Get the free Contact Advantage Tax & Financial ServicesHighland, MI

Get, Create, Make and Sign contact advantage tax amp

Editing contact advantage tax amp online

Uncompromising security for your PDF editing and eSignature needs

How to fill out contact advantage tax amp

How to fill out contact advantage tax amp

Who needs contact advantage tax amp?

Contact Advantage Tax AMP Form - How-to Guide

Understanding the Contact Advantage Tax AMP Form

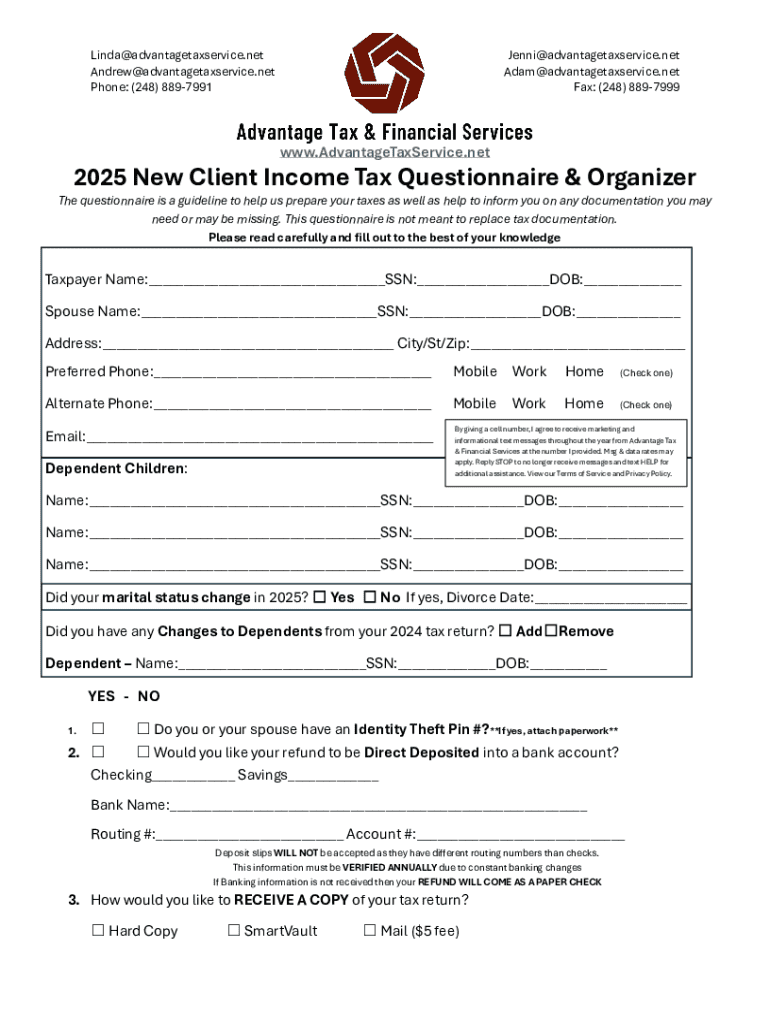

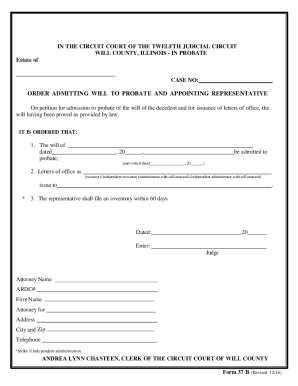

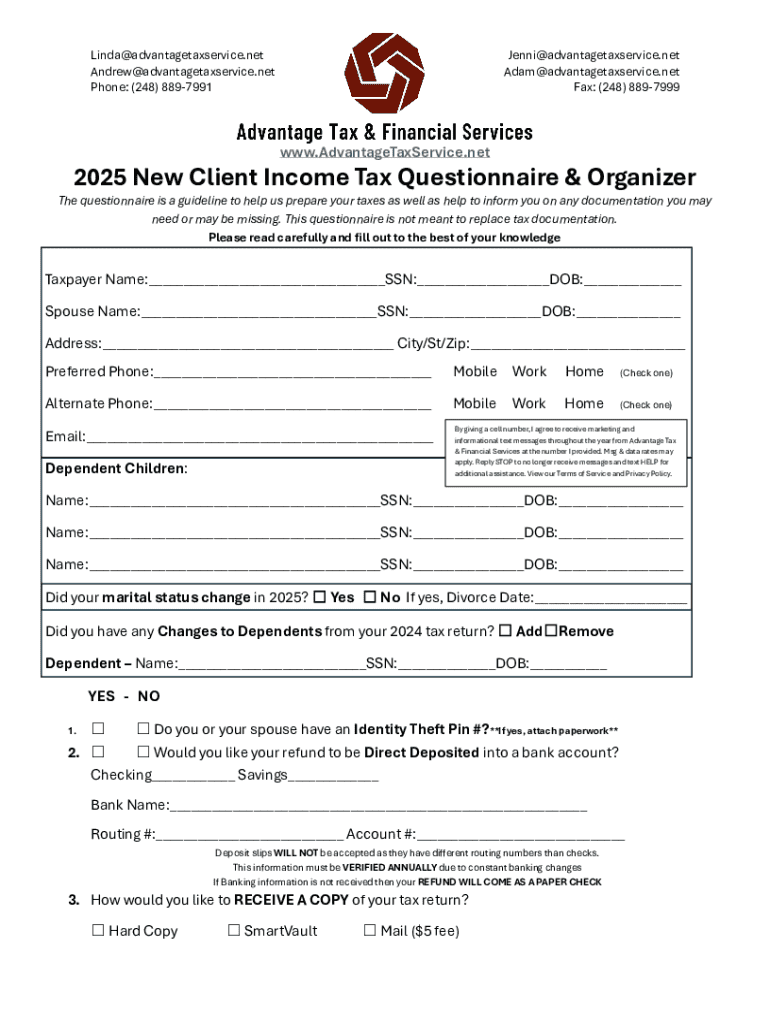

The Contact Advantage Tax AMP Form is a crucial document used for various tax purposes within the United States. This form allows individuals to report essential information to the IRS, ensuring compliance with federal tax laws. Its primary purpose is to collect data that may need further assessment for taxation, deductions, and credits. Accurate submission can significantly affect your tax obligations, potentially leading to benefits such as refunds, mitigated penalties, or avoidance of audits.

Using the Contact Advantage Tax AMP Form is vital for anyone looking to maximize their tax efficiency. By leveraging this tool, taxpayers can communicate key data about their financial circumstances, which can potentially simplify their tax filing experience and enhance clarity for tax professionals.

Eligibility and requirements

Understanding who should use the Contact Advantage Tax AMP Form will ensure that individuals and businesses do not overlook crucial tax responsibilities. Typically, this form is designed for both individuals and businesses that have specific tax reporting needs, such as those claiming deductions or credits. You should consult with a tax professional if you are unsure whether your situation demands this form.

