Get the free NJ ANCHOR Rebate: Deadlines and Steps to Claim

Get, Create, Make and Sign nj anchor rebate deadlines

How to edit nj anchor rebate deadlines online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nj anchor rebate deadlines

How to fill out nj anchor rebate deadlines

Who needs nj anchor rebate deadlines?

Navigating the NJ Anchor Rebate Deadlines Form: A Comprehensive Guide

Understanding the NJ Anchor Rebate Program

The NJ Anchor Rebate Program aims to provide financial relief to homeowners and renters within New Jersey. By offsetting property taxes, the program directly assists residents in alleviating the burden of escalating housing costs. Established in response to growing economic challenges, the program has undergone several updates to adapt to the financial landscape, making it crucial for residents to stay informed about the latest developments.

In the current year, the focus on financial support has intensified, making the NJ Anchor Rebate particularly relevant. With thousands of residents eligible, the benefits can significantly impact personal finance, providing essential relief that allows for better allocation of resources toward other living expenses.

Key deadlines for the NJ Anchor Rebate

Understanding the key deadlines associated with the NJ Anchor Rebate is essential for maximizing benefits. The eligibility period typically spans one full calendar year, during which applicants must ensure they meet all necessary requirements. For the current year, applications must be submitted by the deadline established by the New Jersey Division of Taxation.

Missing these deadlines can result in forfeiting the rebate, leaving applicants without access to crucial financial aid. If you find yourself unable to submit your form on time, consulting with the New Jersey Division of Taxation about potential options for late filings is essential to ensure you do not miss out on any available assistance.

Eligibility criteria for applicants

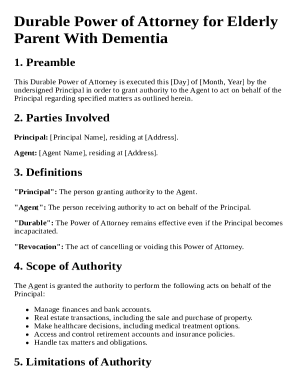

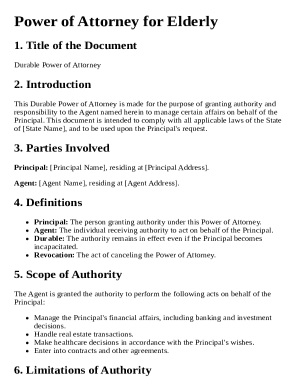

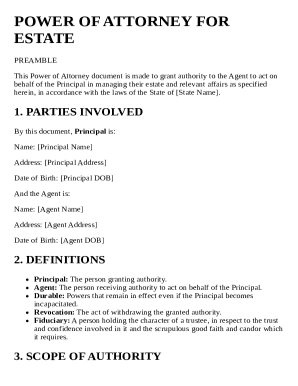

To qualify for the NJ Anchor Rebate, applicants must meet specific eligibility criteria, including income thresholds and residency requirements. Generally, homeowners must demonstrate a certain income level and possess property within New Jersey to be eligible.

Additionally, special considerations are made for senior citizens and disabled citizens, where certain criteria may provide enhanced reimbursement opportunities. It's crucial to review the specific details on the NJ Division of Taxation website to ensure accurate understanding of the nuances related to eligibility.

