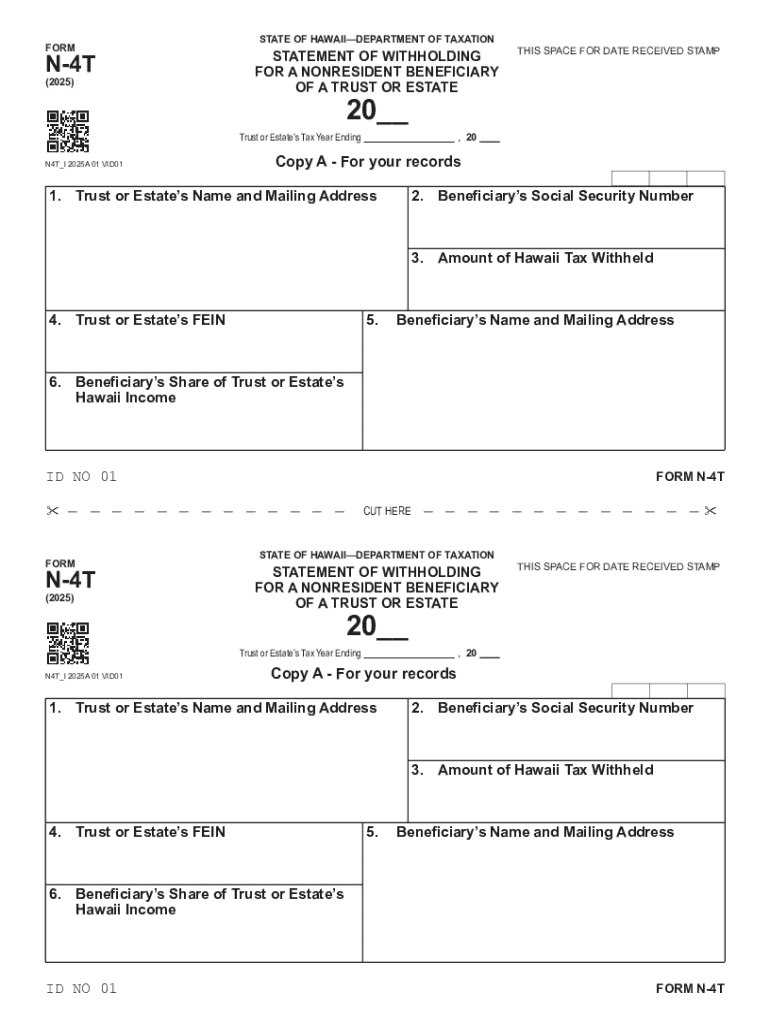

Get the free Estate and Transfer Tax Forms - Hawaii Department of Taxation

Get, Create, Make and Sign estate and transfer tax

Editing estate and transfer tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out estate and transfer tax

How to fill out estate and transfer tax

Who needs estate and transfer tax?

