Get the free indiana partnership return

Get, Create, Make and Sign indiana form it 65

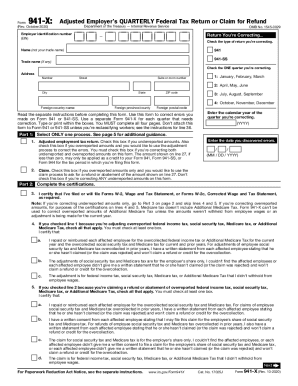

How to edit indiana partnership return form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out indiana partnership return form

How to fill out indiana partnership return booklet

Who needs indiana partnership return booklet?

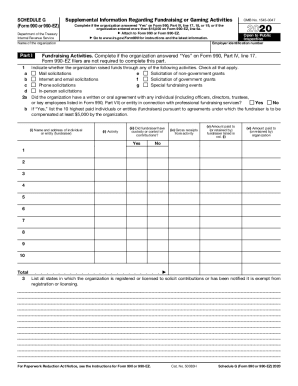

Understanding the Indiana Partnership Return Booklet Form (IT-65)

Overview of the Indiana Partnership Return (IT-65)

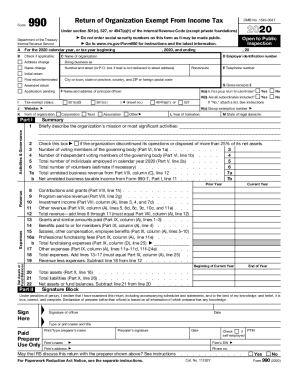

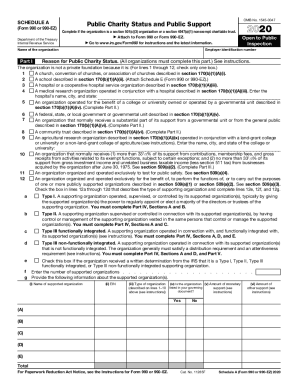

The Indiana Partnership Return (IT-65) is a critical tax document used by partnerships doing business in Indiana. It serves to report the income, deductions, and credits of the partnership, revealing vital financial information that the Indiana Department of Revenue (IDOR) requires. This form is essential not only for tax assessment purposes but also for keeping Indiana's tax system efficient and compliant.

Any partnership with income sourced from Indiana must file an IT-65 return, regardless of whether the business is a limited liability partnership or a general partnership. This includes partnerships with non-resident partners who also need to comply with Indiana tax regulations.

Detailed insights on the Indiana Partnership Return Booklet Form

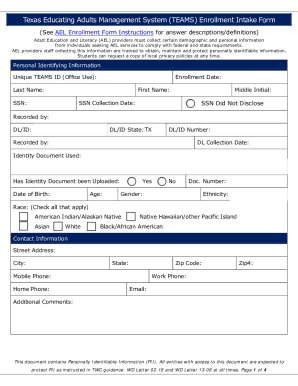

The IT-65 form is comprehensive, consisting of several sections that require specific information from the partnership. Understanding what details need to be reported is crucial for complying with state tax laws.

Partnerships must accurately report income, deductions, and partner distributions. Incorrect information can lead to penalties or audits, emphasizing the importance of precise and honest reporting. Sections of the form guide businesses through different aspects of financial reporting, from revenue recognition to special considerations for partners.

Step-by-step instructions for filling out the IT-65

Filling out the IT-65 requires careful preparation and attention to detail. Begin by gathering all relevant documentation, including income statements and previous tax returns. Ensure you have all information related to each partner, including their share of the income and deductions.

Next, proceed to fill out the form methodically, starting with Section 1, which includes partnership identification. It requires information such as the partnership's name, address, and federal identification number. Accuracy in this section is non-negotiable, as errors can lead to processing delays.

Finally, reviewing entries before submission can prevent costly mistakes. Common issues include misreported income or omitted partner information, which can complicate the filing.

Interactive tools for managing the Indiana Partnership Return

Embracing technology can simplify the process of completing the Indiana Partnership Return. Online platforms, such as pdfFiller, provide robust tools for editing and managing tax forms, making the task less daunting. With user-friendly interfaces, individuals can navigate through their tax documents with ease, enhancing accuracy and efficiency.

pdfFiller stands out as an effective tool for collaboration. Users can upload their IT-65 form, making necessary edits and saving their progress in the cloud. This allows team members to contribute and review documents, ensuring that all necessary input is considered before submission.

Understanding eSignature compliance for the IT-65

Integrating eSignatures into the submission process of the IT-65 is a modern twist that enhances efficiency. eSignatures are legally recognized in Indiana, allowing businesses to sign their tax returns electronically. This not only expedites the submission process but also ensures a higher level of security and verification.

pdfFiller provides comprehensive eSignature tools that meet Indiana’s legal standards. Users can sign their documents electronically and track the signing status, easing the process considerably when multiple partners are involved.

Managing and submitting your IT-65

Once completed, the IT-65 form must be submitted in accordance with state guidelines. Partnerships have the option to file electronically or via traditional paper methods. Electronic filing often leads to quicker processing times, so consider this method if your partnership meets the IDOR’s requirements.

It's important to keep a copy of your submission for records. Moreover, tracking submission status can provide peace of mind, confirming that the Indiana Department of Revenue has received your return and is processing it.

Common questions and troubleshooting tips

Filing taxes can raise numerous questions, especially with something as intricate as the IT-65. Some common queries include what to do if a mistake is made on the form or whether amending a previously filed return is possible. Knowing the answers to these questions helps partnerships navigate their tax responsibilities with greater confidence.

For partners uncertain about their next steps after identifying an error, it is possible to amend the IT-65. This process involves submitting a revised form correlating to the original submission and clearly stating the corrections. Partnerships experiencing difficulty should not hesitate to reach out to the Indiana Department of Revenue for assistance.

Additional considerations for Indiana partnership tax filings

In addition to the IT-65, partnerships may encounter various other forms and obligations concerning Indiana tax laws. Understanding related Indiana tax forms could streamline the overall filing process and ensure complete compliance. Apart from the IT-65, businesses might need forms for withholding tax, sales tax, and other obligations.

Furthermore, preparation for future tax compliance begins with setting reminders for upcoming deadlines. Establishing a calendar with due dates for the IT-65 and any supplementary forms is crucial for any partnership wanting to maintain good standing with the Indiana Department of Revenue.

Special features from pdfFiller for enhanced document management

pdfFiller offers unique features designed specifically for document management. Whether you’re working individually or as part of a team, cloud-based document solutions cater to your accessibility needs. This means you can access your IT-65 from anywhere, ensuring that all partners have the latest version at their fingertips.

Moreover, collaboration tools on pdfFiller enable teams to work on partnership returns together, whether they are all in one office or scattered across states. Security measures ensure sensitive information, including financial data, is protected throughout the editing and submission process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get indiana partnership return form?

How do I execute indiana partnership return form online?

How do I edit indiana partnership return form online?

What is indiana partnership return booklet?

Who is required to file indiana partnership return booklet?

How to fill out indiana partnership return booklet?

What is the purpose of indiana partnership return booklet?

What information must be reported on indiana partnership return booklet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.