Get the free REPORT OF INDEPENDENT EXPENDITURES STATE OF ...

Get, Create, Make and Sign report of independent expenditures

Editing report of independent expenditures online

Uncompromising security for your PDF editing and eSignature needs

How to fill out report of independent expenditures

How to fill out report of independent expenditures

Who needs report of independent expenditures?

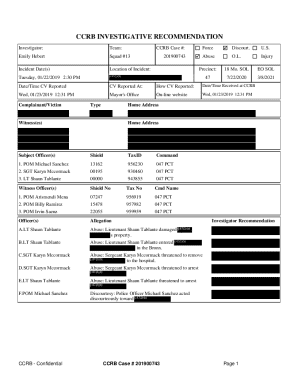

Understanding the Report of Independent Expenditures Form

Understanding independent expenditures

Independent expenditures refer to funds spent on behalf of a political candidate or party without direct coordination with their campaign. These expenditures typically include costs related to advertising, print materials, and other forms of communication meant to advocate for or against a particular candidate or issue.

The regulatory framework governing independent expenditures is crucial for ensuring transparency in political contributions. Both federal and state laws dictate how these funds can be raised and spent. Lack of compliance can lead to severe legal penalties, including fines and restrictions on future political activities.

Purpose of the independent expenditures form

The independent expenditures form is crucial for documenting spending in political campaigns. Its primary purpose is to ensure transparency in election financing, providing a detailed account of how funds are allocated. This transparency allows voters to better understand the influences that might affect their electoral choices.

Key stakeholders who need to file this form include political committees, advocacy groups, and individuals making substantial independent expenditures. By documenting their activities, these entities not only comply with legal stipulations but also contribute to a transparent electoral process.

Key features of the independent expenditures form

The independent expenditures form includes several key components that must be completed accurately to ensure compliance. Essential information required generally includes donor details, descriptions of the expenditures, and the candidates or issues affected by the spending. This detailed information is crucial for regulatory bodies to verify that expenditures are indeed independent and comply with established laws.

Common terminology used in the form includes phrases like 'expenditure limits', 'authorized committee', and 'coordinated expenditures'. Familiarity with these terms helps in accurately filling out the form. With platforms like pdfFiller, users can benefit from interactive features that make the filing process simpler and more efficient. For instance, auto-fill options and pre-made templates save time and reduce errors.

Step-by-step instructions for completing the form

Before filling out the independent expenditures form, it is imperative to gather all necessary documents and information. This includes identifying information about the spending entity, detailed descriptions of the expenditures, and funding sources. Having these details on hand will streamline the process and minimize the risk of errors.

When filling out the form, focus on a section-by-section breakdown. First, ensure that identifying information is complete and accurate. Next, provide a thorough description of the independent expenditures, detailing the nature and purpose of each expense. Lastly, disclose the funding sources, which requires being transparent about where the funds originated.

Reviewing your form for accuracy is a critical step before submission. Common pitfalls include typos, incomplete information, and incorrect donation figures. Suggested checks include comparing the information entered with supporting documents and ensuring all required fields are filled out.

Editing and managing your form on pdfFiller

One of the advantages of using pdfFiller to manage your independent expenditures form is the array of editing tools available. Users can modify pre-filled information, add or change details, and incorporate signatures and dates directly on the platform. This flexibility is particularly useful when changes need to be made promptly as deadlines approach.

Moreover, pdfFiller offers various saving and exporting options for completed forms. Users can save their forms in multiple formats, such as PDF or Word, and are provided with secure methods to share or send their completed forms. This efficiency ensures that your submission reaches the appropriate authorities without delay.

Submitting the independent expenditures form

When it comes to submission, knowing where to send your independent expenditures form is essential. Each state has its own directory of filing agencies, and federally, submissions should go to the Federal Election Commission (FEC). It is wise to familiarize yourself with these agencies to ensure that your form is submitted to the correct location.

Equally important are the deadlines associated with submission. Many states enforce strict timelines, especially around election cycles, when spending typically increases. Tracking your submission status is also crucial for confirming that your documentation was received and processed successfully, helping to avoid any potential complications.

Frequently asked questions

Mistakes on the independent expenditures form can lead to legal repercussions, so it’s essential to address them promptly. If you notice an error after submission, contact the relevant filing agency immediately to understand how to amend the information appropriately. Generally, agencies offer guidance on how to rectify mistakes.

It’s also critical to consider compliance. Failing to adhere to the regulations surrounding independent expenditures can result in significant penalties, including fines and restrictions on future expenditures. Understanding these penalties can help ensure diligent compliance.

