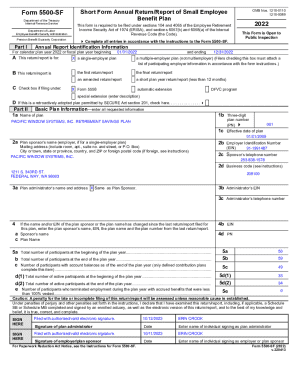

Get the free File and Pay Taxes Online

Get, Create, Make and Sign file and pay taxes

How to edit file and pay taxes online

Uncompromising security for your PDF editing and eSignature needs

How to fill out file and pay taxes

How to fill out file and pay taxes

Who needs file and pay taxes?

A Comprehensive Guide to File and Pay Taxes Form

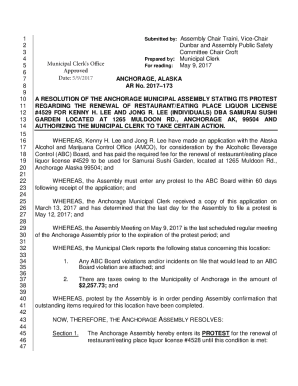

Understanding the tax forms landscape

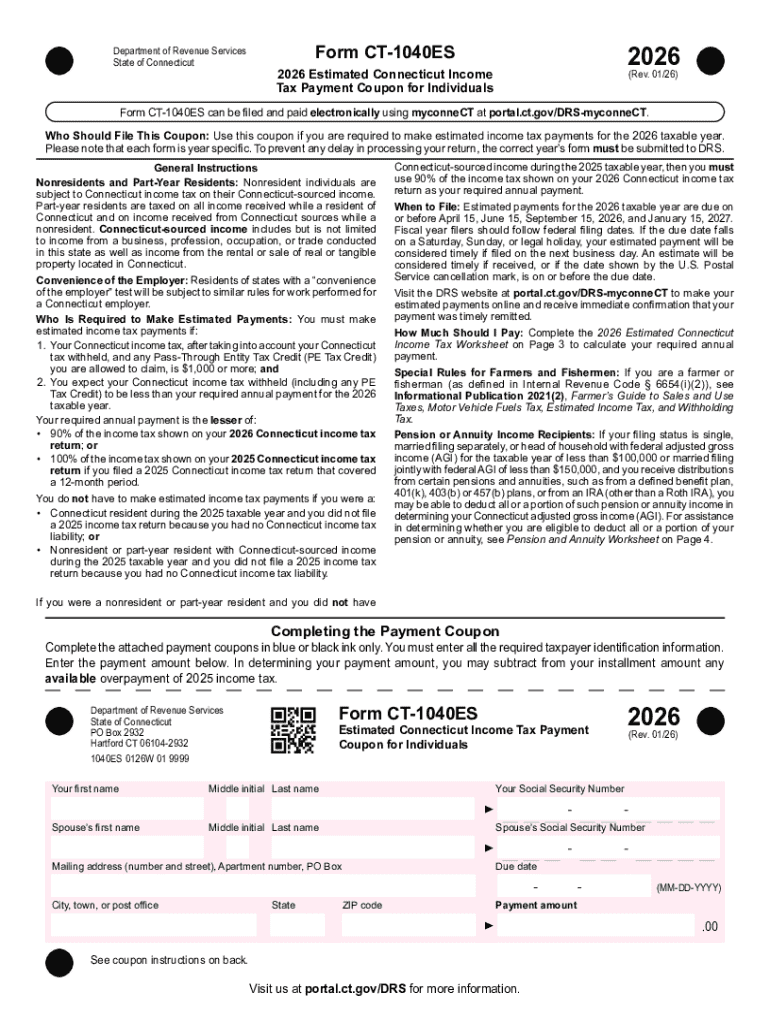

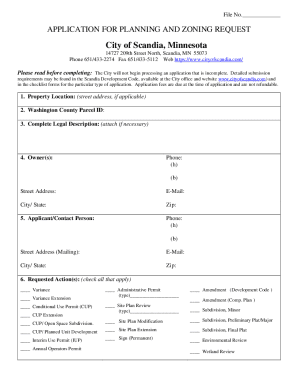

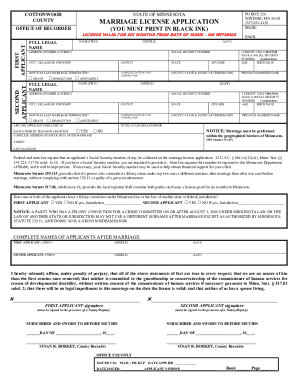

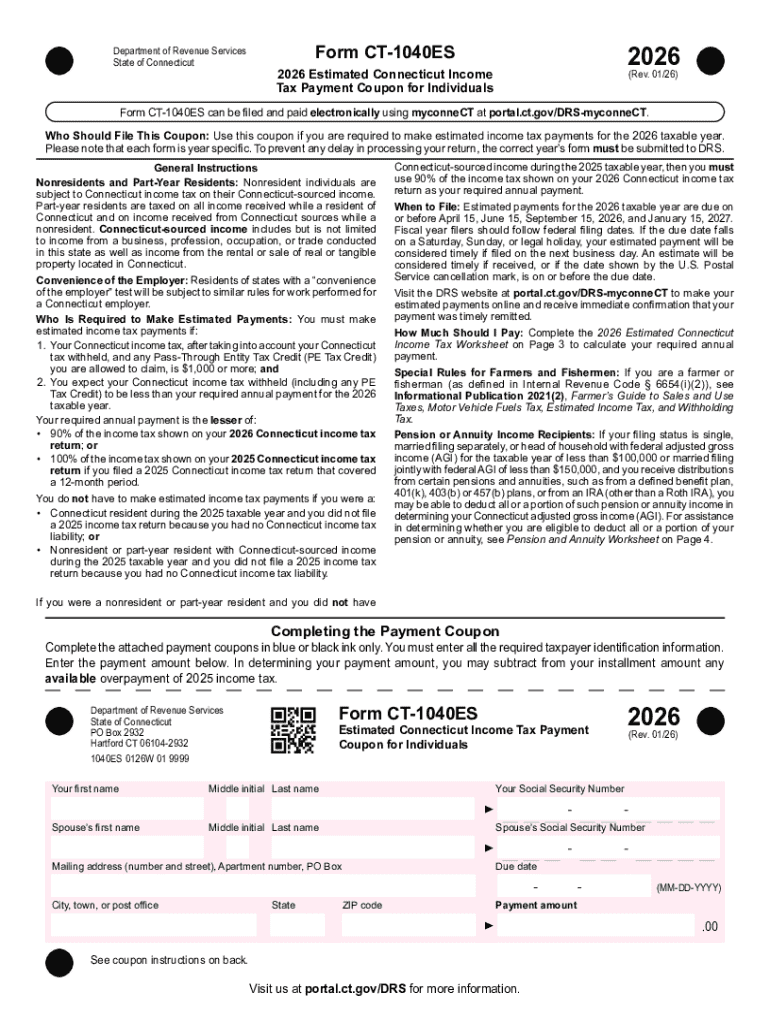

Navigating the world of tax forms can be challenging, especially with the variety of options available. There are primarily two categories of tax forms: individual income tax forms, typically used by regular taxpayers, and business tax return forms, which companies require to report their earnings and expenses. Accurate submission of these forms is critical as it determines tax liabilities, potential refunds, and compliance with IRS regulations.

Submitting the correct form with accurate information not only facilitates smoother processing but also minimizes the risk of audits and penalties. Understanding the tax forms landscape is your first step toward compliance.

Navigating tax form requirements

Filing taxes requires precise documentation. Before beginning, gather essential personal identification records, including your Social Security number or tax ID, as well as employment and income statements like W-2 forms, which report wages and taxes withheld, and 1099 forms, which report other income. Each document plays a vital role in accurately reflecting your financial situation.

Be aware of crucial deadlines, especially the federal tax filing deadline, which is usually April 15. State-specific requirements may vary, so check local regulations to ensure compliance. Missing these deadlines can lead to penalties, so calendar reminders can be a lifesaver.

