Get the free ATM Plus Dispute Form

Get, Create, Make and Sign atm plus dispute form

Editing atm plus dispute form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out atm plus dispute form

How to fill out atm plus dispute form

Who needs atm plus dispute form?

Understanding the ATM Plus Dispute Form: A Comprehensive Guide

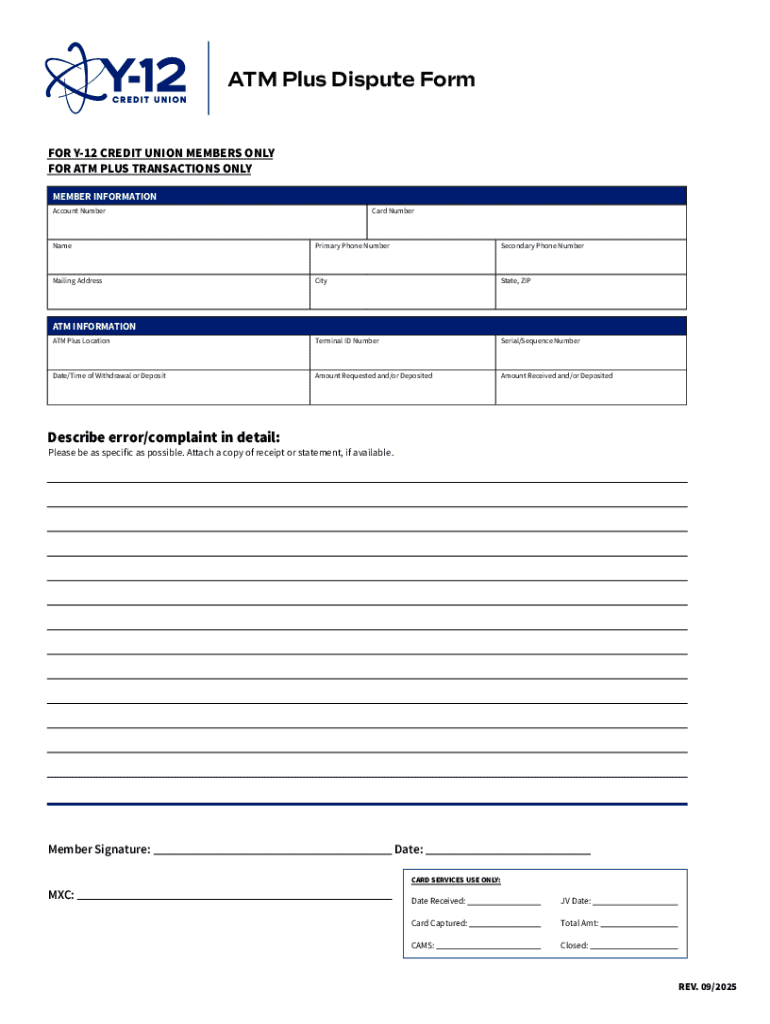

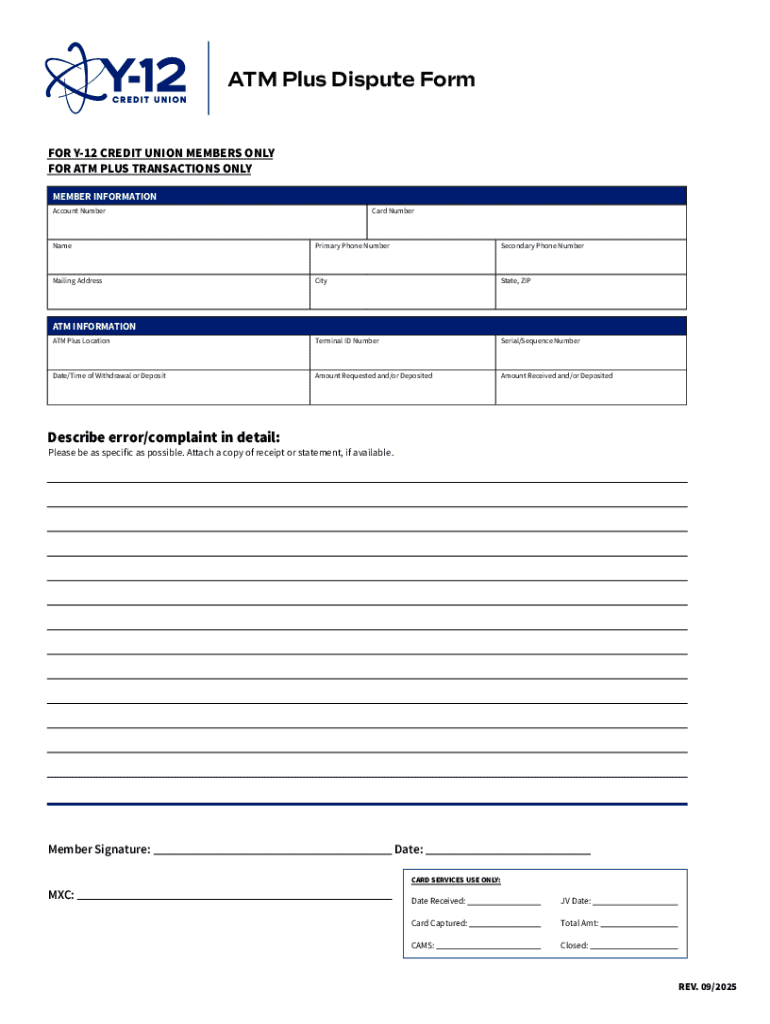

Understanding the ATM Plus Dispute Form

ATM transactions play a pivotal role in daily banking, allowing users to access funds and conduct various financial activities efficiently. However, despite these conveniences, discrepancies and errors can occur. Whether it's an incorrect charge, a card retention incident, or issues stemming from automatic payments, the importance of resolving disputes cannot be overstated.

