Get the free 20-1092: C.G. and U.S. POSTAL SERVICE, POST OFFIC...

Get, Create, Make and Sign 20-1092 cg and us

Editing 20-1092 cg and us online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 20-1092 cg and us

How to fill out 20-1092 cg and us

Who needs 20-1092 cg and us?

Comprehensive Guide to the 20-1092 CG and US Form

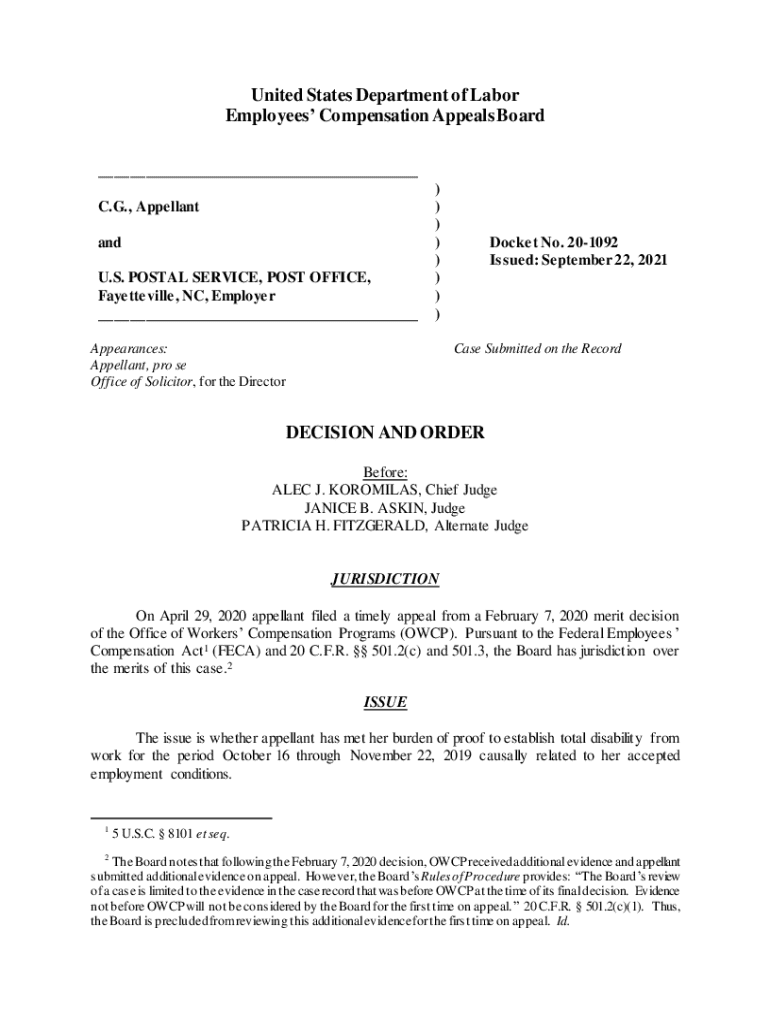

Understanding the 20-1092 CG and US Form

The 20-1092 CG and US Form is a crucial document often utilized within governmental and organizational frameworks. It primarily serves as a standardized form for the declaration of certain information needed for taxation and compliance purposes. Its significance lies in its role in ensuring transparency and accountability, making it an essential tool for both individuals and businesses.

Typically, this form is used by individuals, business entities, and accountants who need to report income, claim deductions, and provide necessary certifications. It streamlines the process of meeting regulatory requirements set forth by governmental agencies, thus aiding in the prevention of errors and potential legal complications.

Key components of the form

Understanding the essential sections of the 20-1092 CG and US Form is vital for accurate completion. Each section is designed to capture specific information, ensuring the form remains organized and comprehensive.

Common terminology used in the form includes terms like "income," "deduction," and "certification." Familiarity with these terms will help users navigate the form with greater ease, minimizing the risk of mistakes during the filling process.

