Maine Non-Bank ATM Renewal Form: A Comprehensive Guide

Understanding non-bank ATMs in Maine

Non-bank ATMs, or Automatic Teller Machines that are not affiliated with a traditional bank, play a significant role in Maine's financial ecosystem. These machines offer essential services, allowing users to withdraw cash, check balances, and make deposits without needing to interact with a bank teller. Their presence is especially vital in rural areas of Maine where traditional banking services might be limited.

The importance of non-bank ATMs in Maine extends beyond mere convenience; they significantly enhance financial accessibility for various communities. With approximately 215,000 individuals living in Maine's rural areas, having easy access to cash is crucial for everyday transactions. Operators of these non-bank ATMs contribute to local economies by providing essential banking services where traditional institutions may not.

Advantages of using non-bank ATMs

The advantages of using non-bank ATMs are numerous. For starters, accessibility is a prime benefit. With ATMs situated in various locations such as convenience stores, retail outlets, and gas stations, users enjoy the ease of accessing their funds without needing to travel to a bank branch. Moreover, these machines often operate 24/7, providing ultimate convenience for users.

Another key advantage lies in cost efficiency. Many non-bank ATMs charge lower fees compared to traditional banking institutions, making them an attractive option for users. This pricing structure not only saves the individual more money but encourages the continued use of these machines. Overall, non-bank ATMs offer a flexible, user-friendly alternative, enhancing financial inclusion across the state.

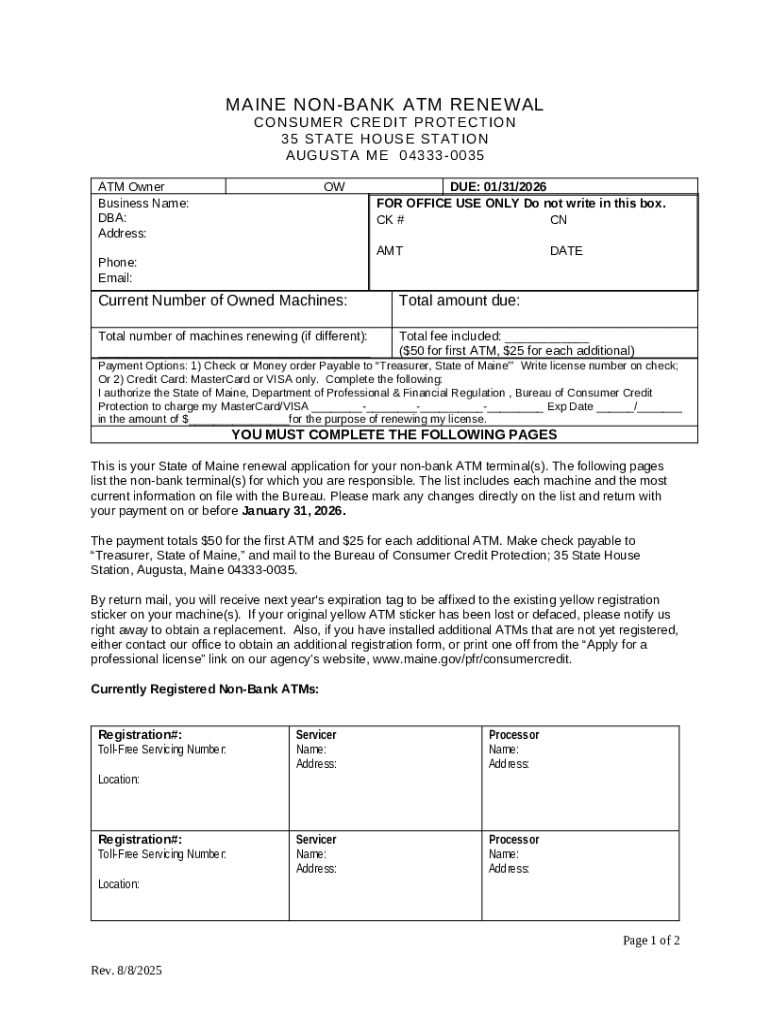

Renewal process for non-bank ATM registration

The renewal of non-bank ATM registration is a critical process for operators to keep their machines compliant with state regulations. The renewal requirements include a review of operational standards and ensuring financial practices meet the prevailing laws established under Maine statutes. This procedure guarantees that your business remains in good standing with regulatory bodies and avoids potential legal issues.

Key documents required for renewal often include proof of previous registration, operational compliance reports, and updated registration fees. The timeframe for submitting renewal applications can vary; however, it's best practice to submit the application well before the current registration expires—generally at least 30 days prior—to ensure a smooth renewal process.

