Get the free Client Trust Account Guidelines for Attorneys

Get, Create, Make and Sign client trust account guidelines

How to edit client trust account guidelines online

Uncompromising security for your PDF editing and eSignature needs

How to fill out client trust account guidelines

How to fill out client trust account guidelines

Who needs client trust account guidelines?

Client Trust Account Guidelines Form: A Comprehensive Guide

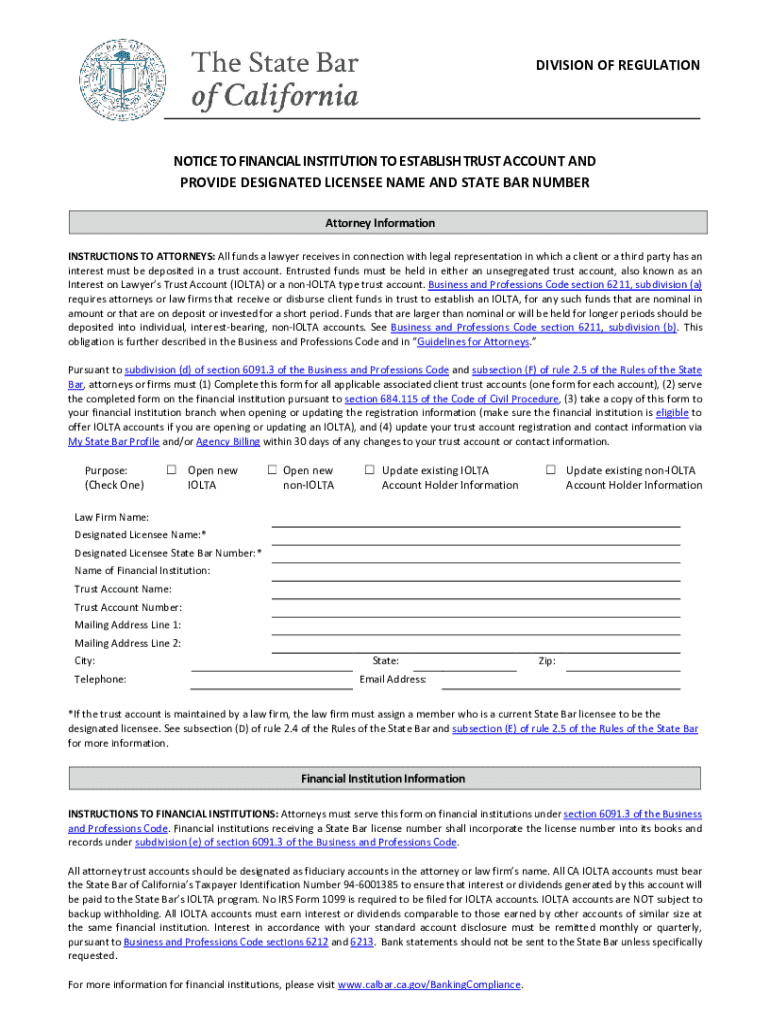

Understanding client trust accounts

Client trust accounts are specialized financial accounts designed to hold funds on behalf of clients until the completion of a specific transaction or obligation. They are commonly utilized in legal, real estate, and various professional engagements where a fiduciary responsibility exists. The primary purpose of these accounts is to ensure that clients' funds are safeguarded and utilized strictly for the agreed-upon purpose, promoting transparency and trust between clients and service providers.

Managing client trust accounts necessitates keen awareness of trust and fiduciary duties, meaning professionals must act in their clients' best interests and ensure the highest standard of accounting practices. Compliance with legal regulations is integral to the operation of client trust accounts, thereby reducing the risk of legal repercussions and fostering a trustworthy environment for clients. Accounting for each transaction meticulously ensures accountability and underlines a commitment to ethical practices.

Overview of client trust account guidelines

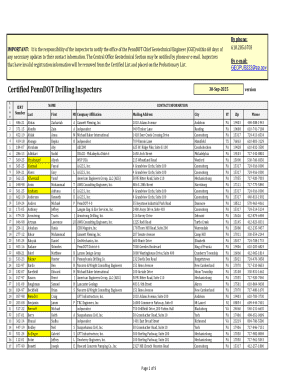

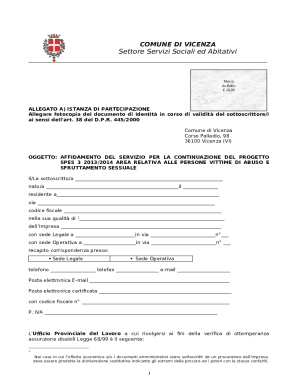

Client trust account guidelines are governed by a robust regulatory framework that varies across jurisdictions. State-specific regulations dictate how trust accounts must be established, maintained, and reported. Furthermore, professionals must remain abreast of any federal guidelines that may also apply, especially in industries like finance and real estate where federally regulated institutions play a role. These guidelines serve to protect all parties involved, ensuring proper conduct and accountability throughout the trust management process.