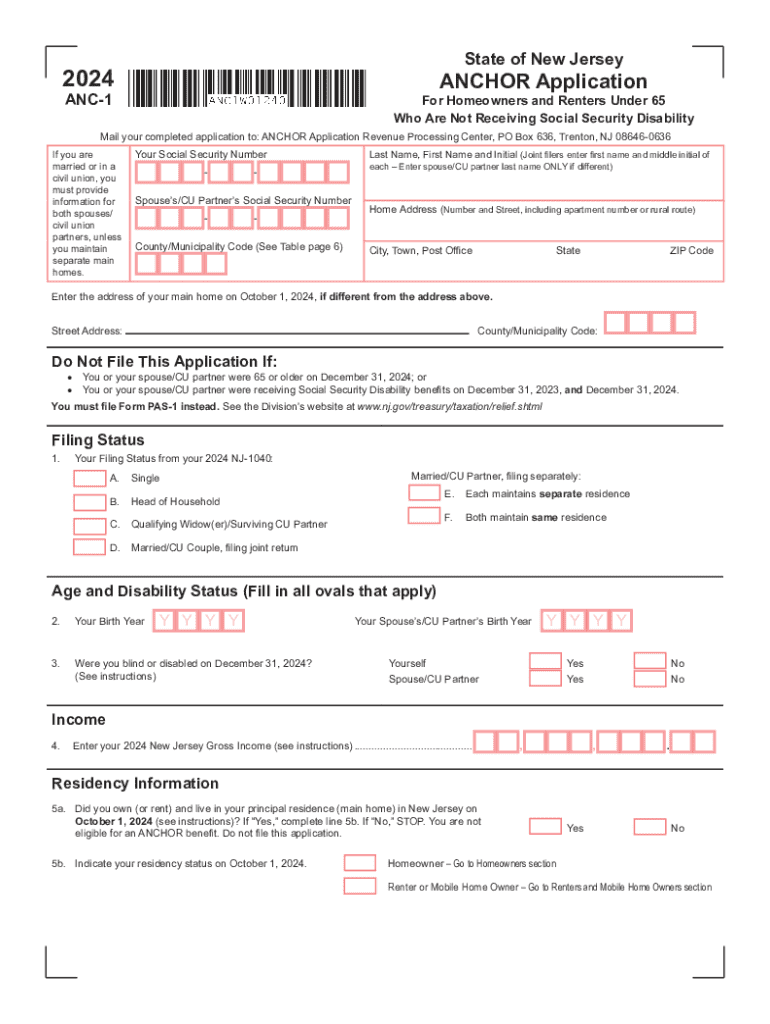

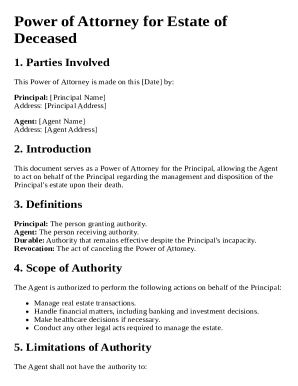

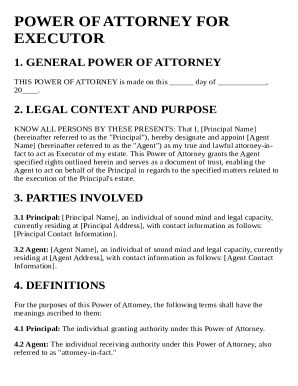

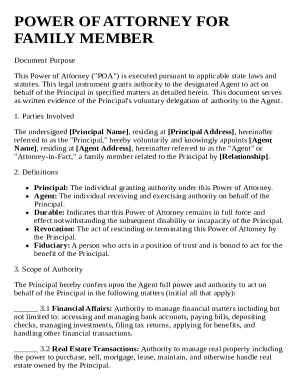

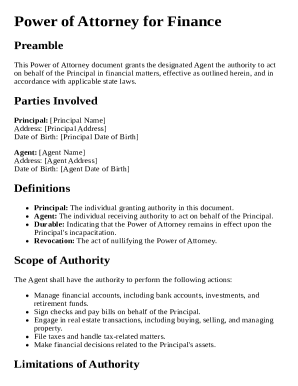

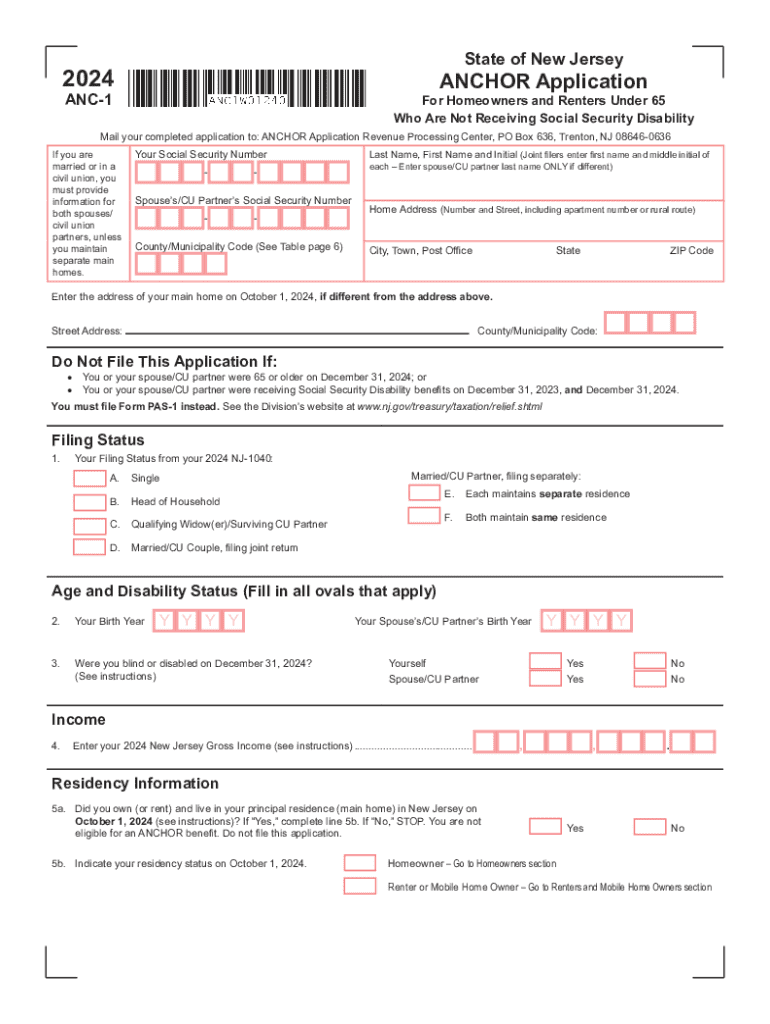

Necessary documentation and information

Completing the NJ Anchor Rebate form requires meticulous preparation of necessary documentation. Essential personal identification details, such as your Social Security number and proof of residency, must be gathered. Furthermore, financial documents like tax returns and income statements are critical for verifying eligibility.

Utilizing interactive tools like pdfFiller can streamline this document preparation process, allowing you to easily gather and organize all required documents before form submission.

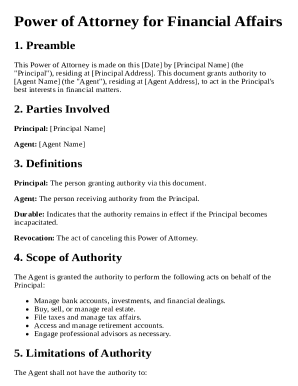

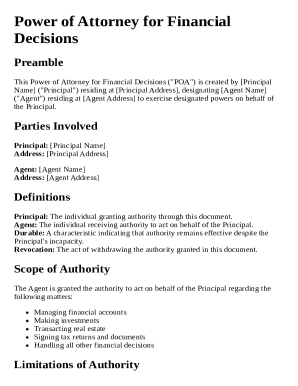

Step-by-step instructions for filling out the NJ Anchor Rebate form

Filling out the NJ Anchor Rebate form efficiently involves understanding the various sections outlined in the document. The form generally includes spaces for personal information, income verification, and residency details. To ensure smooth completion, it’s important to follow a structured approach.

Avoid common mistakes such as misreporting income or omitting critical documentation by double-checking all entries. To further simplify the process, pdfFiller offers interactive demonstrations on editing, signing, and finalizing your document, making your application experience seamless.

Potential benefits of filing for the NJ Anchor Rebate

Successfully filing for the NJ Anchor Rebate can bring considerable financial benefits. For many families and households, the rebate can lead to tangible savings, easing the burden of property taxes and subsequently allowing funds to be redirected toward essential needs such as education, health, and everyday expenses.

Case studies highlight individuals and families who have benefited from these rebates, reinforcing the importance of participation in the program. Such testimonials illustrate that the NJ Anchor Rebate is more than just a formality; it's a pathway to financial empowerment.

