Get the free APPLICATION FOR BANK GUARANTEE UNITED OVERSEAS ...

Get, Create, Make and Sign application for bank guarantee

Editing application for bank guarantee online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for bank guarantee

How to fill out application for bank guarantee

Who needs application for bank guarantee?

Application for Bank Guarantee Form: A Comprehensive Guide

Understanding bank guarantees

A bank guarantee is a promise made by a lender or financial institution to assume the responsibility for a specific financial obligation of a borrower if that borrower fails to meet their contractual obligations. In essence, it acts as a safety net for the party receiving the guarantee, ensuring that they will receive compensation in case of default.

These guarantees play a critical role in many financial transactions, particularly in sectors such as construction, commercial contracts, and international trade. By providing assurance of payment or performance, bank guarantees facilitate smoother dealings between parties, thus fostering trust and stability in various industries.

Who needs a bank guarantee?

Bank guarantees are crucial for various individuals and organizations. For individuals, a bank guarantee may be required when renting a property or taking part in certain transactions. Businesses, particularly in sectors like construction, real estate, and import/export, frequently require bank guarantees as part of their contractual obligations.

Common scenarios that may necessitate a bank guarantee include securing loans, bidding for projects, or entering into lease agreements. For instance, a construction company might need a performance guarantee to assure a client that the work will be completed satisfactorily and on time.

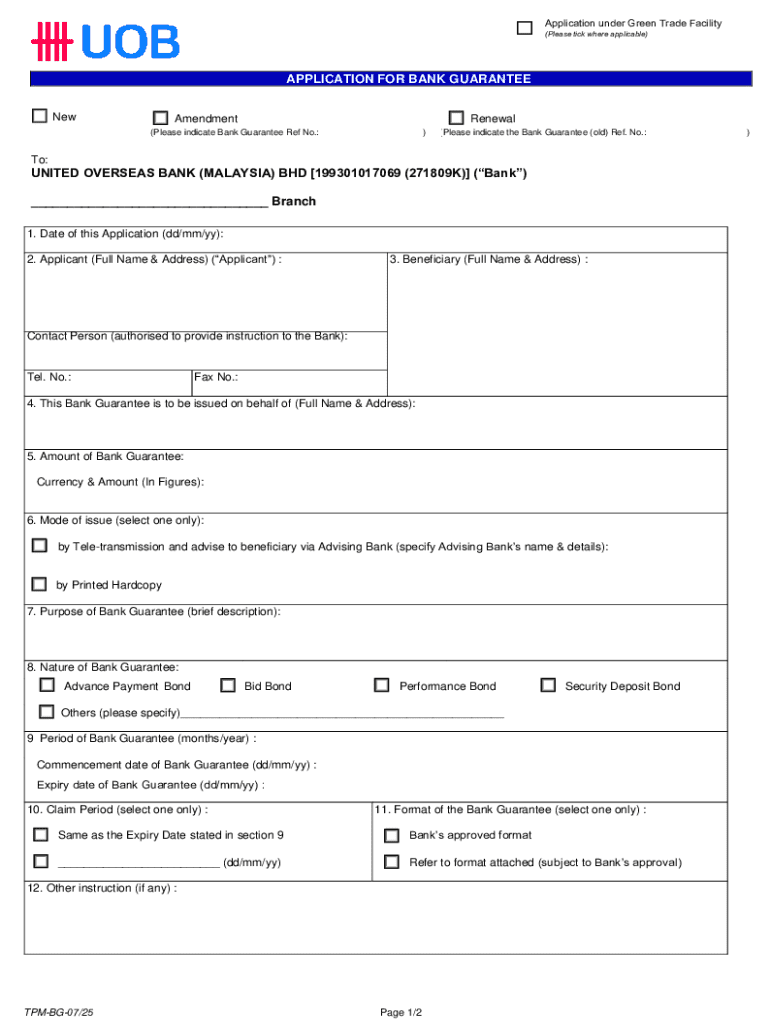

Overview of the application process for bank guarantee

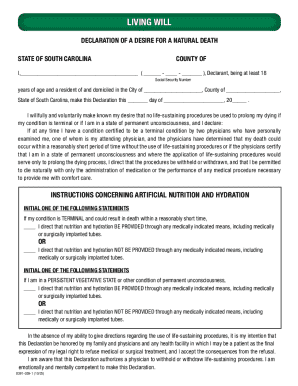

Initiating the application for a bank guarantee involves a few key steps. First, it is crucial to identify the specific type of guarantee needed for your situation. Once this is clear, the next step is to approach your bank or financial institution to express your interest.