Adhering to these guidelines is not merely a legal obligation but also a cornerstone of client relationships. Non-compliance can lead to severe penalties, including legal action, loss of professional licenses, and damage to a practice's reputation. Conversely, structured management of trust accounts reinforces client confidence, showcasing a commitment to transparency and integrity. When clients feel secure in how their funds are managed, it enhances loyalty and fosters a positive working relationship.

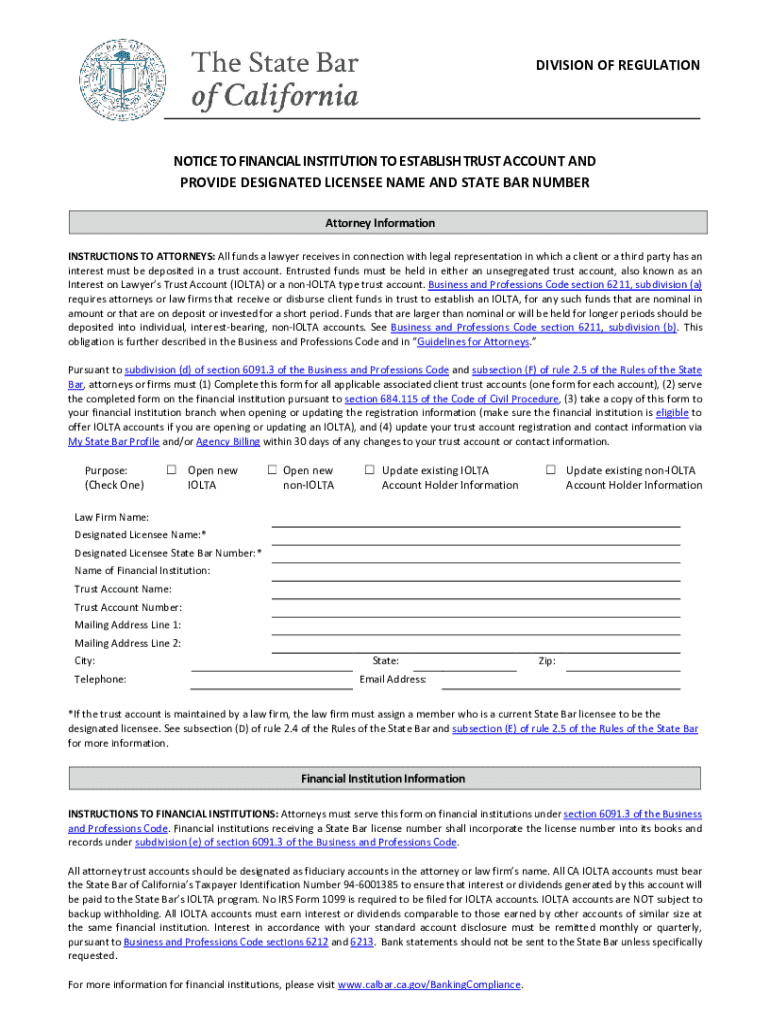

Elements of the client trust account guidelines form

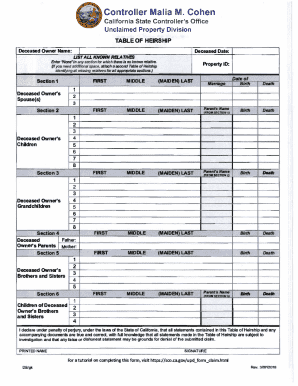

A client trust account guidelines form typically contains several crucial elements that serve to collect all necessary information for proper account management. Key components include client identification details, ensuring that the rightful owner of the funds is clearly documented. Additionally, trust fund source information is necessary to ascertain the origins of the funds, which aids in compliance and prevents fraudulent activity.

The form may include sections such as client name, account type, funding source, and the purpose of the trust. Detailed instructions are often provided to guide users through each portion. For instance, when filling in the client name, ensure it matches the identification documents provided to avoid discrepancies. Understanding the purpose of each section allows users to complete the form accurately, thereby facilitating smoother trust account operations.

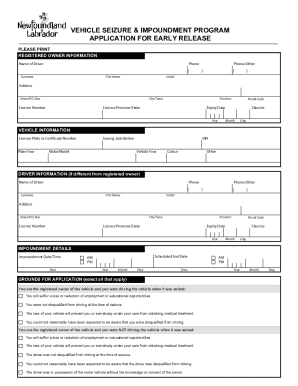

Preparing to fill out the client trust account guidelines form

Before tackling the client trust account guidelines form, it’s essential to gather all necessary information. Key documents may include identification forms, signed contracts, and details related to funding sources. Having these readily available will streamline filling out the form and minimize the potential for errors. Disorganization at this stage may lead to incomplete or incorrect submissions, resulting in compliance issues down the line.

