Get the free (Standard Claim Form As prescribed by IRDA for Health ...

Get, Create, Make and Sign standard claim form as

How to edit standard claim form as online

Uncompromising security for your PDF editing and eSignature needs

How to fill out standard claim form as

How to fill out standard claim form as

Who needs standard claim form as?

A Comprehensive Guide to the Standard Claim Form

Understanding the standard claim form

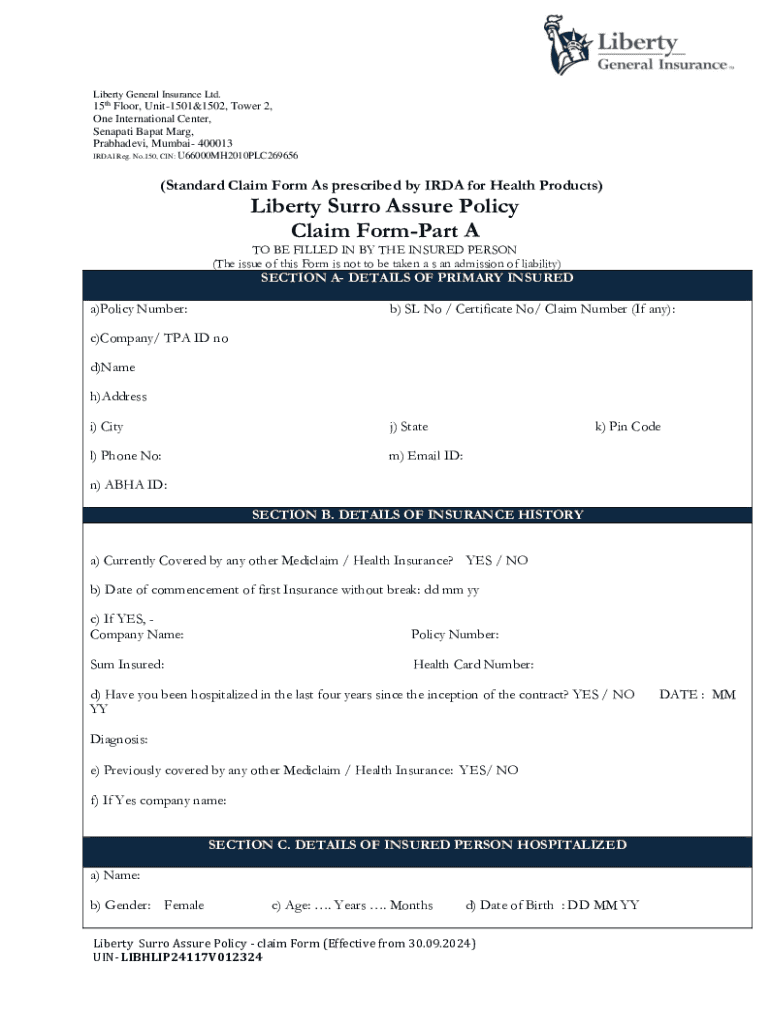

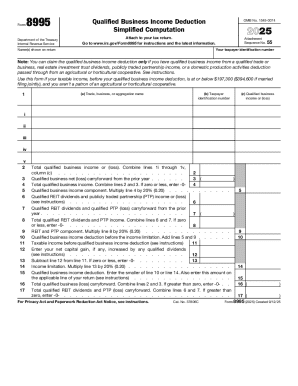

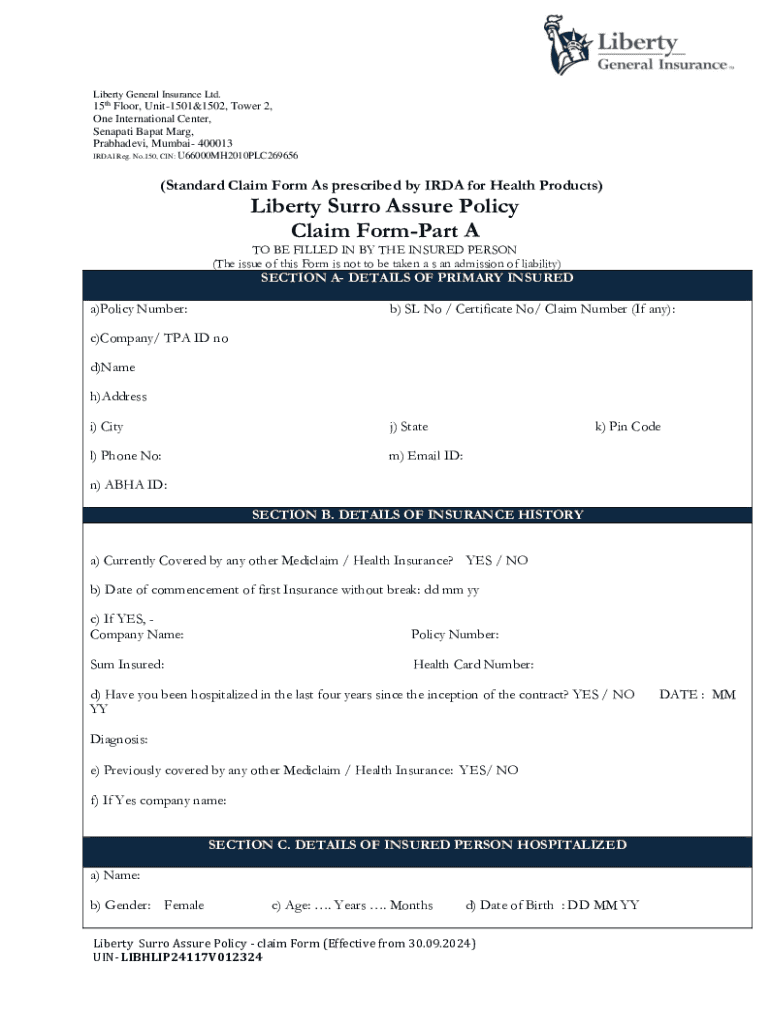

A standard claim form is a crucial document utilized primarily in the insurance industry to facilitate the processing of claims for reimbursement. This form serves as a streamlined method allowing policyholders to submit their claims effectively. Each standard claim form is designed to capture all necessary information related to the claim, ensuring that insurance providers can assess and process these requests efficiently.

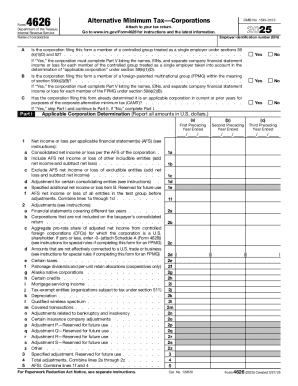

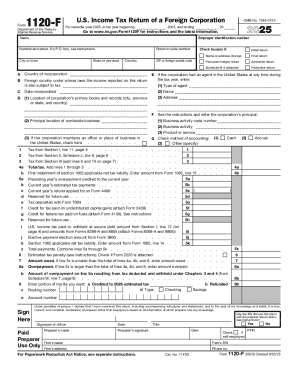

The importance of the standard claim form in insurance cannot be overstated. This form ensures that the claims process is both efficient and standardized, thereby reducing the chances of miscommunication or errors in submission. Utilizing a standardized format allows insurers to process a high volume of claims while adhering to regulatory provisions outlined within Rule 120-2-59, which governs the use of these forms.

Legal foundations

Understanding the legal foundations governing the standard claim form is essential for both claimants and insurers. Under Rule 120-2-59, the authority vested in the commissioner of insurance emphasizes the necessity of these forms in a structured claims management process. This rule outlines the requirements for the claims submission, ensuring compliance with established state regulations.