Estate and Transfer Tax Form: How-to Guide

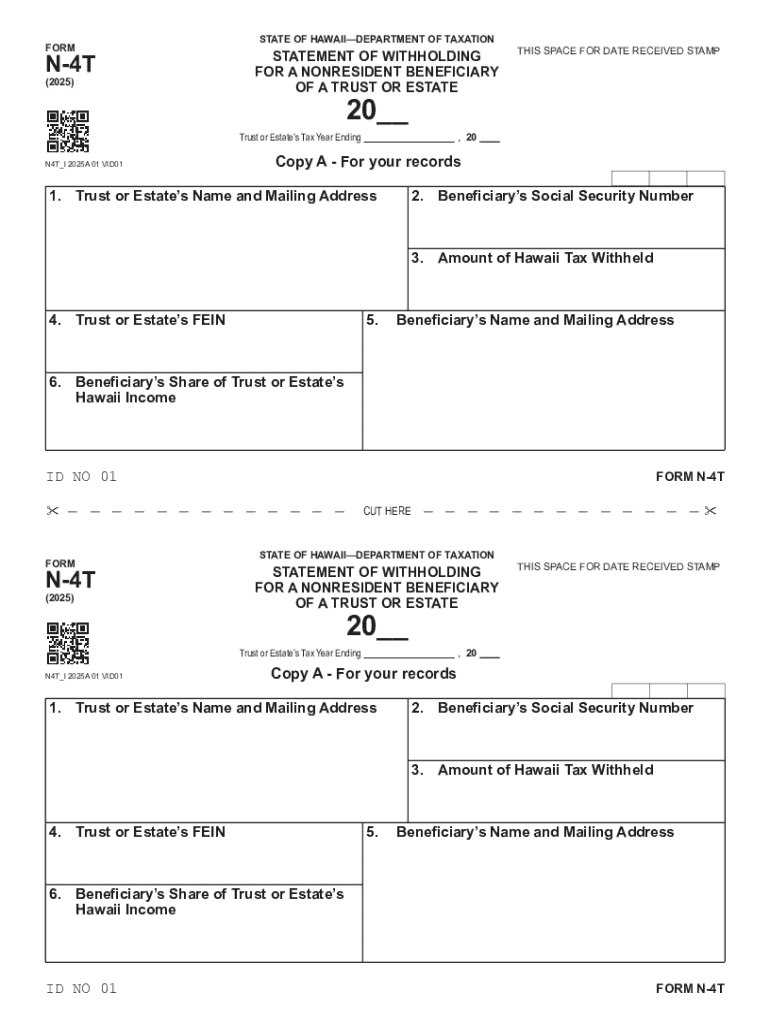

Understanding estate and transfer tax forms

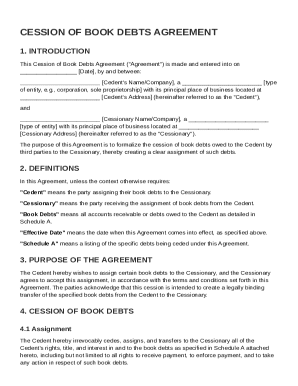

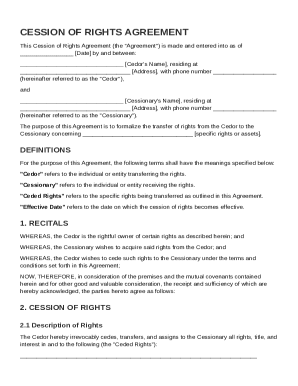

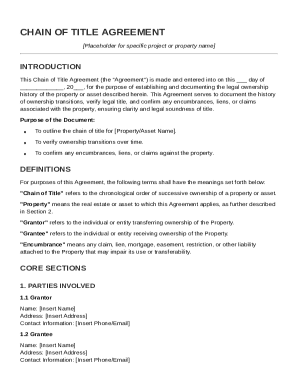

Estate and transfer tax forms are legal documents required by taxation authorities to assess taxes on the transfer of assets after an individual's death. These forms ensure that the state can collect the appropriate taxes based on the value of the estate being passed on to heirs.

Filing the correct forms is crucial, as inaccuracies can lead to penalties or delays in the distribution of assets. Understanding key terms—such as gross estate, taxable estate, and exclusions—is essential for anyone dealing with estate planning or execution.

Overview of the estate and transfer tax form

The estate and transfer tax form serves a vital purpose: it determines the tax owed on an estate before assets can be distributed to beneficiaries. This form is typically filed by the executor of the estate or someone designated to manage the estate's affairs.

Identifying who needs to file can be complex, as regulations differ by jurisdiction. Generally, if the total value of the estate exceeds the federal or state exemption threshold, filing is required. Common scenarios that necessitate the use of this form include when property is inherited from a deceased family member or when a significant gift is made.

Step-by-step guide to filling out the estate and transfer tax form

Before filling out the estate and transfer tax form, it’s essential to gather all necessary documents. This preparation ensures that you have complete and accurate information, streamlining the filing process.

Identification details such as Social Security numbers and dates of birth for both the decedent and beneficiaries are crucial. In addition, property declarations including the fair market value of all estate assets—real estate, bank accounts, investments, and life insurance—must be collected.

