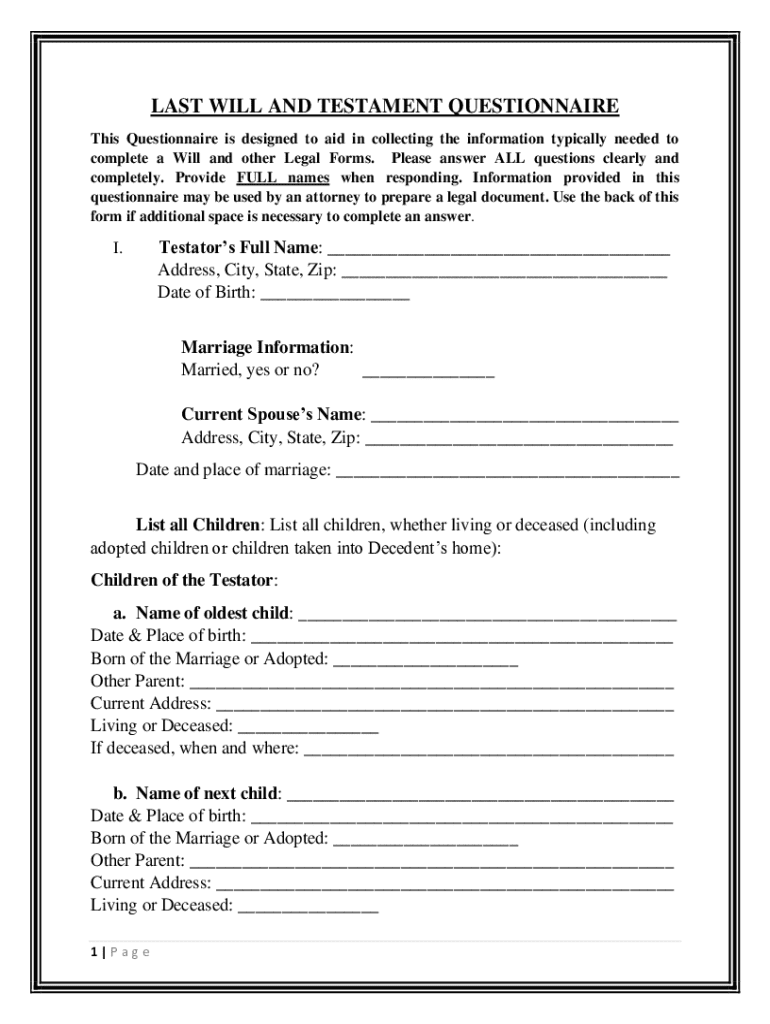

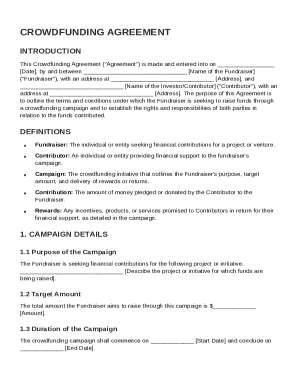

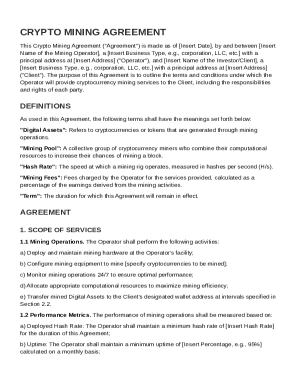

Get the free 1 WILL for SINGLE ESTATE PLANNING QUESTIONNAIRE ...

Get, Create, Make and Sign 1 will for single

How to edit 1 will for single online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 1 will for single

How to fill out 1 will for single

Who needs 1 will for single?

1 Will - A Comprehensive Guide to Creating Your Will

Understanding the importance of having a will

Every adult should prioritize having a will. It ensures that your wishes are respected after your death, detailing how your assets should be distributed and who should take care of minor children. A will plays a crucial role in preventing conflicts among family members during an emotionally charged time. Without one, the state decides how your assets are distributed, which may not align with your wishes.

