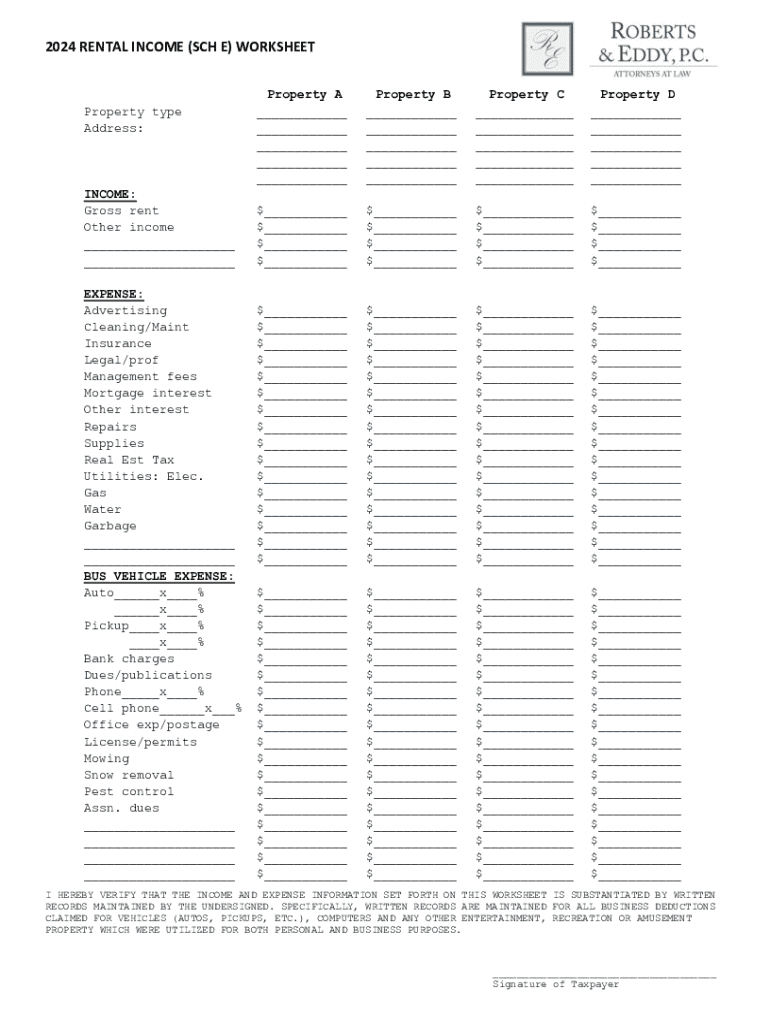

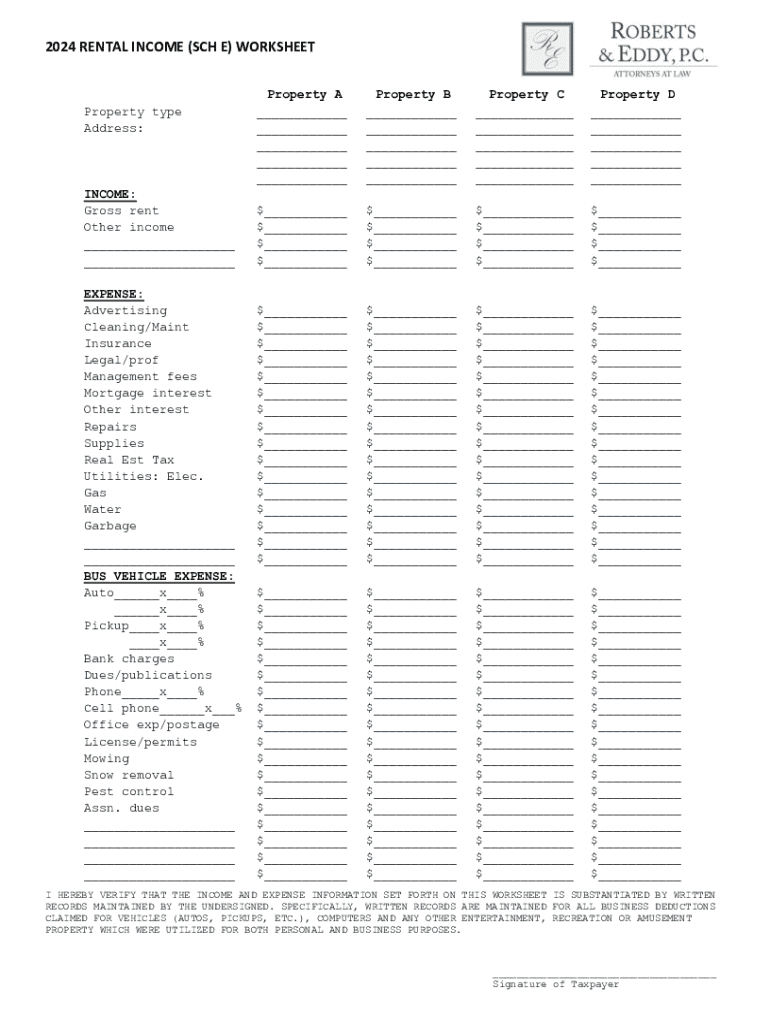

Get the free 2024 rental income (sch e) worksheet

Get, Create, Make and Sign 2024 rental income sch

How to edit 2024 rental income sch online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 rental income sch

How to fill out 2024 rental income sch

Who needs 2024 rental income sch?

