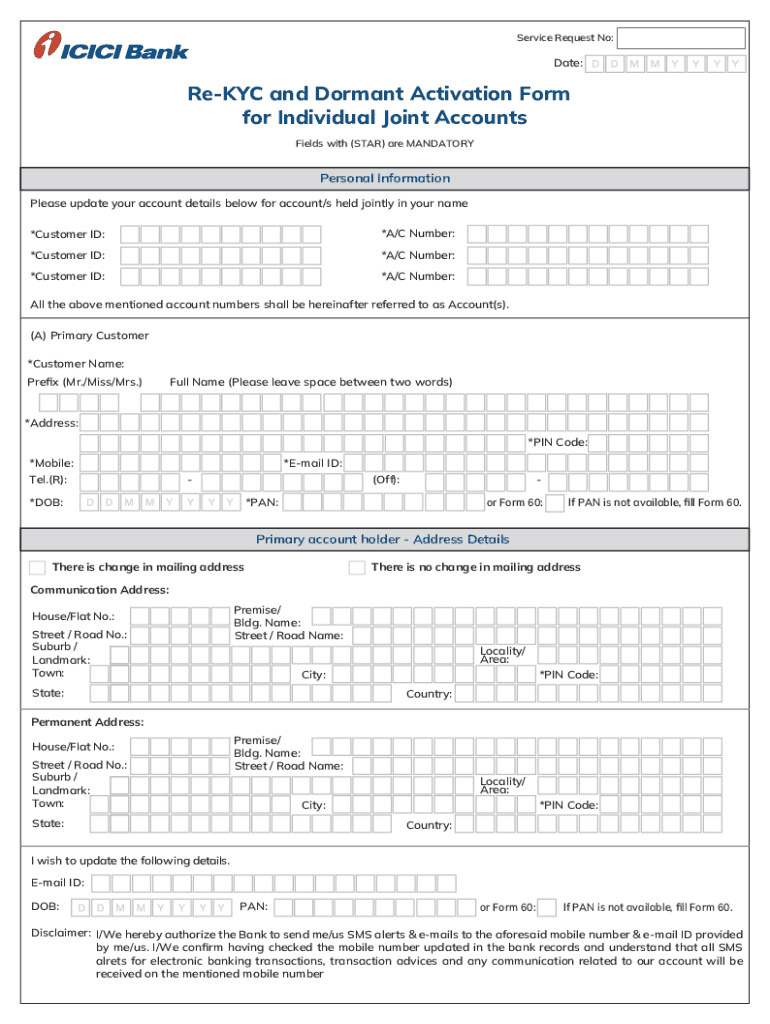

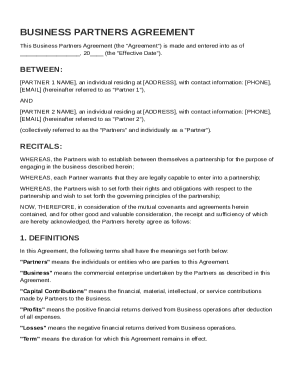

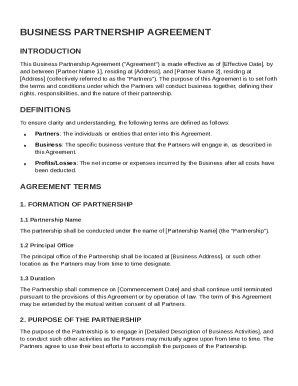

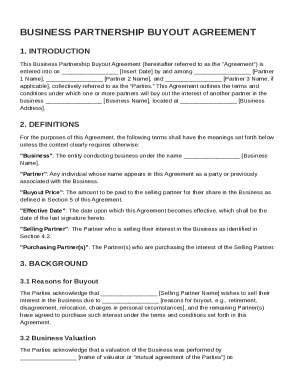

Get the free Dormant Account Activation/Re-KYC Updation Form

Get, Create, Make and Sign dormant account activationre-kyc updation

Editing dormant account activationre-kyc updation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out dormant account activationre-kyc updation

How to fill out dormant account activationre-kyc updation

Who needs dormant account activationre-kyc updation?

