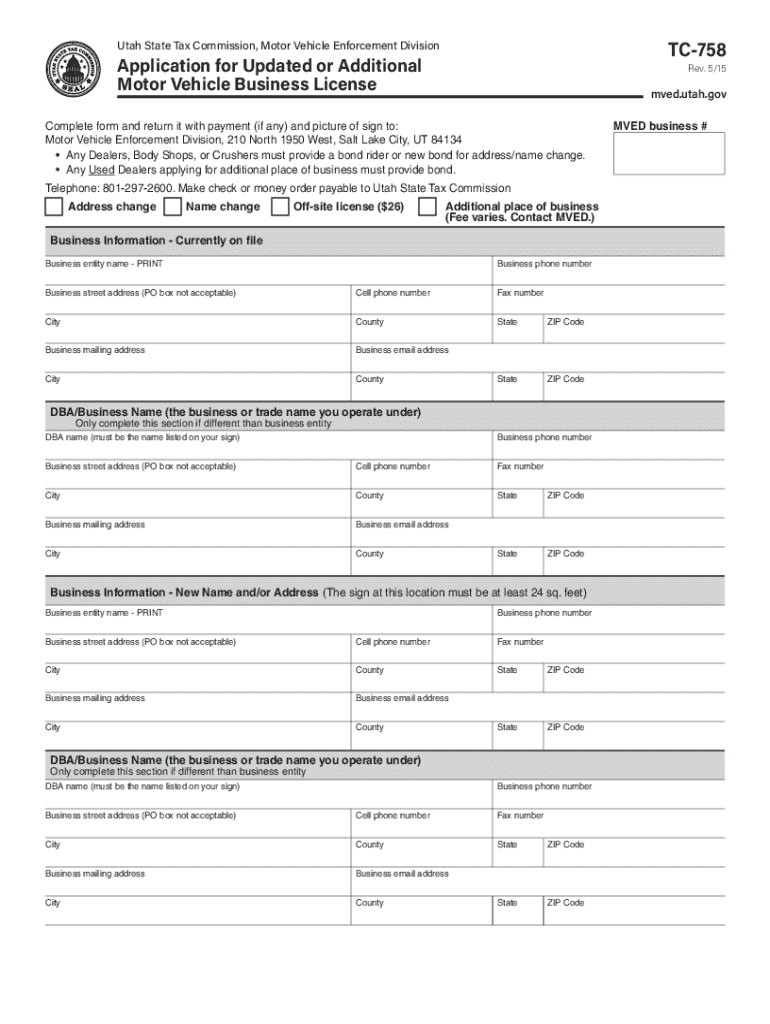

Get the free TC-758 Application for Updated or Additional Motor Vehicle Business License. Forms &...

Get, Create, Make and Sign tc-758 application for updated

How to edit tc-758 application for updated online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tc-758 application for updated

How to fill out tc-758 application for updated

Who needs tc-758 application for updated?

