Get the free Stocks And Securities Donation Form And Instructions Rev ...

Get, Create, Make and Sign stocks and securities donation

How to edit stocks and securities donation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out stocks and securities donation

How to fill out stocks and securities donation

Who needs stocks and securities donation?

Stocks and Securities Donation Form - How-to Guide

Understanding stocks and securities donation

Stocks and securities represent ownership in a company or a claim on its assets and earnings. When individuals choose to donate these assets instead of cash, they have the opportunity to make a significant impact on charitable causes while often benefiting from tax advantages.

Donating stocks and securities can be particularly beneficial, as it allows donors to bypass capital gains tax on appreciated assets, providing a double advantage: supporting a cause and potentially lowering their own tax burdens.

Preparing to donate: essential information

To ensure a smooth donation process, potential donors must be ready with specific personal and brokerage information. This involves collecting relevant details that the charity will need to process the donation efficiently.

The essential information for the donation includes personal identification details, information about the brokerage firm managing the stocks, and specifics regarding the types of securities being donated.

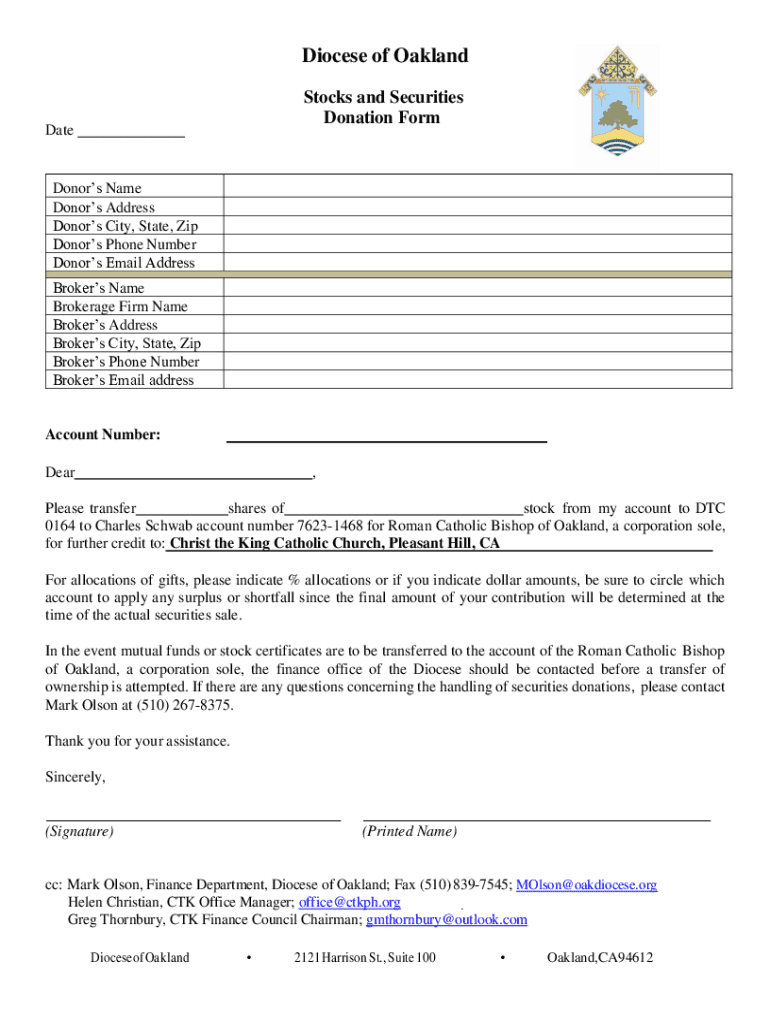

Filling out the stocks and securities donation form

The stocks and securities donation form is crucial for documenting the transfer of assets to a charity. It typically contains several key sections that require careful consideration.

Every donation form will have specific fields designed to capture necessary information about the donor, the brokerage account, the securities being donated, and any designated fund allocations.

Interactive tools for guiding your donation process

To streamline the donation process, utilizing interactive tools like those available on pdfFiller can be invaluable. These tools provide users with a range of benefits that enhance the donation experience.

The pdfFiller platform allows users to fill out and manage their forms electronically, making the overall process more efficient and less time-consuming.

Submitting the donation form: a step-by-step process

Once the stocks and securities donation form is completed, it’s essential to submit it correctly. There are specific steps and checks to ensure that the donation is processed without issues.

Before submitting, don’t forget to verify that all information is accurate and complete, as errors can lead to unnecessary delays.

After submission: managing your donation

After the donation form has been submitted, it’s important to manage and track the status of your donation. Knowing what to expect after submission can help ensure your donation is acknowledged properly.

Most charities provide an acknowledgment letter confirming receipt of the donation, which is essential for your record-keeping and tax purposes. Follow-up actions might also be required depending on your particular situation.

Frequently asked questions about stocks and securities donations

A common question among potential donors is what happens if the securities have lost value. In such cases, donors can still claim a tax deduction based on the lower of the original purchase price or the current value. It’s crucial to understand the tax deductibility of your donations.

Moreover, ensuring the proper completion of the donation form can prevent common issues and difficulties, including form errors or delays in processing your donation.

Exploring giving opportunities for securities

Many organizations and charities are eager to accept stocks and securities as donations. Choosing the right organization is key to ensuring your contribution aligns with your values and desired impact.

Consider researching various causes to identify the opportunities that resonate most with your philanthropic intentions, from local charities to well-known nonprofits.

Gift planning strategies with stocks and securities

To maximize the impact of your donations, explore various gift planning strategies. Consider balancing your financial goals while making philanthropic contributions, whether through lifetime giving or estate planning.

Engaging with a financial advisor can provide personalized guidance, aiding you in navigating the complexities of making multi-asset gifts or ensuring your donation fits into your overall financial plan.

Conclusion of process

This guide has covered crucial aspects of the stocks and securities donation form process. By understanding the requirements, preparing appropriately, and utilizing the right tools, you can make a meaningful contribution to your chosen charitable causes.

We encourage you to explore pdfFiller's features for seamless document management, helping you edit, eSign, and manage your donation documents anywhere you need.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify stocks and securities donation without leaving Google Drive?

How do I edit stocks and securities donation online?

Can I sign the stocks and securities donation electronically in Chrome?

What is stocks and securities donation?

Who is required to file stocks and securities donation?

How to fill out stocks and securities donation?

What is the purpose of stocks and securities donation?

What information must be reported on stocks and securities donation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.