Get the free Form 120/165ES

Get, Create, Make and Sign form 120165es

Editing form 120165es online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 120165es

How to fill out form 120165es

Who needs form 120165es?

Comprehensive Guide to Form 120165ES

Understanding Form 120165ES

The Form 120165ES serves as a critical tool in the realm of corporate taxation, specifically designed for Arizona corporations. This form is utilized for estimated income tax payments, allowing corporations to fulfill their tax obligations on a timely basis. By understanding its mechanics, corporate entities can avoid penalties that arise from late payments while maintaining transparency in their financial dealings.

The primary importance of Form 120165ES lies in its role in corporate tax filing within Arizona. It enables companies to project their expected taxable income and calculate their estimated tax liability, ensuring they remain compliant with state regulations. This proactive approach aids corporations in managing their finances more effectively, optimizing cash flow to support operational needs.

Who needs to file

Various stakeholders are required to file Form 120165ES, particularly corporations operating in Arizona. These include both domestic and foreign corporations that have significant presence or do business within the state. Criteria for qualifying filers typically revolve around the corporation's income levels, corporate structure, and existence of tax liabilities, ensuring that only relevant parties engage with this form.

Key components of Form 120165ES

Understanding the key components of Form 120165ES is vital for accurate completion. It requires essential personal and business information, including the corporate name, tax identification number, address, and the type of tax being filed. Additionally, corporations must submit their financial data, reflecting anticipated taxable income and deductions to arrive at estimated tax payments.

Several sections of the form need careful consideration. Each section requires specific information; failure to provide complete data may lead to rejection or delays. This includes a breakdown for each estimate period, allowing for precise calculations that adhere to Arizona's corporate income tax highlights.

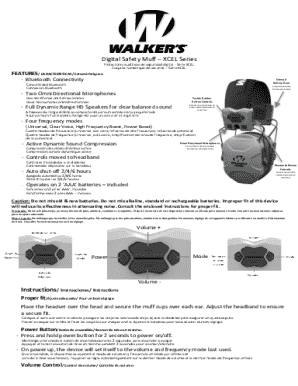

Step-by-step instructions for completing Form 120165ES

To begin, gather necessary documents. This includes prior year income tax returns, financial statements, and any supporting documents that outline your projected financial performance. Ensuring you have these at hand simplifies the process and increases accuracy.

Filling out the form requires meticulous attention to detail. Start by entering your business’ name and identification number clearly. Then, input projected income amounts for the upcoming quarter, and calculate estimated tax payments based on current tax rates. Common mistakes include miscalculating income, omitting necessary information, or choosing incorrect fiscal periods, so be vigilant.

After completing the form, carefully review all entries for accuracy. Consider cross-referencing with your gathered documents to ensure coherence. A checklist can be useful, helping you confirm that sections are filled correctly and all documentation meets requirements.

Electronic options for form submission

The benefits of electronic filing for Form 120165ES include speed and convenience, as submissions can be made from any location with internet access. This online process not only streamlines filing but also reduces paper use, a significant environmental consideration for many corporations today.

To submit Form 120165ES electronically, navigate to the Arizona Department of Revenue's e-file portal. The step-by-step submission process typically involves logging in with your user account menu, attaching your filled form, and confirming submission. Various software platforms, including pdfFiller, support this procedure, making it even more manageable and user-friendly.

Editing and managing your form

Once you've completed your form, the ability to edit is essential, especially if initial data entry contained errors. Utilizing pdfFiller’s editing tools allows for convenient corrections to your Form 120165ES. Remember, changes post-submission may require additional documentation, which can vary based on the nature of the amendments.

For saving and storing forms securely, cloud-based storage solutions are your best option. These platforms not only offer safety but also allow easy access and sharing of documents among team members. Best practices for document management include labeling files properly, using secure passwords, and performing regular backups to prevent data loss.

eSigning Form 120165ES

The importance of eSigning Form 120165ES cannot be overstated. E-signatures provide legal validity, simplifying the process of document execution. This digital method offers convenience without sacrificing security, as many e-sign solutions comply with regulatory standards.

To eSign documents, follow simple instructions provided within your electronic filing framework, such as pdfFiller. This typically involves choosing the eSign option within the platform, adding your signature using a mouse or touchpad, and confirming your identity. Always ensure that security measures are in place to protect sensitive information.

Collaboration tools for teams

For teams managing Form 120165ES submissions, collaboration features are invaluable. Tools available in pdfFiller allow users to share documents securely with colleagues and leave comments directly on the form. This reduces back-and-forth emails and enhances real-time feedback.

Managing team workflows efficiently is crucial for meeting deadlines. By utilizing shared access to forms, team members can streamline multiple submissions, ensuring that information remains consistent and up-to-date. This collaborative approach helps minimize errors and enhances overall productivity.

Troubleshooting common issues

Filing errors are common and can stem from various factors, such as miscalculating estimated tax payments or neglecting to sign the form. These errors can lead to delayed processing or increased tax liabilities for corporations if not rectified timely.

Solutions to common technical issues often involve reviewing FAQs, which address common concerns about Form 120165ES and e-filing procedures. Always check for updates from the Arizona Department of Revenue to stay informed about potential issues impacting the filing process.

Additional considerations

Frequently asked questions surrounding Form 120165ES often focus on submission deadlines and what to do after filing. Users frequently inquire about confirmation timelines and how to follow up if feedback or confirmation isn’t received promptly.

It's critical for corporations to implement a post-submission follow-up protocol, ensuring they review confirmation receipts and remain proactive in addressing any issues. This practice aids in managing tax liabilities and enhances compliance with the Arizona Department of Revenue.

Support and resources

Learning resources are abundant for users navigating Form 120165ES. Tutorial videos and webinars can provide visual guidance, making it easier to grasp the nuances of the form. Additionally, attending live sessions often enables users to ask specific questions and receive direct answers from experts.

When issues arise, knowing how to contact customer support is essential. The Arizona Department of Revenue offers support services through their website, and pdfFiller provides a dedicated support line for users needing assistance with e-filing or any document-related inquiries.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form 120165es in Gmail?

How can I get form 120165es?

How do I edit form 120165es on an iOS device?

What is form 120165es?

Who is required to file form 120165es?

How to fill out form 120165es?

What is the purpose of form 120165es?

What information must be reported on form 120165es?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.