Next, follow the section-by-section breakdown, starting with personal information, which includes names and addresses. Move to the property and asset information section, ensuring all values reflect current fair market rates. Finally, calculate the tax owed based on applicable laws, paying close attention to deductions and exemptions to avoid mistakes.

Be wary of common mistakes such as failing to report all assets, which can result in audits or penalties, and incorrectly valuing property, creating discrepancies in tax calculation.

Editing and managing your form using pdfFiller

Once you've gathered the necessary information, pdfFiller offers comprehensive tools to edit your estate and transfer tax form seamlessly. You can modify text directly, ensuring that all information is updated accurately before submission.

In addition to text editing, pdfFiller allows users to add signatures and initials securely. This feature not only streamlines the process but ensures that all signatures are legally binding. Furthermore, annotating and commenting on sections of the form can facilitate corrections and notes for future reference or collaboration.

After editing, be sure to save and store your completed form in a secure location. pdfFiller allows users to maintain revisions and templates for quick future filings, ensuring that your estate planning process is efficient.

eSigning your estate and transfer tax form

eSigning the estate and transfer tax form is increasingly important as it provides a fast, efficient way to sign documents online. This digital signature is not only convenient but also legally recognized in many jurisdictions, reducing the hassle of physical paperwork.

With pdfFiller, eSigning is a straightforward process involving a few clicks. Choose the eSignature option, place your signature where needed, and that's it! Keep in mind your legal obligations; ensure that the signatory is authorized to sign the document, as non-compliance can lead to issues down the road.

Collaborating on the form submission

Collaboration on the estate and transfer tax form can significantly enhance accuracy and ensure that all necessary parties are informed. pdfFiller enables users to share forms with relatives or tax advisors securely.

The real-time collaboration features allow multiple stakeholders to view and edit the document simultaneously, streamlining the review process. You can also track changes and revisions effectively, ensuring that no important updates are missed, and everyone involved is on the same page.

Submitting your estate and transfer tax form

After completing and reviewing your estate and transfer tax form, it's crucial to understand the different submission methods available. The option for online submission is often the most convenient, as it allows you to bypass lengthy mailing times and ensure prompt processing.

Mail submission still serves as a viable option, particularly for those uncomfortable with digital processes. Regardless of the method, be prepared for post-submission follow-ups. Typically, you can expect a confirmation from tax authorities, and occasionally, there may be requests for additional information or clarifications regarding your submission.

Frequently asked questions (faqs)

Several common questions regarding the estate and transfer tax form can help clarify the file process. One pressing inquiry is about the implications of not filing. Failing to submit can lead to severe penalties, including fines or even legal action, making it integral to meet deadlines.

Processing times for the estate and transfer tax form can vary, but typically, you can expect it to take several weeks. If you find the need to amend your form after submission, contact your tax authorities for precise instructions, as this differs by jurisdiction.

Additional considerations

It's essential to distinguish between state and federal estate and transfer taxes, as requirements and rates differ significantly. Some states impose their estate taxes, adding an additional layer of complexity. Thus, staying informed about specific state requirements—such as thresholds and exemptions—is critical.

Leveraging tools like pdfFiller can simplify ongoing tax compliance. By utilizing its resources for document management and form storage, individuals can keep abreast of their obligations with ease, avoiding last-minute rushes or penalties.

Getting help

Navigating the intricacies of estate and transfer tax forms can be daunting, but there are plenty of resources available. pdfFiller offers excellent customer support options, including troubleshooting for forms and functionalities. Don't hesitate to seek assistance if you encounter challenges during the filing process.

Additionally, online tutorials and guides can provide step-by-step instruction on filling in forms effectively. For comprehensive tax planning or complex estates, consider connecting with tax professionals who can offer personalized guidance tailored to your unique situation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit estate and transfer tax in Chrome?

How do I fill out estate and transfer tax using my mobile device?

How do I complete estate and transfer tax on an iOS device?

What is estate and transfer tax?

Who is required to file estate and transfer tax?

How to fill out estate and transfer tax?

What is the purpose of estate and transfer tax?

What information must be reported on estate and transfer tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.