Get the free home-program-first-time-homebuyer-program-guidelines ...

Get, Create, Make and Sign home-program-first-time-homebuyer-program-guidelines

Editing home-program-first-time-homebuyer-program-guidelines online

Uncompromising security for your PDF editing and eSignature needs

How to fill out home-program-first-time-homebuyer-program-guidelines

How to fill out home-program-first-time-homebuyer-program-guidelines

Who needs home-program-first-time-homebuyer-program-guidelines?

Home Program First Time Homebuyer Program Guidelines Form

Understanding the first time homebuyer program

The First Time Homebuyer Program is designed to provide financial assistance and support to individuals looking to purchase their first home. This initiative aims to make homeownership more accessible and affordable, particularly for those who may face challenges due to limited first-time buyer savings or concerns about credit. It is a vital resource that ensures equitable opportunities to attain housing.

To qualify for this program, several eligibility requirements must be met, ensuring it serves its intended purpose effectively. Potential homeowners need to be aware of age and residency status, specific income limits, and credit score considerations. These criteria help determine who can benefit from the available funds and resources.

Participating in the program can yield several benefits. First, financial assistance options may include down payment assistance, grants, or subsidized loans. Moreover, participants can connect with local housing agencies, which provide tailored guidance and resources. Educational opportunities, such as workshops and informational sessions, further support first-time homebuyers in understanding the process.