tc-758 application for updated form: Your comprehensive guide

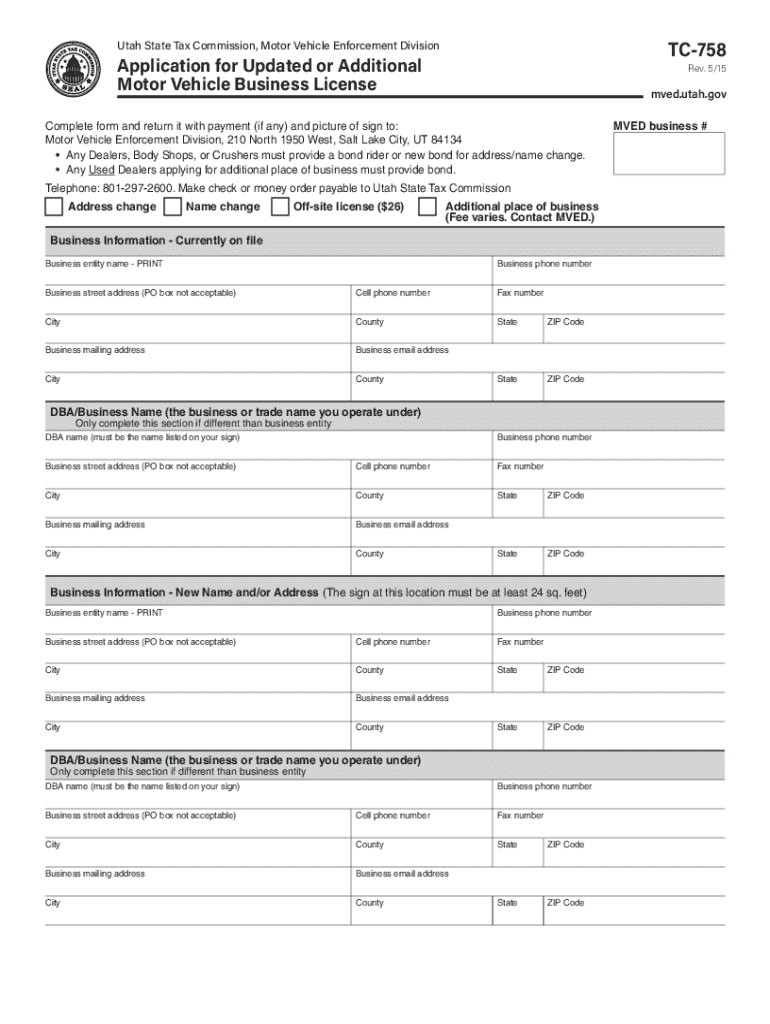

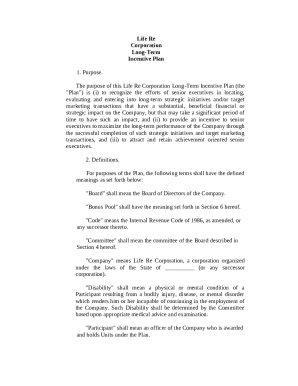

Understanding the tc-758 application

The tc-758 form is a vital document used primarily in the realm of updating and managing applications in various sectors. This form facilitates the formal request for modifications, ensuring that all updates are documented appropriately within your records, whether in professional or personal contexts. With increasing emphasis on digital documentation, the tc-758 is crucial for ensuring compliance with necessary regulations.

Tapping into the utility of the tc-758 form not only streamlines your document management process but also minimizes administrative burdens. By adhering to the usage guidelines of the tc-758, individuals and organizations can ensure their submissions are accurate and conform to state and federal tax laws and regulations, particularly in Utah, where specific local rules may apply.

Eligibility criteria for the tc-758 application

To ensure that all requests are valid, certain eligibility criteria have been established for individuals and teams aiming to file a tc-758 application. These guidelines help ascertain who can apply for the tc-758 form, ensuring that all applicants are authorized to make necessary updates to documentation.

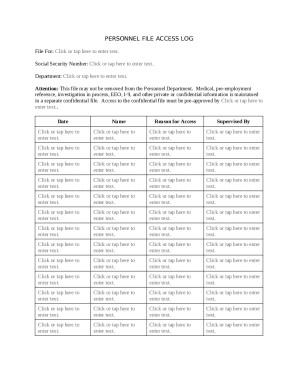

Individuals seeking to apply for the tc-758 form must present adequate identifiers, such as social security numbers or employee IDs. Conversely, teams submitting applications must designate a responsible party and include their team’s documentation to verify eligibility. Special considerations apply to collaborative efforts, where valid representation of each party involved is crucial.

Accessing the tc-758 application

Accessing the tc-758 application is straightforward, mainly through an online platform such as the pdfFiller website. This user-friendly interface enables applicants to locate the document easily within its extensive document library.

To efficiently locate the tc-758 form, begin by navigating to the pdfFiller website. Utilize the search function to filter through available forms, and be sure to check the most up-to-date versions available. Alternatively, you can also directly access the form by following links provided in e-services or through official communications from tax authorities.

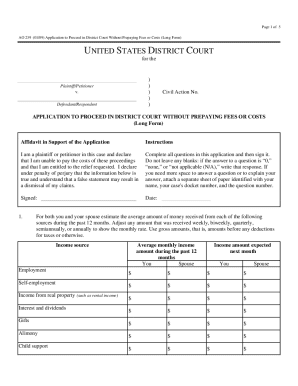

Filling out the tc-758 application

Completing the tc-758 application requires attention to detail, particularly in specific sections that demand clarity and accuracy. It's essential to begin with the personal information section, which typically includes name, address, and contact details. Ensure consistency between what is listed here and other official records.