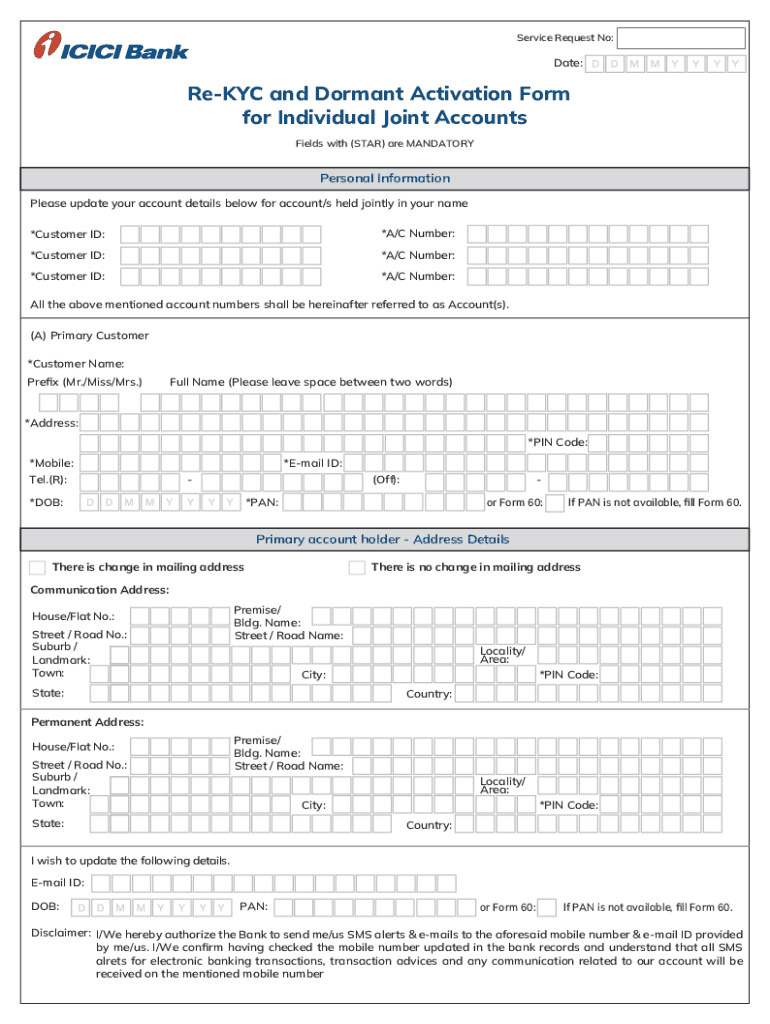

Dormant Account Activation / Re-KYC Updation Form: A Comprehensive Guide

Understanding dormant accounts

A dormant account is an account that has had no activity for a set period, typically defined by the financial institution. This period can range from six months to several years, depending on regulatory requirements and the bank's policies. The significance of dormant accounts lies in the potential financial implications for account holders, as they may lose access to funds, incur fees, or even face account closure if reactivation steps are not followed.

Common reasons accounts become dormant include prolonged inactivity, changes in personal circumstances such as relocation or job loss, or simply forgetting about the account. The consequences of maintaining a dormant status can be severe, potentially leading to reduced financial flexibility and unexpected fees.

Reasons to reactivate your dormant account

Reactivating a dormant account is essential for various reasons. First and foremost, it restores access to your personal finances, enabling you to manage your investments and savings optimally. It ensures that funds remain accessible when needed, preventing levels of unwanted financial stress.

Beyond financial access, dormant accounts often incur inactivity penalties. Reactivating your account can save you from these fees, which can add up over time. Moreover, many banks and financial institutions offer enhanced services and features that require active status, allowing you to take full advantage of what your institution has to offer.