Dying without a will, known as dying intestate, means the government dictates how your property is divided. This often leads to lengthy probate processes, increased costs, and potential disputes among heirs. Additionally, common misconceptions exist about wills, such as the belief that only wealthy individuals need them. In reality, everyone with assets or dependents should have a will in place.

Key components of a will

Creating a will involves several key components that should not be overlooked. The first step is identifying your assets. This means making a comprehensive list of all belongings you wish to bequeath, including real estate, bank accounts, personal possessions, and any investments. It's wise to regularly evaluate the value of these assets, as they can fluctuate over time. Tools like pdfFiller can assist in documenting and valuing your assets effectively.

After identifying assets, naming beneficiaries is essential. Beneficiaries are those who will receive your assets after your death. They can include family, friends, or even organizations. Clearly designating who receives what helps avoid confusion and legal issues later.

Another critical aspect is appointing an executor for your will. An executor is responsible for ensuring that your wishes are honored and that the estate is settled according to the will’s terms. It's essential to choose someone reliable for this role, as they will manage your finances, settle debts, and divide assets according to your wishes.

Types of wills

Wills come in various forms, each suited to different circumstances. A simple will is generally sufficient for straightforward estates, while a complex will may be necessary for larger estates or specific family situations. Living wills address healthcare decisions while a person is still alive, detailing preferences for medical treatment. On the other hand, testamentary trusts manage assets for beneficiaries over time, while holographic wills are handwritten and may not require formal witnessing.

The legal requirements for drafting a will

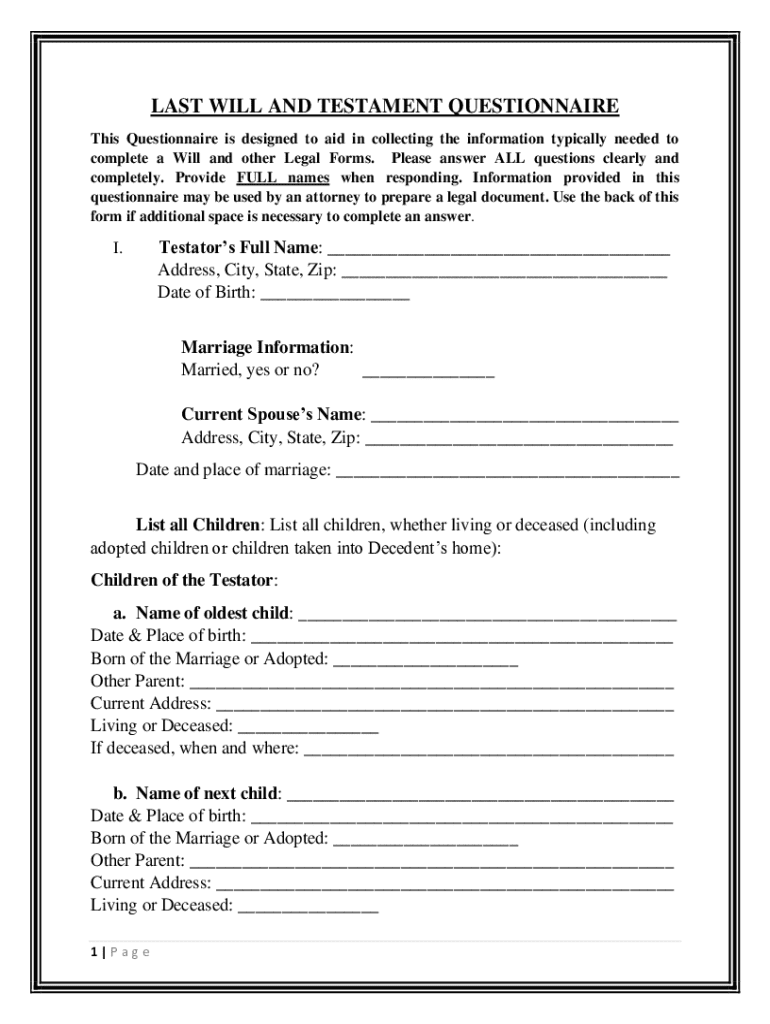

Drafting a valid will mandates adhering to specific legal requirements, which vary by state. Typically, you must be at least 18 years old and of sound mind to create a will. Each will should be signed by the testator (the person making the will) and witnessed by at least two individuals who are not beneficiaries of the estate to avoid conflicts of interest. In some states, notarization is also necessary to ensure the validity of the will.

