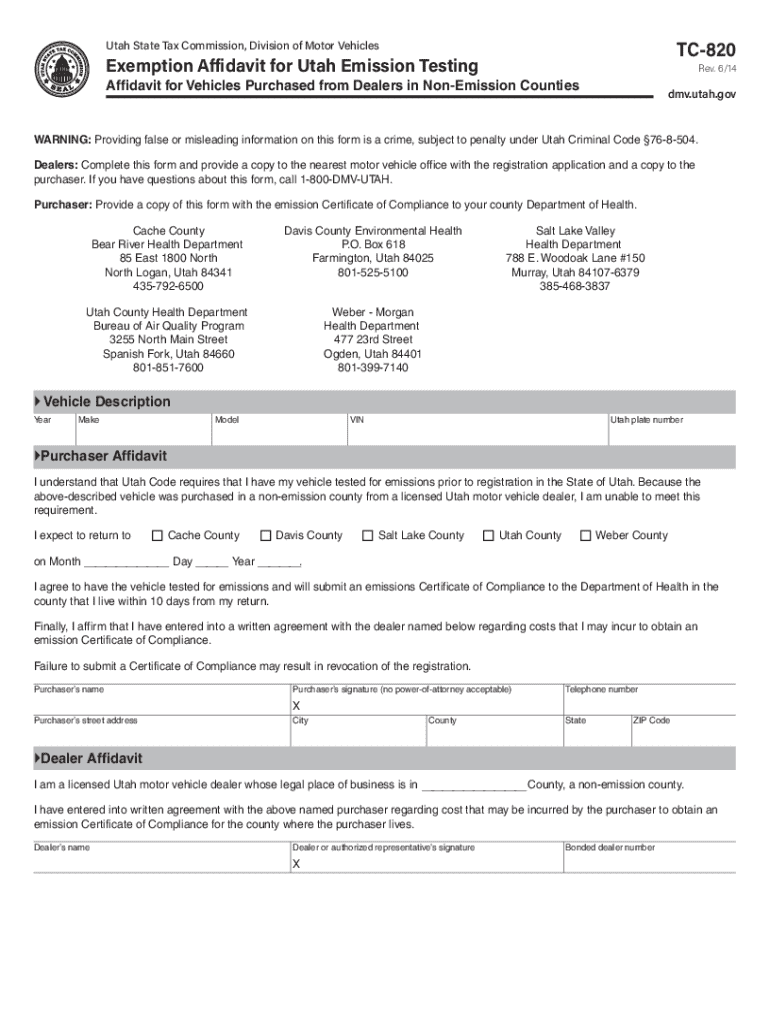

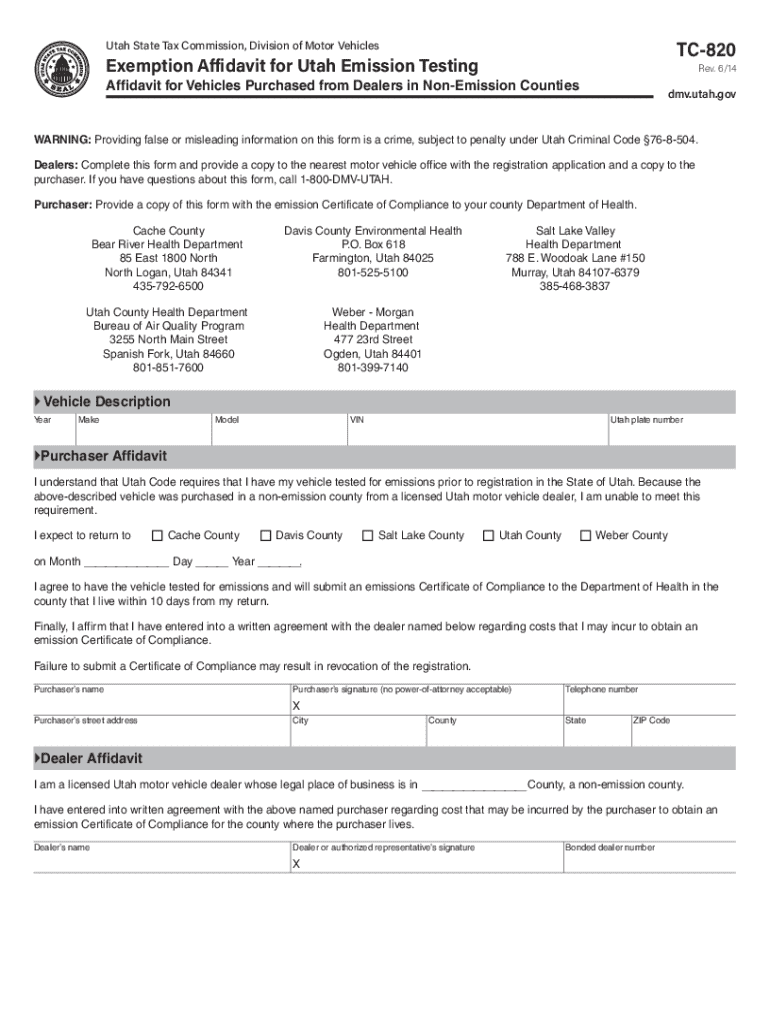

Get the free TC-820 Exemption Affidavit for Utah Emission Testing. Forms & Publications

Get, Create, Make and Sign tc-820 exemption affidavit for

How to edit tc-820 exemption affidavit for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tc-820 exemption affidavit for

How to fill out tc-820 exemption affidavit for

Who needs tc-820 exemption affidavit for?

