Get the free Essential SEC Filings for Investors: Key Forms Explained

Get, Create, Make and Sign essential sec filings for

Editing essential sec filings for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out essential sec filings for

How to fill out essential sec filings for

Who needs essential sec filings for?

Essential SEC filings for form: A Comprehensive Guide

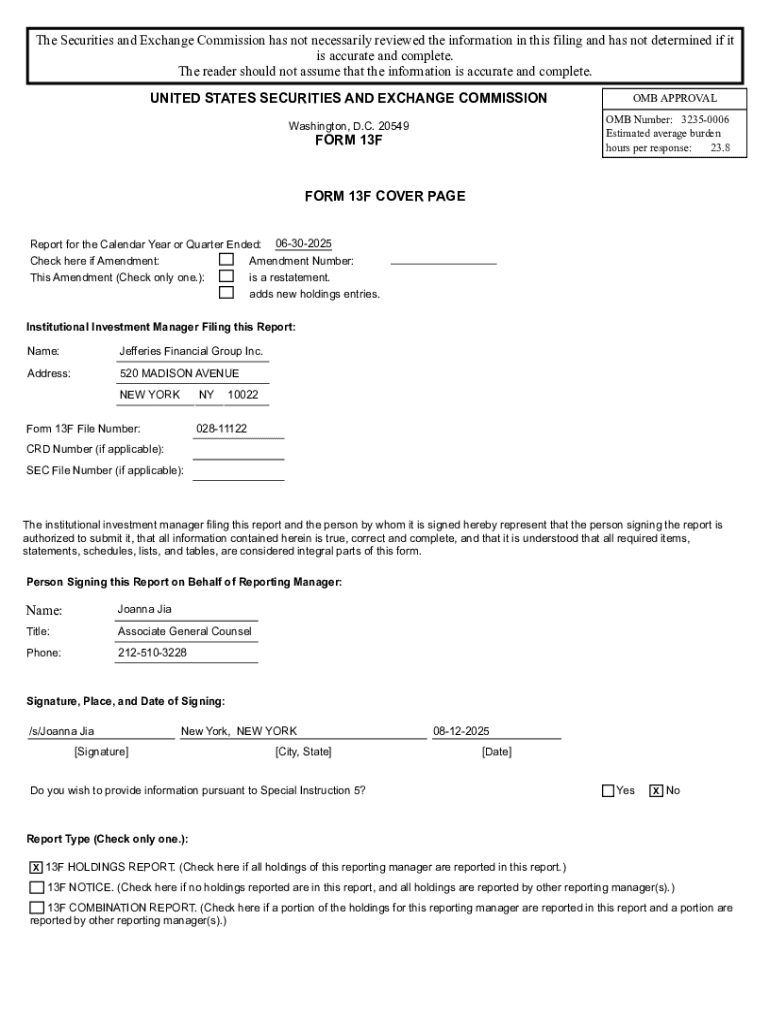

Overview of SEC filings

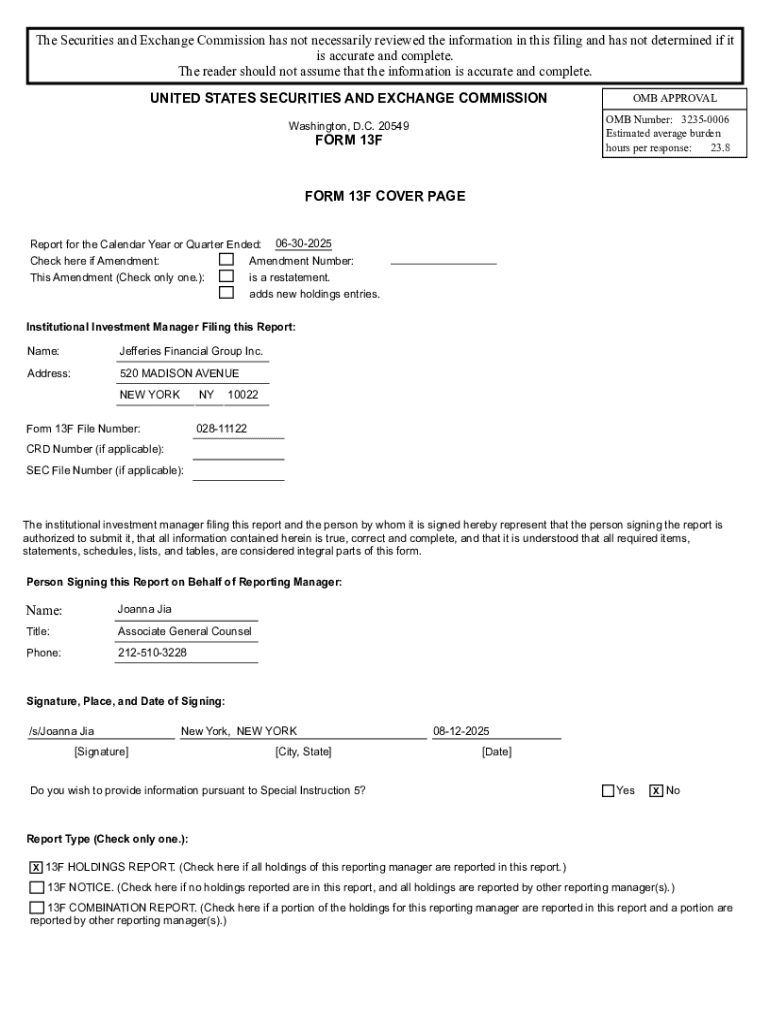

SEC filings are documents submitted to the U.S. Securities and Exchange Commission (SEC) by public companies and certain insiders. These forms are essential for ensuring transparency in the financial reporting of a company and keeping investors informed. They serve as a vital communication tool, allowing stakeholders to access crucial financial data and operational information.

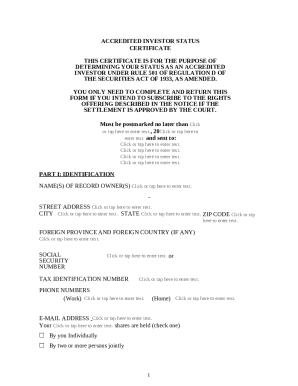

