Get the free NEW YORK CITY TAX COMMISSION

Get, Create, Make and Sign new york city tax

Editing new york city tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new york city tax

How to fill out new york city tax

Who needs new york city tax?

New York City Tax Form: A Comprehensive How-to Guide

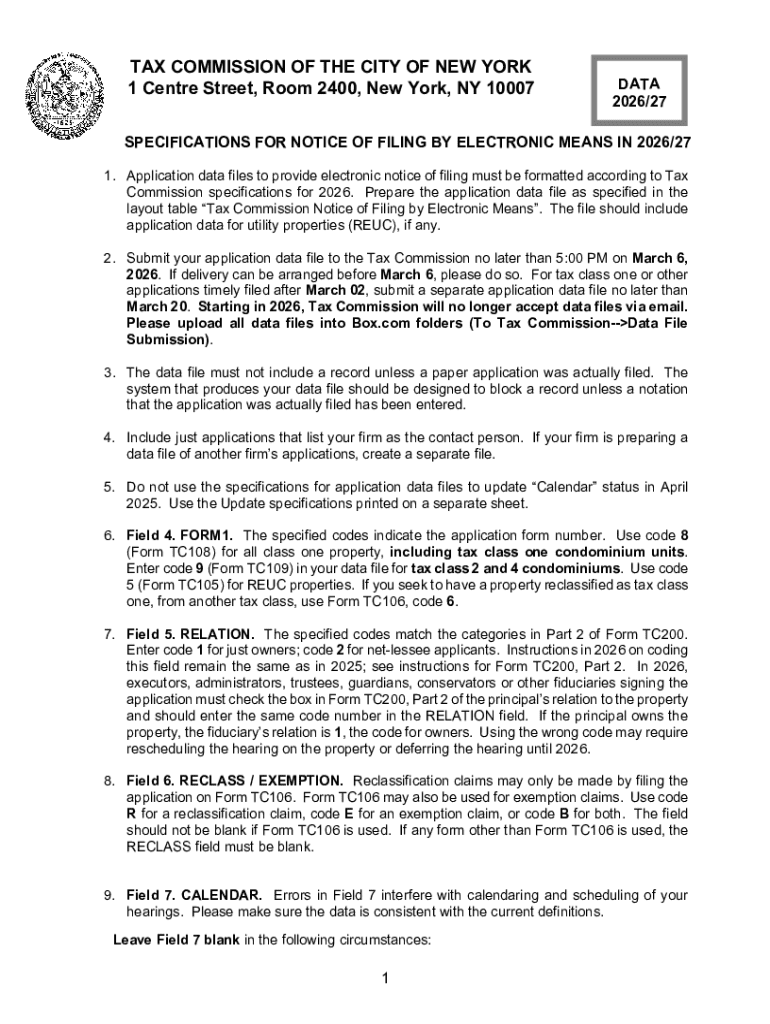

Understanding New York City tax forms

Navigating the landscape of taxation in New York City can seem daunting, but understanding your obligations is essential for compliance and avoiding penalties. The tax department imposes various taxes on individuals and businesses, each requiring specific forms. For residents, staying informed about the types of tax forms available is critical, as accuracy in these forms can prevent issues down the line.

Types of New York City tax forms

New York City tax forms can be categorized based on the type of taxpayer. Residents and non-residents, as well as businesses, have unique obligations that govern which forms they file. Understanding the differences is crucial for compliance and efficient tax management.

For individuals, the **NYC Resident Income Tax Return** and the **NYC Non-Resident Income Tax Return** serve as primary documents to report personal income. Business taxpayers, on the other hand, deal with corporate tax forms and unincorporated business tax returns, which handle profits generated in the city. Additionally, there are special review forms for non-resident employee payments and archived NYC-1127 forms that can provide historical context and guidance.

Step-by-step guide to filling out NYC tax forms

Filling out your New York City tax forms doesn't have to be overwhelming. A methodical approach simplifies the process significantly, starting with gathering all necessary documentation. This includes personal details such as your Social Security number, and financial records like W-2s, 1099s, and other relevant statements.

Next, navigating to pdfFiller for the right forms can streamline your experience. Their platform offers interactive tools that guide you to the correct document based on your specific needs, whether you're filing as an individual or a business.

Filling out the form correctly means understanding detailed instructions for each section. Careful attention is important to avoid common pitfalls during the completion process. After completing your form, you can utilize pdfFiller’s editing features to make necessary adjustments before submission.

Signing and submitting your NYC tax forms

Once you’ve filled your NYC tax forms, it’s time to sign and submit them. pdfFiller’s eSignature feature allows for a seamless signing process, ensuring security and verification as part of your submission. This signature confirms your acknowledgment of the information provided, adding an extra layer of legitimacy to your return.

For submission, you have options: online submission is typically the most efficient method, which can often lead to faster processing times. Alternatively, if you prefer a paper return, be mindful of mailing guidelines like proper addressing and methods, to ensure your forms reach the tax department without delays.

Managing your tax documents post-submission

After you’ve submitted your NYC tax forms, managing your documents becomes crucial. Tracking your tax return through the tax department’s system will allow you to monitor its status and address any issues that arise proactively. Typically, you can expect notifications or messages regarding the progress of your submission.

Organizing and storing your tax documents digitally also aids in future referential needs. pdfFiller provides great tools for document management, enabling you to keep all related forms in a secure, easily accessible digital vault. Should you face an audit or inquiries from the tax department, having your documents well-organized will facilitate smoother communications.

Navigating additional resources

To help you in your journey through New York City tax forms, several resources are available. The NYC Department of Finance offers support, including direct links for inquiries, FAQs, and guidelines tailored to various forms. This can alleviate uncertainty and provide clarity on your obligations, especially if you encounter complex situations.

Language assistance options are also vital, as they ensure all residents can access crucial information. Community tax aid organizations often offer support and can provide personalized assistance to help navigate the tax filing process.

About pdfFiller

pdfFiller stands out as a cloud-based document management solution, offering robust features for editing, signing, and collaborating on tax forms. Their platform is specifically designed to empower users, simplifying the tedious process of filling out and submitting forms. By centralizing all your document needs, pdfFiller promotes efficiency, allowing you to focus on your financial objectives rather than administrative tasks.

User testimonials consistently highlight the platform's impact, illustrating how individuals and teams have successfully navigated the complexities of NYC tax forms with the help of pdfFiller. Their services simplify not just the creation of these forms but the entire lifecycle of document management related to taxation.

FAQs about New York City tax forms

The most common questions regarding NYC tax forms include inquiries about submission requirements, deadlines, and troubleshooting mistakes made during form completion. By addressing these FAQs, individuals can gain confidence in their filing process and mitigate errors that could lead to stressful situations with the tax department.

Including a FAQ section also encourages users to recognize potential hurdles before they become issues, thereby streamlining the entire documentation process, which can ultimately save time and stress.

Connect with pdfFiller

Engaging with pdfFiller fosters an ongoing relationship for support throughout your document journey. Users can benefit from direct feedback mechanisms to improve their experiences on the platform and share insights with the community. This two-way communication ensures that pdfFiller continues to evolve in ways that meet user needs effectively.

Additionally, fostering a community around document management enhances collective knowledge, where users learn from each other’s experiences while navigating NYC tax forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete new york city tax online?

How can I edit new york city tax on a smartphone?

Can I edit new york city tax on an iOS device?

What is new york city tax?

Who is required to file new york city tax?

How to fill out new york city tax?

What is the purpose of new york city tax?

What information must be reported on new york city tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.