Related tax relief programs

Aside from the NJ Anchor Rebate, New Jersey offers several other property tax relief options that residents should explore. There are direct aid programs, tax exemptions, and deductions available to homeowners and renters alike, aiming to ease the financial burden on residents.

Understanding how the NJ Anchor Rebate fits into this broader context is essential. The synergy of this program with other forms of financial support ensures that residents have multiple avenues available to alleviate property taxes and associated costs.

Staying informed on future updates and changes

As policies and deadlines can change, staying informed about the NJ Anchor Rebate program is crucial for all potential applicants. Signing up for email alerts and notifications from the New Jersey Division of Taxation can help residents remain up-to-date on important changes that may affect their eligibility or benefits.

By staying informed on the latest developments, residents can proactively manage their applications and maximize available benefits.

FAQs about NJ Anchor Rebate deadlines and form

Navigating the NJ Anchor Rebate process often comes with questions. Addressing common misconceptions can clarify the filing process and eligibility requirements.

Additionally, expert tips for a smooth filing experience include double-checking all documentation and using resources like pdfFiller for efficient form management. By utilizing available tools and knowledge, applicants can significantly enhance their rebate filing experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit nj anchor rebate deadlines online?

How do I edit nj anchor rebate deadlines in Chrome?

Can I create an eSignature for the nj anchor rebate deadlines in Gmail?

What is nj anchor rebate deadlines?

Who is required to file nj anchor rebate deadlines?

How to fill out nj anchor rebate deadlines?

What is the purpose of nj anchor rebate deadlines?

What information must be reported on nj anchor rebate deadlines?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.