The ATM Plus Dispute Form serves as a critical tool in addressing these discrepancies. Designed specifically for reporting disputes related to ATM transactions, this form allows users to systematically present their cases, ensuring that financial institutions can effectively investigate and resolve the issues at hand.

Preparing to complete the ATM Plus Dispute Form

Before filling out the ATM Plus Dispute Form, it’s essential to gather all necessary information. This includes your transaction records, such as receipts or bank statements, which substantiate your claim. Additionally, personal identification details, such as the account holder’s information, are vital for the banking institution to verify your identity and process the dispute effectively.

Common reasons for disputes often involve inaccurate charges, double transactions, instances where the ATM retained the card, or even phishing incidents that may have compromised a user's account. Understanding these potential issues will guide you in crafting a clearer narrative when completing your form.

Step-by-step instructions for filling out the ATM Plus Dispute Form

Successfully completing the ATM Plus Dispute Form requires attention to detail. The first section typically revolves around entering personal information such as your full name, contact details, and account number. Providing accurate information in this section ensures that the financial institution can easily reach you for follow-up or clarification.

Next is the transaction details section where you’ll report specifics such as the date of the transaction, the amount involved, and the location of the ATM. Be diligent; any inaccuracies here can delay resolution.

The issue description section is perhaps the most crucial. This is where you can effectively communicate the specifics of your dispute. Clarity and conciseness are essential, as the goal is to provide the institution with enough context to understand your situation. Remember, avoiding vague descriptions can significantly aid in expediting the investigation.

Editing and customizing the ATM Plus Dispute Form

Utilizing pdfFiller’s platform can significantly simplify the process of filling out and editing the ATM Plus Dispute Form. First, access the form directly on pdfFiller’s site. Here, the user-friendly interface allows for smooth navigation and quick modifications. Whether you need to correct a mistake or add additional remarks, the editing tools offered are intuitive.

Adding annotations and comments further enhances communication clarity. Utilize tools such as highlight, strike-through, or comment boxes to better explain your point or emphasize critical details. These enhancements can make your submission more informative and persuasive.

Signing and submitting the ATM Plus Dispute Form

Once you’ve filled out and reviewed your ATM Plus Dispute Form, the next step is signing it. pdfFiller provides diverse electronic signature options, which comply with legal standards. Understanding eSigning is vital, as it streamlines the submission process, allowing you to sign documents securely from anywhere.

When it comes to submission, there are generally two main methods: direct submission via your bank’s online portal or print and mail options. If you choose the latter, ensure you send it to the correct address and consider using certified mail for tracking purposes.

Tracking your dispute progress

After submitting your ATM Plus Dispute Form, it's crucial to track your dispute's progress actively. It's advisable to wait approximately a week before following up with your bank. By this point, the institution should have initiated the investigation process. Contacting customer support can provide you with updates and an estimated timeline for resolution.

Expect the bank to follow a defined procedure once your dispute is lodged. Typically, this includes a thorough investigation and may require further documentation or clarification from your side. Being proactive and cooperative during this period will often lead to a smoother resolution.

FAQs about the ATM Plus Dispute Form

Frequently asked questions often revolve around the duration of the dispute process and whether users will receive immediate refunds while their claims are under review. Usually, resolving a dispute can take anywhere from a few days to several weeks, depending on the complexity of the claim and the institution's policies.

Concerns may also arise if a dispute is denied. In such cases, users should consider requesting further clarification or escalate the dispute to a higher authority within the banking institution. Understanding the escalation process can help users navigate the complexities of banking disputes more effectively.

Additional tools and resources for managing ATM disputes

Managing ATM disputes can be streamlined through additional tools offered by pdfFiller. The platform enables users not only to fill out the ATM Plus Dispute Form but also access a variety of other relevant templates and forms that aid in the documentation process. Having consent forms or tracking sheets readily available can provide further layers of organization and efficiency.

Another essential best practice is maintaining meticulous records of all transaction-related documentation. Organizing receipts, statements, and correspondence can prove invaluable in resolving current or future disputes. A proactive approach to record-keeping ensures that you're better equipped to handle banking issues as they arise.

Conclusion on the importance of proper form management

Efficient management of documents, particularly forms like the ATM Plus Dispute Form, plays a crucial role in maintaining financial stability. Users are encouraged to harness technology to enhance their document handling experience and ensure that disputes are resolved with minimal effort.

pdfFiller empowers users by facilitating seamless interactions with financial documents. By using the platform effectively, individuals and teams can navigate their banking needs with confidence, ensuring that their financial rights are preserved and upheld at all times.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute atm plus dispute form online?

How do I edit atm plus dispute form on an Android device?

How do I fill out atm plus dispute form on an Android device?

What is atm plus dispute form?

Who is required to file atm plus dispute form?

How to fill out atm plus dispute form?

What is the purpose of atm plus dispute form?

What information must be reported on atm plus dispute form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.