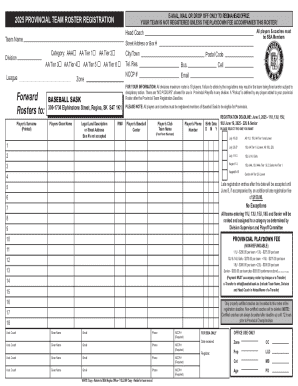

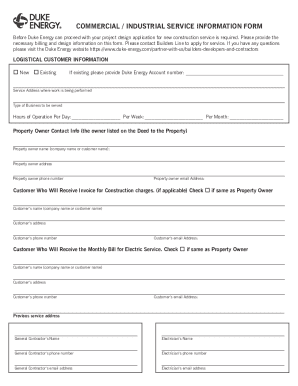

Before starting the form, gather necessary documentation. Essential documents typically include tax returns from the previous year, income statements, and documentation supporting any deductions or credits you intend to claim. Having accurate and comprehensive information ready significantly speeds up the process and reduces errors.

Accessing the Contact Advantage Tax AMP Form

Accessing the Contact Advantage Tax AMP Form is seamless through the pdfFiller platform. To locate the form, simply follow these steps: First, visit the pdfFiller website and log in to your account. Next, navigate to the search bar, where you can input 'Contact Advantage Tax AMP Form.' You can also browse through the categories related to tax forms if you're looking for additional resources.

Once you’ve found the form, you have the option to fill it out online or download a paper version. The online format allows for easier editing, signature application, and submission, which is more convenient in today’s fast-paced environment.

Online options vs. paper format

Digital convenience is a significant advantage of using pdfFiller for the Contact Advantage Tax AMP Form. Online forms allow for instant editing, correction of mistakes, and direct submission to relevant authorities. Conversely, opting for paper forms requires printing, filling in manually, and mailing to the appropriate addresses, which can delay processing.

By choosing the pdfFiller online platform, you not only save time but also reduce the risk of data entry errors associated with paper-based forms.