The purpose of the standard claim form, as stated in Rule 120-2-59-.02, is to enhance the efficiency of the claims process while adhering to regulatory standards. The provisions outlined in Chapter 24 of Title 33 address the various types of claims that may utilize this form, providing clarity about its scope and applicability. Understanding these legal specifications ensures that users are knowledgeable about their rights and obligations, assisting in more accurate and timely claims management.

Key definitions

Navigating the standard claim form can often involve intricate terminology. Understanding these terminologies is crucial for individuals preparing to submit a claim. According to Rule 120-2-59-.04, there are several key definitions that help clarify the language used in the form, enhancing comprehension for users.

Furthermore, having a glossary readily available can assist users unfamiliar with insurance jargon. A simplified vocabulary list can break down complex terms, making it easier for individuals and teams to understand their responsibilities and the requirements necessary for a successful claim submission.

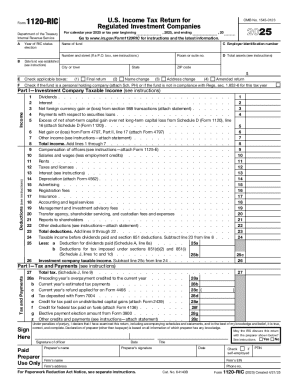

Completing the standard claim form

Successfully completing a standard claim form requires careful attention to detail in several key areas. First, gather all necessary information, including personal details, policy numbers, and specifics about the incident or treatment that triggered the claim. Ensuring accuracy in this initial stage can significantly streamline the remainder of the process.

Understanding each section of the form is equally critical. Different sections are often designated for personal information and claim details, including dates, locations, and the nature of the claim. Common mistakes to avoid include leaving sections incomplete or misrepresenting information. Thoroughly checking for accuracy can save time and prevent unnecessary delays in reimbursement.

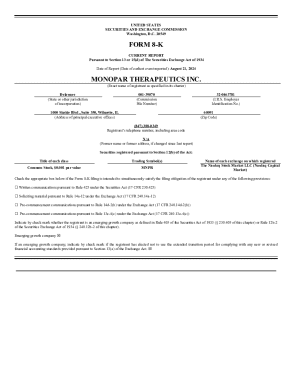

Submitting your claim

After completing the standard claim form, the next step is to submit it to your insurer. Depending on your preference, you can choose between online and offline submission methods. Online submission is often seen as more efficient, with platforms such as pdfFiller streamlining the process through electronic document management.