Step-by-step guide to completing the 20-1092 CG and US Form

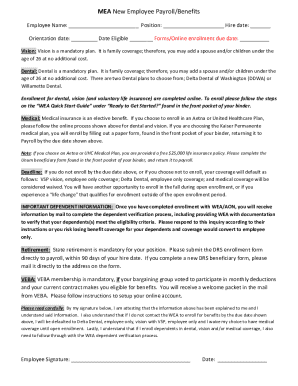

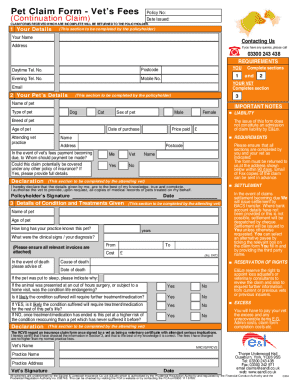

The first step in completing the 20-1092 CG and US Form is preparing to fill it out. This preparation involves gathering all necessary information and relevant documents that would be needed during the completion of the form. Ensure you have personal identification, financial statements, and any receipts that may support deductions.

Collecting required data can be made easier by keeping a checklist of the information needed. Start by identifying your income sources, and make a list of all applicable deductions. This will not only streamline the process but also prepare you for any potential audit inquiries.

Detailed Instructions for Each Section

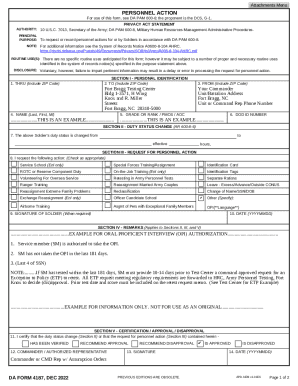

Section 1 of the form focuses on personal information. This section typically requires your full name, address, Social Security number, and contact details. Ensure accuracy to avoid complications during processing.

Moving on to Section 2, income reporting requires a detailed declaration of all income streams, including salaries, wages, bonuses, and any other income sources. Providing accurate information here is critical, as discrepancies can lead to compliance issues.

Section 3 addresses deductions and credits. It’s essential to familiarize yourself with available deductions such as healthcare expenses, charitable contributions, and mortgage interest. Each of these can significantly affect your tax liability.

The final section ensures the completeness of your application through certification and signature. It’s crucial to double-check that all previous sections are accurate before signing, as your signature validates the accuracy of the information provided.

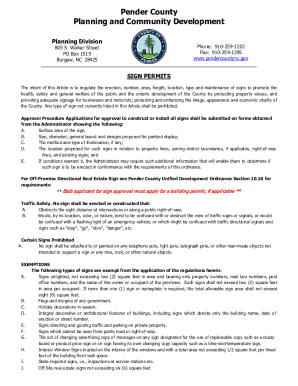

Editing the 20-1092 CG and US Form with pdfFiller

Once you have filled out the 20-1092 CG and US Form, using pdfFiller enables a seamless editing experience. Start by uploading your document to the platform. pdfFiller supports various file formats, making the initial upload straightforward.

The editing tools available in pdfFiller allow you to add text, images, and annotations easily. You can streamline revisions by utilizing collaborative features, making it a breeze for teams to work together effectively on the same document.

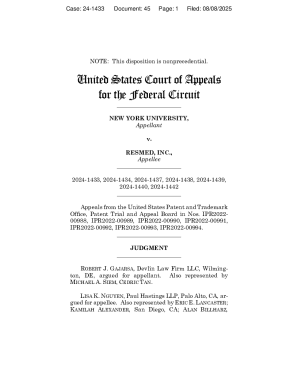

eSigning the 20-1092 CG and US Form

eSignatures have gained immense importance in recent years due to their convenience and legality. By using pdfFiller for eSigning, you can validate documents quickly while ensuring compliance with legal standards.

Adding your eSignature in pdfFiller is a simple step-by-step process. After completing the form, locate the eSignature option, and follow the prompts to create and secure your digital signature. Ensuring document security post-signing is also important; pdfFiller provides encryption and secure storage options for added peace of mind.

Collaborating with teams on the 20-1092 CG and US Form

Collaboration on the 20-1092 CG and US Form can significantly enhance accuracy and compliance. pdfFiller enables document sharing, allowing team members to access and contribute to the form in real-time. Setting up document sharing is straightforward; simply invite team members through the platform to join.

Moreover, the platform’s real-time collaboration features empower users to track changes and leave comments. This ensures that everyone involved stays informed, and the form is finalized with comprehensive team input.