Filling out the Contact Advantage Tax AMP Form

Filling out the Contact Advantage Tax AMP Form can appear daunting, but understanding its structure will alleviate many concerns. This form typically comprises multiple sections, including personal identification information, financial data, and relevant tax information. Start by carefully entering your name, address, and contact information—inaccurate personal details could lead to serious issues later.

From there, you will proceed to disclose your financial information, detailing income, deductions, and any credits you wish to claim. Each section needs to be completed with precision to prevent audits or penalties. Consider methods such as keeping careful notes or consulting with a tax professional as a way to reinforce the accuracy of your information.

Common mistakes to avoid

Editing and customizing your form on pdfFiller

One of the most powerful features of pdfFiller is its comprehensive editing tools. Once you've accessed the Contact Advantage Tax AMP Form, you can easily modify any field, including text or images. This is particularly beneficial if you need to correct any mistakes quickly or wish to provide additional context through notes and annotations.

Editing features allow you to add or remove fields, ensuring that all necessary information is included. When making changes, utilize pdfFiller’s intuitive interface, which makes the process straightforward even for those not technologically inclined. Remember, the more tailored your form is to your specific needs, the more accurate your submission will be.

Benefits of customization

Customizing your Contact Advantage Tax AMP Form can significantly enhance its functionality. Personalizing the form according to your unique financial circumstances not only improves the accuracy of your information, but also ensures you include all necessary details that could affect your tax outcome. A well-tailored form allows you to convey precisely what is required to tax authorities, substantially minimizing back-and-forth issues.

eSigning the Contact Advantage Tax AMP Form

Once your Contact Advantage Tax AMP Form is filled out, the next critical step is to sign it. Using pdfFiller’s eSignature features provides a secure and convenient way to authenticate your document digitally. To add your signature, navigate to the signature field and follow the prompts to draw, type, or upload your signature.

Legally, electronically signing your form is equivalent to signing it in person, granting you the same protections and obligations. This modern method is not only efficient but also helps maintain the integrity of your submission.

Collaborating with teams on the tax form

For those who need to involve team members, pdfFiller supports real-time collaboration. Sharing your Contact Advantage Tax AMP Form is easy—you just have to invite your colleagues to review or edit the document. This feature is especially helpful for tax professionals or business owners who require input from their teams on complex tax matters.

Collaboration tools also allow users to track changes and comments effectively. As team members make edits, you can see who contributed what, making it easier to consolidate feedback and ensure everyone’s input is considered before submission.

Submitting the Contact Advantage Tax AMP Form

After completing and signing your Contact Advantage Tax AMP Form, knowing how to submit it is key. Detailed submission guidelines vary depending on the specific requirements set forth by the IRS or state tax agencies. Generally, forms can be submitted online, mailed, or faxed based on what your situation requires.

Always check for the most current deadlines and important dates surrounding the submission process to ensure that you remain compliant with tax regulations. Late submissions can lead to penalties, so being aware of these timelines is crucial.

Managing your documents post-submission

Once your Contact Advantage Tax AMP Form is submitted, managing the documentation is equally as important. Within pdfFiller, you can organize your forms using folders and tags which makes retrieving completed forms effortless.

Furthermore, pdfFiller’s management tools enable you to track submitted documents, set reminders for follow-up actions, and easily access historical forms whenever you need them. This streamlined document management can significantly alleviate the stress of staying organized during tax season and beyond.

Troubleshooting common issues

Encountering difficulties while filling out the Form should not deter you. Many questions arise, especially regarding what specific information is needed or how certain terms are defined. One common concern is about what to do if you realize a mistake has been made after the form is submitted.

To find solutions for your concerns, pdfFiller has a dedicated support section where you can find FAQs specifically about the Contact Advantage Tax AMP Form. If you can't find the answer you’re looking for, it’s straightforward to contact pdfFiller’s customer support for immediate assistance.

Staying informed about tax changes

Tax laws can fluctuate annually, impacting how you fill out forms like the Contact Advantage Tax AMP Form. It's critical to keep yourself educated about the latest rules and regulations that might affect your financial obligations. Use reputable resources such as the IRS website, tax professional blogs, or financial news outlets to stay up to date.

Being proactive in learning about tax changes ensures that you are prepared for tax season, helping you avoid last-minute scrambles and possible penalties for non-compliance. Continuous education can lead to better financial decisions, optimizing your tax strategy effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send contact advantage tax amp for eSignature?

How do I fill out the contact advantage tax amp form on my smartphone?

How do I edit contact advantage tax amp on an iOS device?

What is contact advantage tax amp?

Who is required to file contact advantage tax amp?

How to fill out contact advantage tax amp?

What is the purpose of contact advantage tax amp?

What information must be reported on contact advantage tax amp?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.