Essential documents typically required for submission include identification (like a passport or driver's license), proof of income, details of the transaction or contract, and any specific terms of the guarantee being requested. Common mistakes include not providing enough details about the guarantee needed and failing to understand the terms and conditions outlined by the issuing bank.

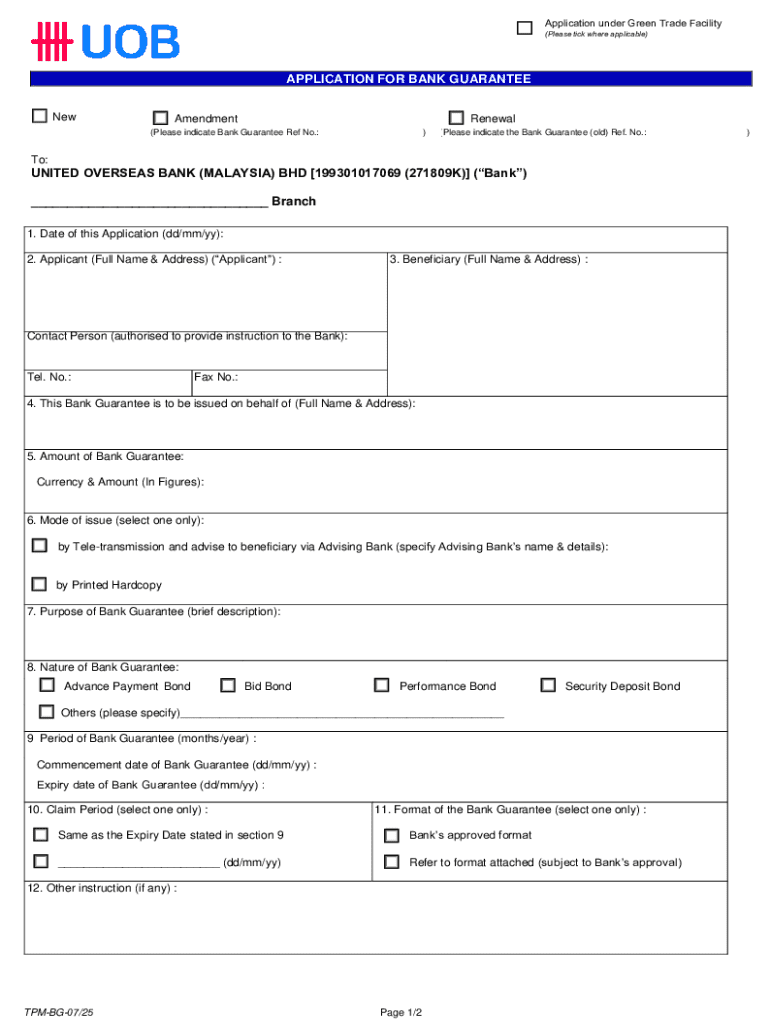

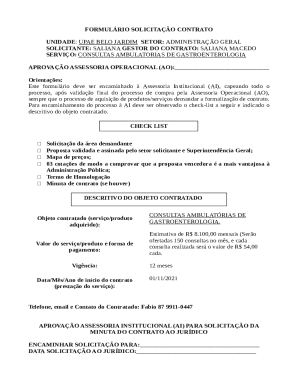

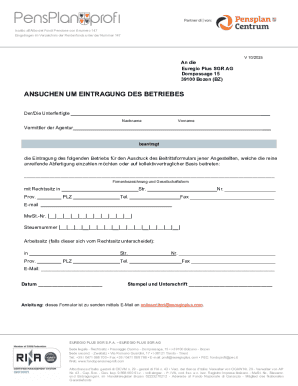

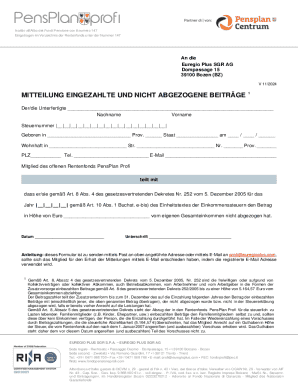

Detailed breakdown of the application for bank guarantee form

The application for bank guarantee form contains several sections that must be accurately filled out. The first section typically requires personal or business information, which includes the name, address, and contact details of the applicant.

