Get the free resolution for deposit account

Get, Create, Make and Sign resolution for deposit account

How to edit resolution for deposit account online

Uncompromising security for your PDF editing and eSignature needs

How to fill out resolution for deposit account

How to fill out resolution for deposit account

Who needs resolution for deposit account?

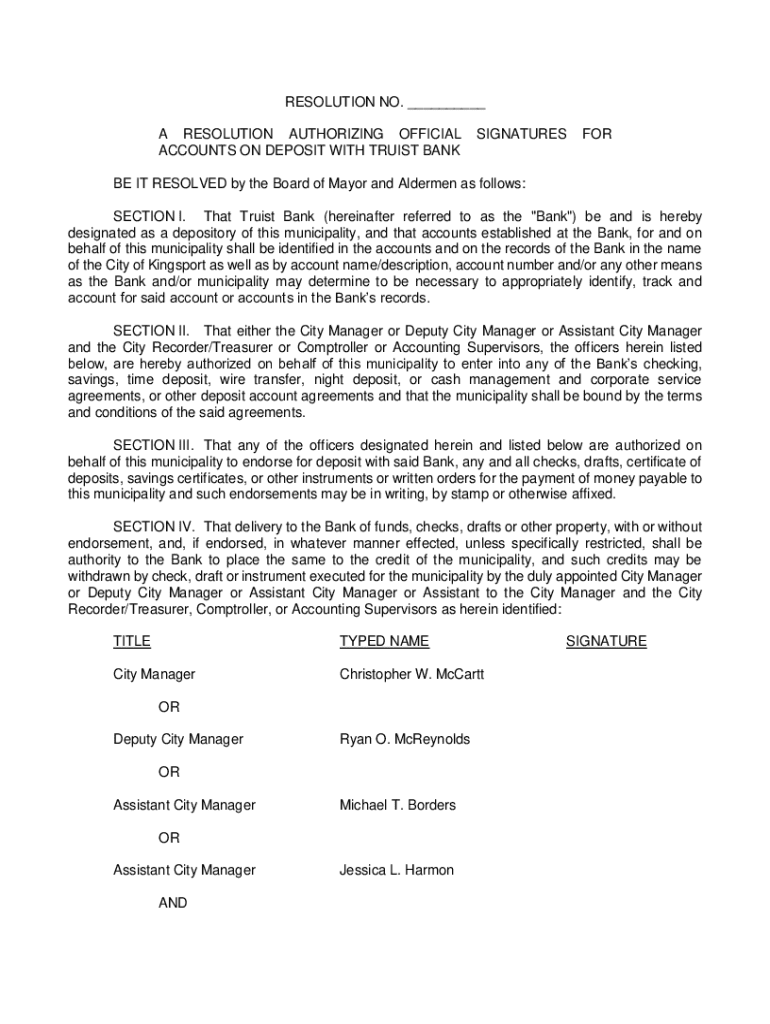

Understanding and Creating a Resolution for Deposit Account Form

Understanding deposit accounts and resolutions

A deposit account is a type of account maintained by a financial institution that allows individuals or businesses to deposit funds for safekeeping. These accounts can take various forms, such as checking accounts, savings accounts, or certificates of deposit, each serving unique purposes.

In the banking realm, a resolution for a deposit account serves as an official document that outlines the terms and conditions under which an account is established and managed. Resolutions are critical because they authorize institutions to act on behalf of the account holder, mandating who can manage account activities, much like a roadmap detailing the journey.

The importance of resolutions cannot be overstated; they protect both the institution and account holders. By clearly identifying authorized signatories and specifying how funds can be accessed, resolutions help mitigate risks associated with unauthorized transactions and ensure compliance with internal and external regulations.

Key components of a resolution for deposit account

Creating a resolution for a deposit account involves including several key components that must be accurately documented. The first necessary piece of information is the name of the institution, which identifies where the account will be held.

Next, the account type and purpose must be specified. Identifying whether it is a savings, checking, or business account is vital, as this influences its operational policies. Furthermore, detailing the account signatories and their authority is critical to clarifying who has the right to make decisions regarding the account.

A well-structured banking resolution also requires legal and compliance considerations. Ensuring that all parties adhere to the necessary regulations enhances the document’s validity.

