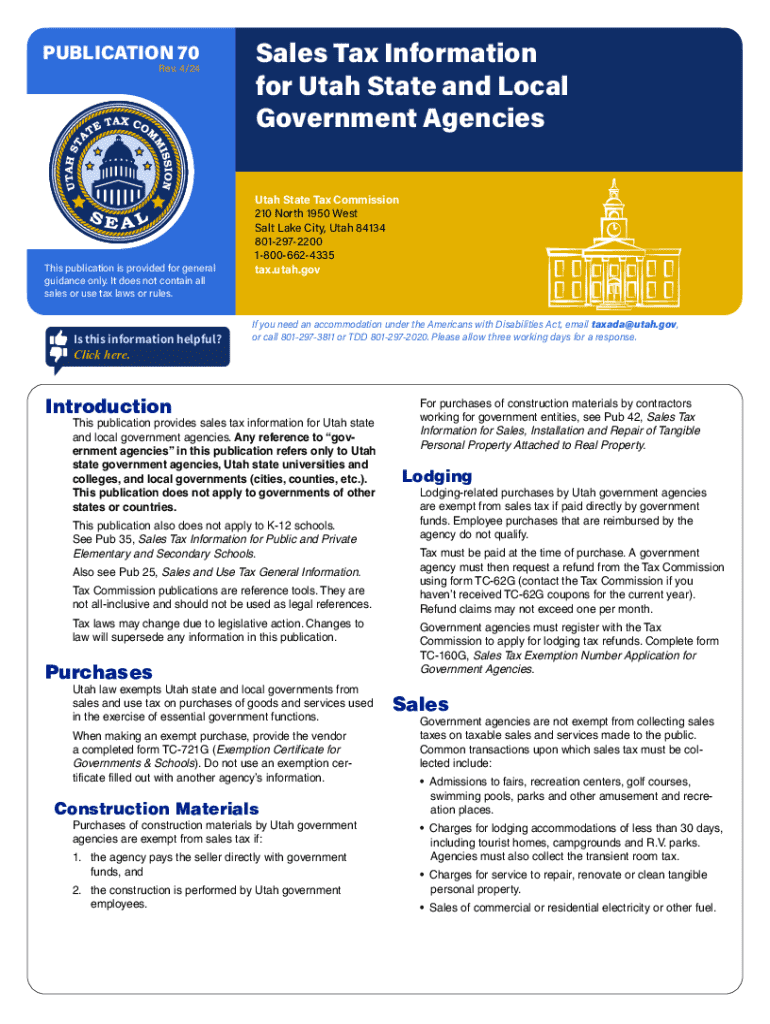

Get the free Publication 70 Sales Tax Information for Utah State and Local Gov Agencies. Forms &a...

Get, Create, Make and Sign publication 70 sales tax

Editing publication 70 sales tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out publication 70 sales tax

How to fill out publication 70 sales tax

Who needs publication 70 sales tax?

Understanding the Publication 70 Sales Tax Form: A Comprehensive Guide

Understanding Publication 70: What You Need to Know

Publication 70 is a vital resource that provides instructions and requirements related to sales tax in various jurisdictions. This document serves as a guide for individuals and businesses to properly report and remit sales tax to state authorities. Navigating sales tax obligations can often be confusing due to variations between different states, which is why understanding Publication 70 is crucial.

Sales tax compliance ensures that both individuals and businesses meet their legal obligations while avoiding penalties. Key terms associated with sales tax include taxable sales, exemptions, and rates. Understanding these concepts is fundamental to successfully completing the Publication 70 sales tax form and ensuring compliance with local tax laws.

Overview of the sales tax form

The sales tax form outlined in Publication 70 is designed to help taxpayers report their sales tax accurately. Its primary purpose is to document sales transactions and the corresponding tax liabilities owed to the state or municipalities. Failing to file this form or submitting incorrect information can lead to audits and fines.

Individuals, businesses, and organizations that engage in taxable sales or provide taxable services must file using Publication 70. This form covers various types of transactions, including retail sales, leases, and certain services. Knowing whether your transactions are taxable or exempt is essential for accurate reporting.

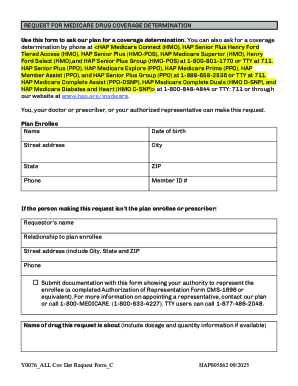

Accessing and downloading Publication 70 sales tax form

Accessing the Publication 70 sales tax form is straightforward. It can often be found on both official state websites and platforms like pdfFiller. The availability of the form in different formats, such as PDF and editable formats, is critical for users who need flexibility in how they prepare their documents.

Step-by-step guide to completing the publication 70 sales tax form

Completing the Publication 70 sales tax form effectively can be broken down into several manageable steps. Following these steps can ensure accuracy and compliance.

Editing the form with pdfFiller’s tools

pdfFiller enhances the usability of the Publication 70 sales tax form by allowing users to edit their documents effortlessly. Features include adding text and digital signatures, which streamline the completion process.

Additionally, you can insert images or relevant documentation to support your submissions. The collaborative features allow team members to work together on the form, making it ideal for businesses seeking input from multiple departments.

Managing your form submissions

Once your Publication 70 sales tax form is submitted, managing that submission is just as crucial. pdfFiller provides tools to access submitted forms easily, helping users keep track of their tax obligations.

FAQs about publication 70 sales tax form

When dealing with the Publication 70 sales tax form, various questions often arise that can cause confusion. Understanding these common inquiries can clarify the process.

Exploring additional features of pdfFiller

Beyond the Publication 70 sales tax form, pdfFiller offers valuable features for document management. With the ability to integrate your form management with other documents, users can streamline their workflows.

Leveraging pdfFiller for other tax forms and publications can save time and enhance productivity. User testimonials frequently highlight the benefits of using pdfFiller as a comprehensive solution for all their document needs.

Staying informed on sales tax changes

Sales tax regulations are subject to change, making it essential to stay informed about updates to Publication 70. Monitoring changes ensures that you remain compliant with state tax regulations, allowing you to avoid unnecessary penalties.

User tips: maximizing your experience with pdfFiller

To fully benefit from pdfFiller’s capabilities, consider implementing some simple yet effective strategies. From tips for fast and efficient documentation to best practices for collaboration, these suggestions can enhance your overall experience.

Conclusion: Your next steps after completing publication 70

After successfully completing the Publication 70 sales tax form, ensure you stay organized with your tax documents. Keeping both digital and hard copies of submitted forms safeguards against potential issues in the future.

It is essential to regularly review your tax obligations to avoid potential pitfalls in future filing seasons. This proactive approach ensures compliance and streamlines the financial management aspects of running a business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit publication 70 sales tax straight from my smartphone?

How do I fill out publication 70 sales tax using my mobile device?

How do I complete publication 70 sales tax on an iOS device?

What is publication 70 sales tax?

Who is required to file publication 70 sales tax?

How to fill out publication 70 sales tax?

What is the purpose of publication 70 sales tax?

What information must be reported on publication 70 sales tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.