Get the free I 174

Get, Create, Make and Sign i 174

Editing i 174 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out i 174

How to fill out i 174

Who needs i 174?

Your Comprehensive Guide to the 174 Form

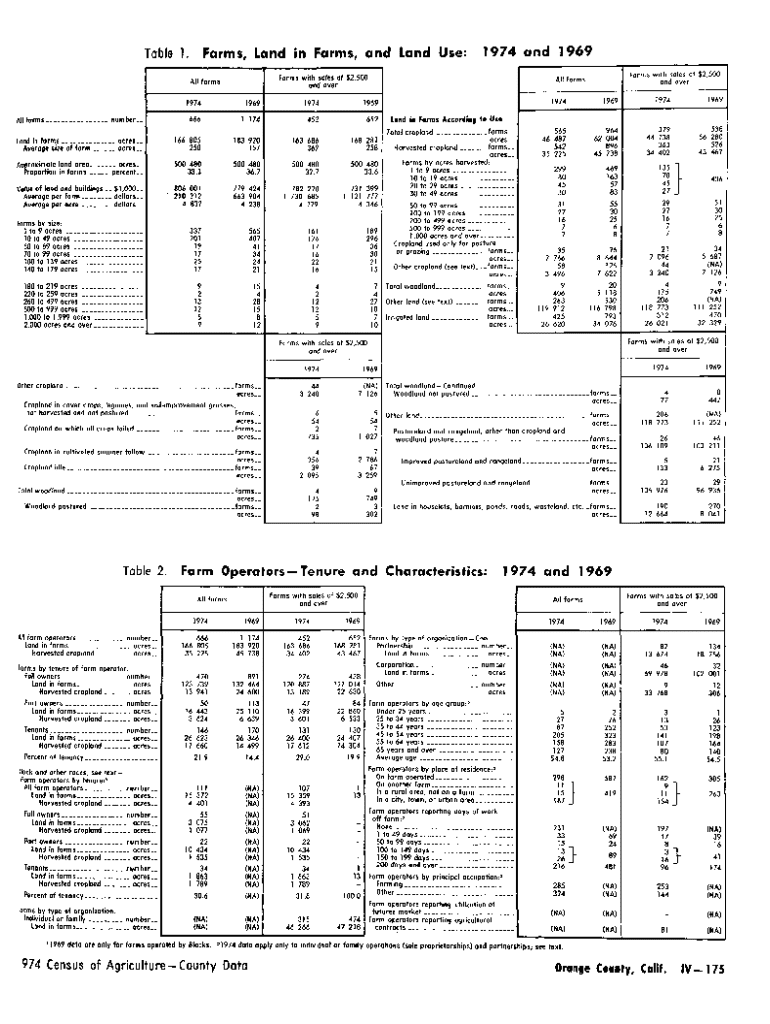

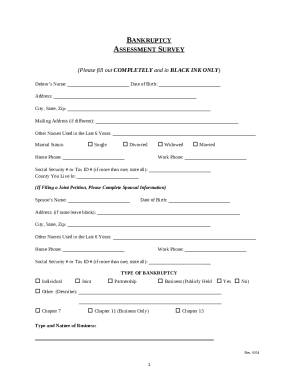

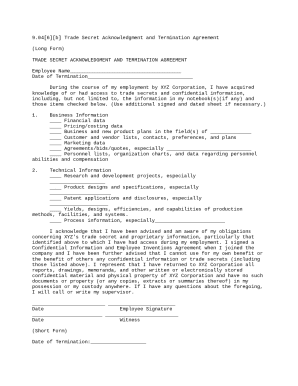

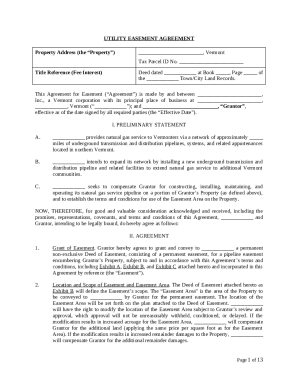

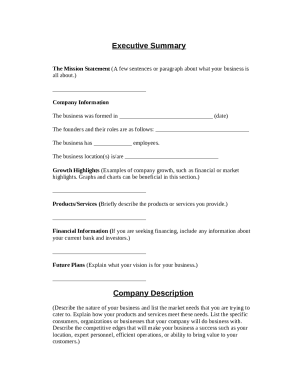

Understanding the 174 form

The i 174 form serves a crucial role in document management, dealing primarily with the processing and verification of various data submissions. Its significance cannot be understated, as it acts as a formal structure to streamline information gathering for administrative purposes. From financial reporting to legal compliance, the scenarios in which the i 174 form is applicable are diverse and often critical to operations.

Common scenarios where the i 174 form might be applicable include job applications requiring identification verification, tax documentation for companies and individuals, or even healthcare forms that involve patient details. Understanding these contexts lays the groundwork for correct and efficient usage of the form.

Key terms and definitions

To effectively utilize the i 174 form, it’s essential to familiarize yourself with key terms associated with it:

Preparing to use the 174 form

Before diving into filling out the i 174 form, it's advisable to gather all necessary information. This could include personal identification, business records, financial statements, or any other pertinent data that may be required on the form. Ensuring you have everything on hand is key to a smooth submission process.