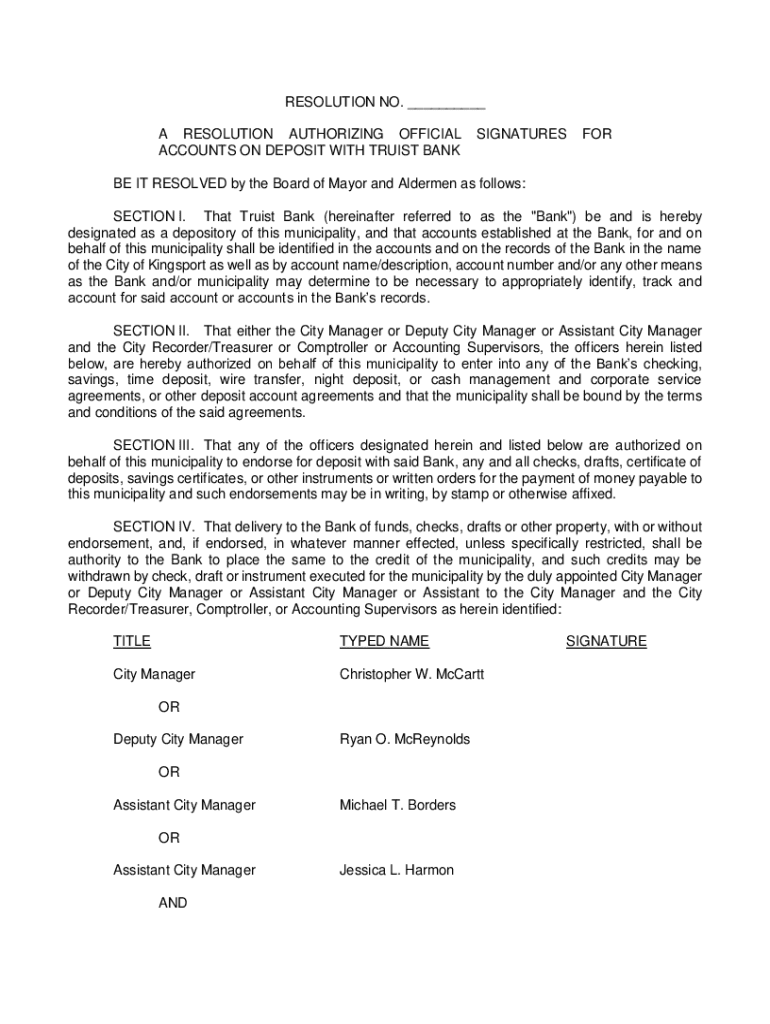

Steps to create a resolution for deposit account

Creating a compelling resolution for your deposit account involves a series of structured steps that ensure all critical aspects are attended to meticulously. The journey begins with identifying your needs.

This necessitates understanding the various types of deposit accounts available and determining the necessity of a resolution. Recognizing whether you require access for multiple stakeholders or if a singular authority suffices can shape the outcome of your resolution.

Next, gather all required information. Collect documentation reflecting legal structures, such as organizational charters if applicable, and designate authorized signatories—these are individuals who will manage the account and make critical decisions regarding its operations.

Drafting the resolution can take different forms; utilize a template that suits your organizational needs, including provisions for both routine and extraordinary transactions. Sample phrasing can range from simple declarations of authority to more detailed operational guidelines.

Once the resolution is drafted, it needs to go through an approval process. Depending on your organization’s governance structure, a voting procedure may be required for board approval, followed by collecting the necessary signatures.

Subsequently, you’ll need to submit the resolution to the bank. Presenting it clearly and concisely can minimize follow-up questions. After submission, ensure to follow up with the institution to confirm acceptance and clarify any outstanding concerns.

Frequently asked questions about deposit account resolutions

As you navigate the world of deposit account resolutions, several common queries can arise. One prevalent question is whether banks require a formal resolution for deposit accounts. Typically, while not universally mandated, many banks do require this for accounts involving multiple signatories or significant transactions.

Another query pertains to the consequences of not submitting a resolution. Without one, transactions may be delayed or denied, leading to operational inefficiencies. Additionally, many users wonder if a resolution can be revised or amended. The answer is yes; modifying the document is possible as long as changes are documented and formally approved.

Managing multiple signatories can pose its own challenges. Clear communication and documentation in the resolution are vital to avoid disputes over authority. Finally, specific templates exist for different types of accounts, offering tailored guidance suited to various banking needs.

Interactive tools for creating your resolution

Leveraging technology can significantly streamline the resolution creation process. With pdfFiller, users gain access to exceptional document creation features that simplify the entire experience. Interactive guides help you fill out forms in real-time, offering step-by-step assistance to ensure accuracy.

Collaboration tools within pdfFiller allow teams to share and edit resolutions in real-time. Each member can contribute, ensuring that everyone involved is on the same page regarding account management and authority—this fosters greater transparency and accuracy in multi-signatory situations.

Troubleshooting common issues

Even with careful preparation, drafting a resolution for deposit accounts can lead to complications. Common mistakes, such as omitted information or incorrect signatory details, can result in processing delays. Therefore, meticulously reviewing your resolution before submission can prevent these issues.

Addressing roadblocks during bank processing can be challenging; proactive communication is essential. If the bank requests additional documentation or clarification, respond promptly to keep the process moving forward. Additionally, consider tips for streamlining the approval process within your organization to alleviate bottlenecks.

Best practices for managing deposit account resolutions

After creating and submitting your resolution, it’s prudent to regularly review and update it. Account needs may evolve, and ensuring that your resolution reflects current operational realities is crucial for compliance and efficiency.

Storing resolutions securely is just as important. Utilizing tools offered by pdfFiller allows you to manage and store all document versions safely in a cloud-based environment, providing easy access for authorized personnel. Moreover, adopting collaborative approaches for resolutions with multiple stakeholders enhances participation and accountability.

Conclusion: maximizing efficiency with pdfFiller

Empowering your team to manage resolutions smoothly is achievable with pdfFiller. Its user-friendly platform streamlines the process of creating, editing, signing, and managing document resolutions, ensuring that all members can contribute effectively.

The benefits of adopting a cloud-based document management system extend beyond mere convenience; they enhance collaboration, increase accuracy, and promote compliance. With pdfFiller, your organization can navigate the complexities of deposit account management with confidence and efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute resolution for deposit account online?

How do I complete resolution for deposit account on an iOS device?

How do I fill out resolution for deposit account on an Android device?

What is resolution for deposit account?

Who is required to file resolution for deposit account?

How to fill out resolution for deposit account?

What is the purpose of resolution for deposit account?

What information must be reported on resolution for deposit account?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.