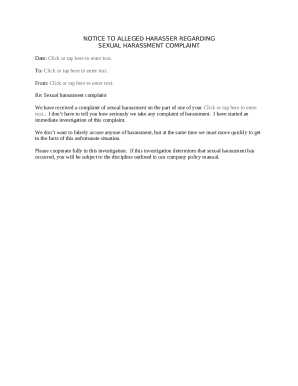

Get the free TPD Discharge Form

Get, Create, Make and Sign tpd discharge form

How to edit tpd discharge form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tpd discharge form

How to fill out tpd discharge form

Who needs tpd discharge form?

TPD Discharge Form: A Comprehensive How-to Guide

Understanding the TPD discharge form

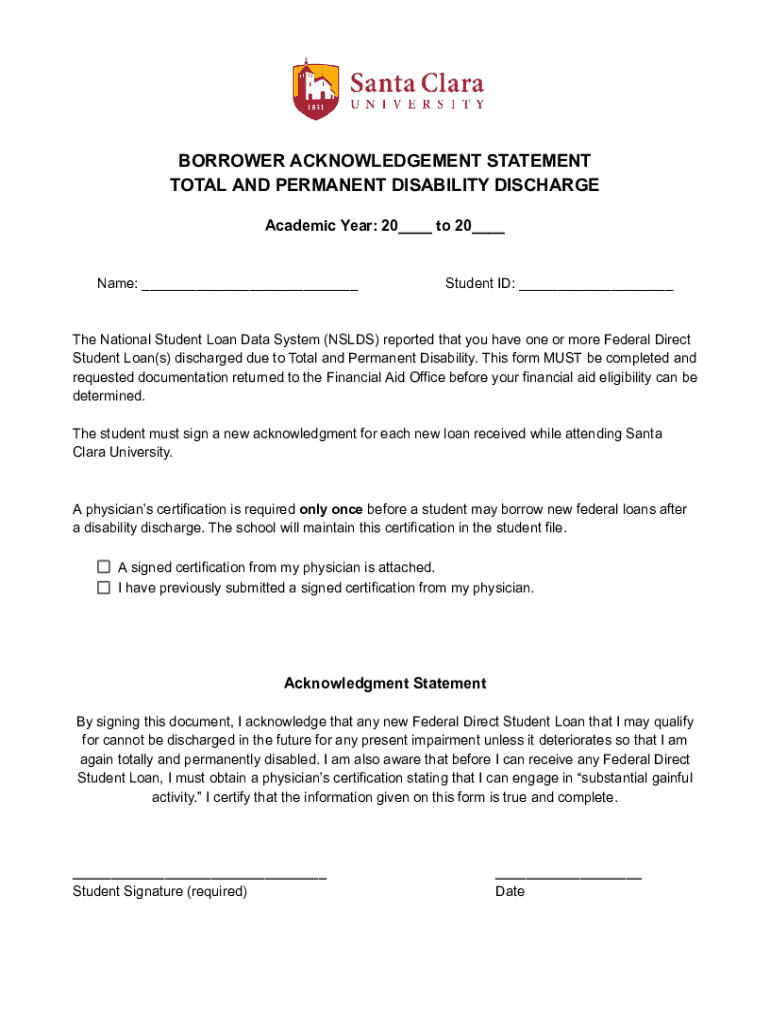

The TPD discharge form, or Total and Permanent Disability discharge form, is a crucial document for individuals who can no longer earn a living due to a disability. This form allows eligible borrowers to discharge their federal student loans, relieving them of the repayment burden that they can no longer manage. Given the economic and emotional toll of living with a disability, understanding the TPD discharge form becomes a vital step in your financial journey.

Completing and submitting the TPD discharge form not only provides relief from loan payments but also helps those affected regain their financial footing. Moreover, this process ensures that federal student loan holders are not penalized for circumstances beyond their control, thus creating a fairer financial landscape.

Assessing your eligibility for TPD discharge

To determine eligibility for the TPD discharge form, potential applicants must meet specific criteria. Primarily, individuals must qualify as being totally and permanently disabled, which is defined by federal guidelines. This disability can stem from various conditions, including those that severely impair mobility, cognitive function, and other essential life activities.

The types of disabilities qualifying for discharge encompass a range of physical and mental impairments. To prove eligibility, applicants must present appropriate documentation showcasing their disability, which often includes detailed medical records and evidence of how their condition affects their employment opportunities.

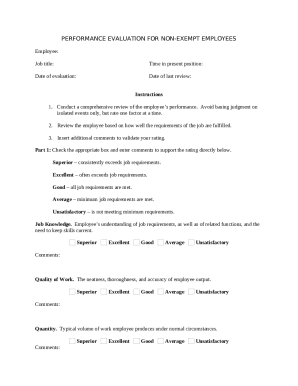

How to complete the TPD discharge form

Filling out the TPD discharge form can seem daunting at first, but breaking it down into manageable steps can simplify the process. Start by gathering necessary documents that support your application. This may include your medical records, a signed statement from your doctor, and any documentation that sheds light on the impact your disability has had on your employment.