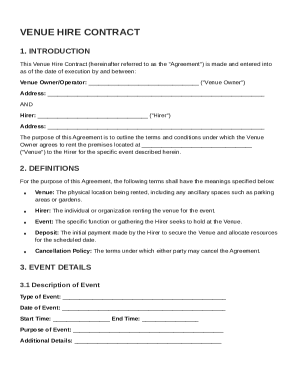

Overview of the homebuyer program guidelines form

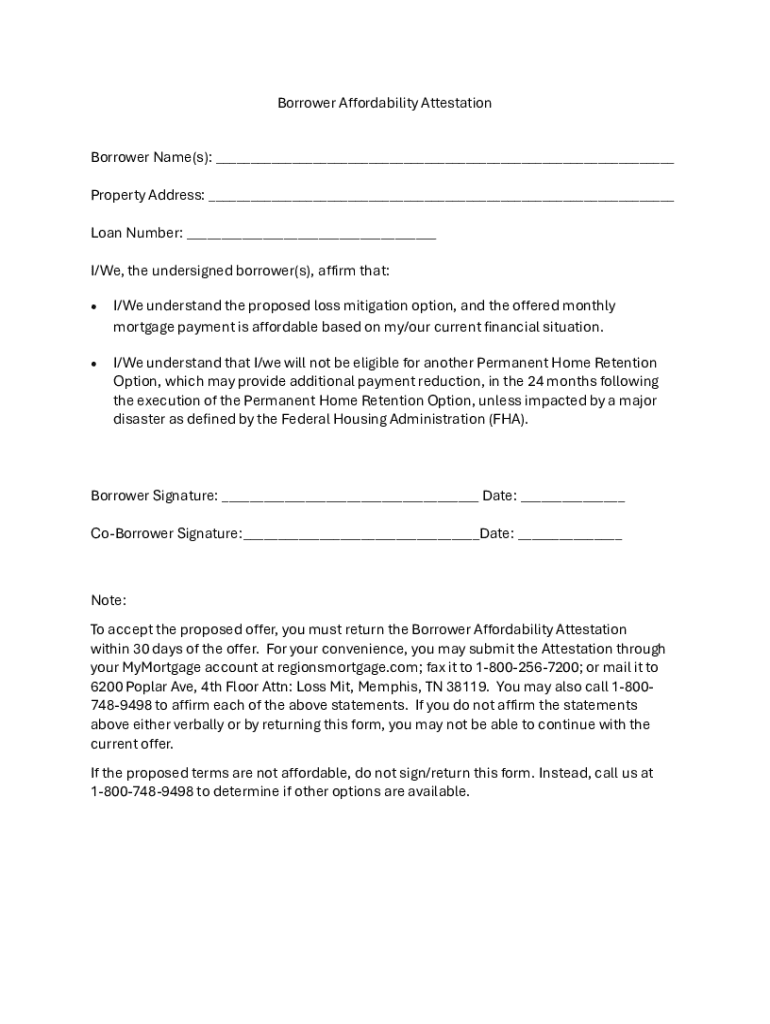

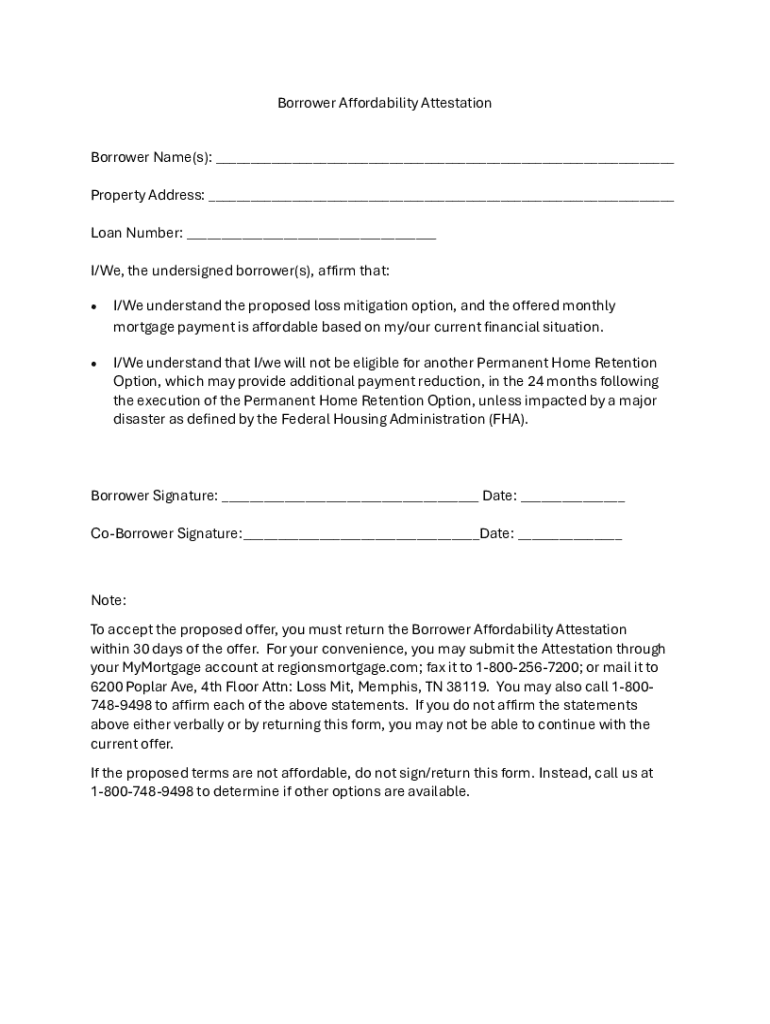

The Homebuyer Program Guidelines Form serves as a crucial document to initiate the application process for first-time homebuyers. Its purpose is to collect necessary information for evaluating applicants’ qualifications and ensuring they meet the program's requirements. This comprehensive form asks for a range of details, which are vital for the screening process.

Key sections of the form include personal information, financial qualification, and property information. Completing each segment accurately is of utmost importance, as inaccuracies can lead to delays or rejection of the application. Providing precise data allows housing agencies to assess each applicant fairly and efficiently.

Accuracy in filling out the form is essential to a smooth application process. Erroneous data can impede your request for assistance and potentially lead to missed opportunities for homeownership. Therefore, double-checking information before submission is strongly advised.

Step-by-step instructions for filling out the form

Before starting the application, gathering required documents is crucial in ensuring you have all necessary information at hand. This includes proof of income, identification documents, tax returns, and any other financial statements requested within the guidelines. Having these ready can streamline the form-filling process.