Tips for organizing and preparing documents include categorizing them based on the sections of the i 174 form, verifying the accuracy of the data, and keeping all your digital files in a single accessible location. This preparation will enhance your efficiency when filling out the form.

Understanding format requirements

The i 174 form has specific formatting guidelines that must be adhered to for it to be processed without issues. This includes font specifications, margin requirements, and whether the form should be filled out digitally or by hand. Common pitfalls involve failing to follow these guidelines, which can lead to rejection of the form.

Step-by-step instructions for filling out the 174 form

Filling out the i 174 form can be a straightforward process if broken down into manageable sections. Begin with the applicant details, ensuring all personal information is accurate. Follow this with detailed sections concerning employment history or financial conditions, depending on the nature of your submission.

In terms of formatting, it's advisable to use clear headings, consistent font sizes, and bullet points for lists to enhance readability. Utilize templates if available, and always proofread the final document to catch any errors. Recommended tools like pdfFiller offer features for format verification that simplify this process.

Enhancing your 174 form experience with pdfFiller

Using pdfFiller can significantly ease the editing process. The platform allows users to upload the i 174 form effortlessly. Once uploaded, take advantage of the drag-and-drop functionality to organize your sections conveniently.

Additionally, the auto-fill options available on pdfFiller can prepopulate certain data fields based on previously entered information, saving time and minimizing the risk of errors. This feature is particularly beneficial for users who frequently fill out multiple forms.

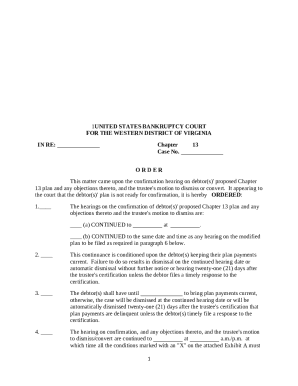

eSigning the 174 form

Adding a digital signature has never been easier with pdfFiller. Follow a step-by-step guide to incorporate your eSignature securely on the i 174 form. The process involves simply selecting the signature field, choosing your digital signature style, and placing it accordingly on the document.

Utilizing eSigning benefits users by ensuring that your signature is tamper-proof and can be validated easily, as opposed to traditional pen-and-paper methods that might raise authenticity concerns.

Collaborating on the 174 form

Collaboration enhances productivity when multiple individuals are involved in the i 174 form's completion. Using pdfFiller, you can easily share the form with team members by inviting them to review or edit. The platform enables you to set specific permissions, ensuring that users can only access areas necessary for their roles.

To track changes and revisions, pdfFiller's version history feature allows you to revert to previous edits if necessary. Maintaining an organized feedback loop fosters a smoother collaborative process, encouraging team communication and improving document accuracy.

Managing your completed 174 forms

Saving and storing your completed i 174 form correctly is crucial for future reference. With pdfFiller, you can save your form securely in the cloud. This method eliminates the risk of losing physical documents and allows for easy access from any device.

For file management, organize forms into folders labeled by project or submission date for easy retrieval. Additionally, archiving completed forms is highly beneficial. Ensure you follow specific instructions on how to archive these forms, which typically involve tagging the documents appropriately for easy future searching.

Troubleshooting common issues with the 174 form

Common problems encountered when dealing with the i 174 form include incomplete information and formatting errors. For instance, failing to include a mandatory field can result in the rejection of your submission, while improper formatting might hinder processing or lead to delays.

Solutions for these problems include meticulously reviewing every section before submission and utilizing pdfFiller’s help resources. In scenarios of persistent issues, seeking professional assistance may be prudent to ensure your submission meets all requirements.

Frequently asked questions (FAQs)

Many individuals have queries regarding the i 174 form, its purpose, and its usage. Commonly asked questions include:

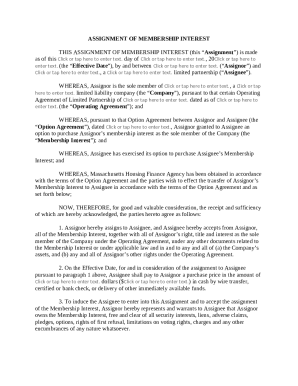

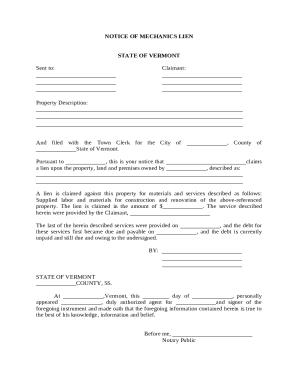

Related forms and additional tools

In conjunction with the i 174 form, you may come across various other forms that serve related purposes. These can include tax forms or employment verification documents that require similar information.

It’s also essential to consider additional tools for document management beyond pdfFiller. Platforms such as Google Drive for storage solutions or document creation tools like Microsoft Word can complement your efforts, streamlining your overall workflow near-document completion.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my i 174 directly from Gmail?

Can I create an electronic signature for the i 174 in Chrome?

How do I edit i 174 on an Android device?

What is i 174?

Who is required to file i 174?

How to fill out i 174?

What is the purpose of i 174?

What information must be reported on i 174?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.