Who must renew?

All entities operating non-bank ATMs, including businesses, organizations, and individual operators, are required to renew their registration periodically. Storeowners looking to install additional machines must also adhere to these renewal requirements to ensure compliance with licensing regulations. Non-compliance could lead to penalties that might hinder business operations, making timely renewal vital for growth.

Step-by-step guide to completing the Maine non-bank ATM renewal form

Completing the Maine non-bank ATM renewal form requires careful attention to detail. The following steps outline a methodical approach to ensure compliance and successful submission.

Gathering Required Documentation: Collect all necessary documents, including previous registration, operational records, and payment information.

Filling Out the Form: Accurately complete each section of the renewal form, paying close attention to ensure all required information is provided.

Reviewing Your Application: Before submission, double-check your information for accuracy and completeness to avoid delays.

Submitting the Form: Choose your preferred method for submission—online or via traditional mail—and ensure you receive confirmation of receipt.

This step-by-step approach minimizes errors and accelerates the renewal process, ensuring that your machines remain operational and compliant with the law.

Editing and signing the Maine non-bank ATM renewal form

Utilizing tools like pdfFiller provides significant advantages in managing your Maine non-bank ATM renewal form. With pdfFiller, users can easily edit their PDF documents, making it straightforward to update any information that might change over time. Its integrated features allow users to modify the renewal form without hassle, streamlining the overall application process.

To efficiently use pdfFiller, operators can upload their forms directly onto the platform and make necessary modifications such as filling out missing sections or correcting errors. Once editing is complete, users can leverage pdfFiller’s electronic signing capabilities. This allows users to eSign the renewal form directly within the platform, providing a legal and convenient alternative to traditional signing methods.

It is important to note that electronic signatures are legally valid in Maine, making pdfFiller an efficient option for busy operators. This streamlining of the signing process not only saves time but also ensures documents are handled swiftly, allowing operators to focus on their core business operations.

Common issues and troubleshooting

During the renewal process for non-bank ATM registration, operators may encounter several common issues. A prevalent problem is missing information on the application, which can lead to delays or rejections. To avoid this, ensure that every field on the renewal form is completed accurately and that all necessary documentation is attached before submission.

Another common issue is submitting incomplete forms. Failing to update certain sections such as business addresses or operational changes can result in rejection of the application. Should this occur, operators are encouraged to reach out for assistance. Resources are available, including support hotlines and online forums, which provide additional guidance and trouble-shooting options for operators seeking to resolve their issues efficiently.

Maintaining compliance after renewal

Once the Maine non-bank ATM renewal form is approved, operators must understand their ongoing obligations to remain compliant with state laws. This includes maintaining accurate records of transactions and adhering to reporting obligations. Regular audits of operational practices should also be conducted to ensure continuous compliance. By keeping accurate logs and reports, operators can avoid potential legal ramifications.

Best practices for operating non-bank ATMs focus on transparency and ethical conduct. Operators should consistently review state regulations regarding fees, withdrawals, and general operations. Conducting regular training for team members regarding compliance factors can also minimize risks associated with non-compliance. Ultimately, timely renewals and adherence to regulations positively affect your business standing and promote a safer financial environment.

Interactive tools & resources

pdfFiller offers a range of interactive tools integrated within its platform to assist users with managing their Maine non-bank ATM renewal forms effectively. The system includes document templates specific to non-bank ATMs, which can expedite the preparation process for operators. Utilizing interactive, step-by-step guides allows users to navigate complex forms seamlessly, reducing the time and effort typically required.

For those seeking additional learning resources, the platform provides links to state regulatory websites and downloadable content that users can easily access. Such resources ensure that operators remain knowledgeable about state laws and procedures, further supporting their compliance efforts and operational success.

Frequently asked questions (FAQs)

Common queries surrounding the renewal process arise frequently among operators. One common question is, 'How often must I renew my registration?' In Maine, non-bank ATM registrations must typically be renewed annually. Staying aware of renewal timelines is essential to avoid lapses in registration that could affect machine operation.

Another prevalent concern is, 'What happens if my application is rejected?' In such cases, operators should promptly review the feedback provided, make necessary corrections, and resubmit the application. Addressing issues quickly and thoroughly is crucial for maintaining uninterrupted ATM service. Additionally, many operators inquire about the feasibility of operating multiple non-bank ATMs; yes, one can operate several machines, but each must be registered and renewed separately.