The second section focuses on the details of the guarantee required, such as the purpose of the guarantee and the amount being requested. It is crucial to provide thorough and precise information here to avoid confusion or delays in processing.

Utilizing interactive tools can help users complete forms accurately. Simple software like pdfFiller allows you to fill out forms with ease, offering tips and prompts to guide you through the process.

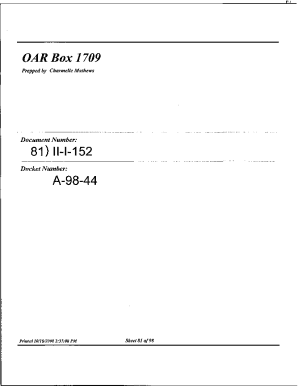

Editing and customizing your application for bank guarantee form

Once the form is completed, utilizing editing tools available from platforms like pdfFiller can enhance your application. You can make modifications to the form without any hassle. Moreover, adding electronic signatures has never been easier, which is often a requirement when submitting financial documents.

Furthermore, pdfFiller offers collaboration features that allow multiple stakeholders to view and review drafts before submission. This is particularly beneficial for businesses requiring input from various departments or partners.

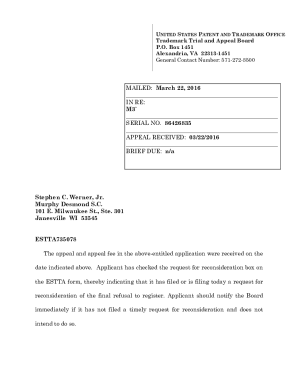

Signature and submission process for bank guarantees

After editing, it’s essential to securely sign the application before submission. PdfFiller provides a step-by-step guide that allows users to sign their documents electronically, ensuring a fast and efficient process.

Once signed, submitting the completed form online is straightforward. Banks often offer secure portals for submission, and following up after submission is recommended to confirm that your application is being processed.

Managing your bank guarantee after submission

Tracking the status of your application is crucial once it's submitted. Most banks provide a method for applicants to check the progress of their guarantee application. In cases where additional information is requested, being prepared to provide this information promptly can expedite the process.

If circumstances change and there is a need to amend or cancel a bank guarantee, understanding your bank's policies on modifications is essential. Often, banks can facilitate such changes efficiently if the request is made appropriately.

Common FAQs about bank guarantee applications

Bank guarantee applications often come with questions about denial processes and timing. In the event your application is denied, banks will usually provide an explanation which can guide you in making necessary adjustments for future attempts.

Typically, the processing time varies but it can take anywhere from a few days to a few weeks based on the bank and the complexity of the guarantee. Additionally, understanding the fees associated with bank guarantees is vital, as these can significantly vary by institution and type of guarantee.

Leveraging pdfFiller for comprehensive document management

PdfFiller’s cloud-based platform offers users a variety of features designed to streamline document management, including the creation and editing of application forms for bank guarantees. The ability to access documents from any device enhances flexibility and efficiency.

Many users have benefitted from pdfFiller’s services, especially when it comes to organizing and managing multiple documents. Success stories reveal how businesses have simplified their application processes, ensuring that necessary guarantees are secured in a timely manner.

Conclusion of the application process

In managing a bank guarantee application, it's important to have a clear understanding of the process and the necessary paperwork involved. Utilizing platforms like pdfFiller can simplify your experience, making it easier to create, edit, and manage your documents.

By following the outlined steps and leveraging available tools, you can navigate the complexities of obtaining a bank guarantee with confidence and ease.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete application for bank guarantee online?

Can I create an electronic signature for signing my application for bank guarantee in Gmail?

Can I edit application for bank guarantee on an Android device?

What is application for bank guarantee?

Who is required to file application for bank guarantee?

How to fill out application for bank guarantee?

What is the purpose of application for bank guarantee?

What information must be reported on application for bank guarantee?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.