Get the free D.C. and cannabis trade group clash over constitutionality ...

Get, Create, Make and Sign dc and cannabis trade

Editing dc and cannabis trade online

Uncompromising security for your PDF editing and eSignature needs

How to fill out dc and cannabis trade

How to fill out dc and cannabis trade

Who needs dc and cannabis trade?

and cannabis trade form: A comprehensive guide for businesses

Understanding the cannabis trade landscape

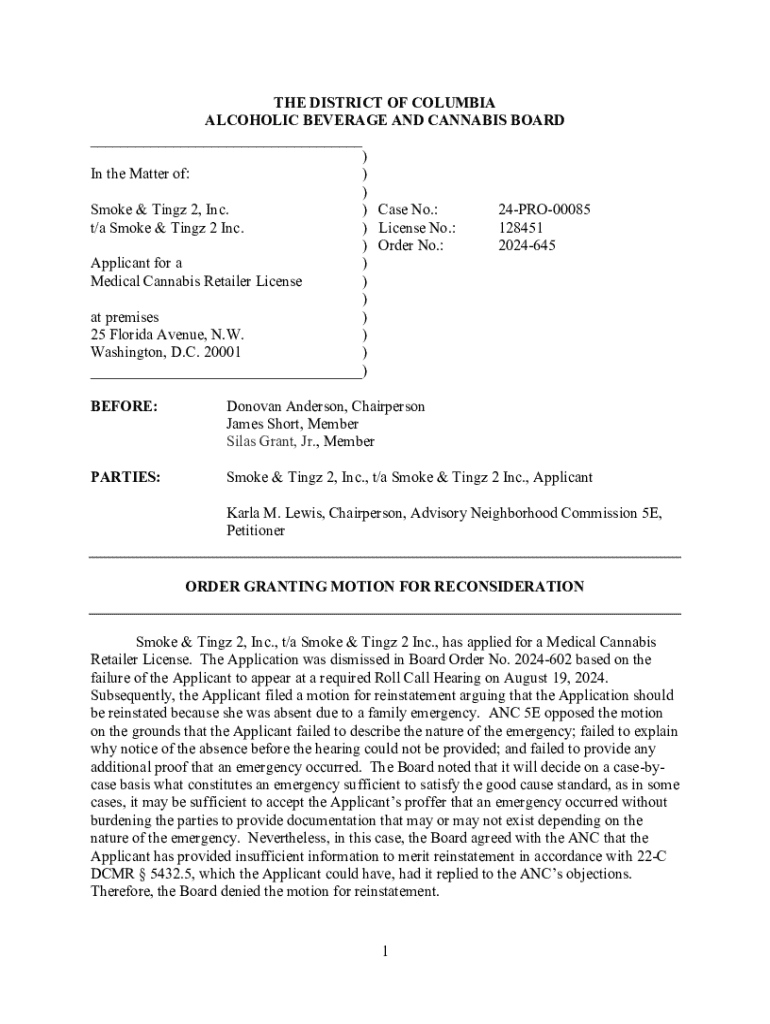

Washington, DC has undergone significant transformations in its approach to cannabis legislation over the past decade. In 2010, the DC Council legalized medical marijuana, allowing residents with qualifying conditions to access cannabis products. However, it wasn't until 2014 that recreational cannabis was decriminalized. As of 2023, cannabis trade in DC is permitted under strict regulations that prioritize public safety and compliance.

With the evolving landscape comes a set of regulations that businesses must navigate. This includes obtaining the proper licenses, ensuring the product meets quality standards, and maintaining accurate records for tax purposes. Non-compliance can lead to hefty fines and potentially the revocation of licenses, making an understanding of the relevant cannabis trade forms crucial.

Conversely, compliance enhances a business's credibility and can streamline operations. Businesses that adhere to regulations demonstrate their commitment to safety and integrity, which can attract more customers.

Types of cannabis trade forms

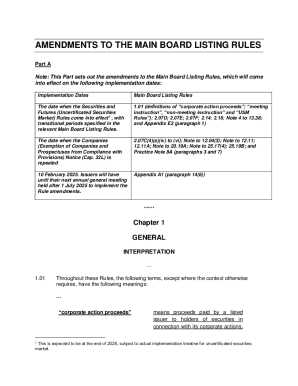

Navigating the world of cannabis trade forms in DC can be complex, given the different categories of forms necessary for compliance. These typically fall into three main categories: licensing forms, taxation forms, and operational forms. Each category serves a distinct purpose and is essential for the proper functioning of a cannabis business.