When submitting offline, ensure you understand the specifics of mailing or faxing your claim. Details such as the appropriate address or fax number can be obtained from your insurer. Tracking the status of your claim is also vital; many insurers offer interactive tools that allow claimants to monitor their submissions conveniently. Tools provided by pdfFiller further enhance your ability to track claims, making the entire process more transparent.

Handling claims revisions and appeals

Claims revisions and appeals are important aspects of the claims process that require attention if your initial claim is denied or requires adjustments. Knowing when and how to revise your claim is crucial. Revisions may occur if new information is available or if there was an error in the original submission, and a clear understanding of your insurer's policy on revisions can be beneficial.

The claim appeal process can be intricate. It typically involves several steps: understanding the reason for denial, gathering necessary documentation, and formally submitting an appeal with a clear explanation of your position. Additionally, ensuring that you include evidence or supplementary documents to support your case can make a significant difference in the appeal outcome.

Frequently asked questions (FAQs)

Addressing common queries regarding the standard claim form can help minimize confusion and empower users in their claims management journey. Many individuals may have similar questions about the contents of the form, the necessity of providing certain information, or the repercussions of errors within the submission. By offering detailed answers to these common inquiries, users can feel more equipped to navigate the claims process.

Troubleshooting common issues is also essential. For example, if a claim is denied due to missing information, knowing the steps to rectify this can save time and effort. There are various resources available, both from insurers and third-party services like pdfFiller, that can assist in clarifying any doubts and providing further assistance.

Leveraging pdfFiller for your claim forms

Utilizing pdfFiller can significantly enhance your experience with the standard claim form. One of its most prominent features is seamless editing and customization capabilities, allowing users to make necessary adjustments before submission. In addition, the platform provides eSigning and collaboration tools that simplify the process, making it easier to get the necessary approvals and ensure that all stakeholders are on the same page.

Case studies further illustrate how pdfFiller has facilitated successful claims management for various users, showcasing real-life success stories around the effective use of the standard claim form. User testimonials highlight positive experiences, emphasizing the importance of document management solutions in easing the complexity of claims and ensuring timely submissions.

Ensuring document security and compliance

As with all sensitive documents, ensuring document security and compliance with insurance privacy regulations is paramount when handling the standard claim form. pdfFiller employs robust security measures to protect your personal and financial information throughout the claims process. These measures help establish trust and confidence for users submitting their claims online.

Understanding insurance privacy regulations is essential for protecting policyholders’ rights. The regulations provide guidance on how personal data should be treated, ensuring that unauthorized access or misuse does not occur. With platforms like pdfFiller, users can feel reassured that their information is being handled in accordance with applicable regulations, preserving confidentiality and security.

Transitioning to a paperless process

Transitioning to a paperless process for claims management presents numerous benefits, both for users and insurance providers. Moving to digital forms can facilitate a more efficient claims management process, reducing processing times and minimizing potential errors associated with paper-based submissions.

To digitize your claims management process, consider utilizing trustworthy document management platforms such as pdfFiller. These tools streamline the entire claim process, enabling users to create, edit, submit, and even track their claims all in one place. The ability to access documents from anywhere and collaborate with others simplifies teamwork and speeds up the claims process significantly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get standard claim form as?

How do I edit standard claim form as on an iOS device?

How can I fill out standard claim form as on an iOS device?

What is standard claim form as?

Who is required to file standard claim form as?

How to fill out standard claim form as?

What is the purpose of standard claim form as?

What information must be reported on standard claim form as?

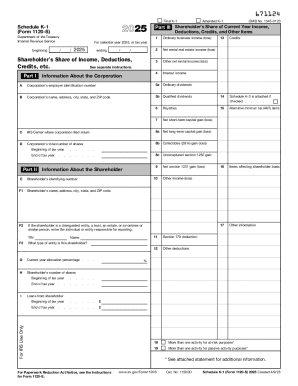

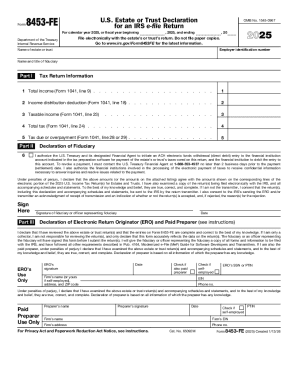

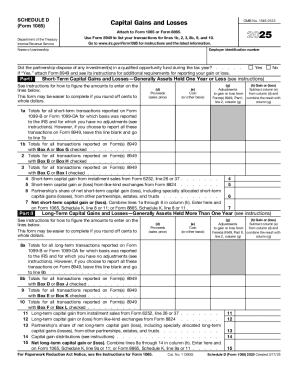

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.