Managing the 20-1092 CG and US Form post-completion

Proper organization and storage of your 20-1092 CG and US Form after completion are vital. Adopting best practices for document management, such as categorizing and backing up files in cloud-based storage, will help minimize loss or misplacement.

pdfFiller provides various export options, allowing you to convert the form into different file types, accommodating diverse requirements. Additionally, the benefit of cloud-based storage means you can access your documents from anywhere, ensuring that you maintain important information at your fingertips.

Troubleshooting common issues with the 20-1092 CG and US Form

Users often encounter issues while completing the 20-1092 CG and US Form, ranging from missed fields to submission errors. One common problem might be an error message related to incomplete information, prompting users to double-check the form for missing data.

To resolve these common errors, break down the submission process step-by-step. If an error is flagged, refer to the indicated section, ensure all required fields are completed, and that provided information is accurate. Knowing common pitfalls empowers users to navigate the submission process smoothly.

Leveraging additional features of pdfFiller for document management

Beyond just the 20-1092 CG and US Form, pdfFiller offers a wide array of forms and templates. Users can access a comprehensive document library that includes various forms required for governmental and organizational purposes, further enhancing the utility of the platform.

Integrating pdfFiller with other tools can also be beneficial. The platform connects easily with popular applications, allowing for enhanced workflow efficiency. Utilizing such integrations can streamline document processes, making the preparation of forms like the 20-1092 CG and US Form faster and more efficient.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the 20-1092 cg and us form on my smartphone?

How do I edit 20-1092 cg and us on an iOS device?

How do I fill out 20-1092 cg and us on an Android device?

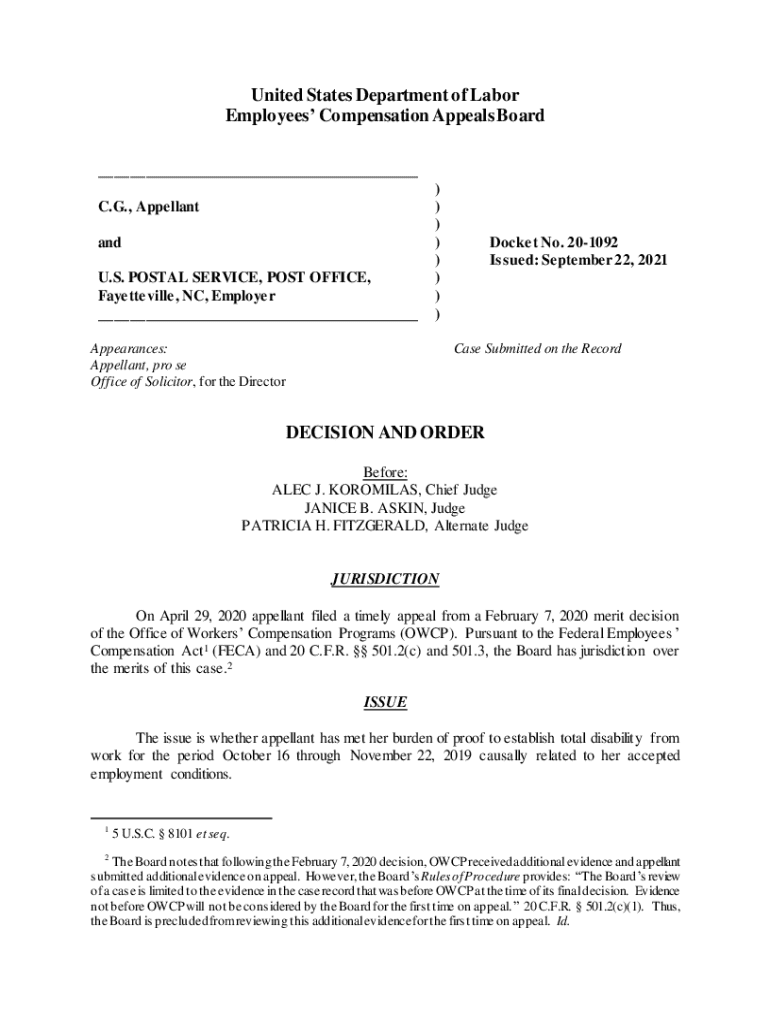

What is 20-1092 cg and us?

Who is required to file 20-1092 cg and us?

How to fill out 20-1092 cg and us?

What is the purpose of 20-1092 cg and us?

What information must be reported on 20-1092 cg and us?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.