Understanding the TC-820 Exemption Affidavit for Form

Understanding the TC-820 exemption affidavit

The TC-820 exemption affidavit is a crucial document used by individuals and organizations to claim tax exemptions for specific properties or vehicles. While the form may seem straightforward, its significance lies in facilitating the exemption process for eligible parties.

Tax exemptions can provide significant financial relief, reducing the burden of property taxes for homeowners and operational costs for non-profit organizations. As such, understanding the TC-820 form is essential for those looking to claim available tax benefits.

Who needs to use the TC-820 exemption affidavit?

Eligible parties for the TC-820 exemption affidavit typically include property owners and non-profit organizations. Homeowners may seek exemptions for their primary residence, while non-profit organizations can claim exemptions on properties used for charitable activities.

Situations necessitating the affidavit can vary widely. For instance, individuals may need to complete the TC-820 form when claiming tax exemptions on specific property types, such as residential homes or vehicles declared as collector items.

How to access the TC-820 exemption affidavit

Accessing the TC-820 exemption affidavit is straightforward. The form can typically be found on state taxation or revenue department websites. Users should ensure they are looking at the most current version of the form to prevent any issues during submission.

Step-by-step instructions for filling out the TC-820 exemption affidavit

Filling out the TC-820 exemption affidavit involves several essential steps. Begin by gathering all necessary documentation, including personal identification and property details. Properly compiled information reduces the risk of errors.

Gathering necessary documentation

Make sure to collect proof of ownership, tax identification numbers, and any other relevant documents such as prior tax exemption certificates or vehicle registration papers. This information lays the groundwork for a successful submission.

Completing the affidavit

As you fill out each section of the TC-820, pay attention to the instructions provided. Common pitfalls include incomplete sections or misreported information. Use a checklist to ensure you have filled each section accurately.

Finally, reviewing your completed form is paramount. Taking the time to double-check aligns your submission with state regulations, minimizing the likelihood of delays or rejections.

Submitting the TC-820 exemption affidavit

Once the TC-820 has been completed, the next step is submission. Applicants can streamline this process by selecting between electronic submission and mailing their affidavit. Each option has its pros and cons, so be sure to choose according to your needs.

Tracking the status of your TC-820 exemption affidavit

After submission, tracking the status of your TC-820 exemption affidavit is important. A simple phone call or online check can confirm whether your affidavit was received. Most state departments offer online portals for users to query their submission statuses.

It's crucial to understand the expected response timeframe from authorities. Should your application be denied, familiarize yourself with the appeal process, ensuring you can take appropriate steps to rectify any issues.

Maintaining your tax exemption over time

Securing a tax exemption is just the first step; ongoing responsibilities must also be addressed. After receiving your exemption, you may be required to provide annual updates or reports depending on state regulations.

Notable changes in property status, such as alterations or new ownership, should be reported promptly to maintain your exemption eligibility. Awareness of these responsibilities can prevent future complications.

Frequently asked questions about the TC-820 exemption affidavit

Common inquiries about the TC-820 exemption affidavit often arise. One frequent question is what happens if a mistake is made on the submitted form. Typically, applicants can submit an amended form or contact the tax department for corrections.

Benefits of using pdfFiller for your TC-820 exemption affidavit needs

Utilizing pdfFiller for your TC-820 exemption affidavit needs offers a seamless document editing and completion experience. With access to customizable templates, users can efficiently fill in the necessary details without worrying about formatting errors.

Additionally, pdfFiller provides collaborative tools that allow teams to work together in real time. The platform’s eSignature capabilities mean you can sign and share documents quickly and securely, enhancing your process efficiency.

Additional tips for a successful TC-820 exemption affidavit experience

For a successful TC-820 exemption affidavit experience, consider employing document management strategies such as organizing supporting materials digitally. A tidy, labeled file structure can save time when compiling necessary documents for submission.

Expert recommendations frequently suggest contacting tax experts or consultants when navigating complex situations or appealing a rejected affidavit. Their insights can illuminate potential pitfalls and streamline your overall tax management process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my tc-820 exemption affidavit for in Gmail?

How do I edit tc-820 exemption affidavit for straight from my smartphone?

Can I edit tc-820 exemption affidavit for on an iOS device?

What is tc-820 exemption affidavit for?

Who is required to file tc-820 exemption affidavit for?

How to fill out tc-820 exemption affidavit for?

What is the purpose of tc-820 exemption affidavit for?

What information must be reported on tc-820 exemption affidavit for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.