Creating an optimal work environment can significantly enhance efficiency during this process. Utilize digital tools that offer easy access to electronic documents and reminders for critical deadlines. By ensuring a distraction-free space, you can focus on the meticulous nature of trust account management. A quiet workspace paired with effective digital solutions can help maintain the high level of accuracy required in filling out the client trust account guidelines form.

Step-by-step instructions for completing the form

Completing the client trust account guidelines form can be done efficiently by following a systematic approach. Begin with Step 1: Inputting client information, where detailed personal data must be accurately entered. It’s vital to double-check names and identification numbers to ensure that they match clients' official documents, maintaining compliance with regulations.

Step 2 involves documenting financial information such as the source of funds. It’s crucial to specify any relevant transaction details to ensure clarity in the trust fund's origin. In Step 3, thoroughly review and verify all information before submission. This is a non-negotiable step as inaccuracies can jeopardize the integrity of the entire account management process. Lastly, Step 4 focuses on the submission process. Understand the correct channels for submitting the completed form, whether electronically to a bank or another institution, to ensure it reaches the right authority promptly.

Tools for editing and managing client trust account documents

The utilization of effective tools can simplify the editing and management of client trust account documents considerably. pdfFiller's features enable users to easily access document editing tools, allowing for swift input of information and modifications as necessary. This tool offers the added benefit of electronic signatures, expediting the signing process and onboarding clients quickly, which is vital in a fast-paced professional environment.

Moreover, collaborative tools within pdfFiller facilitate teamwork, allowing team members to access, share, and edit documents in real time. This ensures that anyone involved in the trust management process is aligned, potentially reducing errors and enhancing overall management efficiency. Teams can work simultaneously without the risk of confusion or lost information, fostering a collaborative atmosphere that supports client trust account management.

Common mistakes to avoid when filling out the form

Common errors in documentation related to client trust account guidelines forms can lead to significant issues. One frequent mistake is the misplacement of crucial information, such as failing to correctly identify clients or confusing the trust fund's source. Leaving certain fields incomplete can result in compliance issues or delays in processing, underscoring the importance of thoroughness.

To minimize potential problems, double-checking entries is vital. Implement a checklist approach where each piece of information is reviewed prior to submission. This reduces the risk of overlooking details and ensures that every element is accounted for. Avoiding common errors in documentation ultimately leads to smoother client account management and avoids unnecessary complications.

Frequently asked questions (FAQs)

When navigating client trust accounts, several inquiries regularly arise. One common concern is what to do if certain documents cannot be located. It’s recommended to have a backup backup plan, such as creating digital copies of critical documents and using electronic filing systems. This can ease the process when physical documents are misplaced.

Another frequent query pertains to handling disputes related to trust funds. Establishing clear protocols for addressing disagreements among clients or between clients and service providers can mitigate potential issues. Educating everyone involved about the established dispute resolution process is critical for compliance and maintaining trust. Staying proactive about common challenges helps reduce surprises and maintain a smooth operational flow in managing client trust accounts.

Ongoing management of client trust accounts

Effective ongoing management of client trust accounts requires the establishment of best practices for monitoring and reporting. Regular audits of the account not only ensure compliance but also reinforce trust with clients. A routine monitoring schedule can help identify discrepancies promptly and provide an opportunity for timely correction.

Utilizing tools and resources for ongoing compliance remains critical. This might include accounting software specifically designed for trust accounting records, which can simplify reporting and tracking. Continuous education for staff about the evolving landscape of trust account regulations enhances compliance and ensures that everyone is adept at managing client funds responsibly. With a proactive approach to account management, professionals can uphold the integrity of client trust accounts and strengthen client relationships.

Final checklist before submission

Before submitting the client trust account guidelines form, a final checklist can ensure all necessary steps have been followed. Begin by summarizing and verifying the required information—client details, funds source, and purpose for the trust are a must. Each point on the checklist should be ticked off as items are confirmed, preventing any oversight.

Additionally, implement verification steps, such as cross-checking for any incomplete fields or errors in figures entered. Lastly, confirm the submission method and track the receipt if applicable, safeguarding against the risk of lost documentation. This methodical approach ensures that each client trust account management process is executed effectively and confidently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in client trust account guidelines?

How do I make edits in client trust account guidelines without leaving Chrome?

How do I fill out client trust account guidelines on an Android device?

What is client trust account guidelines?

Who is required to file client trust account guidelines?

How to fill out client trust account guidelines?

What is the purpose of client trust account guidelines?

What information must be reported on client trust account guidelines?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.