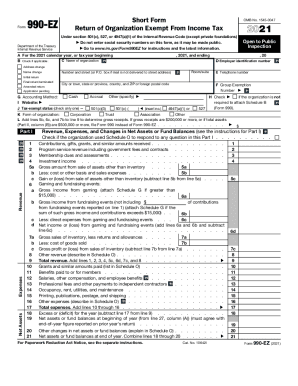

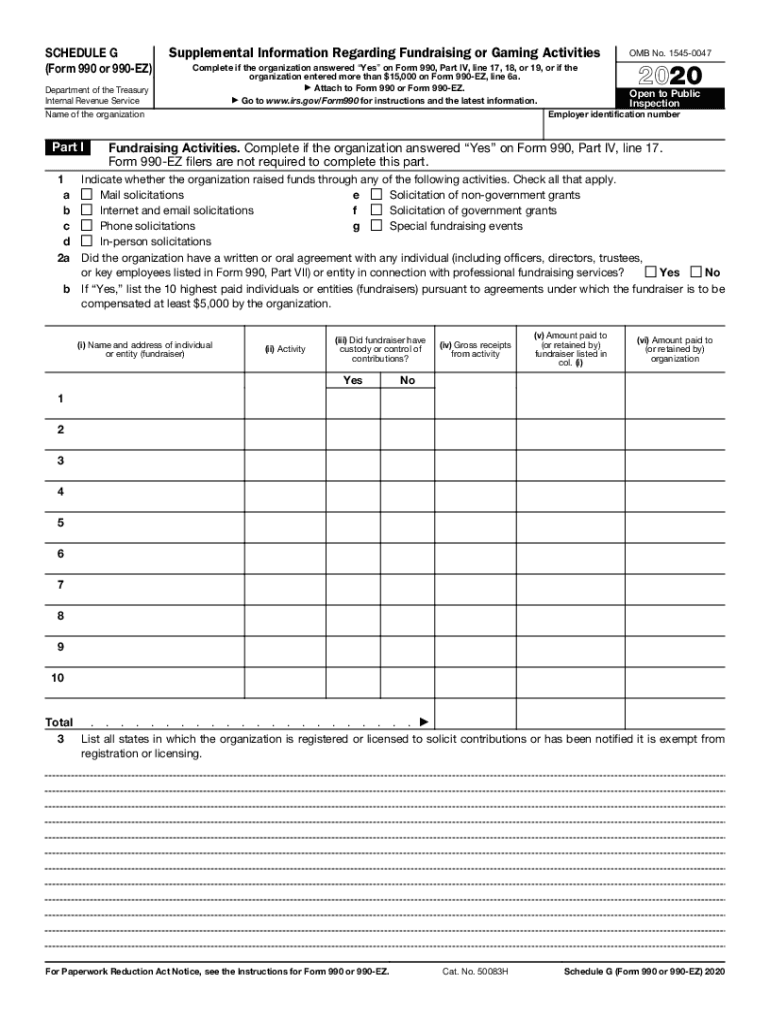

IRS 990 - Schedule G 2020 free printable template

Instructions and Help about IRS 990 - Schedule G

How to edit IRS 990 - Schedule G

How to fill out IRS 990 - Schedule G

About IRS 990 - Schedule G 2020 previous version

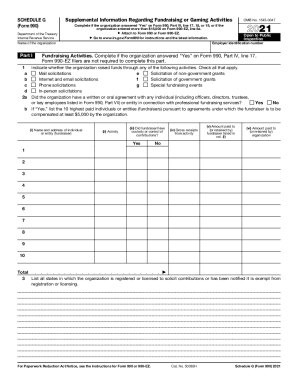

What is IRS 990 - Schedule G?

Who needs the form?

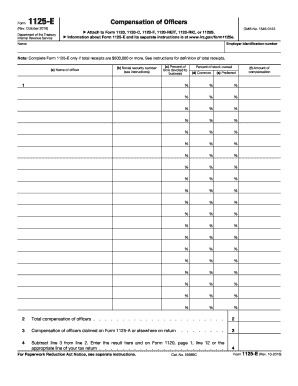

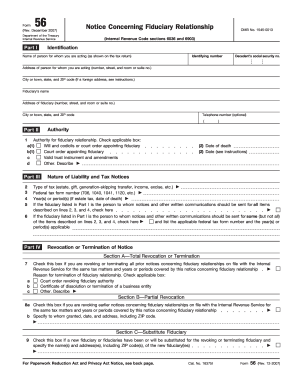

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 990 - Schedule G

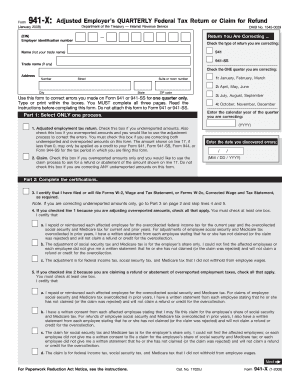

What should I do if I realize I made a mistake on my IRS 990 - Schedule G after submission?

If you discover a mistake after filing your IRS 990 - Schedule G, you should file an amended return. You can do this by preparing a new Schedule G that clearly indicates any corrections. Ensure you follow the instructions for amendments carefully to avoid delays in processing.

How can I verify that the IRS has received my IRS 990 - Schedule G?

To verify receipt of your IRS 990 - Schedule G, you can check the tax transcripts available through the IRS online account system. Additionally, if you e-filed, look for confirmation emails from your e-filing service provider, which often include a status update.

What should I keep in mind regarding record retention for my IRS 990 - Schedule G?

When you file your IRS 990 - Schedule G, you must retain copies of the form and supporting documents for at least three years from the filing date. This ensures you have records available in case of an audit or inquiry by the IRS.

How do I handle e-signatures when filing my IRS 990 - Schedule G?

e-Signatures are acceptable when filing your IRS 990 - Schedule G electronically. Ensure that the e-signature system used is compliant with IRS requirements to avoid any issues during processing. Double-check the system for compatibility with your filing software.

What common errors should I avoid when filing the IRS 990 - Schedule G?

Common errors when filing IRS 990 - Schedule G include incorrect figures, missing signatures, and failing to provide required disclosures. To avoid these issues, carefully review the entire form against your financial records before submission and consider using a checklist.

See what our users say