Overview of the re-KYC process

KYC, or Know Your Customer, is a process attributed to regulatory compliance, requiring financial institutions to verify the identity of their customers. It plays a crucial role in combating fraud, money laundering, and terrorist financing. As such, updating your KYC information periodically remains vital for maintaining account activity.

When it comes to dormant accounts, your bank typically mandates KYC updates before reactivation. Staying compliant not only safeguards your account but also protects your financial interests. Keeping your information up-to-date ensures that you remain within the boundaries of regulatory requirements and can continue enjoying the banking services you need.

Preparing for account reactivation

Before submitting the dormant account activation form, gathering the necessary documents is crucial. Most banks require valid identity proof, such as a passport or a driver’s license, along with address proof, which can include a recent utility bill or a bank statement. Additional verification documents may also be required based on your institution’s policies.

Next, it’s vital to check whether your bank offers online methods for reactivation. Many banks today provide online portals where you can submit the activation request and upload required documents, making the process far more convenient.

Step-by-step guide to completing the dormant account activation form

Successfully completing the dormant account activation form requires attention to detail. Here’s a detailed walkthrough of the typical sections found in such a form:

Before submission, it’s advisable to review the whole form. Ensure that all information is accurate, as any discrepancies can lead to delays or denials.

Submitting your form

Submitting your dormant account activation form can be done through various methods. If you’re opting for online submission, platforms like pdfFiller make this process far more accessible. Utilizing cloud-based features allows you to edit and sign documents seamlessly and submit them directly to your bank.

For those who prefer offline methods, you can print the form and mail it or schedule an in-person visit to your bank's local branch. Familiarize yourself with your bank’s procedures to ensure that your form reaches the correct department efficiently.

After submission: What to expect

Once you've submitted your dormant account activation form, you should receive a confirmation of receipt from your bank. This serves as a reassurance that your request is being processed. Timeframes for processing your re-KYC application can vary widely among institutions, so it’s important to remain patient.

If your application faces delays or is denied, there are steps you can take. Keeping the communication line open with your bank can unveil issues quickly, guiding you toward resolution.

Managing your account post-reactivation

After successfully reactivating your account, consider setting up alerts for inactivity. This feature can help prevent your account from becoming dormant again by notifying you of account activities or reminders to engage with your account regularly.

Furthermore, using tools like pdfFiller for ongoing document management can streamline your financial processes. The platform's features for editing, signing documents, and collaborating with financial advisors can be invaluable in keeping your account in good standing.

Troubleshooting common issues

Experiencing difficulties with form submission is not uncommon. If you encounter challenges, checking your bank's online resources or FAQ sections can provide immediate solutions. Common issues often revolve around document format compatibility or missing information.

In situations where submitted documents are rejected, it’s critical to understand the reasons behind the rejection. Contact customer support for clarification and additional guidance on how to resolve such issues. This proactive approach can save time and lead to successful reactivation.

Leveraging cloud technology for document management

Using a platform like pdfFiller provides numerous advantages when managing financial documents. With cloud technology, you can easily access and edit all your important documents from anywhere. This flexibility is increasingly important in our fast-paced world.

Seamlessly transitioning to a digital document management solution not only streamlines your processes but also future-proofs your finances. Staying organized and compliant with all necessary documentation helps avoid unnecessary stress. As your financial needs evolve, embracing these tools can enhance your overall financial management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the dormant account activationre-kyc updation in Chrome?

How do I fill out the dormant account activationre-kyc updation form on my smartphone?

Can I edit dormant account activationre-kyc updation on an iOS device?

What is dormant account activation/re-kyc updation?

Who is required to file dormant account activation/re-kyc updation?

How to fill out dormant account activation/re-kyc updation?

What is the purpose of dormant account activation/re-kyc updation?

What information must be reported on dormant account activation/re-kyc updation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.