The eligibility confirmation section follows, where you affirm your qualifications for submitting the form. Be meticulous about including all required attachments, such as evidence of prior documentation or other supporting materials, ensuring there are no gaps that might delay processing.

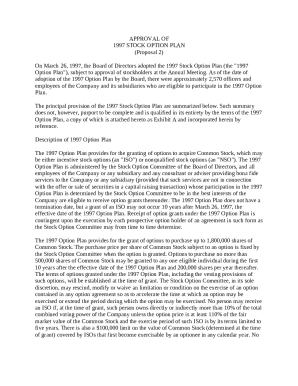

Editing and customizing the tc-758 application

One of the standout features of using pdfFiller is the ability to edit existing forms seamlessly. Users can modify fields easily, ensuring that any information needing updates can be altered without starting from scratch. This is particularly beneficial for those who may need to submit multiple applications over time.

Further, pdfFiller allows for the addition of digital signatures and annotations, making it a comprehensive tool for document management. Teams can collaborate effectively using pdfFiller's interactive features, allowing for real-time editing among team members, thus facilitating a smoother submission process.

Submitting the tc-758 application

Submitting the tc-758 application involves several steps that can vary based on whether you choose to submit online or via physical mail. When submitting online, follow the prompts on pdfFiller to ensure you upload any necessary documents and provide the requested information according to established guidelines.

If opting for a physical submission, print the completed form and send it to the designated address provided on the website or in corresponding documentation. Be aware of key deadlines, particularly in relation to state holidays or fiscal year cutoff dates, as missing these could hinder your application processes.

Managing your tc-758 application after submission

Once your tc-758 application has been submitted, effective document management becomes crucial. Utilizing the organizational features provided by pdfFiller, users can easily access and locate submitted applications without sifting through stacks of paper or backlog. The platform's designed functionalities simplify this process, allowing for efficient document retrieval.

Additionally, users should maintain open lines of communication with service providers in case of questions regarding application statuses or required follow-ups. It is advisable to regularly check the platform for any updates related to submission statuses, particularly around tax periods or when regulations may shift.

FAQs about the tc-758 application

Addressing common queries related to the tc-758 application ensures users are well-prepared when filing their forms. Many individuals often find themselves confused about specific requirements or the nuances involved in updates. By providing thorough answers to frequently asked questions, pdfFiller aims to smoothen the experience for everyone involved.

Common inquiries include how to rectify an error post-submission, how long processing typically takes, and what to do if additional documentation is requested. It's crucial for applicants to understand their rights and responsibilities while navigating tax laws in Utah and how variations might affect their submissions.

Interactive tools for enhancing your experience

pdfFiller’s suite of interactive tools enhances the tc-758 application experience significantly. Users can create their own templates based on previous tc-758 forms to streamline future processes, thus minimizing time and reducing the potential for inaccuracies. These tools promote efficiency and consistency in filing.

Additionally, best practices for document collaboration within teams ensure that everyone is on the same page. By utilizing real-time editing features, team members can collectively manage submissions, allowing for improved tracking and accountability.

Conclusion

Navigating the tc-758 application process can be simplified through clearly defined steps and by leveraging pdfFiller’s extensive features. From accessing and filling out the form to managing your submission post-filing, users have access to invaluable resources that empower them to maintain effective document management. Understanding the specifics of the tc-758 application ensures that users remain compliant while enjoying the convenience provided by modern e-services.

By employing the tools and insights shared in this guide, individuals and teams can confidently tackle their tc-758 submission, ensuring all updates are delivered accurately and in a timely manner.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tc-758 application for updated to be eSigned by others?

Where do I find tc-758 application for updated?

How do I edit tc-758 application for updated online?

What is tc-758 application for updated?

Who is required to file tc-758 application for updated?

How to fill out tc-758 application for updated?

What is the purpose of tc-758 application for updated?

What information must be reported on tc-758 application for updated?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.