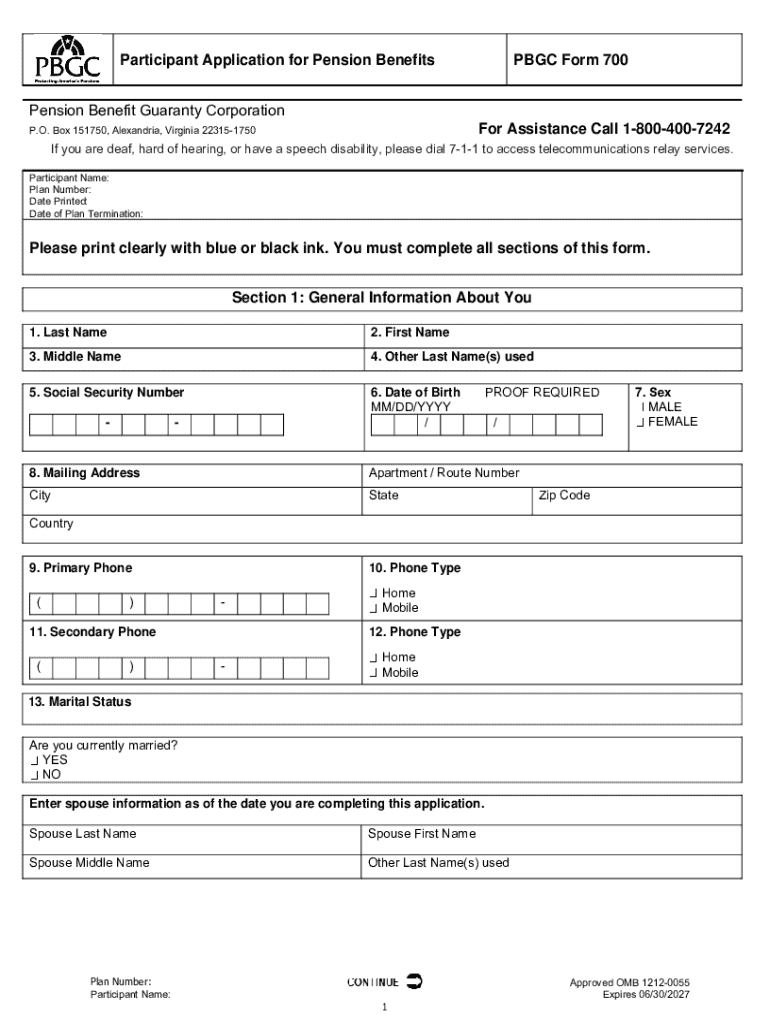

Get the free Participant Application for Pension Benefits PBGC Form ...

Get, Create, Make and Sign participant application for pension

How to edit participant application for pension online

Uncompromising security for your PDF editing and eSignature needs

How to fill out participant application for pension

How to fill out participant application for pension

Who needs participant application for pension?

