Get the free 2025 personal property tax forms and instructions for ...

Get, Create, Make and Sign 2025 personal property tax

Editing 2025 personal property tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 personal property tax

How to fill out 2025 personal property tax

Who needs 2025 personal property tax?

2025 Personal Property Tax Form - How-to Guide

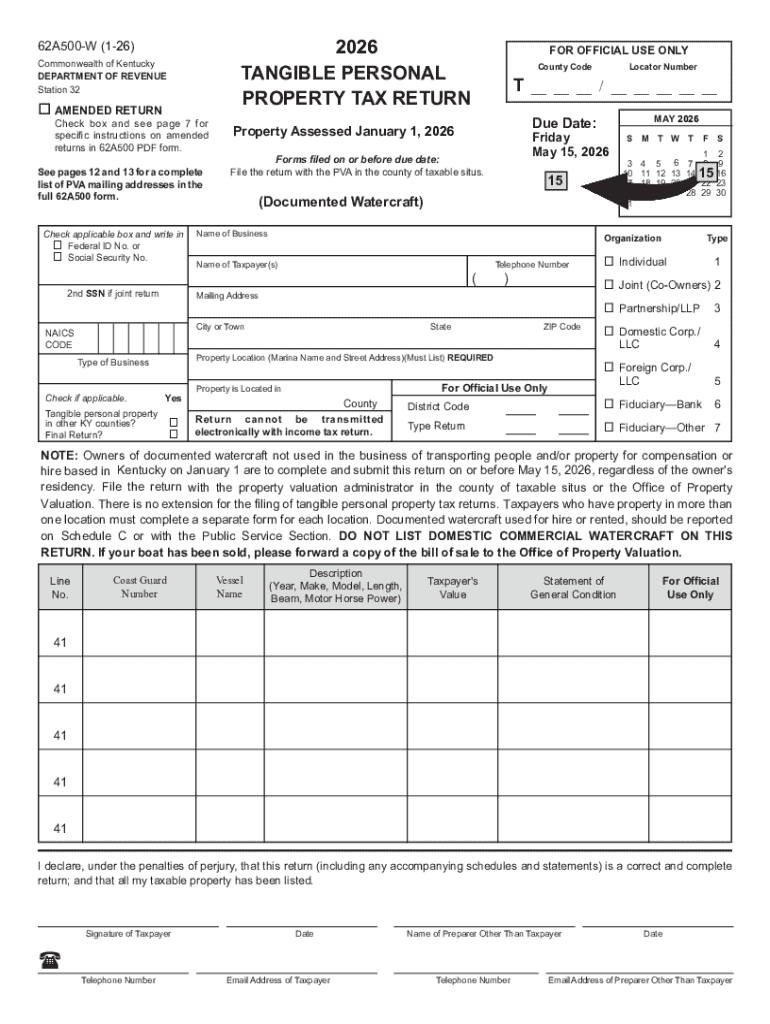

Understanding the 2025 personal property tax form

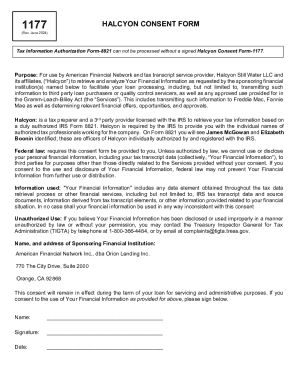

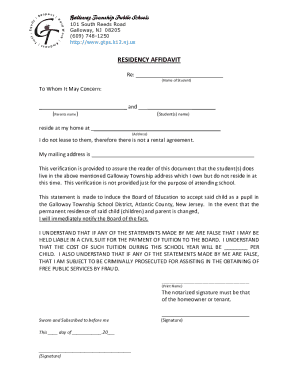

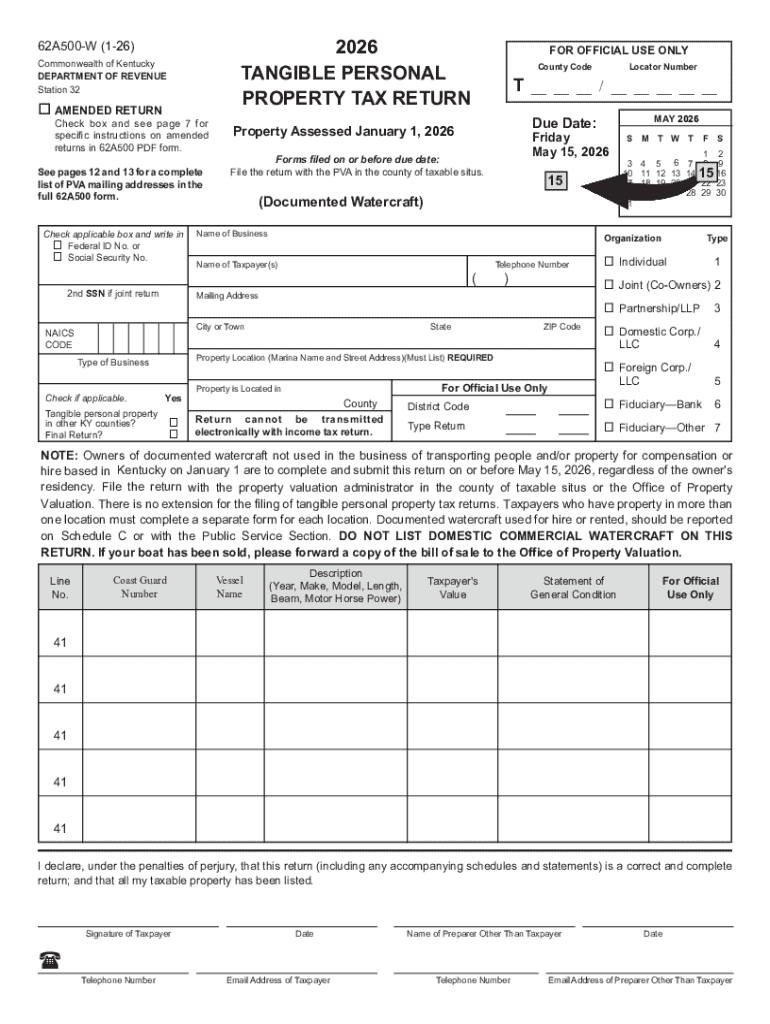

The 2025 personal property tax form is a critical document for both individuals and businesses that own tangible assets. This form serves to report the value of personal property to local tax authorities, ensuring the accurate taxation of assets like vehicles, machinery, and equipment. Understanding its importance is crucial for compliance and accurate financial planning.

Filing this form is not just a bureaucratic necessity; it plays a vital role in determining your tax liabilities and safeguarding exempt properties if eligible. For businesses, in particular, proper documentation can affect operational costs significantly.

Who needs to file?

Generally, anyone who owns personal property that is not specifically exempt from taxation is required to file. This includes individuals with personal vehicles and businesses with capital equipment. Misunderstandings about filing requirements often lead taxpayers to either overreport or underreport their holdings, which can lead to penalties or financial loss.

Key changes in the 2025 tax form

The 2025 personal property tax form introduces several noteworthy changes from previous years, reflecting adjustments in tax laws and valuation methodologies. One of the significant updates is the introduction of new reporting requirements aimed at enhancing transparency. For example, taxpayers may now be required to provide additional details on asset depreciation, which can influence overall tax assessments.

Moreover, local jurisdictions may implement their specific requirements based on changes at the state level, thereby necessitating awareness of these variations. Understanding the legislative changes in one’s state can provide clarity on how they affect your tax responsibilities.

Understanding impacts of legislative changes

As laws vary from state to state, it’s critical for taxpayers to stay informed. Changes in assessment methodologies or depreciation schedules can have substantial impacts on taxpayers. For instance, states that decrease assessment ratios may reduce property tax liabilities significantly, while others may increase them, leading to higher tax bills.

Preparing to complete your personal property tax form

The key to completing the 2025 personal property tax form accurately lies in thorough preparation. Gathering necessary documents is the first critical step. This should include recent property invoices, assessment papers, and documentation of any improvements made to the property. Keeping these documents well-organized is essential, enabling a smoother filing process.