2024 Rental Income Schedule Form: A Comprehensive How-to Guide

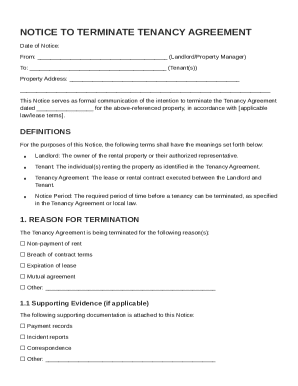

Understanding the 2024 rental income schedule form

The 2024 rental income schedule form, formally known as IRS Schedule E, is an essential document for landlords and property owners in the United States. This form is used to report income and deductions related to rental real estate, ensuring compliance with federal tax laws. Each year, the IRS updates the form to reflect changes that can impact how income from rentals is calculated and reported. For the 2024 tax year, some key changes have been introduced, making it crucial for property owners to familiarize themselves with the new requirements.

Who needs to fill out the 2024 rental income schedule form?

The 2024 rental income schedule form is essential for various groups of individuals and businesses involved in renting properties. This includes traditional landlords who manage single-family homes or multi-family units as part of their income strategy. Additionally, individuals who operate Airbnb listings or other short-term rentals must also report their earnings through this form. Landlords with multiple properties should take extra care in filling out the form accurately to maximize their deductions and ensure they meet IRS regulations.

Step-by-step guide to completing the 2024 rental income schedule form

Completing the 2024 rental income schedule form involves several steps that help ensure accuracy and compliance with tax laws. The initial phase is gathering the necessary documentation. Property owners should keep comprehensive records of their earnings and expenses to simplify the process. Following documentation, the form can be filled out by carefully following the form's structure and understanding the various sections required.

Gather necessary documentation

To fill out the 2024 rental income schedule form effectively, property owners should compile essential documents, which include:

Maintaining accurate record-keeping makes it easier to report rental income and deductions now and in future years.

Understanding the sections of the form

The 2024 rental income schedule form comprises several sections that guide the property owner in reporting their income and deductions accurately. The first section focuses on income from rental properties, which includes describing each property, the tenant’s rent, and any additional income derived from the rental, such as fees for services or amenities.

Special considerations for different types of rentals

Different types of rental properties may have specific implications when reporting income on the 2024 rental income schedule form. For instance, owners of long-term leases can generally adopt standard deductions and methods for reporting their income. However, those who engage in short-term rentals, like Airbnb hosts, may have to follow different rules, especially regarding how they categorize their earnings as either active or passive income. Mixed-use properties can also pose challenges in determining which expenses may be deductible, making it crucial to understand IRS guidelines.

Navigating complex scenarios

Handling complexities in rental income reporting is a significant aspect of filing the 2024 rental income schedule form. For instance, owners may face losses that may be categorized as passive losses, which could limit how much of those losses can be deducted from other income. Moreover, the ability to claim depreciation, which can ultimately reduce taxable income, requires understanding the distinctions between repairs and property improvements.

Handling losses and depreciation

Understanding how to track and report rental property losses is essential for any real estate investor. Passive losses, according to IRS guidelines, can sometimes be only partially deductible. Here’s how to handle these nuances:

What to do when rental properties are sold

Property owners must also be aware of how to report the sale of their rental properties on their 2024 rental income schedule form. When a property changes hands, capital gains or losses need to be reported accurately. Notably, any 1031 exchanges must also be documented, as these can significantly impact tax obligations. Understanding these factors is crucial for real estate investors wanting to optimize their tax positions and avoid unexpected liabilities.

Tips for using pdfFiller for your 2024 rental income schedule form

Using pdfFiller, a leading online PDF editor, simplifies the process of filling out the 2024 rental income schedule form. This platform provides a user-friendly experience for editing, signing, and managing forms from anywhere. Here are some tips for getting the most out of pdfFiller while completing your schedule:

To fill out your form effectively, pdfFiller provides templates that can streamline your workflow and save time. You can fill out forms directly in the tool, utilize editing options to adjust any section as needed, and ensure compliance with the latest IRS requirements.

FAQs about the 2024 rental income schedule form

Many property owners face similar questions regarding the reporting of rental income on their 2024 rental income schedule form. Frequently, inquiries revolve around the intricacies of income deductions, the documentation required, and general clarifications on how to fill out the form accurately. Proper understanding of frequently asked questions can ease the anxiety that comes with tax season.

Key takeaways for efficient form completion

For an efficient and accurate completion of the 2024 rental income schedule form, property owners should remember a few key points. Timeliness in filing not only helps avoid penalties but also facilitates better financial planning. Here are the primary takeaways for landlords and property owners to ensure seamless reporting and compliance:

Practical examples and case studies

Understanding the practical application of the 2024 rental income schedule form can be illustrated through real-life examples. For instance, a successful rental property owner effectively navigated the complexities of Schedule E by maintaining meticulous records and employing deductions strategically. Common mistakes include failing to keep sufficient documentation or misclassifying expenses between repairs and improvements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 2024 rental income sch from Google Drive?

How do I edit 2024 rental income sch on an Android device?

How do I complete 2024 rental income sch on an Android device?

What is 2024 rental income sch?

Who is required to file 2024 rental income sch?

How to fill out 2024 rental income sch?

What is the purpose of 2024 rental income sch?

What information must be reported on 2024 rental income sch?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.