IRS 1040 - Schedule 2 (SP) 2025-2026 free printable template

Get, Create, Make and Sign IRS 1040 - Schedule 2 SP

How to edit IRS 1040 - Schedule 2 SP online

Uncompromising security for your PDF editing and eSignature needs

IRS 1040 - Schedule 2 (SP) Form Versions

How to fill out IRS 1040 - Schedule 2 SP

How to fill out 2025 schedule 2 form

Who needs 2025 schedule 2 form?

Understanding the 2025 Schedule 2 Form: A Comprehensive Guide

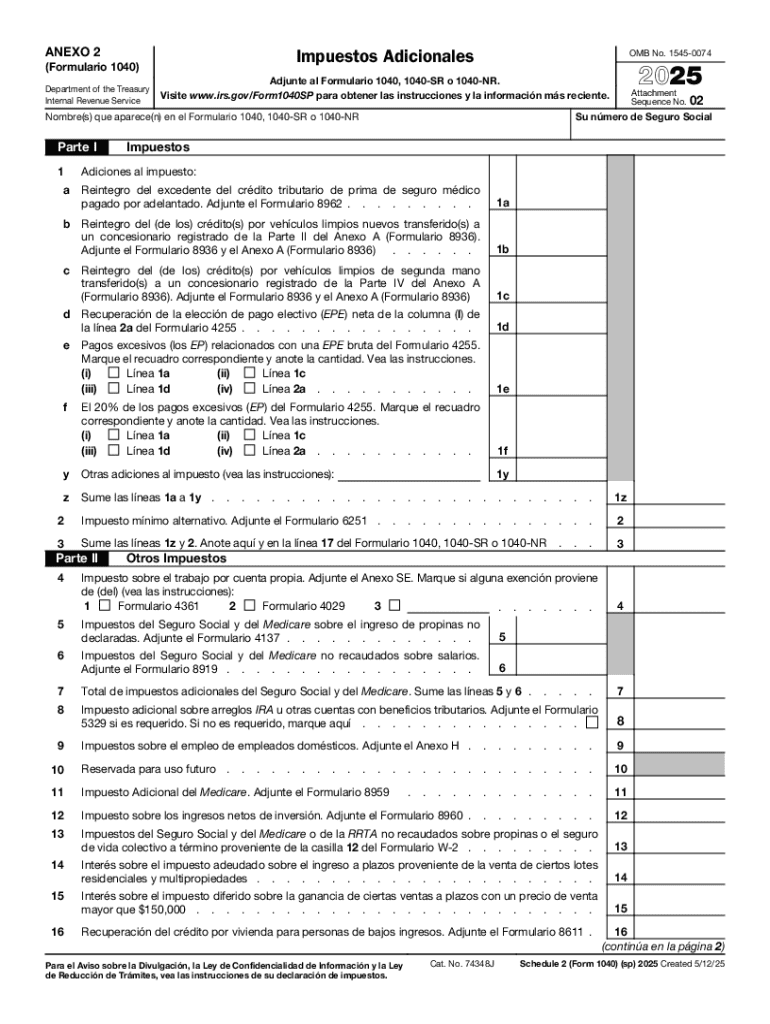

Understanding the 2025 Schedule 2 Form

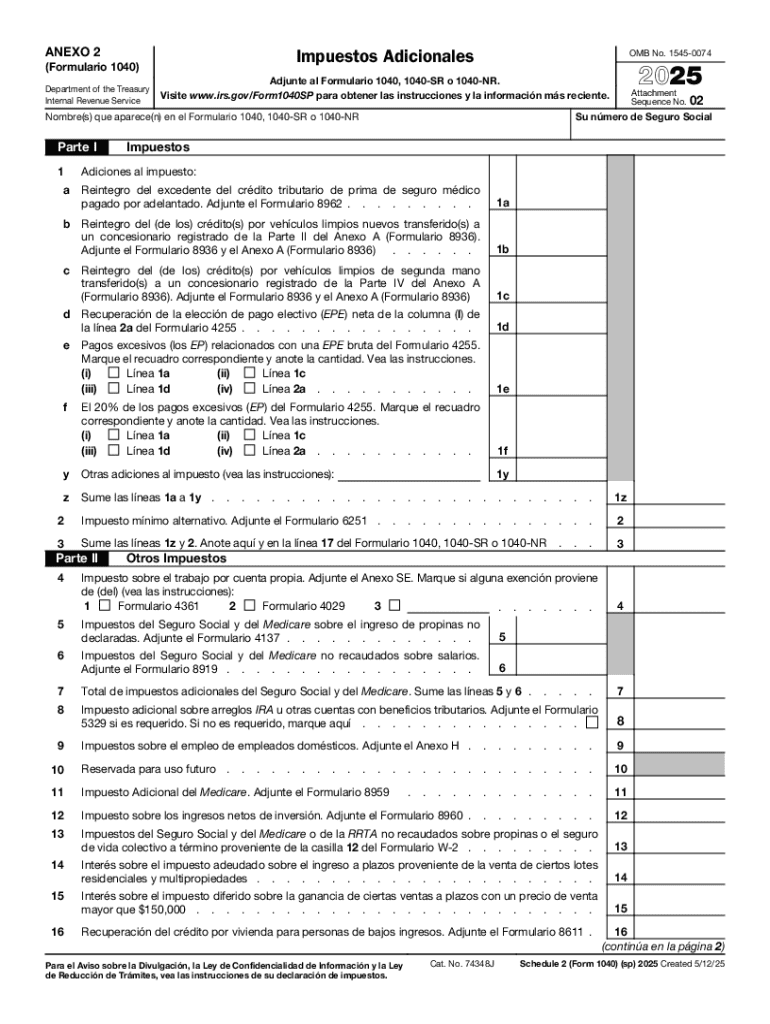

The 2025 Schedule 2 form is an integral part of the tax filing process for individuals and entities. This form plays a critical role in reporting additional taxes and claiming certain credits that are not addressed on the standard tax return. The importance of the Schedule 2 form lies in its ability to ensure an accurate tax liability calculation for taxpayers, providing clarity on additional tax obligations or credits that may affect their overall tax situation.

In the 2025 version, notable changes have been implemented to streamline the reporting process. These modifications include updates to tax credits and a revised structure that enhances user experience while filing. Taxpayers are encouraged to familiarize themselves with these changes to effectively navigate their tax obligations for the year.

Who needs to file the 2025 Schedule 2 form?

The requirement to file the 2025 Schedule 2 form primarily applies to taxpayers who have certain types of income or tax situations. Specifically, if you owe any additional taxes or are claiming certain credits that exceed what is reported on your standard Form 1040 or 1040-SR, you must include this form with your filing. Common scenarios include self-employment tax, additional tax on retirement distributions, and taxes related to healthcare coverage.