The form should be approached section by section. Begin with filling out the personal information, ensuring names and social security numbers are correct. Next, move to the financial qualification section, where accurate reporting of income and debts is imperative for successful assessment.

While completing the form, avoid common mistakes such as inaccurate financial data, misrepresentation of personal details, and omitting required documentation. Each of these can negatively impact your application and lead to additional delays or complications.

Using pdfFiller for the first time homebuyer program guidelines form

pdfFiller's cloud-based platform offers numerous benefits for managing the Home Program First Time Homebuyer Program Guidelines Form. One of the most significant advantages is the accessibility it provides, enabling users to fill out forms from any device—be it a computer, tablet, or smartphone. This ease of access makes home preparation and form submission much more manageable.

Additionally, pdfFiller allows for collaborative editing, where applicants can share forms with others involved in the process. This feature is particularly useful for couples or families working together on a home purchase.

Furthermore, the process for eSigning the form is straightforward on pdfFiller. Users can create a digital signature quickly and send the form for additional signatures as needed. This functionality simplifies the signing process, making it much less cumbersome compared to traditional methods.

Managing your homebuyer application

Once your Home Program First Time Homebuyer Program Guidelines Form has been submitted, managing your application becomes the next crucial step. Keep track of the application status via the housing agency’s portal or direct communication channels. By staying informed about your application, you can prepare for the next steps in the home-buying process.

Effective communication with housing agencies is essential. Establish a point of contact early on, and don’t hesitate to reach out whenever you have questions or need clarification on the next steps. Moreover, maintaining records of all submissions and correspondence can help ensure smooth communication and transparency during the review period.

Frequently asked questions (faqs)

After submitting your application, a common concern is what happens next. Typically, housing agencies will review your submission and may reach out for additional information. The approval process durations can vary widely, but many applicants receive feedback within a few weeks, depending on specific agency workloads.

It's important to note that modifications to the application after submission can be challenging and may not be permitted once the review has started. Therefore, it’s crucial to verify all details before sending. Additional resources are available for first-time homebuyers, often via local housing agencies or online platforms, ensuring support throughout the process.

Connecting with local housing agencies

Establishing a connection with local housing agencies can significantly enhance your experience and success in the homebuying process. Finding the right resources tailored to specific counties or cities is essential, as assistance programs can vary widely based on local needs and available funds.

Types of assistance offered by housing agencies typically include financing options, down payment grants, and homebuyer education workshops. Networking with these agencies can provide you with insights on additional opportunities for future home purchases, including newly available programs or government resources.

Additional considerations for first time homebuyers

As you embark on your journey as a first-time homebuyer, there are additional aspects to consider, such as understanding closing costs and fees associated with purchasing a home. Closing costs can incur various fees, including those for preventative measures, local taxes, and agency charges.

It's also crucial to develop a long-term financial plan as a new homeowner. Consider your monthly mortgage payment, ongoing maintenance costs, and potential home value changes. Establishing a budget that incorporates these elements is vital for sustainable homeownership.

Sharing your success story

Once you successfully navigate the first-time homebuyer landscape, sharing your success story can inspire others to pursue their journey. Encouraging participation in local programs can foster a sense of community and support among aspiring homeowners.

Utilizing social media platforms to document your journey and progress not only keeps your friends and family updated but can also help spread awareness of effective housing programs. Additionally, consider joining community homebuyer events to connect with others and share knowledge around the homebuying process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit home-program-first-time-homebuyer-program-guidelines from Google Drive?

Can I sign the home-program-first-time-homebuyer-program-guidelines electronically in Chrome?

How can I edit home-program-first-time-homebuyer-program-guidelines on a smartphone?

What is home-program-first-time-homebuyer-program-guidelines?

Who is required to file home-program-first-time-homebuyer-program-guidelines?

How to fill out home-program-first-time-homebuyer-program-guidelines?

What is the purpose of home-program-first-time-homebuyer-program-guidelines?

What information must be reported on home-program-first-time-homebuyer-program-guidelines?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.