Licensing forms

Acquiring the proper licenses is foundational for any cannabis business. To start, applicants must complete the necessary licensing forms particular to their type of operation, whether they are growers, dispensaries, or processors. Each category has defined requirements that dictate the components needed for submission, including personal details, business plans, and security measures.

Taxation forms

In Washington, DC, cannabis sales are subjected to an excise tax. Businesses need to fill out specific tax forms to report their earnings and comply with tax obligations. Understanding the intricacies of state taxation laws is essential for avoiding penalties and ensuring that all financial records are accurate.

Operational forms

Operational compliance is also key to running a successful cannabis trade. This includes forms for employee registration, operational protocols, and inventory tracking. Proper documentation helps businesses maintain compliance with labor laws and cannabis regulations, minimizing the risk of disruptions.

Step-by-step guide to completing cannabis trade forms

Completing the necessary DC cannabis trade forms accurately is vital to running a compliant operation. Start by identifying the right forms specific to your business needs. Various resources are available, including government websites and local industry associations, which can provide the latest updates on required documentation.

The next step involves filling out the licensing application form thoroughly. Pay close attention to each section, as incomplete forms can delay the application process. Common pitfalls to avoid include providing incorrect information or failing to include required documentation.

Navigating the tax forms for cannabis sales can be daunting, but a step-by-step breakdown will simplify the process. Ensure you accurately report all sales, assess applicable taxes, and maintain records of expenses related to the cannabis trade, as these will impact your tax outcomes.

Lastly, creating an operational compliance form requires including essential elements related to employee training, safety protocols, and inventory measures. Accurate record-keeping is vital not just for compliance but also for enhancing operational efficiency.

Utilizing pdfFiller for cannabis trade forms

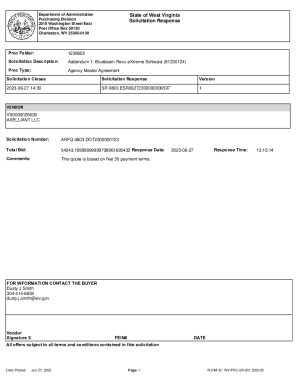

To streamline the management of cannabis trade forms, pdfFiller offers a powerful solution. With its interactive features, businesses can easily fill out, edit, and manage forms from a single cloud-based platform. This is particularly beneficial for cannabis businesses that may require collaborative efforts in document creation and submission.

Editing forms for compliance can be crucial in an industry where regulations frequently change. pdfFiller allows businesses to customize their forms to meet DC regulations efficiently, simplifying the approval process.

The platform also supports eSigning capabilities, making it easy to finalize documents securely. Best practices for document submission include verifying that all required sections are complete before electronically submitting forms to maintain proper records.

Frequently asked questions (FAQs)

Understanding common queries related to DC cannabis trade forms can further assist businesses in navigating their responsibilities. First, what are the penalties for incomplete or incorrect forms? Fines and potential legal action can arise from submitting forms that lack necessary information or contain inaccuracies.

Another frequent concern involves how often cannabis trade forms must be updated. Typically, forms should be reviewed and updated annually or anytime there's a change in company operations, ownership, or regulations.

For ongoing education, numerous resources exist, including workshops and training sessions provided by local cannabis associations that help licensees stay informed about changes in DC cannabis regulations.

Document management best practices

Organizing cannabis trade documents effectively is paramount for businesses in this sector. Strategic digital filing practices facilitate quick retrieval and assess compliance status. Implementing a version control system ensures that teams are using the most recent documents and forms.

Regular audit and compliance checks are essential for maintaining operational integrity. Scheduling consistent audits allows businesses to identify operational weaknesses and potential compliance issues before they escalate. Employing tools to track the compliance status of documents can further enhance accountability within the organization.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify dc and cannabis trade without leaving Google Drive?

Can I create an eSignature for the dc and cannabis trade in Gmail?

How do I edit dc and cannabis trade on an iOS device?

What is dc and cannabis trade?

Who is required to file dc and cannabis trade?

How to fill out dc and cannabis trade?

What is the purpose of dc and cannabis trade?

What information must be reported on dc and cannabis trade?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.