Get the free Pillur startUP Loan Application & Guide

Get, Create, Make and Sign pillur startup loan application

Editing pillur startup loan application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pillur startup loan application

How to fill out pillur startup loan application

Who needs pillur startup loan application?

Navigating the Pillur Startup Loan Application Form: A Comprehensive Guide

Understanding the Pillur startup loan

A Pillur startup loan provides essential capital for budding entrepreneurs looking to establish or grow their business. Unlike traditional loans, startup loans are tailored specifically for new businesses, offering accessible funding options to help stimulate growth and innovation.

Obtaining a startup loan can be a crucial step in transforming your business idea into reality. The financial support allows entrepreneurs to cover initial expenses, invest in marketing, and acquire necessary equipment, fostering an environment conducive to success.

The Pillur startup loan is characterized by competitive interest rates, flexible repayment terms, and tailored support for those new in the market. With a commitment to empowering startups, Pillur focuses on creating favorable lending conditions that facilitate growth and stability.

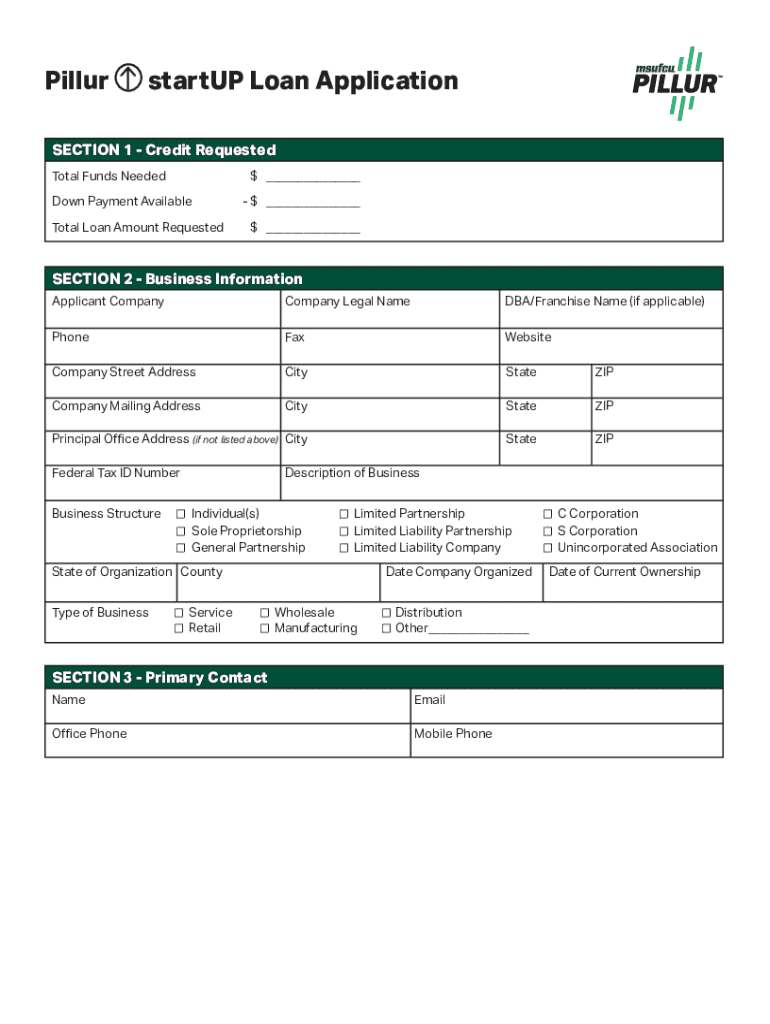

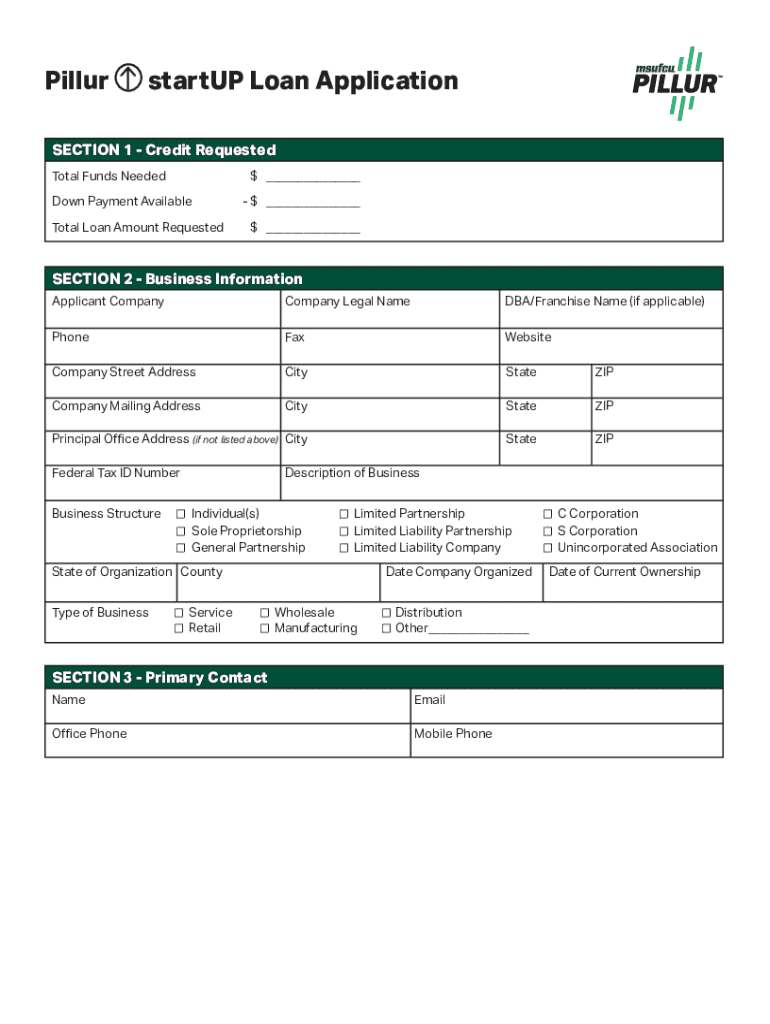

Key features of the Pillur startup loan application form

The Pillur startup loan application form features a user-friendly design that simplifies the loan application process. Designed to enhance the user experience, it streamlines information entry and reduces the time spent on applications.

Interactive elements guide users through the form, ensuring that all necessary information is captured efficiently. The platform is cloud-based, offering security measures to protect your sensitive data while providing anytime, anywhere access, which is particularly valuable for startups on the go.

Step-by-step guide to completing the application form

Completing the Pillur startup loan application form is straightforward. Below is a step-by-step guide to help you navigate the process.

Step 1: Accessing the form

Visit pdfFiller and search for the Pillur startup loan application form using the site’s search feature. Ensure you are on the correct section of the website to access the latest version of the form.

Step 2: Filling out personal information

Input your personal details in the designated fields. This includes your name, contact information, and the business type and structure details. Accuracy is key, as discrepancies can lead to delays.

Step 3: Providing financial information

Disclose your income and expenses comprehensively. It’s crucial to clearly explain your current funding needs and provide a precise breakdown of the requested loan amount. This information helps assess your loan eligibility.

Step 4: Business plan essentials

A comprehensive business plan is pivotal in a loan application. It should include key components such as a thorough market analysis, sales strategy, and financial projections, showcasing the potential success of your venture.

Step 5: Document preparation and uploading

Prepare additional documentation, including identification, business registrations, tax documents, and financial statements. Utilize pdfFiller’s user-friendly interface to upload and organize your documents seamlessly.

Editing and collaborating using pdfFiller

pdfFiller’s editing tools allow users to enhance their application by adding comments and annotations effortlessly. Mistakes can easily be corrected, ensuring the application is polished and professional before submission.

Collaboration is key in the application process. By sharing the application form with team members, feedback can be gathered efficiently, ensuring that everyone’s insights are included. The multi-user access feature allows for real-time updates and discussions.

Effective eSigning of your application