Participant application for pension form: Your comprehensive guide

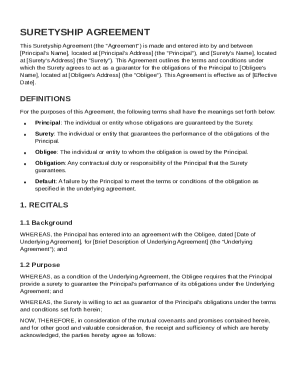

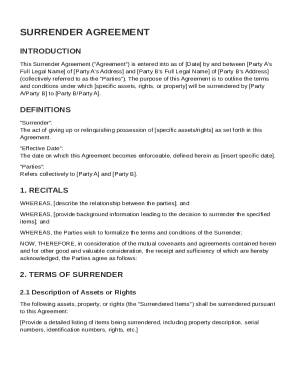

Understanding the participant application for pension

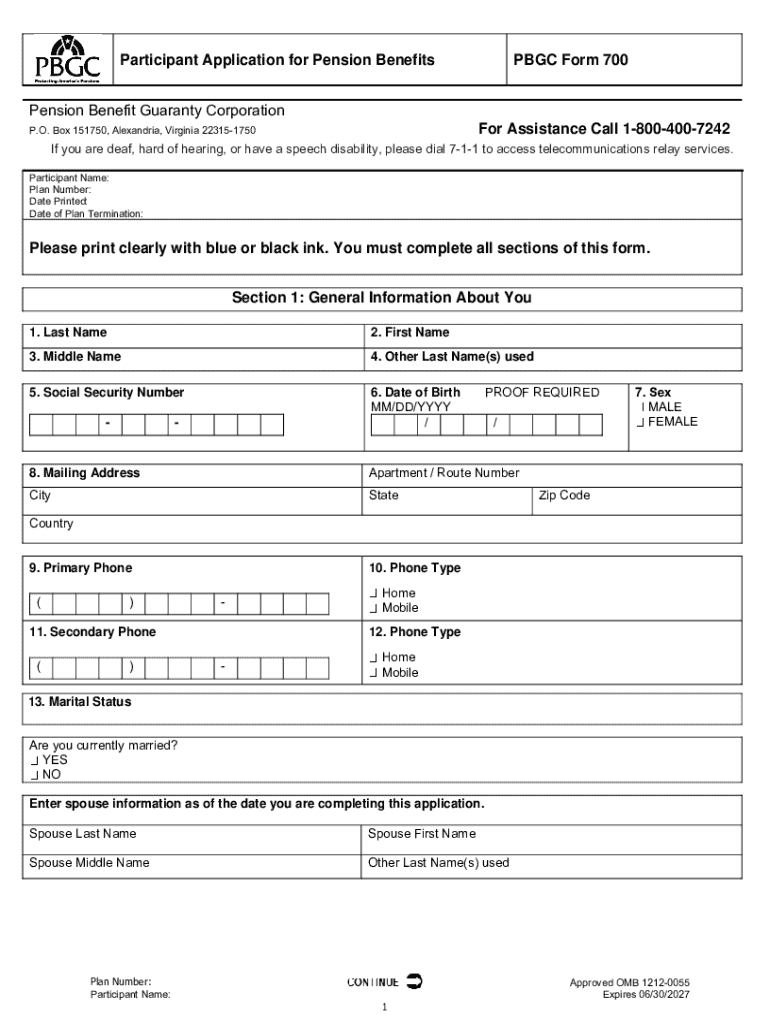

The participant application for pension form is a crucial document for individuals seeking to access their earned retirement benefits. This form initiates the process by which you declare your intention to retire and formally request your pension entitlements. The significance of timely submission cannot be overstated, as a delay might impact your financial stability during your retirement.

Every pension plan has specific eligibility criteria. Generally, you'll need to have a minimum number of service years with your employer, as well as a certain minimum age. Understanding these criteria can significantly streamline your transition into retirement, allowing for a smoother financial journey.

Pre-filling preparation

Before diving into the participant application for pension form, preparation is key. Gathering essential documentation will not only save you time but also reduce the chances of errors during submission. Required documents commonly include personal identification, verification of your employment history, and records of past contributions.

Moreover, it's critical to familiarize yourself with the specific terms and conditions of your pension plan. Understanding key dates and deadlines will ensure that you don’t miss out on valuable deadlines, which could impede your benefits.

Step-by-step instructions for completing the application

Completing the participant application form requires careful attention to detail. Below is a breakdown of each section you’ll encounter during your application process.

After completing the sections, it’s wise to review your application thoroughly. Utilize tools like pdfFiller's editing features to ensure that your submission is error-free.

Utilizing interactive tools for application assistance

Navigating the participant application for pension form can be streamlined with the use of interactive tools. pdfFiller offers a user-friendly interface, allowing you to modify fields easily. This helps in making any necessary adjustments efficiently, saving you both time and effort.

Additionally, collaborative features enable you to invite input from colleagues and family members. Such collaboration can enhance the quality of your application by integrating feedback that you may have overlooked.

Submitting the application

Once you’ve filled out the participant application for pension form accurately, it’s time to submit it. There are primarily two submission options: you can submit directly online via pdfFiller or send it via traditional mail. If opting for mailing, remember to consider tracking options to ensure your application reaches its destination.

Upon submission, you’ll want to verify receipt of your application. Expect processing timelines to vary, but certain confirmations can provide peace of mind as you wait for a response.

Post-submission management

After submitting your application, it’s essential to track its status. Utilizing pdfFiller can provide real-time updates on your application’s progress, which is critical for planning your retirement effectively.

Moreover, being prepared to handle inquiries or additional requests from the pension plan administrator is necessary. Expect common follow-up questions about your documentation, and be ready with the information required.

Additional resources and forms

While the participant application for pension form is vital, many related forms and resources can assist you in retirement planning. pdfFiller provides easy access to these pension-related forms, simplifying your process.

In addition to these forms, utilizing search tools for comprehensive information on pension benefits ensures you are fully informed, making well-rounded decisions regarding your retirement.

Staying informed and connected

Continually learning about retirement benefits is essential as regulations and policies evolve. Staying updated helps safeguard your rights and entitlements.

These community resources can offer invaluable support during your application process, and attending workshops can further bolster your understanding of your retirement plan.

Frequently asked questions (FAQs)

Navigating the participant application for pension form may raise some concerns, and you’re not alone. Many individuals seek clarification on eligibility and the specifics of the pension application process. Here are some common inquiries.

Being prepared with answers to these questions equips you for a smoother application process, allowing you to address potential issues proactively.

pdfFiller’s value proposition

pdfFiller empowers users to seamlessly edit PDFs, eSign, collaborate, and manage documents from a single, cloud-based platform. This value proposition is particularly beneficial for those completing the participant application for pension form, enhancing your experience.

By utilizing pdfFiller's unique features, individuals and teams can streamline their applications, ensuring a more efficient and user-friendly process. The advantages of having a seamless platform for document handling cannot be overstated, as they contribute to a hassle-free experience as you prepare for retirement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the participant application for pension in Gmail?

How do I fill out the participant application for pension form on my smartphone?

How do I edit participant application for pension on an iOS device?

What is participant application for pension?

Who is required to file participant application for pension?

How to fill out participant application for pension?

What is the purpose of participant application for pension?

What information must be reported on participant application for pension?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.