Case studies: successful use of independent expenditures

Analyzing past elections reveals how independent expenditures can significantly influence outcomes. Exemplary cases, such as the campaigns supported by large Super PACs, showcase how strategic spending can sway voter opinion and impact election results. In some instances, meticulously filed forms have enabled organizations to effectively communicate their political message, leading to increased voter engagement.

However, not all expenditures are successful. Some campaigns may struggle due to filing mistakes or misinterpretations of regulations. Learning from these errors emphasizes the importance of accuracy in filing independent expenditures forms. The success stories often highlight how transparency and compliance can lead to better engagement and election outcomes.

Utilizing pdfFiller for comprehensive document management

Beyond filling out just the independent expenditures form, pdfFiller empowers users with a suite of tools for comprehensive document management. The platform offers a variety of additional forms and templates relevant to political finance, ensuring users have access to the necessary documentation to navigate the complexities of political contributions.

Collaboration features also allow teams to work together on the independent expenditures form seamlessly. With the ability to share documents and communicate within the platform, pdfFiller streamlines the compliance process, integrating document management within existing workflows. This holistic approach facilitates efficient document handling while maintaining adherence to regulatory requirements.

Accessing additional support

For those navigating the nuances of the independent expenditures form, pdfFiller offers robust user support and resources. The platform not only guides users through the form-filling process but also provides access to community forums where individuals can exchange insights and seek expert advice.

Legal advice is also accessible through various resources, ensuring users remain compliant with regulations surrounding independent expenditures. By leveraging these support systems, individuals and organizations can confidently manage their independent expenditures forms and engage effectively in the political process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my report of independent expenditures in Gmail?

How can I edit report of independent expenditures from Google Drive?

How can I fill out report of independent expenditures on an iOS device?

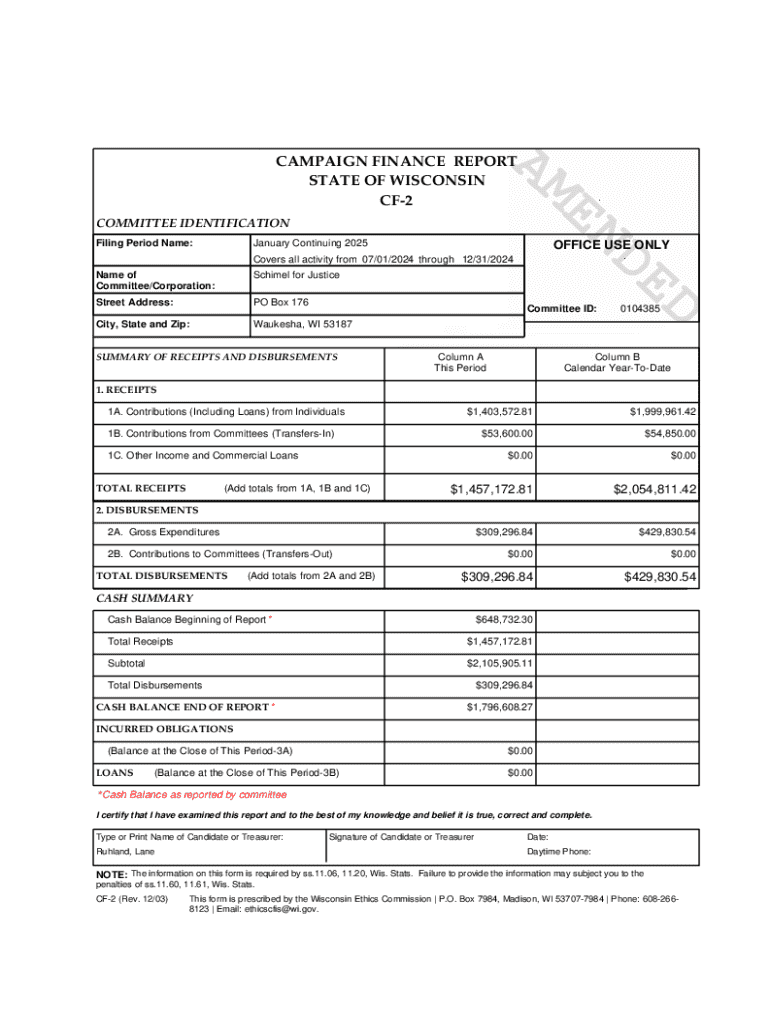

What is report of independent expenditures?

Who is required to file report of independent expenditures?

How to fill out report of independent expenditures?

What is the purpose of report of independent expenditures?

What information must be reported on report of independent expenditures?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.