Once the application is complete, leveraging the eSignature functionality on pdfFiller simplifies the signing process. Users can sign documents electronically, which is especially helpful for those managing multiple applications or who may not be physically present.

Best practices for eSigning include reviewing the entire document before signing and ensuring that all necessary fields are completed. It’s crucial to remember that eSignatures have legal validity, making them a reliable choice for formal applications.

Managing your application and tracking progress

Staying organized during the application process is crucial. You can save your progress at any stage by utilizing the draft mode and auto-save features provided by pdfFiller. This way, you won’t lose any information mid-completion.

To observe your application status, consistently check for updates via the platform. pdfFiller allows you to track any correspondence or inquiries from the loan officer, putting you in control of your application journey.

Troubleshooting common issues with the application process

While applying for the Pillur startup loan, you might encounter some common roadblocks. Understanding these issues can help mitigate delays. Common challenges often include missing information, document errors, or technical difficulties with the pdfFiller platform.

If you experience issues, refer to the frequently asked questions section about Pillur startup loans for clarity. For further assistance, promptly contacting customer support can provide solutions and help you move forward with your application.

Ensuring compliance and successful submission

Adhering to submission guidelines is paramount when finalizing your application. Before clicking submit, ensure that you double-check your application for any errors or missing information. Thoroughly reviewing the form not only ensures compliance but also boosts the professionalism of your application.

Timeliness is another critical factor in loan application success. Maintain a proactive approach by preparing your application ahead of deadlines to avoid last-minute complications. An organized submission reflects your seriousness and commitment to your business.

Reflecting on your funding journey

Securing a Pillur startup loan can mark the beginning of a significant funding journey. With the right financial backing, startups have the opportunity to carve out their market presence, innovate, and achieve long-term growth goals.

As you navigate these initial funding steps, consider future opportunities for expansion. Leveraging the relationships built during your loan application process can help you access additional resources and support that can further enrich your business's potential.

Leveraging pdfFiller for all your document management needs

Utilizing a cloud-based platform like pdfFiller not only simplifies the Pillur startup loan application but also enhances your overall document management. This platform allows for easy editing, secure signing, and efficient collaboration on a variety of documents beyond just loan applications.

As your business grows, pdfFiller can adapt to meet your evolving needs. From managing invoices to handling payment processing and document sharing, the tools provided can streamline various aspects of your operations, helping you maintain organization and focus on your core business activities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify pillur startup loan application without leaving Google Drive?

How can I send pillur startup loan application to be eSigned by others?

How do I fill out pillur startup loan application using my mobile device?

What is pillur startup loan application?

Who is required to file pillur startup loan application?

How to fill out pillur startup loan application?

What is the purpose of pillur startup loan application?

What information must be reported on pillur startup loan application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.