Once you have your documents in order, complete the personal information section, where you will provide your name, contact details, and loan information. Pay special attention to detailing your disability status, as this section is crucial for validation. Lastly, make sure to sign and date the form, as any missing signature may delay processing.

Avoiding common mistakes is just as vital. Ensure every section of the form is filled out completely to prevent back-and-forth notifications, which can extend the processing time significantly.

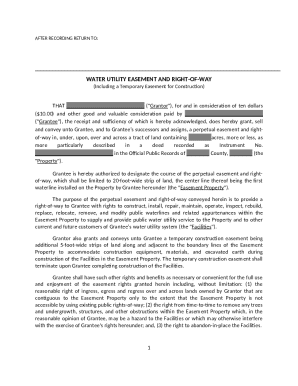

Submission process for the TPD discharge form

Once your TPD discharge form is completed and signed, the next step is submitting it correctly. You can send your form via mail to the appropriate address based on your loan servicer. It's crucial to ensure you send it to the right place to avoid delays in processing your application.

Considerable timing is involved post-submission. Generally, borrowers can expect the review process to take several weeks, depending on the volume of applications received. Keeping track of your application status can be done by contacting your loan servicer. This proactive approach ensures you can address any potential issues swiftly.

What happens after you submit your TPD discharge form?

Upon submission of your TPD discharge form, the review process is initiated. During this period, your application will be evaluated against eligibility criteria, and a decision will be made on whether to approve or deny your request. Typically, borrowers receive notification within 30 to 90 days, though this timeframe can vary based on numerous factors.

If your application is approved, the implications for your student loans are substantial, as the loans will be discharged, providing significant financial relief. However, in the unfortunate scenario where your application is denied, you will have options. This includes the ability to reapply or appeal the decision, emphasizing the importance of understanding the process thoroughly.

Frequently asked questions about TPD discharge

Many potential applicants often have questions regarding the TPD discharge form. One common inquiry is whether individuals can apply for TPD discharge more than once. The answer is yes, as long as they can provide sufficient documentation and justify the reason for reapplication. Additionally, some applicants worry about their circumstances changing and improving after receiving discharge. It's important to note that if your condition improves, you must notify your loan servicer to discuss the ramifications on your discharged loans.

Finally, issues can arise when borrowers face unresponsiveness from their loan servicers. It’s recommended to follow up regularly and escalate concerns if necessary, as this may prompt quicker responses. Understanding these common questions can help demystify the process and provide clarity.

Real stories: Experiences with TPD discharge

Personal anecdotes from individuals who have successfully navigated the TPD discharge process provide valuable insights. Many express a sense of relief upon receiving approval, as the financial burden of student loans can weigh heavily, especially when combined with the stress of living with a disability. Successful applicants often highlight the importance of thorough documentation and timely communication with their loan servicers as key to overcoming challenges.

Additionally, lessons learned from these experiences serve as guidance for future applicants. Many encourage others to remain persistent and to seek help if needed, emphasizing that understanding one’s rights and being well-informed about the application process can significantly impact outcomes.

Key tools and resources for managing your TPD discharge

Utilizing tools such as pdfFiller can streamline the document preparation process for the TPD discharge form. This platform is equipped with features that allow users to edit PDFs easily, eSign documents, and collaborate with others efficiently. Having the ability to manage your documents from a single, cloud-based platform enhances the experience, especially for those navigating the complexities of a disability and associated paperwork.

Engaging with additional digital resources can further provide ongoing support as applicants move through their discharge journey. These resources often offer advice, personal stories, and frequently asked questions that can illuminate the path toward successful discharge application.

Staying informed: Updates on TPD discharge legislation and policies

The landscape of TPD discharge policies is continually evolving, making it vital for potential applicants to stay informed. Recent legislative changes could impact eligibility criteria, submission processes, or overall benefits. Being aware of these changes can help applicants prepare and arm them with the information necessary to make informed decisions about their financial futures.

To stay updated, individuals can subscribe to newsletters from educational institutions or financial aid organizations. Additionally, monitoring government announcements and engaging in online forums can foster a supportive community of individuals navigating similar paths.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

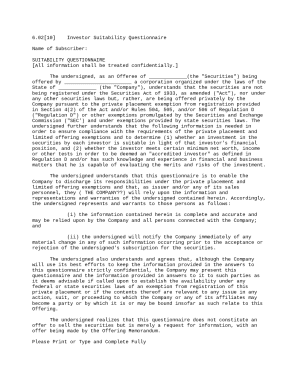

Can I create an electronic signature for the tpd discharge form in Chrome?

Can I create an eSignature for the tpd discharge form in Gmail?

How do I complete tpd discharge form on an Android device?

What is tpd discharge form?

Who is required to file tpd discharge form?

How to fill out tpd discharge form?

What is the purpose of tpd discharge form?

What information must be reported on tpd discharge form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.