Get the free CBDDQ Wolfsberg Questionnaire

Get, Create, Make and Sign cbddq wolfsberg questionnaire

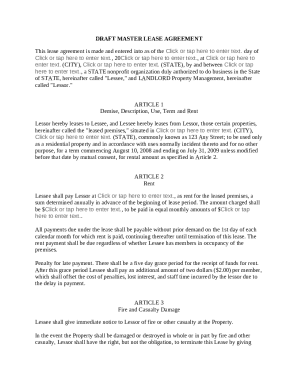

How to edit cbddq wolfsberg questionnaire online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cbddq wolfsberg questionnaire

How to fill out cbddq wolfsberg questionnaire

Who needs cbddq wolfsberg questionnaire?

A Comprehensive Guide to the CBBDQ Wolfsberg Questionnaire Form

Understanding the CBBDQ Wolfsberg questionnaire

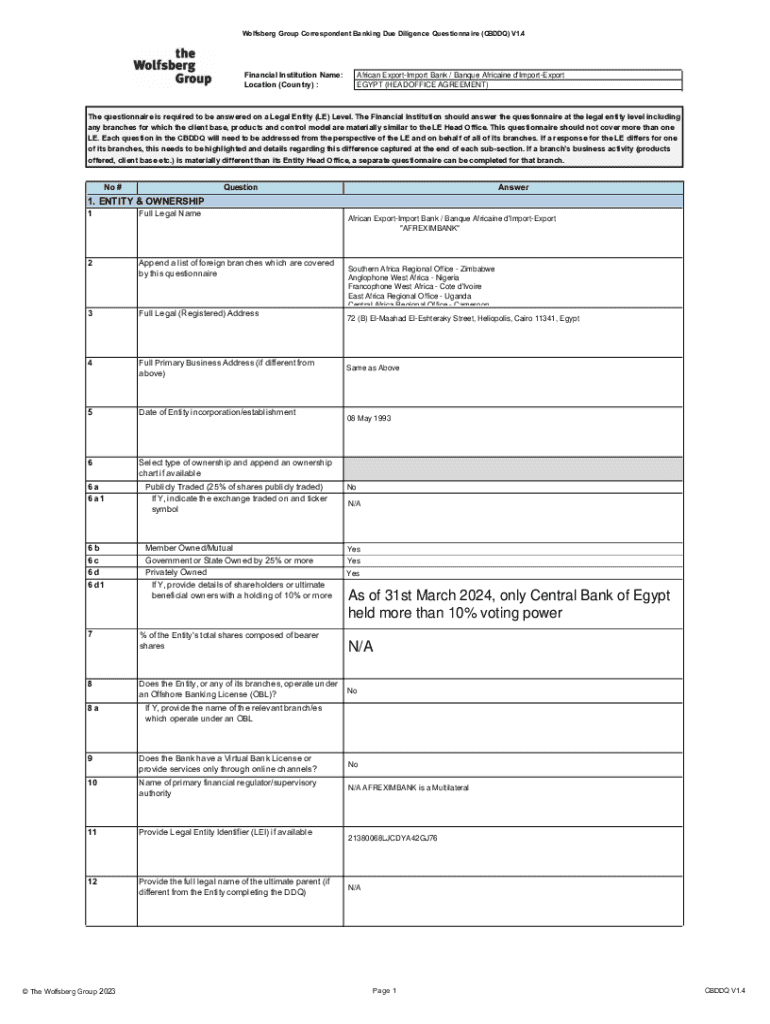

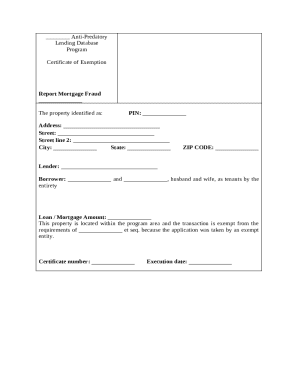

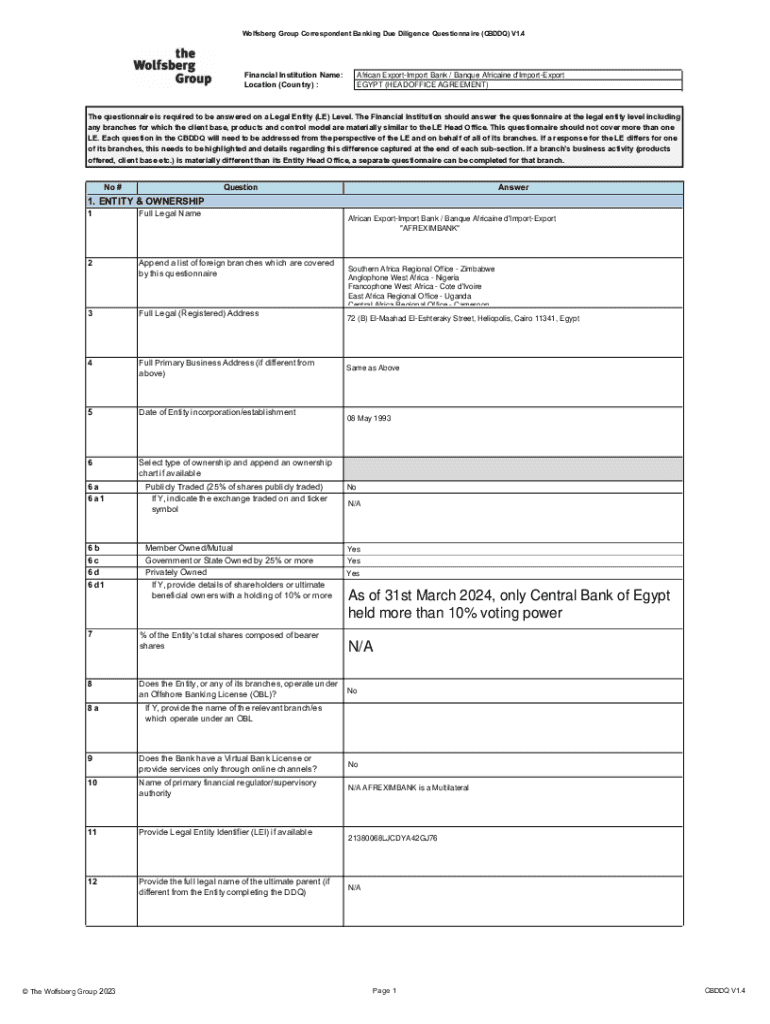

The CBBDQ Wolfsberg Questionnaire is a crucial tool designed for financial institutions to assess the risk associated with their customers. The acronym CBBDQ stands for the 'Correspondent Banking Due Diligence Questionnaire'. This document emphasizes the importance of understanding a client's risk profile to ensure compliance with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations.

Formed in 2000, the Wolfsberg Group is an association of 13 global banks committed to developing frameworks and guidance for managing financial crime risks. The organization aims to enhance standards in the banking industry by providing tools such as the CBBDQ, which helps institutions evaluate their clients effectively.

The questionnaire plays a significant role in compliance and risk management by fostering transparency and promoting standardized practices across institutions. It assists banks in mitigating potential risks originating from inadequate due diligence practices.

Key components of the CBBDQ Wolfsberg questionnaire

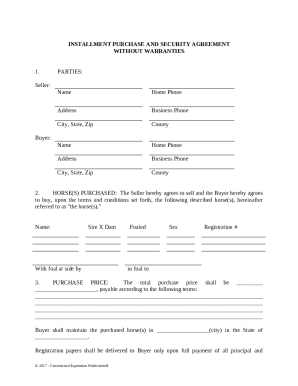

Understanding the CBBDQ Wolfsberg Questionnaire requires familiarity with its key components. These elements are structured to capture essential data about customers, evaluate risks, and ensure compliance. Here are the necessary sections:

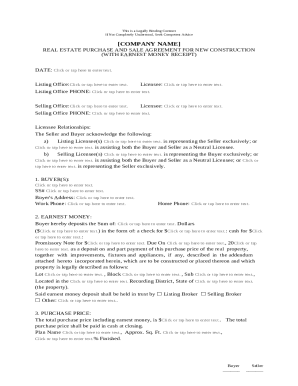

Step-by-step guide to completing the CBBDQ Wolfsberg questionnaire

Completing the CBBDQ Wolfsberg Questionnaire involves several key steps to ensure accuracy and thoroughness. Here’s a guide to navigate the process efficiently.

Tools for managing the CBBDQ Wolfsberg questionnaire

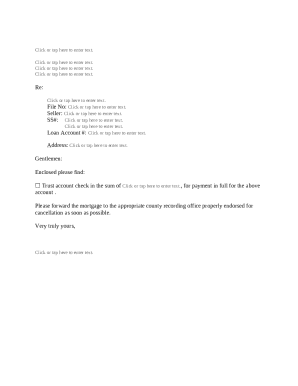

Managing the CBBDQ Wolfsberg Questionnaire can be streamlined using modern document management tools. One such powerful tool is pdfFiller, which enhances workflow and efficiency in completing compliance forms.

Advantages of using pdfFiller for CBBDQ Wolfsberg questionnaire management

