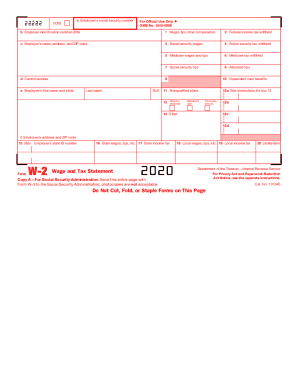

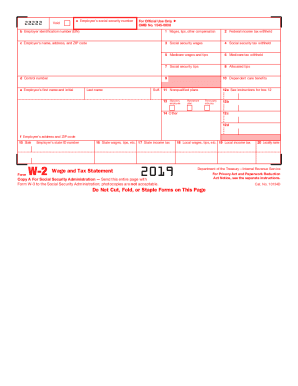

Who Needs Form W-2AS?

American Samoa is a U.S. territory located in the Pacific Ocean. Just as the people working in on the American mainland, all the taxpayers in American Samoa must file tax returns. Form W-2AS is a Wage and Tax Statement that must be filled out by employers in American Samoa.

What is Form W-2AS for?

Form W-2AS is a variation of the Form W-2, one of the basic tax documents used to report the amount of taxes withheld from an employee's’ paycheck. Form W-2AS is the same Wage and Tax Statement designed for those who reside and work in American Samoa.

Is Form W-2AS Accompanied by Other Forms?

Since W-2AS is sent to the employee to be used for their individual tax return, Copy A is attached to the tax return.

When is Form W-2AS Due?

All employees must receive their W-2AS by the 31st of January. Copy A of the form is sent to the SSA by the end of February.

How do I Fill out Form W-2AS?

The form is filled out by an employer to provide an employee with information about the amount of taxes that will be withheld from their paycheck. You must enter information in Form W-2AS in black ink. Copy A of the form will be read by a machine, so you must observe all filing rules, make sure all entries are correct and not exceed the required size.

The form is rather short. It contains 14 fields for different kinds of wages and tax. On the top of the form, an employer enters the employee’s SSN, his own EIN, employee’s name and address.

Make sure all the information on the form, especially the employee’s name and SSN is correct. If there are some mistakes, you may be penalized.

Where do I send W-2AS form?

A completed W-2AS is sent to the employee and to the Social Security Administration not the IRS.