Comprehensive Guide to Indemnity Bond for Form

Understanding the indemnity bond

A VII indemnity bond is a legal agreement that provides a guarantee against future claims and liabilities. It is essentially a protective measure that allows entities to safeguard themselves economically. The bond acts as a security for specific obligations, ensuring that the parties involved remain compliant with various requirements. This type of bond plays a crucial role in fields such as construction, finance, and real estate.

Understanding the importance of the VII indemnity bond is critical, especially for those engaged in contractual agreements or projects that involve substantial assets. By securing an indemnity bond, parties can mitigate risks associated with unforeseen events. The legal implications of signing this bond involve a commitment to indemnify the obligee for any losses incurred, making it essential to read and comprehend the terms before signing.

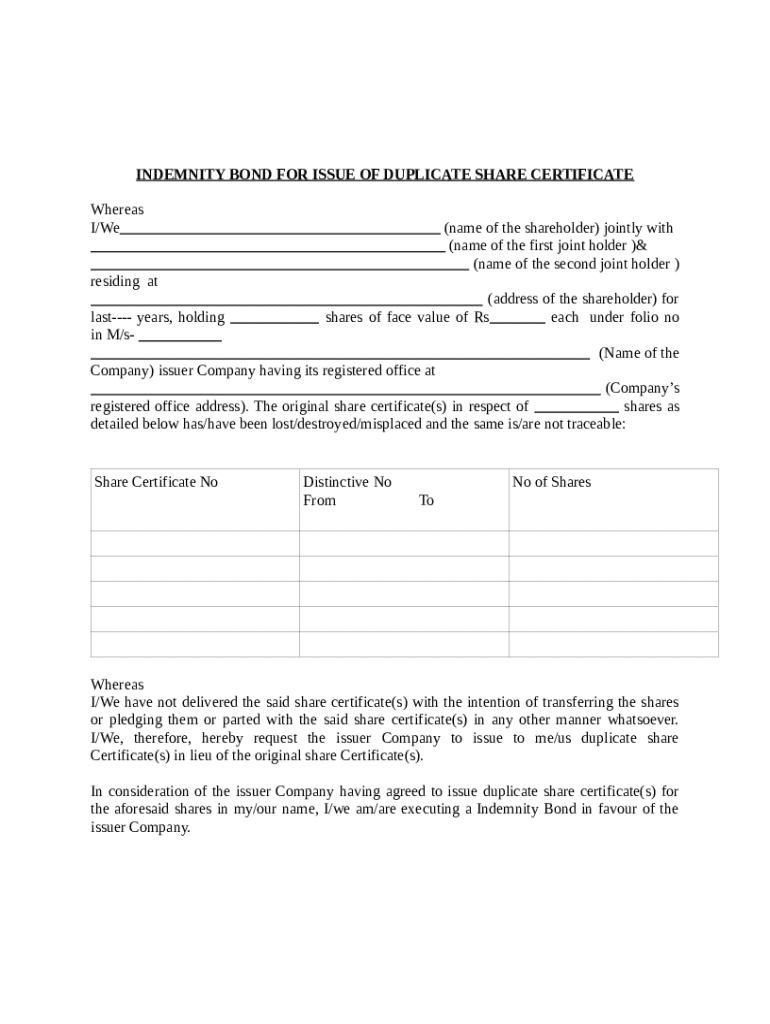

Key components of the indemnity bond form

When you approach the VII indemnity bond form, knowing the key components is essential for effective completion. Firstly, the form requires detailed information about the bonded entity, which is the person or business providing the bond. Secondly, it requires input about the obligee, the party who gains protection through the bond. Lastly, a comprehensive description of the obligation tied to the bond is crucial, outlining what the bond secures.

Details of the bonded entity, including name, address, and identification.

Information about the obligee, stating their entitlement under the bond.

A clear description of the obligation, detailing the conditions and purpose of securing the bond.

Moreover, the signatures on the form represent the roles and responsibilities of all parties involved. It is also necessary to accompany the bond with supporting documents, which may include identification and financial statements to establish credibility.

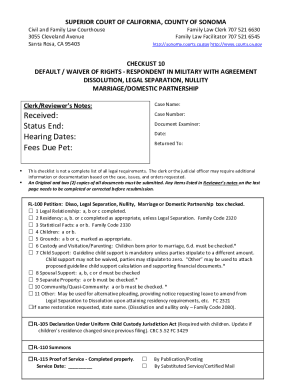

Step-by-step guide to completing the indemnity bond form

Completing the VII indemnity bond form can be daunting, but following a systematic approach can simplify the process. Begin by gathering all necessary information and documents. This includes verifying identifications for all signers and ensuring you have the authorization to act on behalf of your organization.

