. Key areas include reporting the trust’s or estate’s gross income first, followed by allowed deductions, and distributions to beneficiaries reported in Schedule K-1. Each section commands specific attention as inaccuracies can lead to complications.

Reviewing and validating your form

Once the form is filled out, reviewing is imperative. Cross-referencing with IRS guidelines ensures all applicable laws are adhered to, and conducting a final review against the checklist helps to catch any glaring errors. Mistakes can cause unnecessary delays, so it's prudent to take the time for thorough validation.

Submitting your form

When submitting the completed fiduciary tax form, fiduciaries can choose to do so through electronic filing or send a paper return. Many opt for online submission due to its convenience and quick processing times. It's also advisable to track submission status for peace of mind that all obligations have been met efficiently.

Tips for efficient document management

Efficient document management is vital for fiduciaries handling taxes. Platforms like pdfFiller enable users to streamline their operations. The use of cloud-based solutions is particularly beneficial, offering features such as secure storage and easy access from anywhere, which is crucial for collaboration among team members or co-fiduciaries.

Frequently asked questions (FAQs)

Many misconceptions surround fiduciary taxes that can lead to confusion for fiduciaries. Common questions often arise regarding the correct forms to file, particularly the differences between federal and state requirements. Furthermore, the nuances regarding tax deductions and the necessary documentation for Schedule K-1 can also create uncertainty, highlighting the need for clarity.

Navigating tax changes and updates

Tax legislation can be an ever-changing landscape, especially for fiduciaries. Staying informed about recent changes impacting fiduciaries is crucial for ensuring compliance. Regular consultations with tax professionals and reviewing annual filings help maintain accuracy and understanding of both state and federal tax laws.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit fiduciary tax deadlines on an iOS device?

How can I fill out fiduciary tax deadlines on an iOS device?

How do I fill out fiduciary tax deadlines on an Android device?

What is fiduciary tax deadlines?

Who is required to file fiduciary tax deadlines?

How to fill out fiduciary tax deadlines?

What is the purpose of fiduciary tax deadlines?

What information must be reported on fiduciary tax deadlines?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.