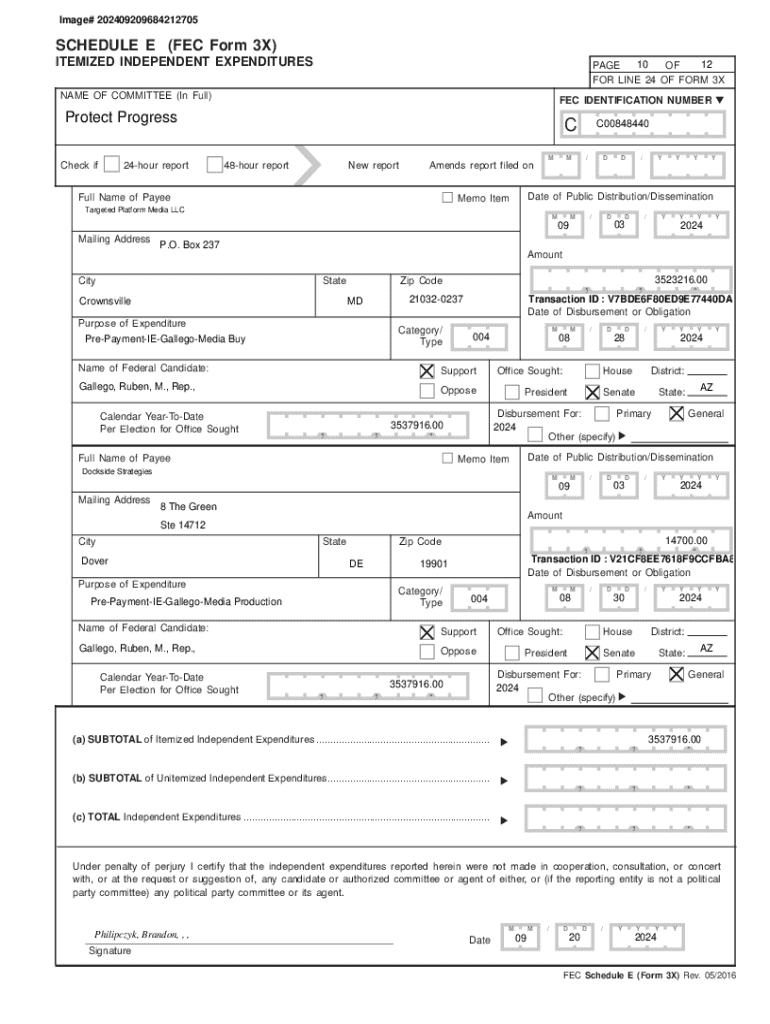

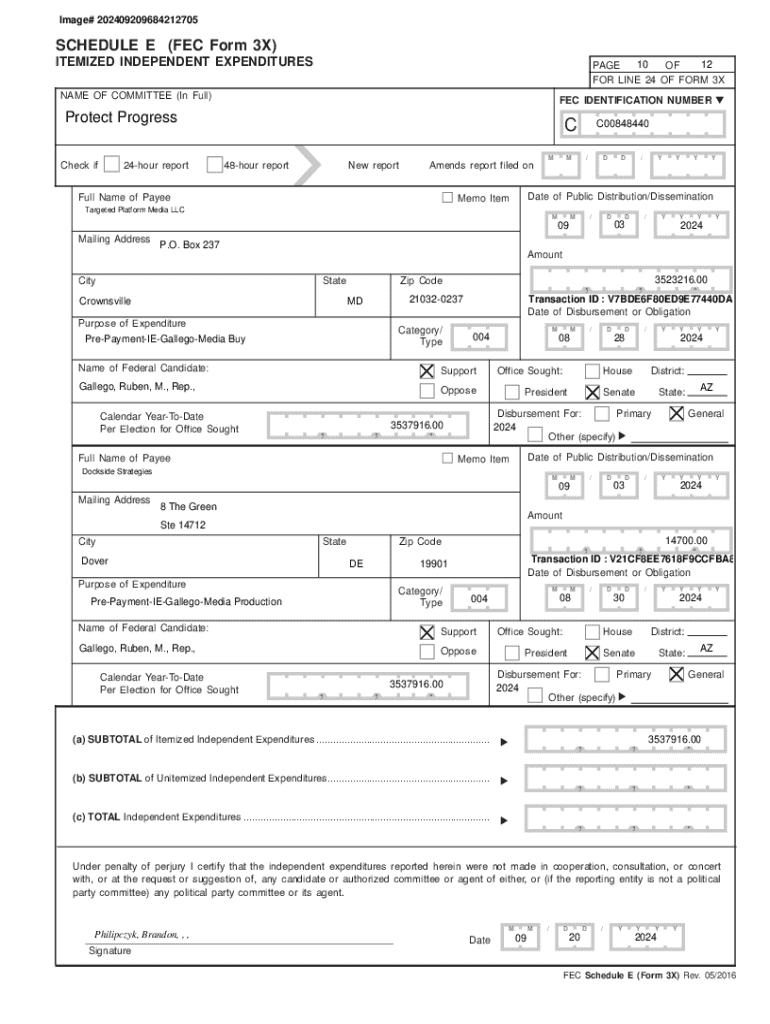

Get the free SCHEDULE E (FEC Form 3X) Protect Progress

Get, Create, Make and Sign schedule e fec form

How to edit schedule e fec form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out schedule e fec form

How to fill out schedule e fec form

Who needs schedule e fec form?