Furthermore, it's essential for those who have recently seen changes in their financial situation — such as increased investment income or the loss of certain tax credits due to income thresholds — to ensure they accurately assess their need to include Schedule 2 in their tax documentation.

Navigating the 2025 Schedule 2 form

Navigating the 2025 Schedule 2 form requires an understanding of its structure and key sections. The form is divided into two main parts: Part I, covering tax credits, and Part II, which details other taxes that you may need to report. This layout is designed to simplify the process of identifying the extra taxes one might incur or the credits that can be claimed, making it easier for taxpayers to complete the form accurately.

Unlike previous versions, the updated layout of the Schedule 2 form not only enhances readability but also clearly delineates the requirements for each section. This proactive approach by the IRS ensures that taxpayers spend less time deciphering forms and more time focusing on accurate reporting.

Parts of the Schedule 2 form

Part I of the Schedule 2 form primarily addresses various tax credits that can be claimed by taxpayers. These might include the Residential Energy Credit or the Credit for Other Dependents. Green energy initiatives have continued to influence tax credits, reflecting the government's current priorities. This section may require meticulous calculations based on allowable deductions, thus it is essential to consult relevant IRS resources for guidance on eligibility and amounts.

Part II of the Schedule 2 form deals with additional taxes that need to be reported. This section includes taxes such as the self-employment tax, which is applicable for individuals running their own business or freelancing, as well as the additional Medicare tax that applies to higher income earners. Understanding these taxes is crucial not only for compliance but to ensure that taxpayers do not face penalties or underpayment issues afterward.