Leveraging pdfFiller for managing the CBBDQ Wolfsberg Questionnaire offers several advantages. As a cloud-based platform, it ensures that team members can access and collaborate on documents from anywhere, facilitating a flexible working environment.

Security is paramount, especially when handling sensitive data. pdfFiller provides enhanced security features, including data encryption and secure backup options, ensuring that your compliance documents are protected against unauthorized access.

Additionally, pdfFiller integrates seamlessly with other compliance management systems, allowing for an efficient flow of information and improved handling of compliance-related processes.

Common challenges in completing the CBBDQ Wolfsberg questionnaire and how to overcome them

Completing the CBBDQ Wolfsberg Questionnaire can present challenges that may hinder timely submissions. Common issues include difficulty in gathering necessary information, confusion over compliance standards, and collaborative hurdles among teams.

Best practices for ongoing management and updates of the CBBDQ Wolfsberg questionnaire

Ongoing management and updates of the CBBDQ Wolfsberg Questionnaire are essential for sustained compliance and risk mitigation. Regular reviews should be a priority in your compliance routine.

Frequently asked questions about the CBBDQ Wolfsberg questionnaire

Questions often arise when dealing with the CBBDQ Wolfsberg Questionnaire. Below are some of the most common inquiries and their solutions.

Case studies: Successful implementation of the CBBDQ Wolfsberg questionnaire

Numerous organizations have effectively implemented the CBBDQ Wolfsberg Questionnaire to strengthen their compliance frameworks. For instance, ABC Bank, a mid-sized financial institution, streamlined its risk assessment process by incorporating a digital solution for filling out the questionnaire.

This transition enabled the bank to reduce turnaround time by 35%, significantly improving compliance rates as staff became more adept at using the questionnaire as a proactive risk management tool. Such success stories illustrate the questionnaire's potential to promote sound practices and enhance organizational integrity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find cbddq wolfsberg questionnaire?

How do I fill out cbddq wolfsberg questionnaire using my mobile device?

How can I fill out cbddq wolfsberg questionnaire on an iOS device?

What is cbddq wolfsberg questionnaire?

Who is required to file cbddq wolfsberg questionnaire?

How to fill out cbddq wolfsberg questionnaire?

What is the purpose of cbddq wolfsberg questionnaire?

What information must be reported on cbddq wolfsberg questionnaire?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.