Comprehensive Guide to Filling Out the Schedule E FEC Form

Understanding Schedule E of the FEC Form

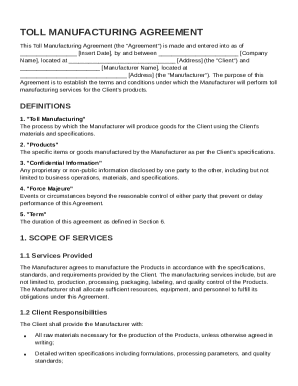

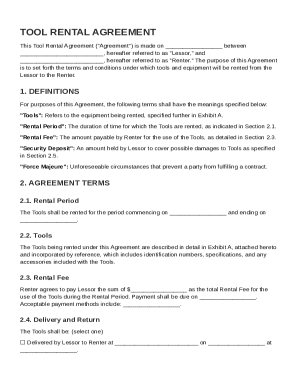

The Schedule E FEC form is a crucial component for political candidates and committees, serving as a detailed account of expenditures related to campaign finance. This document helps ensure transparency and compliance with federal election laws. Specifically, it documents contributions received for a political campaign, detailing who contributed, how much, and the purpose of the contribution.

Understanding the purpose and correct usage of Schedule E is vital, as it plays a central role in campaign finance reporting. This form is distinct from other FEC schedules — for instance, Schedule A focuses on individual contributions, while Schedule B addresses expenditures made by a campaign. Thus, Schedule E specifically revolves around documenting the contributions received, ensuring all financial activities are accurately recorded and reported.

Who should use Schedule E?

Schedule E is primarily designed for candidates, political committees, and campaign managers who manage funding and contributions for political campaigns. Candidates need to report their fundraising efforts, while committees use Schedule E to ensure compliance and keep their financial records in check.

Common scenarios that necessitate the use of Schedule E include fundraising events where contributions may be collected, and in-kind contributions where goods or services are provided instead of cash. Each of these instances is important for campaign financial reporting, and it’s essential to log every detail accurately.

Preparing to fill out Schedule E

Before diving into the completion of Schedule E, it is important to gather all necessary information. This includes details about contributors such as name, address, and occupation, alongside the contribution amounts and the dates the contributions were made. Having this information ready simplifies the process and minimizes the risk of errors.

Using tools like pdfFiller can greatly enhance your document management efficiency while filling out Schedule E. Setting up a pdfFiller account is user-friendly, offering an accessible platform where you can edit, sign, and complete your forms individually or collaboratively.

Step-by-step instructions for completing Schedule E

Filling out Schedule E involves several specific steps to ensure accuracy and compliance. Let’s break down each step to facilitate a smooth completion process.

Following these steps diligently helps you create a comprehensive and compliant Schedule E form, allowing for a transparent representation of your campaign's financial dealings.

Editing and collaborating on Schedule E using pdfFiller

Once you've completed the Schedule E form, editing and collaboration features of pdfFiller come into play. You can make instant edits and add comments or annotations for team members to review. This collaborative aspect is crucial when multiple people contribute to compiling the campaign’s financial reports.

These collaboration tools streamline the process, allowing teams to work cohesively and accurately on the Schedule E form.

Signing and submitting Schedule E

Once the Schedule E form is complete, the next steps involve signing and submitting it. Utilizing pdfFiller, you can electronically sign the document, ensuring a timestamped and secure signing process.

Timely submission and adherence to electronic signing procedures are critical for ensuring compliance and avoiding penalties.

Troubleshooting common issues with Schedule E

Despite careful preparation, issues may arise when completing the Schedule E form. Common errors include incorrect contributor information or failing to properly categorize expenditures. It's essential to review all entries thoroughly before submission to correct any mistakes.

Being proactive in identifying and correcting potential issues can help maintain the integrity of a campaign’s financial reporting.

Understanding compliance and regulations related to Schedule E

Compliance with federal election regulations is non-negotiable for any political campaign. Understanding the legal expectations surrounding the Schedule E form is crucial to ensure that campaign financing remains within legal boundaries. This includes adhering to contribution limits and accurately reporting all financial activities.

By maintaining compliance with FEC regulations, political candidates can uphold their integrity and foster trust among their constituents.

Additional insights on Schedule E FEC form

Accurate record-keeping is paramount for campaign operations. The Schedule E form, for instance, provides a structured way to document contributions and helps ensure that all transactions are accounted for. With frequent changes in reporting requirements, staying informed about updates to the Schedule E is also essential for compliance.

Continual learning and adaptation to changes in the regulatory landscape are beneficial strategies for political candidates and committees.

Benefits of using pdfFiller for filing Schedule E

Utilizing pdfFiller for filling out the Schedule E form offers numerous advantages for campaign finance management. It allows you to manage all your documents from one secure platform, enhancing efficiency and accessibility.

By leveraging these benefits, candidates and committees can streamline their campaign finance reporting and focus more on driving their campaigns forward.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send schedule e fec form for eSignature?

How do I execute schedule e fec form online?

How do I edit schedule e fec form on an Android device?

What is schedule e fec form?

Who is required to file schedule e fec form?

How to fill out schedule e fec form?

What is the purpose of schedule e fec form?

What information must be reported on schedule e fec form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.