Collect all required documents such as ID, financial documents, and authorization letters.

Ensure that each section is filled out completely to avoid processing delays. Common mistakes include inputting incorrect names or missing required fields.

Before submission, review all entries for accuracy. Utilize a checklist to ensure completeness.

Following these steps diligently ensures that you minimize errors and increases the chances of a smooth approval process.

Editing and customizing your indemnity bond

The ability to edit and customize your VII indemnity bond form is crucial for many users. By utilizing resources like pdfFiller, you can make changes with ease. Whether you need to adjust specific clauses to better reflect your situation or add custom modifications, pdfFiller provides tools that allow for efficient editing.

Access a variety of editing tools that let you modify text, insert signatures, and adjust formatting.

Customize the bond by entering clauses that reflect the specific needs of your transaction.

Invite team members to collaborate directly on the document, streamlining group input and reducing errors.

This flexibility ensures that the completed form accurately represents the intentions of the parties involved.

Signing the indemnity bond

Signing the VII indemnity bond is a pivotal step in its execution. Understanding the various signing methods is essential for compliance. The eSignature process is becoming increasingly popular and is valid legally in many jurisdictions, which increases efficiency. Depending on your preferences, you can choose between digital signatures for speedy processing or traditional signatures for a more conventional approach.

Learn how eSignatures work and their validity in your region.

Evaluate whether a digital or traditional signature suits your business needs better.

Research your local regulations to ensure that whichever signing method you choose is legally binding.

Taking the time to consider your signing options can make a significant difference in ensuring the document meets all legal standards.

Managing and storing your completed indemnity bond

Effective document management is vital after completing the VII indemnity bond. Establishing best practices for document storage can help maintain organization. Utilizing cloud-based solutions like pdfFiller offers immense benefits, such as easy access and enhanced security. Cloud storage provides several advantages, such as being able to access your documents from anywhere, and sharing them securely with relevant stakeholders.

Keep your documents organized by creating descriptive folders and maintain a proper naming convention.

Consider using pdfFiller for reliable and secure document management.

Use pdfFiller's sharing options to control who can access your document and to track changes.

Managing your VII indemnity bond with effective storage solutions not only enhances accessibility but also ensures its safety from unauthorized access.

Troubleshooting common issues with the indemnity bond form

Filling out the VII indemnity bond form can present challenges, leading users to common mistakes like missing information or inaccurate details. Several frequent issues arise during form submission that can cause delays. This segment addresses these potential problems.

Review common queries related to the VII indemnity bond form for better clarity.

Identify frequent mistakes and respective solutions during submission.

Access support through pdfFiller for assistance if problems persist.

Staying informed about potential issues will enable users to navigate the form with greater confidence.

Case studies: real-world applications of the indemnity bond

Examining real-world cases where the VII indemnity bond has played a significant role can provide practical insights. For instance, businesses in industries like construction often use these bonds to guarantee project completion and payment of materials. Similarly, individuals may require indemnity bonds for transactions that involve large sums, such as real estate deals.

Analyze how businesses utilize VII indemnity bonds to protect themselves from unforeseen losses.

Explore cases where individuals need indemnity bonds for personal transactions, ensuring protection against financial liabilities.

Understanding these scenarios highlights how versatile the VII indemnity bond can be across different sectors.

Regulatory considerations surrounding indemnity bonds

The landscape of indemnity bonds is influenced by various regulatory frameworks that govern their use. It’s important to be aware of the legal requirements for indemnity bonds, as these can vary by jurisdiction. Being knowledgeable about recent updates in legislation can play an instrumental role in ensuring compliance. Non-compliance with these regulations can lead to severe ramifications, including financial penalties.

Understand the regulations and standards applicable to indemnity bonds in your area.

Stay informed about changes in indemnity bond legislation, as they can affect your obligations.

Recognize the consequences of failing to adhere to indemnity bond regulations.

Being proactive about these considerations ensures that your bond remains valid and effective.

Maximizing efficiency in document management with pdfFiller

pdfFiller uniquely positions itself as an essential tool for managing your VII indemnity bond. With features tailored specifically to meet the complexities of bond documentation, it allows users to seamlessly edit PDFs, eSign, collaborate, and manage documents from a single, cloud-based platform. Utilization of pdfFiller’s technology can greatly enhance workflow efficiency by integrating document management directly into your operations.

Explore functionality such as secure editing tools, user-friendly eSignature options, and collaborative features.

Tie document management processes seamlessly into your workflow for improved efficiency.

Take advantage of pdfFiller’s encryption and security features to protect your documents.

Ultimately, leveraging pdfFiller can transform the way you handle indemnity bonds, ensuring that every aspect of the process is streamlined, secure, and efficient.