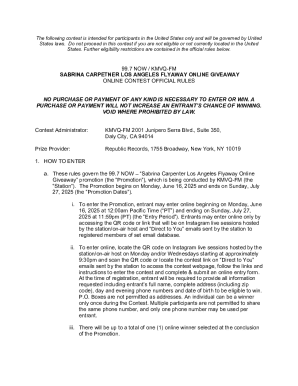

Get the free Application for Receivership

Get, Create, Make and Sign application for receivership

How to edit application for receivership online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for receivership

How to fill out application for receivership

Who needs application for receivership?

Application for Receivership Form - How-to Guide

Understanding receivership and its importance

Receivership is a legal process initiated when a company or individual is unable to meet its financial obligations. A court appoints a receiver to manage the assets and liabilities of the distressed entity, aiming to stabilize its operations. Understanding receivership is crucial for stakeholders considering financial intervention, as it directly impacts the structure and future of a business.

There are several key reasons why seeking receivership may be a strategic choice. First, it provides a mechanism for resolving financial distress while protecting vital assets from creditors. Second, it can facilitate business turnaround opportunities by allowing a more structured approach to management. Finally, receivership may avert total insolvency, preserving jobs and essential operational capacity.

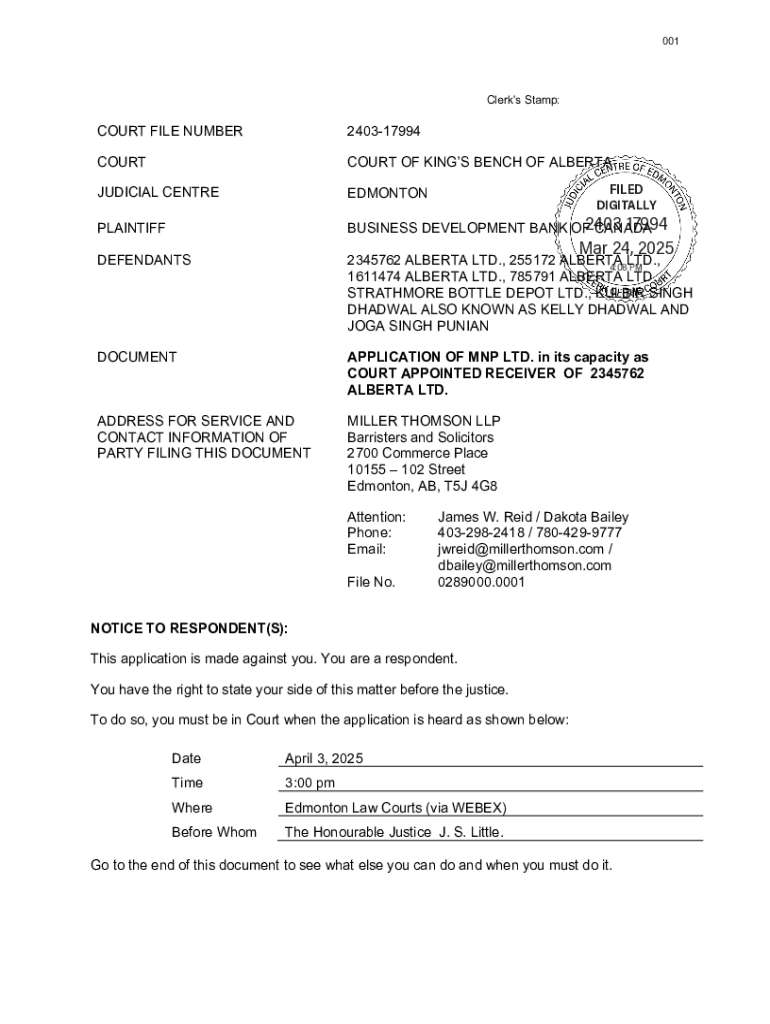

Overview of the application for receivership form

The application for receivership form serves as the formal request for a court to appoint a receiver. It outlines the specifics of the financial distress and the assets in question, providing the court with the necessary details to make an informed decision.

This form can be utilized by both individuals facing personal financial crises and organizations struggling to meet their financial obligations. However, applicants must be aware of the legal requirements and considerations that come into play during this process, including jurisdictional regulations and documentation standards.

Components of the application for receivership form

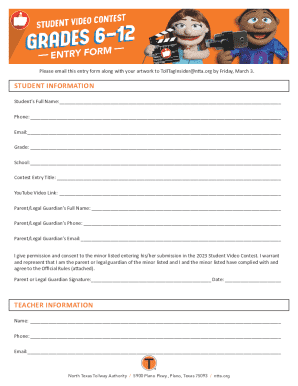

The application for receivership form consists of several key components, each designed to capture relevant information succinctly. The first section typically requests personal information about the applicant, including contact details and identification.

Next, the form requires a detailed disclosure of financial statements and assets, as well as information about debts and creditors. This ensures the court has a comprehensive view of the applicant's current financial situation. Additionally, details regarding the proposed receiver, such as their qualifications and experience, must be included to assist the court in appointing the right person for the role.