Step-by-step process to create your will

Creating your will involves several steps. Begin by gathering all necessary information, such as asset valuations and potential beneficiaries. This foundational work sets a clear path forward. Once familiar with your assets, decide how you wish to distribute them among your beneficiaries.

There are various resources available, including pdfFiller, which provides templates and tools for easy drafting and managing your will. The convenience of online will creation ensures that you can modify your will as life circumstances change, keeping it relevant and effective.

Online will creation with pdfFiller

Creating a will online is increasingly popular due to its accessibility and ease. With pdfFiller, users can access will templates quickly from anywhere. The platform allows you to edit documents interactively, making the process seamless and user-friendly. Moreover, you can eSign your will securely, ensuring your document is both valid and safely stored.

Collaboration is another key feature, as pdfFiller lets you involve family members in the drafting process. Sharing drafts allows for input and agreement on asset distribution, which can improve family dynamics and prevent misunderstandings down the line.

Storing your will

Storing your will securely is crucial. Physical storage solutions include keeping the document in a safe deposit box or a fireproof safe at home. Ensure trusted family members or your executor know where it is located. Digital storage offers added benefits, as pdfFiller allows you to keep your will safely in the cloud, accessible from anywhere while managing the risk of loss or damage.

Make it a point to inform your executor about the will's location. This step ensures that when the time comes, they can access the document without delay. Regularly reviewing and updating your will can further enhance its effectiveness, ensuring it reflects your current wishes.

Frequently asked questions about wills

Many individuals have questions when it comes to wills. A commonly asked question is whether you can change your will after it’s written. The answer is yes. It’s advisable to review your will every few years or whenever there's a significant life change, such as marriage, divorce, or relocation.

Another frequent concern is related to moving to a different state. Wills may need updating to comply with new state laws. Additionally, some ask how marriage or divorce affects their will. Generally, marriage may revoke a prior will unless explicitly stated. In contrast, divorce may not automatically invalidate a will, though it's wise to review your will after such life events.

Special considerations

When creating a will, special considerations must be made, especially for blended families. It's essential to explicitly state your wishes to prevent potential disputes among step-siblings or half-siblings. Additionally, trusts can serve as an alternative to wills, providing tax benefits and controlling the distribution of assets over time.

Debts can also impact the execution of your will. Ensuring that your executor is aware of all outstanding debts will help them settle your estate more effectively, as debts need to be paid before beneficiaries receive their inheritances. Understanding the balance between assets and liabilities is crucial for smooth estate settlement.

Next steps after creating your will

Once your will is created, it is essential to keep it updated. Regularly reviewing it, especially after significant life events such as births, deaths, or relocations, ensures that it accurately reflects your wishes. Understanding how changes in circumstances can affect your will will empower you to maintain its relevancy.

Consulting with estate planning professionals can provide further insight, particularly for individuals with complex estates or specific family situations. Their expertise can help navigate the nuances of estate law and asset management, ensuring that every aspect of your will meets legal requirements and your desires.

Interactive tools and resources

Utilizing interactive tools can significantly streamline your will creation. pdfFiller offers a comprehensive will template that is user-friendly and accessible. Along with templates, it provides educational materials to enhance understanding of will planning and the importance of estate management.

For those requiring professional advice, pdfFiller facilitates online consultations with estate planning experts. This feature allows you to seek legal guidance without the hassle of traditional appointments, getting you the clarity and assistance you need to create a well-structured will.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 1 will for single directly from Gmail?

How can I send 1 will for single to be eSigned by others?

How do I complete 1 will for single online?

What is 1 will for single?

Who is required to file 1 will for single?

How to fill out 1 will for single?

What is the purpose of 1 will for single?

What information must be reported on 1 will for single?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.