The significance of SEC filings cannot be overstated. They provide investors with insights into a company's financial health, operational results, and strategic direction. By mandating these disclosures under the Securities Act of 1933 and the Securities Exchange Act of 1934, the SEC helps facilitate a transparent and orderly market, thereby protecting investors from fraud.

Key entities required to file SEC documents include publicly traded companies, investment companies, and companies planning to go public. These entities must adhere to strict deadlines and reporting formats to ensure compliance with federal securities laws.

Types of SEC forms

Overview of common SEC forms

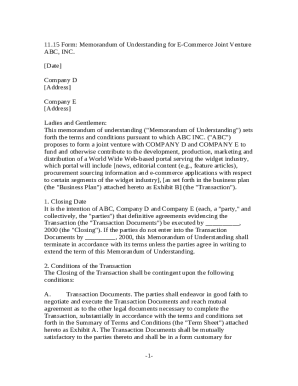

The SEC provides various forms for different reporting needs, each serving a unique purpose in the filing system. Here’s a look at some of the most commonly used forms:

Less common SEC forms

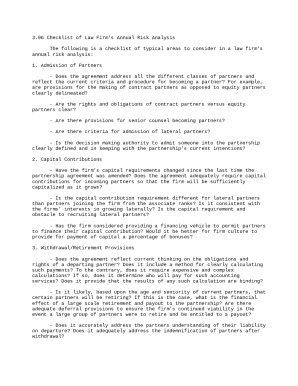

Beyond the commonly filed forms, there are lesser-known SEC forms that fulfill specific reporting requirements. These include:

Key components of SEC filings

Basic information required

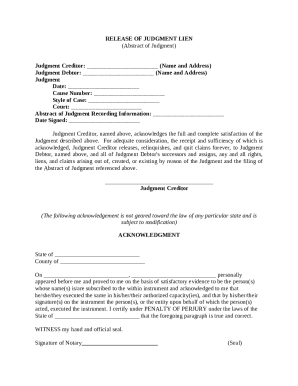

Every SEC filing must include certain basic information to provide a clear picture of the company's financial standing and risks. Essential elements include:

Schedules and exhibits

SEC filings often include additional schedules and exhibits to provide supplementary information. Common schedules include details about compensation plans or business operations, while exhibits may encompass various contractual agreements, significant operational metrics, or even legal documents that support the filings made.

Step-by-step instructions for filing SEC forms

Preparing your information

Before filing any SEC form, meticulous preparation is key. Gather all relevant financial data and review the reporting requirements specified by the SEC for your particular filing. This includes understanding the timelines and specific data points you must report on.

Filling out the form

Completing SEC forms requires precision and adherence to specified formats. Use technology, such as pdfFiller, to assist with formatting tasks and ensuring clarity in your submissions. It provides tools that help in editing and reviewing your documents before submission.

Submitting your SEC filing

The submission of SEC filings must be done electronically via the EDGAR (Electronic Data Gathering, Analysis, and Retrieval) system. After uploading your documents, it’s essential to confirm the successful submission to maintain compliance. Keep records of submission confirmations for your files.

Best practices for SEC filings

Accuracy and transparency

Ensuring the accuracy of information in your SEC filings is non-negotiable. Mistakes in submissions can lead to severe consequences, including fines and reputational damage. Regularly review all data and double-check calculations before finalizing your forms to avoid any oversight.

Regular review and updates

Establishing a filing calendar is crucial. This schedule should help you keep track of upcoming reporting deadlines and generally monitor ongoing reporting requirements. Make it a practice to assess your filings periodically to stay compliant.

Utilizing tools for efficiency

pdfFiller enhances the filing process with its efficient tools for document management, allowing for collaborative editing, eSigning, and comment reconciliation. Features designed for efficiency can significantly cut down on formatting tasks and ensure that every document is ready for submission.

Frequently asked questions (FAQs)

Common queries about SEC filings often arise, especially concerning what documents are required and the best practices for submission. It’s essential to have a consistent approach, and several resources are available to guide you. Understanding troubleshooting steps can help resolve any submission issues that may occur.

Clarification on document retention policies

Inquiries regarding how long to retain SEC filings and related documents are frequent. Generally, companies should keep these records for a minimum period defined by the SEC and consider their policies regarding document retention and retrieval.

Interactive tools for document management

Utilizing pdfFiller for SEC filings

pdfFiller offers a range of interactive tools designed to enhance your SEC filing experience. Its collaborative editing features allow teams to work together seamlessly, ensuring that all changes are tracked and reconciled efficiently. Additionally, eSignature capabilities streamline the signing process, making compliance easier.

Case studies

Numerous companies have successfully utilized pdfFiller for their SEC filings. These success stories illustrate how pdfFiller's tools can reduce time spent on filing processes and enhance overall document management. By leveraging technology, organizations can ensure accuracy and compliance in their submissions.

Conclusion and next steps

To excel in SEC filings, continuous education on SEC regulations is vital. Organizations must stay updated on the latest rules and forms, including any changes that may affect filing requirements. By fostering a culture of compliance and utilizing effective document management tools like pdfFiller, companies can navigate the complexities of SEC filings with confidence.

Engagement with industry news and resources keeps your filing practices sharp and aligned with current practices. By proactively managing your filing processes, you ensure that your company remains compliant in the rapidly evolving financial landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete essential sec filings for online?

Can I sign the essential sec filings for electronically in Chrome?

Can I edit essential sec filings for on an Android device?

What is essential sec filings for?

Who is required to file essential sec filings for?

How to fill out essential sec filings for?

What is the purpose of essential sec filings for?

What information must be reported on essential sec filings for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.