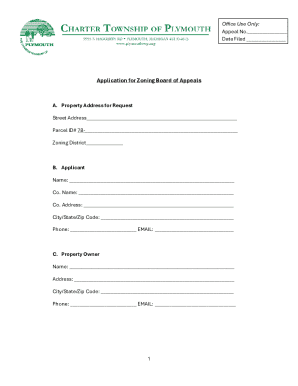

Filing taxes made easy

Filing your taxes doesn’t have to be a daunting task. Start by gathering all necessary documents as mentioned earlier. Next, select the correct tax form based on your income and filing status. Then, proceed to complete the tax form systematically. Here’s a breakdown of the steps involved:

Avoid pitfalls such as neglecting to report all income or miscalculating deductions. Double-check your math and ensure all fields are filled before submission to prevent any delays in processing your return.

Interactive tools for tax preparation

pdfFiller offers a range of interactive tools designed to simplify tax preparation. Utilize pdfFiler’s platform for seamless document management. With easy uploading and editing capabilities, you can manage all necessary tax forms effortlessly.

Additionally, collaborate with tax professionals by sharing forms in real-time. Getting immediate feedback can drastically reduce errors and streamline your filing process.

Paying your taxes: What you need to know

Once your taxes are filed, the next step is payment. It’s essential to understand your options for tax payment. The IRS offers a straightforward method to pay online via IRS Direct Pay, allowing you to pay your taxes directly from your bank account without any fees.

Stay informed about your tax payment schedules as some may require estimated tax payments throughout the year. Missing payments can lead to penalties, compounding your liability. Therefore, always check for relevant dates or schedules to stay compliant.

Common issues and troubleshooting

It’s not uncommon to encounter issues while filing taxes. Some frequent problems include missing information or incorrect calculations that could lead to significant delays in processing. To resolve these issues, regularly double-check your inputs and ensure all required documents are submitted.

If you encounter problems after filing, such as receiving a notice from the IRS, contact them directly or file an amended return promptly. Addressing issues quickly can prevent further complications down the line.

Resources for tax preparation support

Finding the right tax preparation support can ease the stress of filing. Look for local tax assistance programs, including IRS Volunteer Income Tax Assistance (VITA) which offers free services for qualifying individuals. Additionally, local tax preparation businesses can provide personalized guidance tailored to your specific needs.

Online resources on the IRS Official Website are invaluable for current and comprehensive tax information. Explore financial literacy tools to enhance your understanding of tax implications and filing formats.

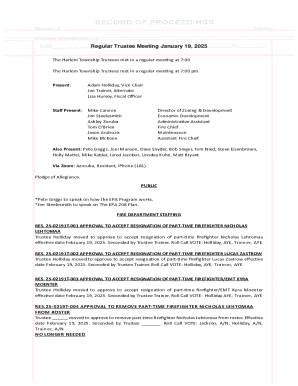

Keeping track of your tax documents

Organization is key when it comes to managing tax records. Create a centralized filing system either physically or digitally to keep track of all relevant documents. Investing time in organizing not only aids in the current tax season but also prepares you for future filings.

Keep in mind the importance of retaining tax records. How long should you keep these documents? Most professionals recommend keeping records for at least three years, but retaining them longer can help in case of audits or discrepancies.

Future considerations for tax filing

Tax laws are subject to change, and staying informed on upcoming legislation impacting tax filings is crucial. Evolving digital tools, particularly those provided by pdfFiller, can aid in making tax management less stressful and more efficient. Keeping abreast of these developments ensures that you are not left in the dark during tax season.

Embracing technology in tax management not only simplifies the process but also ensures accuracy and efficiency, allowing you to focus on what matters most.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify file and pay taxes without leaving Google Drive?

How do I edit file and pay taxes online?

Can I create an electronic signature for signing my file and pay taxes in Gmail?

What is file and pay taxes?

Who is required to file and pay taxes?

How to fill out file and pay taxes?

What is the purpose of file and pay taxes?

What information must be reported on file and pay taxes?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.