Step-by-step instructions for filling out the form

Filling out the application for receivership form requires careful attention to detail. Begin by gathering all necessary documents that provide evidence of financial distress, such as bank statements, tax returns, and a list of assets.

Each section of the application should be approached methodically. Start with entering personal information accurately. Then, disclose your financial standing, ensuring that the numbers reflect your current state. Specify the proposed receiver, detailing why they are qualified to hold that position. Finally, attach all required documents to provide context and backup to your application.

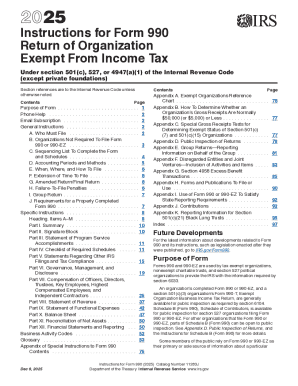

Editing and managing your receivership form

To ensure accuracy and compliance, leveraging tools like pdfFiller for editing your application for receivership form can be beneficial. This platform allows users to upload and modify the application easily. Users can add electronic signatures, ensuring that the form is ready for submission without the hassle of printed paperwork.

Moreover, collaboration tools available within pdfFiller enable real-time sharing with co-signers or legal advisors. This ensures that all stakeholders can provide feedback and adjustments quickly, thus streamlining the form's completion process.

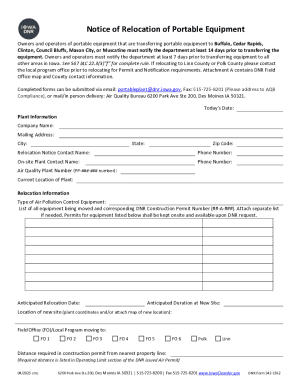

Submitting your application for receivership

Once your application for receivership form is complete, knowing how to properly submit it is essential. You can submit the application electronically, which is often the fastest option, or mail it to the appropriate court or governing body. Each method has its own procedures, so ensure you understand the requirements for your chosen submission method.

After submission, it's important to track the status of your application. Courts may have varying timelines, so being proactive can help you manage expectations. After submission, you can usually expect confirmation from the court and a timeline for any hearings that may need to take place.

Common mistakes to avoid when filling out the receivership form

Filling out the application for receivership form can be challenging, and many individuals make common mistakes that can delay or hinder the process. One frequent pitfall is providing incomplete information. Each section must be filled out thoroughly to avoid rejection or requests for clarification.

Furthermore, not attaching the correct documentation can lead to significant processing delays. Always double-check that you have included all required documents and that they are up-to-date. Lastly, ensure you follow submission guidelines meticulously, as any deviations can result in your application being misfiled.

Resources for understanding receivership further

To further comprehend the intricacies of receivership, numerous resources are available. Legal assistance contacts can guide applicants through the process, ensuring that they understand their rights and responsibilities in receivership. Additionally, financial counseling services can offer support to individuals, helping them develop sustainable practices for managing debts and finances.

Government resources and guidelines are also invaluable for applicants. Many jurisdictions provide online materials to help users navigate the process effectively, offering step-by-step guidance for filing applications and understanding the implications of receivership.

User testimonials and success stories

Many users have found success while navigating receivership with the help of pdfFiller. Individuals share how easily they managed to prepare and submit their applications online, reducing stress and improving efficiency. The platform empowers users to create well-organized applications quickly, helping them access the relief they need.

Benefits such as the ability to collaborate with legal advisors in real-time have also highlighted how pdfFiller streamlines the receivership process for many. This user-friendly document management solution has proven essential for individuals and teams involved in this often complex legal journey.

Frequently asked questions (FAQs) about the application for receivership form

Understanding what happens after submitting your application for receivership is a common concern among applicants. Generally, the court will review your paperwork and may call for a hearing. During this time, stakeholders may present evidence regarding the necessity of the receiver's appointment.

Another frequent inquiry is about the duration of the receivership process. This can vary widely based on jurisdiction and the specifics of each case. Finally, applicants may wonder if there’s an option to appeal a receivership decision. While this is sometimes possible, the process can be complicated and usually requires legal representation to navigate effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit application for receivership in Chrome?

Can I create an eSignature for the application for receivership in Gmail?

How do I edit application for receivership straight from my smartphone?

What is application for receivership?

Who is required to file application for receivership?

How to fill out application for receivership?

What is the purpose of application for receivership?

What information must be reported on application for receivership?

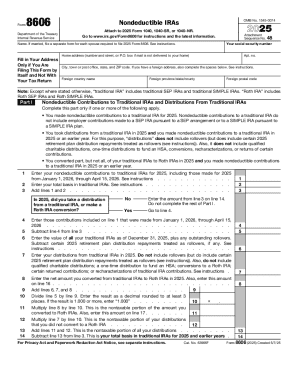

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.