Step-by-step guide: Completing the 2025 Schedule 2 form

Step 1: Gathering necessary information

Before embarking on filling out the 2025 Schedule 2 form, gathering the necessary documentation is vital. This is typically comprised of income statements, previous tax returns, and records of any receipts pertaining to credits you intend to claim. Staying organized with these documents ensures a smoother filing process and diminishes the likelihood of mistakes. Consider using labeled folders or a digital filing system to keep everything easily accessible.

Step 2: Filling out Part

Part I requires careful attention to detail as you calculate your eligible credits. Start by filling out each line item according to the instructions provided. This may involve referencing previous tax years or IRS guidelines for clarity. A common error here is not accurately calculating your credits based on the most current rules or misunderstanding eligibility. Therefore, it’s crucial to double-check your entries for accuracy.

Step 3: Completing Part

When progressing to Part II, provide clear documentation of any additional taxes owed. This area can be complex, particularly regarding self-employment tax calculations. Utilize examples from IRS publications or tax software to understand calculations clearly. Detail-oriented approaches will avoid common errors, as miscalculations here can lead to issues with the IRS.

Step 4: Reviewing your Schedule 2 form

After completing the form, it’s important to conduct a thorough review. Cross-reference all figures and ensure that all required sections are filled out correctly. An easy way to avoid common mistakes is to read through the form aloud or have someone else review your entries. Missing or incorrect data can delay processing, so it’s wise to invest time in this step to minimize complications.

Utilizing interactive tools for Schedule 2 submission

Accessing pdfFiller’s interactive tools

pdfFiller simplifies your experience with the 2025 Schedule 2 form by offering an array of interactive tools tailored to your tax filing needs. The platform enables users to easily fill out, edit, and eSign documents efficiently. Key features of pdfFiller include the ability to save progress, access templates, and utilize pre-filled data from previous forms, thereby enhancing convenience and minimizing errors during the completion of your Schedule 2.

Collaborating with others using pdfFiller

PdfFiller also allows for easy collaboration between parties involved with the tax documentation process. Users can share completed forms securely and communicate through integrated comments, streamlining review processes. This functionality is particularly beneficial for individuals working with tax professionals who can provide insights and adjustments before final submission.

Getting assistance with your Schedule 2 filing

When to seek expert help

Recognizing when to seek expert help can alleviate stress during tax season. If your financial situation is complex, such as multiple streams of income or unique deductions, consulting a tax professional may provide significant benefits. Signs that you need assistance include confusion regarding deductible items or complexities in calculating additional taxes as reported on Schedule 2.

Leveraging pdfFiller's support

pdfFiller provides robust support options designed to assist users in navigating form completion and submission. With an extensive knowledge center containing tutorials, guides, and templates specifically for the Schedule 2 form, users are empowered to utilize pdfFiller efficiently and confidently. This resource can be invaluable in addressing questions or concerns that might arise throughout the tax filing process.

Additional insights into the 2025 Schedule 2 form

Frequently asked questions about Schedule 2

Frequent questions regarding the Schedule 2 form often revolve around eligibility for tax credits and the reporting of additional taxes. Many taxpayers are unsure about which credits they qualify for or how to navigate complex tax obligations. It’s essential to review the IRS's guidance or consult a tax professional to ensure full compliance and to maximize potential benefits.

Best practices for tax season

During tax season, organizational strategies can significantly impact the efficacy of your filing process. Consider maintaining a dedicated folder (physical or digital) for all related tax documents. This should include income records, receipts for deductions, and previous tax returns. Such organization makes it easier to gather necessary information quickly and avoid last-minute filing challenges. Also, aim to start the process early to give yourself ample time to resolve any unexpected issues.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my IRS 1040 - Schedule 2 SP in Gmail?

How do I make changes in IRS 1040 - Schedule 2 SP?

Can I edit IRS 1040 - Schedule 2 SP on an iOS device?

What is 2025 schedule 2 form?

Who is required to file 2025 schedule 2 form?

How to fill out 2025 schedule 2 form?

What is the purpose of 2025 schedule 2 form?

What information must be reported on 2025 schedule 2 form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.