Understanding property valuation

Understanding how your personal property is valued is crucial. Valuation methods can include cost approaches, sales comparison, or income approaches depending on the nature of the assets. Engaging with local property assessors or utilizing online resources can provide insights into assessing property values accurately.

Step-by-step guide to filling out the 2025 personal property tax form

Once prepared, accessing the form is the next logical step. The 2025 personal property tax form can easily be found on pdfFiller, allowing for both download and online filling options. Utilizing these tools can enhance your filing experience.

Detailed instructions on each section

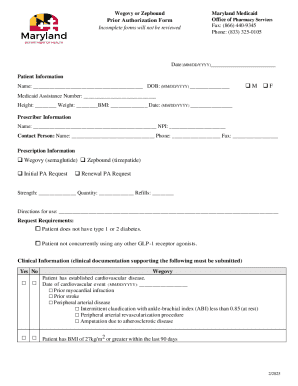

Filling out the form consists of several key sections that need attention: Section 1 focuses on personal information, requiring name, address, and taxpayer ID. It's crucial to ensure this information is accurate and up-to-date.

Common mistakes to avoid

Even experienced tax filers can overlook critical details. Common mistakes include misreporting asset values, neglecting to include all eligible properties, or failure to provide accurate depreciation figures. Utilizing checklist methods can help ensure completeness.

Always double-check the information provided in each section before submission to minimize errors and misunderstandings.

Utilizing interactive tools for document management

pdfFiller offers significant advantages in managing your personal property tax form due to its cloud-based editing capabilities and electronic signing features. This aspect of pdfFiller ensures that users can collaborate easily—essential for teams managing shared assets.

Benefits of using pdfFiller for your tax filing

With pdfFiller, you can fill out forms interactively using straightforward tools tailored to your needs. Collaboration features allow multiple users to work on a single form, enhancing efficiency in document management.

Submitting your 2025 personal property tax form

Submission methods for the 2025 personal property tax form can vary by locality. Generally, you have the option of submitting online, mailing the completed form, or delivering it in person to your local tax office.

What to expect after submission

After submission, taxpayers should expect a confirmation message from their chosen method of submission. Checking the status of your filing can be essential, especially in busy periods leading up to tax deadlines. Most tax authorities will provide online portals to check your filing status.

Additional tips for effective document management

Storing your tax documents correctly is vital. Implementing best practices for both digital and physical storage ensures easy retrieval of your records during annual filings. Storing documents digitally on platforms like pdfFiller can offer an ongoing management solution that allows users to update documents efficiently.

Maintaining compliance for future tax years

To ensure compliance for future tax years, maintain an ongoing record of changes in your personal property. Being proactive about this can save you time and potential penalties during subsequent filings. Setting reminders to review your records annually contributes to better tax planning and preparation.

Frequently asked questions (FAQs)

Understanding common concerns about the 2025 personal property tax form can mitigate confusion. Many taxpayers are often unsure about deadlines, specific exemptions, or how to address discrepancies in assessments. Clear guidance can alleviate these worries and promote a smoother filing experience.

Resources for additional assistance

When in doubt, tax authorities provide resources for taxpayers facing complex situations. Local tax offices often offer guidance and can clarify specific forms and procedures relevant to your area.

About pdfFiller

pdfFiller is dedicated to empowering users by enhancing their document management experiences. Our mission is to provide seamless solutions for document creation, enabling users to edit PDFs, eSign, and manage their forms in a simple and efficient manner.

With features designed specifically for facilitating document management processes, pdfFiller ensures that users have the tools they need for successful tax season preparation. Testimonials from satisfied users highlight the benefits and ease of use that pdfFiller provides.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 2025 personal property tax from Google Drive?

How can I edit 2025 personal property tax on a smartphone?

Can I edit 2025 personal property tax on an Android device?

What is 2025 personal property tax?

Who is required to file 2025 personal property tax?

How to fill out 2025 personal property tax?

What is the purpose of 2025 personal property tax?

What information must be reported on 2025 personal property tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.